Form 8949 Exception To Reporting

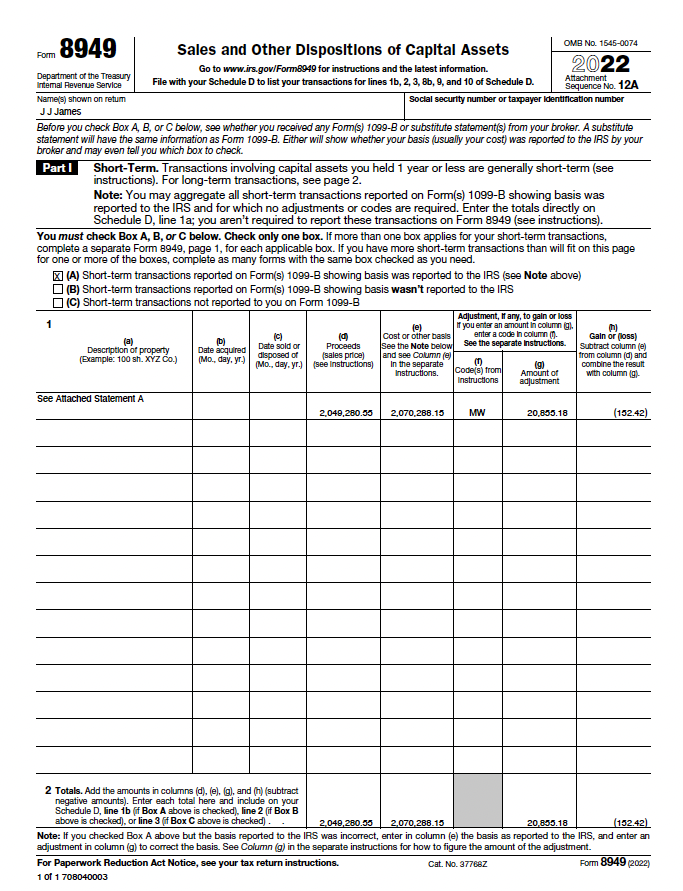

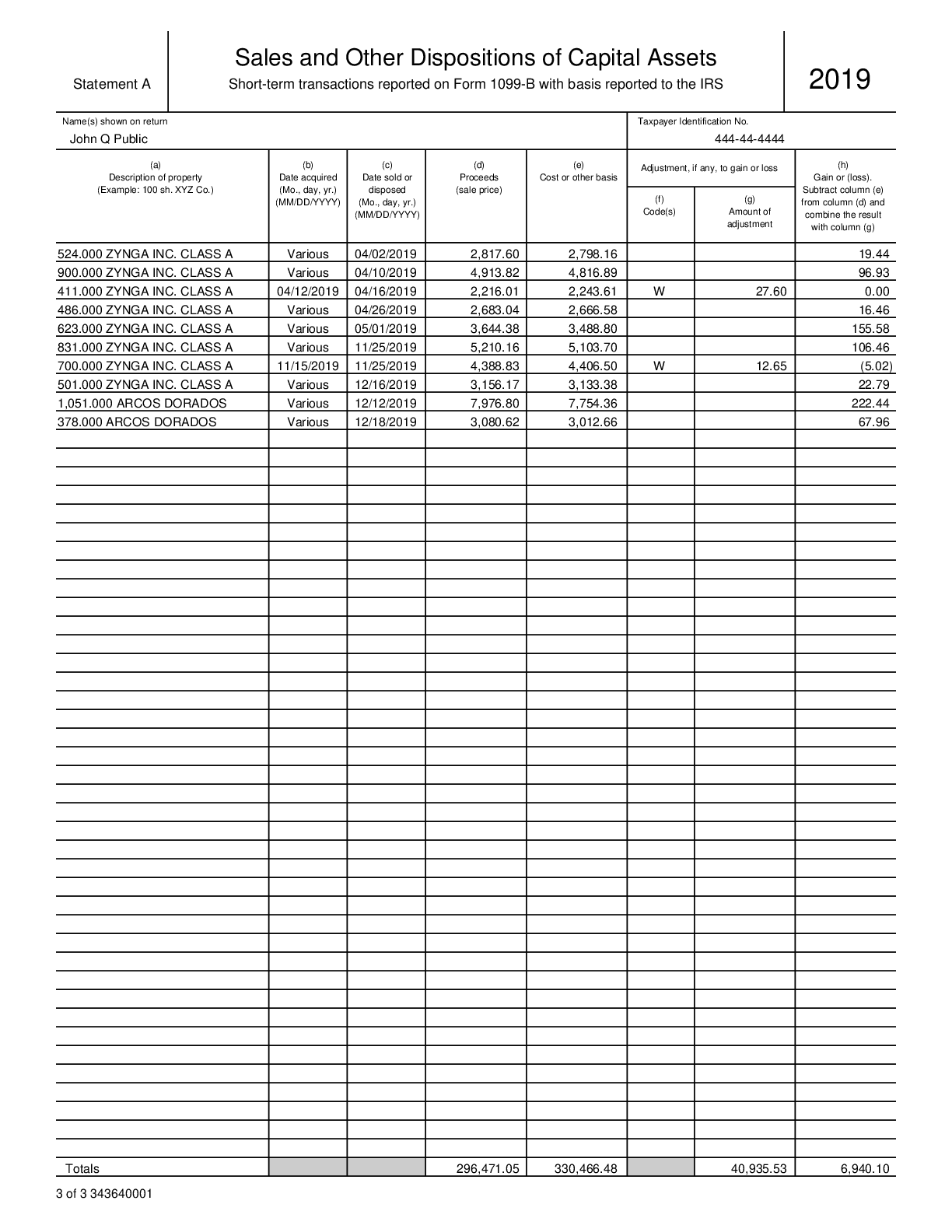

Form 8949 Exception To Reporting - Web report the disposition on form 8949 as you would report any sale or exchange. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web use schedule d (form 1040), capital gains and losses and form 8949, sales and other dispositions of capital assets when required to report the home sale. Solved•by intuit•181•updated 1 week ago. Free, fast, full version (2023) available! Here is more information on how tax form 8949 is used from the irs: Looking for some advice on form 8949 reporting exception transations. In the send pdf attachment. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. The gain/loss is not from. Form 8949 is a list of every transaction, including its cost basis,. You aren’t required to report these transactions on form 8949 (see instructions). Web you will report the totals of form 8949 on schedule d of form 1040. Complete, edit or print tax forms instantly. Web exception 1 per the form 8949 instructions: Free, fast, full version (2023) available! When i requested a csv file, i see just little less than 2000 lines. If sales transactions meet certain irs requirements, you can bypass form 8949. Web to report most capital gain (or loss) transactions you have to fill out the schedule d of the irs form 1040. To report amounts directly on schedule. Web report the disposition on form 8949 as you would report any sale or exchange. This basically means that, if you’ve sold a. The gain/loss is not from. Report the rest of your transactions as explained in. Reporting form 8949, exception 2 each transaction on a separate line in lacerte. Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. In the send pdf attachment. Web use schedule d (form 1040), capital gains and losses and form 8949, sales and other dispositions of capital assets when required to report the home sale. Essentially, form 8949 is the detailed information behind the.. Web use schedule d (form 1040), capital gains and losses and form 8949, sales and other dispositions of capital assets when required to report the home sale. Check box a, b, or. In the send pdf attachment. Complete, edit or print tax forms instantly. Web no, a taxpayer with capital gains or losses to report must file both form 8949. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Form 8949 exception reporting statement. Web you will report the totals of form 8949 on schedule d of form 1040. If sales transactions meet certain irs requirements, you can. Web schedule d, line 1a; Web to report most capital gain (or loss) transactions you have to fill out the schedule d of the irs form 1040. Essentially, form 8949 is the detailed information behind the. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and. Web form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web to report most capital. Web 2 i have been trading in 2017 on robinhood. If both exceptions apply, you can use both. Essentially, form 8949 is the detailed information behind the. Web report the transactions that qualify for exception 1 directly on either line 1a or 8a of schedule d, whichever applies. Looking for some advice on form 8949 reporting exception transations. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. To report amounts directly on schedule d, transactions must meet all of these irs requirements. If sales transactions meet certain irs requirements, you can bypass form 8949. But before. Web you will report the totals of form 8949 on schedule d of form 1040. If both exceptions apply, you can use both. Here is more information on how tax form 8949 is used from the irs: Web use schedule d (form 1040), capital gains and losses and form 8949, sales and other dispositions of capital assets when required to report the home sale. Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. Web to report the sale of stocks on your taxes, you need two extra forms, form 8949 and schedule d. Ad get ready for tax season deadlines by completing any required tax forms today. Web schedule d, line 1a; This basically means that, if you’ve sold a. Web report the transactions that qualify for exception 1 directly on either line 1a or 8a of schedule d, whichever applies. Solved•by intuit•181•updated 1 week ago. Looking for some advice on form 8949 reporting exception transations. You aren’t required to report these transactions on form 8949 (see instructions). In the send pdf attachment. Web 2 i have been trading in 2017 on robinhood. Reporting form 8949, exception 2 each transaction on a separate line in lacerte. Essentially, form 8949 is the detailed information behind the. The irs recommends that you save the pdf attachment of form 8949 as form 8949. Complete, edit or print tax forms instantly. You report multiple transactions on a single row as described in exception 2 or special.2016 Form 8949 Fill Online, Printable, Fillable, Blank pdfFiller

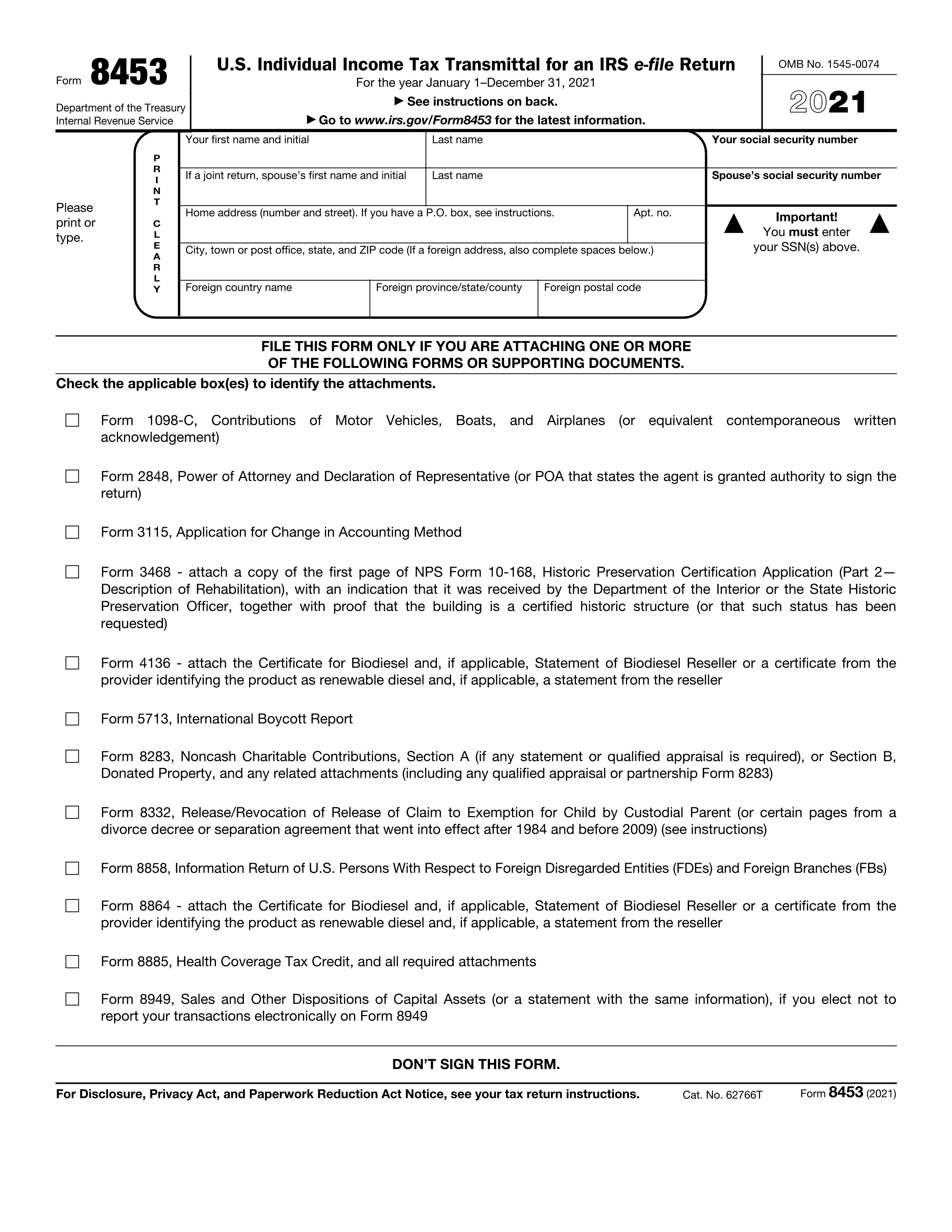

IRS Form 8949 Instructions 📝 Get 8949 Tax Form for 2022 Printable PDF

Form 8949 2023

Generating Form 8949 for Tax Preparation TradeLog Software

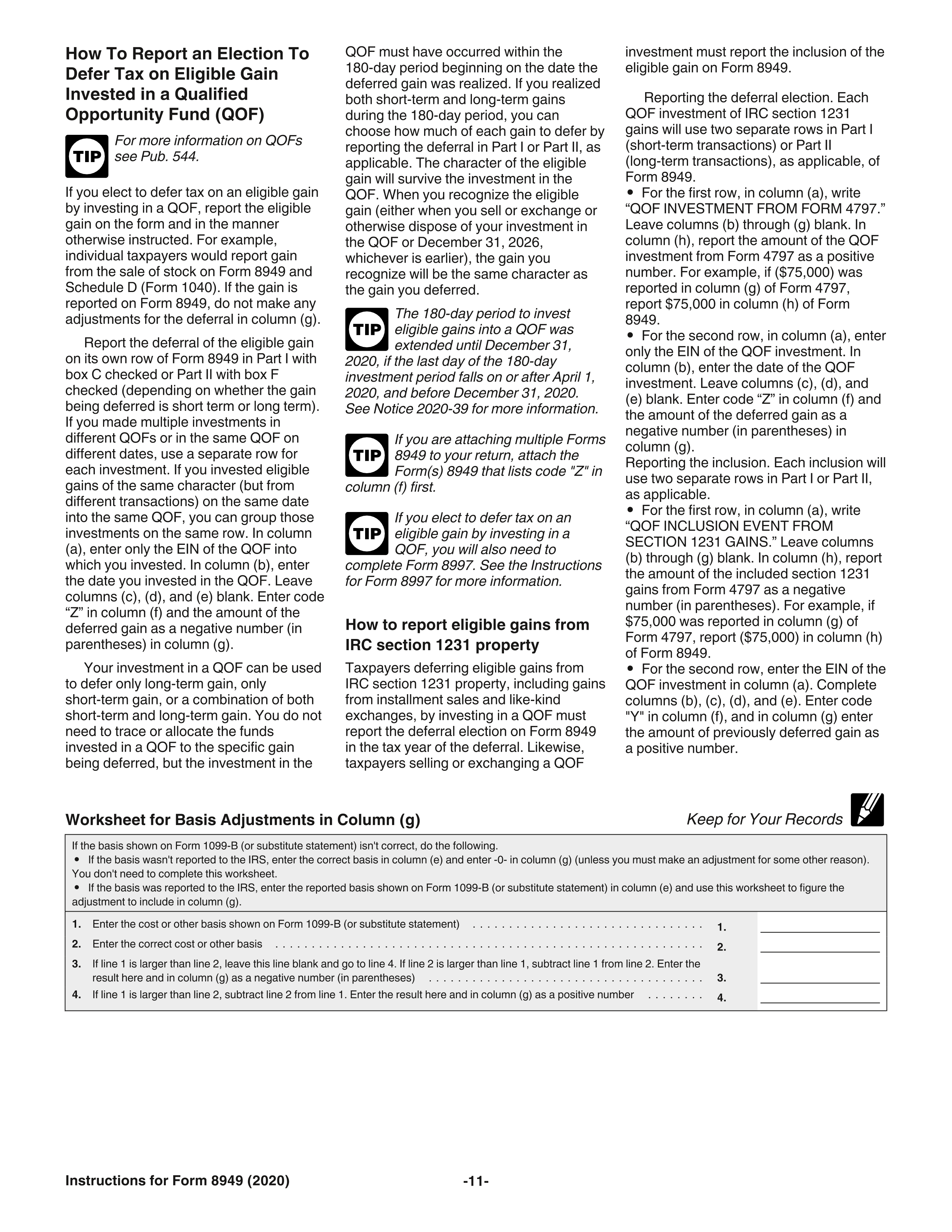

IRS Form 8949 instructions.

Explanation of IRS Form 8949 Exception 2

Entering Form 8949 Totals Into TaxACT® TradeLog Software

Explanation of IRS "Exception 2"

Form 8949 Exception 2 When Electronically Filing Form 1040

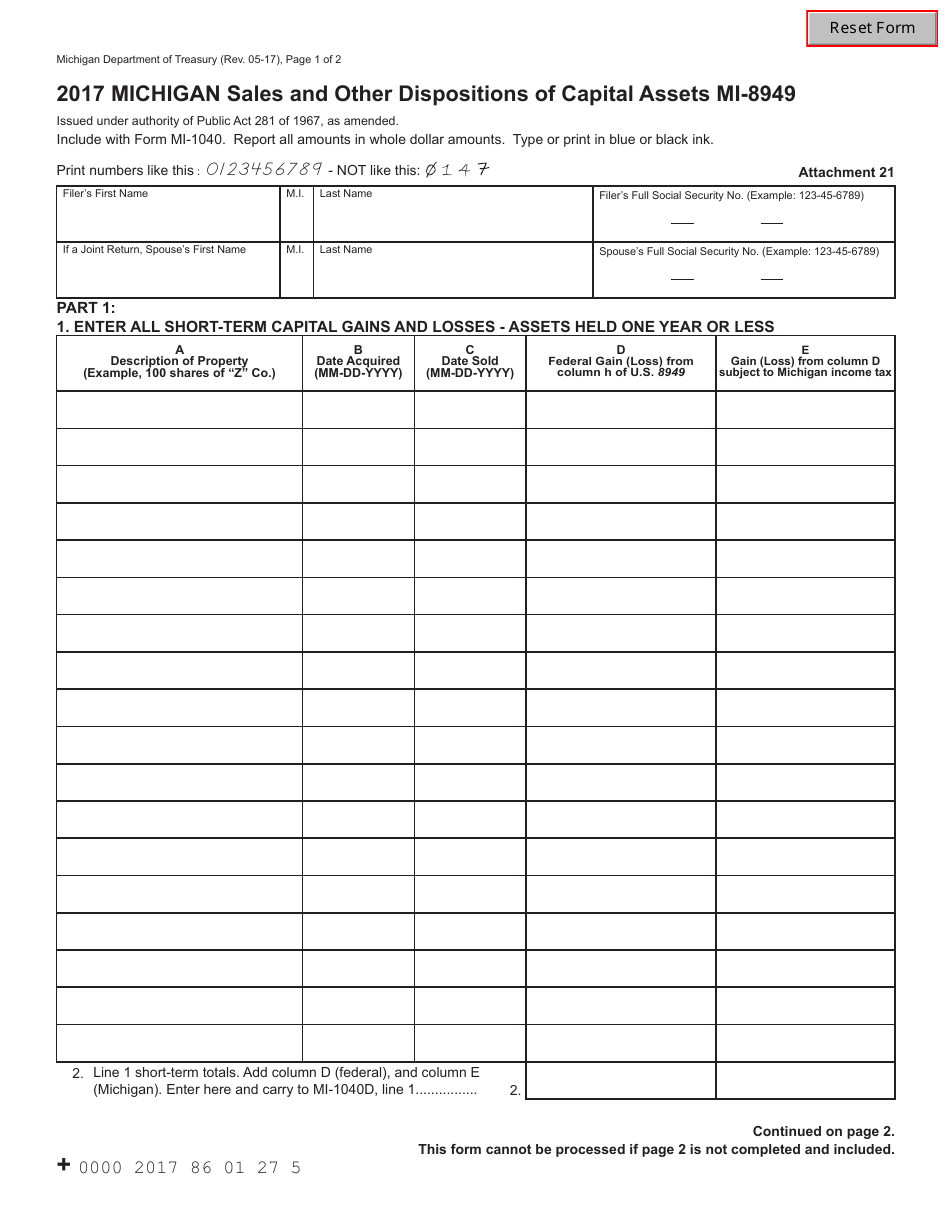

Form MI8949 2017 Fill Out, Sign Online and Download Fillable PDF

Related Post: