Form 8949 Code Q

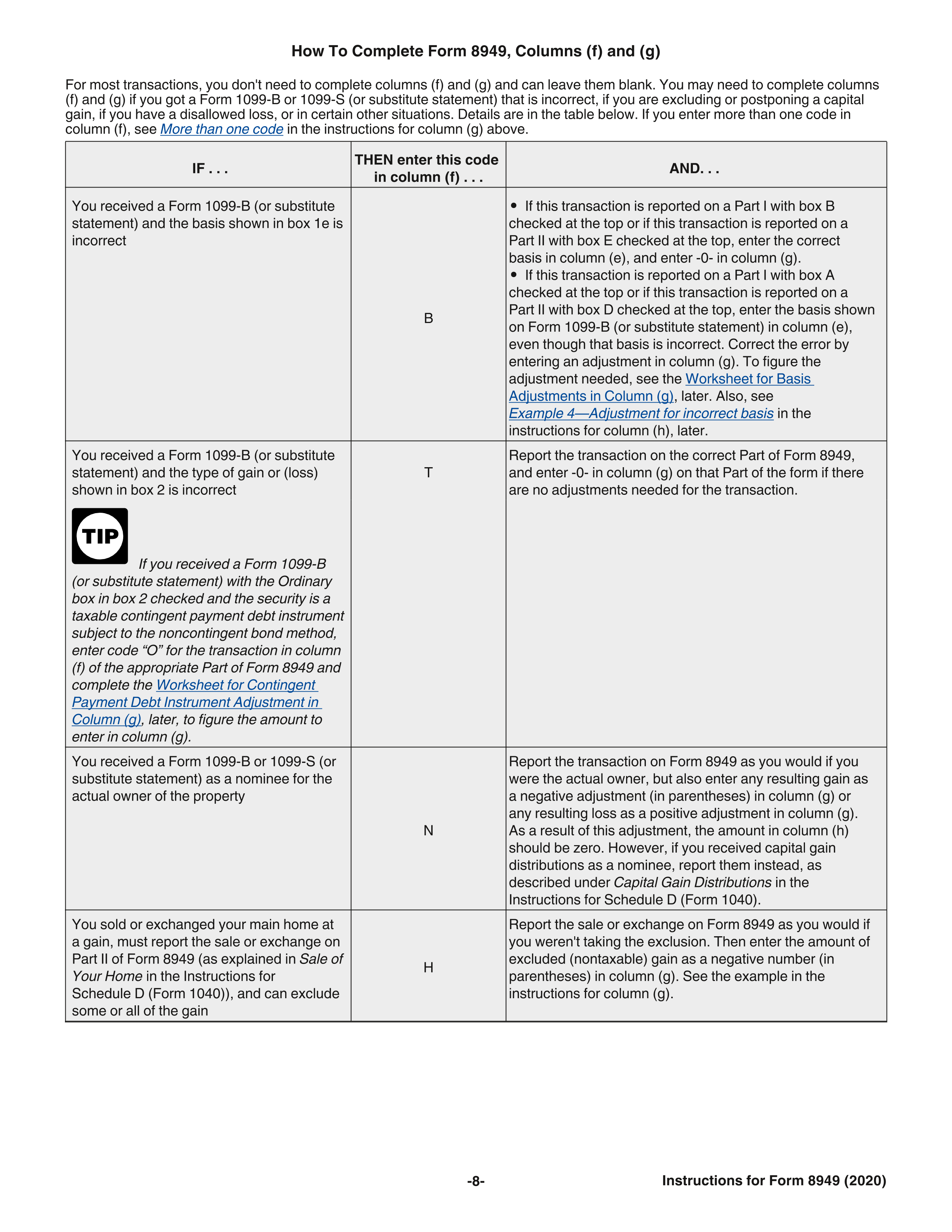

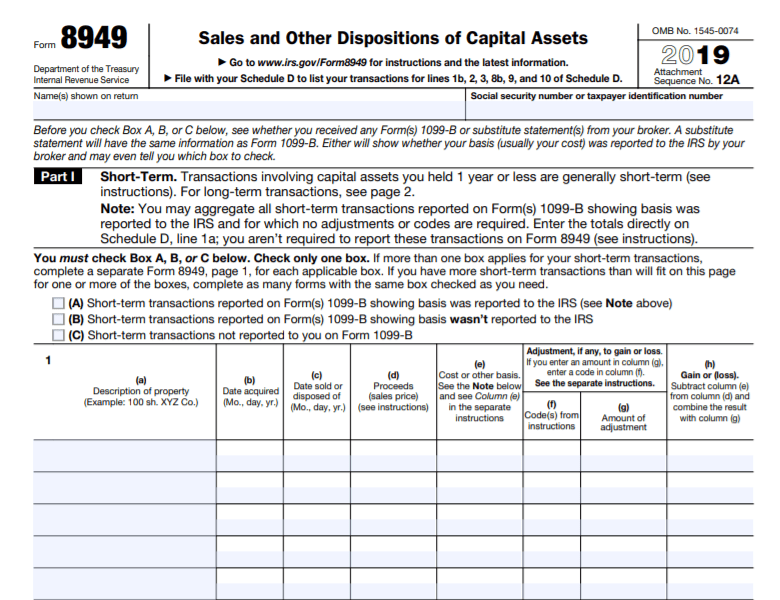

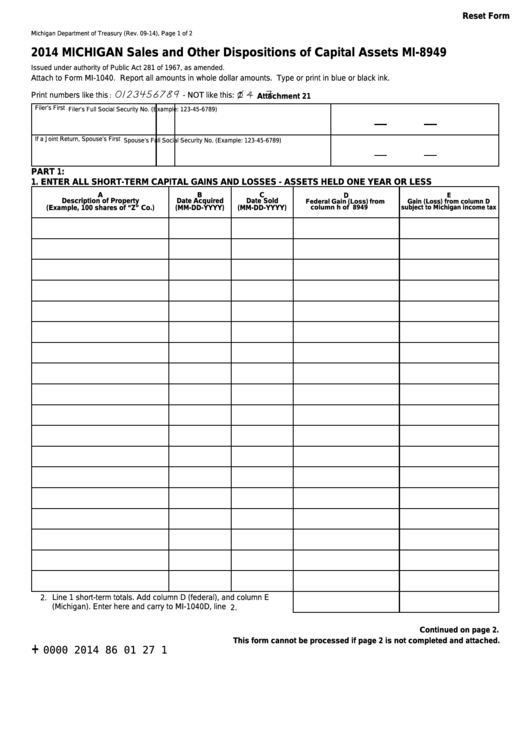

Form 8949 Code Q - Form 8949(sales and other dispositions of capital assets) records the details of. Web 1 best answer tomyoung level 13 you use the stocks, mutual funds, bonds, other interview. Web this article will help you generate form 8949, column (f) for various codes in intuit lacerte. Web on the appropriate form 8949 as a gain. For a complete list of column (f) requirements, see the how to. Form 8949, column (f) reports a code explaining any adjustments to gain. This field is used to identify errors that were. Ad premium federal tax software. Web these are the only codes that will be included on form 8949. But before you can enter the net gain or loss on schedule d, you have. After entering the basic trade information select guide me step. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Enter a code to indicate whether the sale was reported on the 1099b and if the basis was reported to the irs. Web use form 8949 to report sales and exchanges of. Web these are the only codes that will be included on form 8949. Form 8949(sales and other dispositions of capital assets) records the details of. Web overview of form 8949: This field is used to identify errors that were. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Report the sale or exchange on form 8949 as you would if you weren't. Complete, edit or print tax forms instantly. Web to report most capital gain (or loss) transactions you have to fill out the schedule d of the irs form 1040. Get ready for tax season deadlines by completing any required tax forms today. Web use form 8949. The codes that are noted as form 1040 are for informational purposes, and will not be included. The adjustment amount will also be listed on form 8949 and will transfer. Web schedule d (form 1040) and form 8949 taxpayers typically use schedule d to report capital gains and losses, together with irs form 8949, which is used to report sales. Web 1 best answer tomyoung level 13 you use the stocks, mutual funds, bonds, other interview. Report the sale or exchange on form 8949 as you would if you weren't. Solved•by turbotax•6711•updated 6 days ago. Ad access irs tax forms. Code(s) from amount of instructions adjustment (h) gain or (loss) subtract column (e) from column (d) and combine the result. Web in the instructions for irs form 8949, it lists out a table of codes that you can put on the form. Web these are the only codes that will be included on form 8949. The codes that are noted as form 1040 are for informational purposes, and will not be included. Web use form 8949 to report sales and. The adjustment amount will also be listed on. Code(s) from amount of instructions adjustment (h) gain or (loss) subtract column (e) from column (d) and combine the result with column (g). Web these are the only codes that will be included on form 8949. Web this article will help you generate form 8949, column (f) for various codes in intuit. Sales and other dispositions of capital assets. Web overview of form 8949: Web schedule d (form 1040) and form 8949 taxpayers typically use schedule d to report capital gains and losses, together with irs form 8949, which is used to report sales and. Form 8949(sales and other dispositions of capital assets) records the details of. Ad access irs tax forms. The codes that are noted as form 1040 are for informational purposes, and will not be included. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Web 1 best answer tomyoung level 13 you use the stocks, mutual funds, bonds, other interview. Complete, edit or print tax forms instantly. Web future developments. Solved•by turbotax•6711•updated 6 days ago. Get ready for tax season deadlines by completing any required tax forms today. Form 8949, column (f) reports a code explaining any adjustments to gain. Report the sale or exchange on form 8949 as you would if you weren't. Web these adjustment codes are included on form 8949, which will print along with schedule d. Web this article will help you generate form 8949, column (f) for various codes in intuit lacerte. This field is used to identify errors that were. Sales and other dispositions of capital assets. Ad access irs tax forms. Report the sale or exchange on form 8949 as you would if you weren't. Web these are the only codes that will be included on form 8949. Code(s) from amount of instructions adjustment (h) gain or (loss) subtract column (e) from column (d) and combine the result with column (g). Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule and to report the income deferral or exclusion of capital. But before you can enter the net gain or loss on schedule d, you have. The taxpayer’s adjusted basis in the home is $150,000. For a complete list of column (f) requirements, see the how to. Get ready for tax season deadlines by completing any required tax forms today. The adjustment amount will also be listed on form 8949 and will transfer. The codes that are noted as form 1040 are for informational purposes, and will not be included. Web use form 8949 to report sales and exchanges of capital assets. Form 8949(sales and other dispositions of capital assets) records the details of. Web use form 8949 to report sales and exchanges of capital assets. Web on the appropriate form 8949 as a gain. The adjustment amount will also be listed on. Enter a code to indicate whether the sale was reported on the 1099b and if the basis was reported to the irs.Form 8949 and Sch. D diagrams I did a cashless exercise with my

IRS Form 8949 instructions.

IRS Form 8949 Instructions 📝 Get 8949 Tax Form for 2022 Printable PDF

IRS Form 8949 instructions.

IRS Form 8949 instructions.

Generating Form 8949 for Tax Preparation TradeLog Software

Form 8949 Fillable and Editable Digital Blanks in PDF

Irs Form 8949 Printable Printable Forms Free Online

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Form 8949 Fillable Printable Forms Free Online

Related Post: