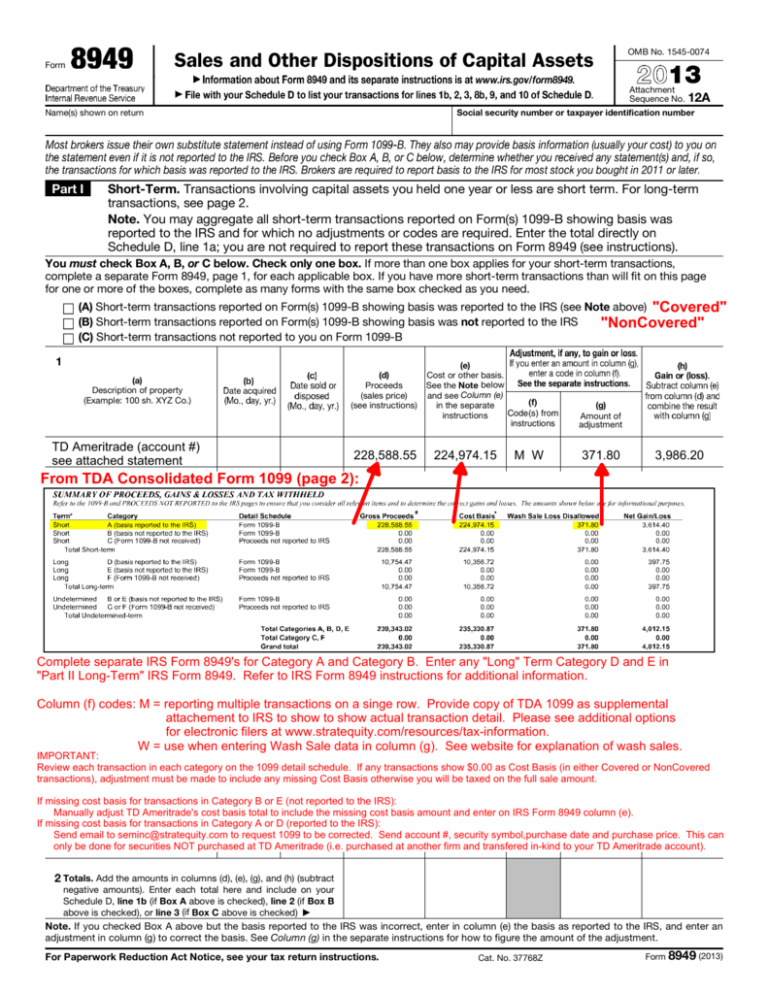

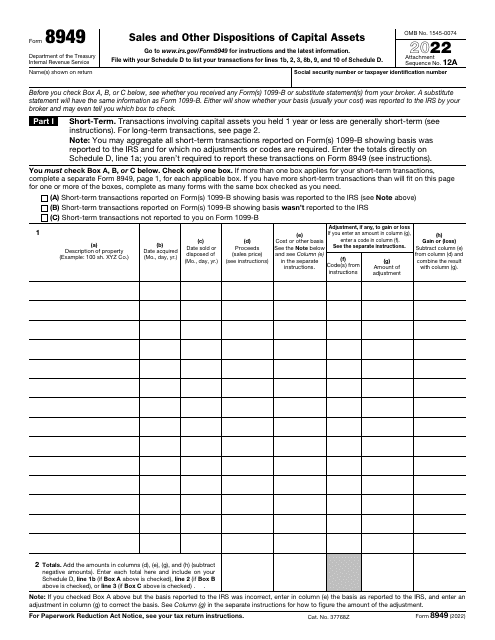

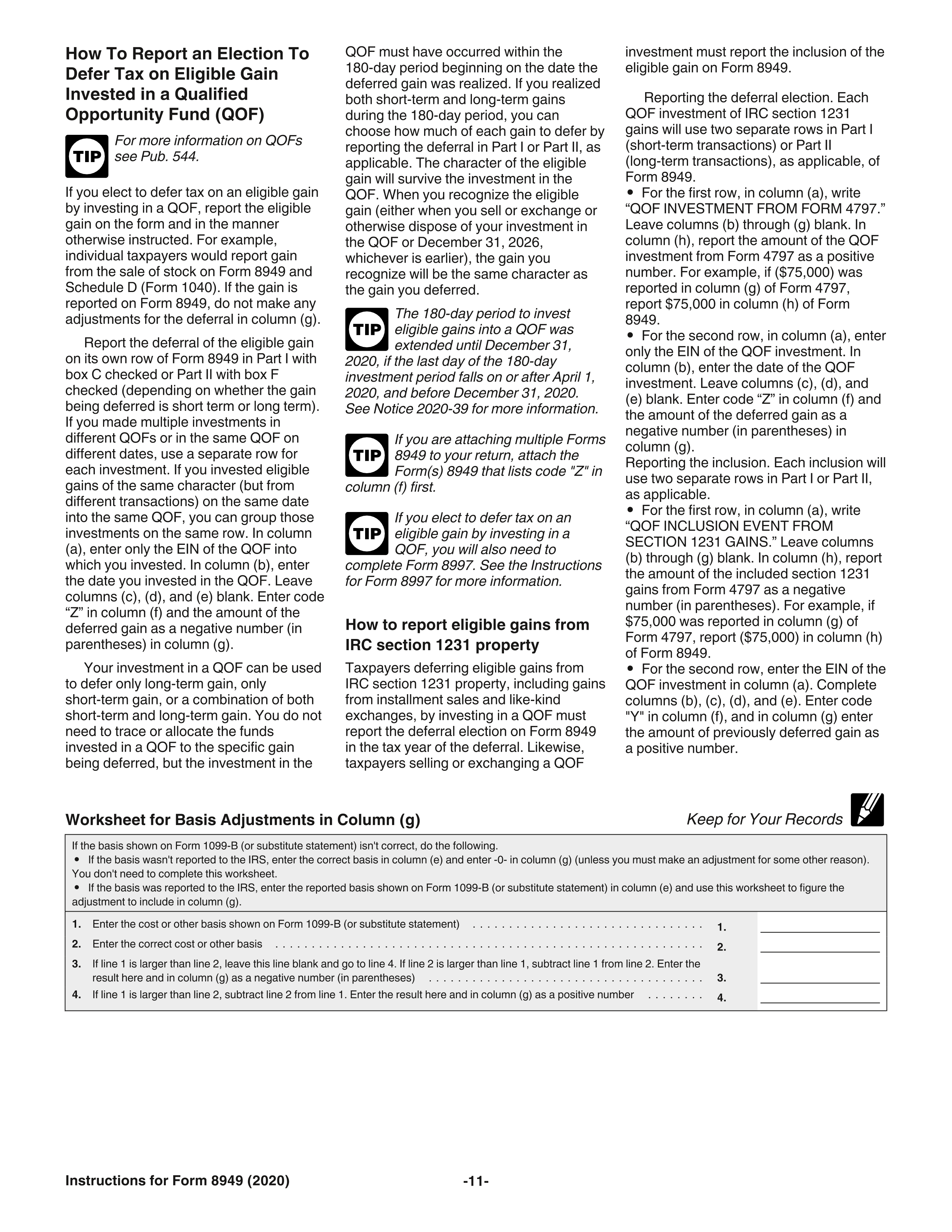

Form 8949 Code M

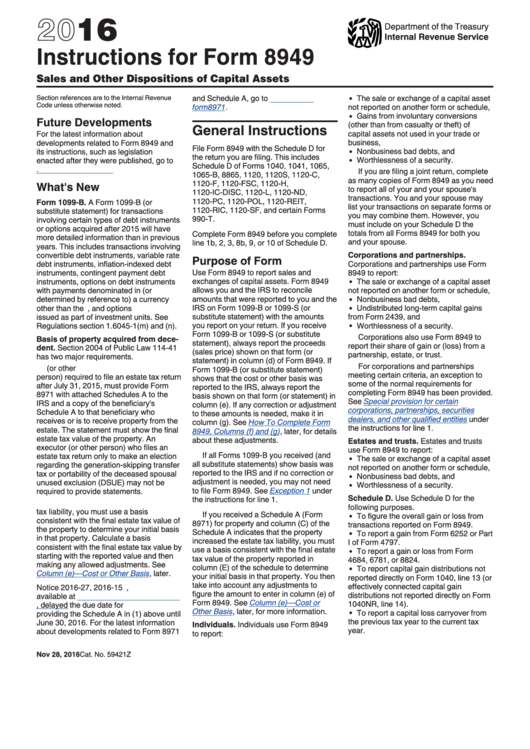

Form 8949 Code M - For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and (g) section of the. Refer to this article for instructions on reporting multiple disposition items for form 8949, code m. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Web in the adjustment code (s) field enter code m. Sales and other dispositions of capital assets. Web file form 8949 with the schedule d for the return you are filing. By forrest baumhover april 11, 2023 reading time: Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Complete, edit or print tax forms instantly. Go to www.irs.gov/form8949 for instructions and the latest information. Web what is form 8949 used for? If you need to enter multiple codes see entering multiple codes on form 8949, column f for entry instructions. Web form 8949 adjustment codes are reported in column (f). Web in the adjustment code (s) field enter code m. These are the only codes that will be included on form 8949. This article will help to report multiple disposition items without entering each one separately in the individual module,. These are the only codes that will be included on form 8949. Web department of the treasury internal revenue service. Web b, t, d, x, r, w, c, m, o, and z are valid choices. Web gain, form 8949 will show the. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Web solved•by intuit•181•updated 1 week ago. By forrest baumhover april 11, 2023 reading time: If you need to enter multiple codes see entering multiple codes on form 8949, column f for entry instructions. These are the only codes that will be included on. Web solved•by intuit•181•updated 1 week ago. Refer to this article for instructions on reporting multiple disposition items for form 8949, code m. Go to www.irs.gov/form8949 for instructions and the latest information. Web form 8949 adjustment codes are reported in column (f). If you need to enter multiple codes see entering multiple codes on form 8949, column f for entry instructions. Refer to this article for instructions on reporting multiple disposition items for form 8949, code m. Web department of the treasury internal revenue service. Web irs form 8949 instructions. By forrest baumhover april 11, 2023 reading time: For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and (g) section of the. Web form 8949 adjustment codes are reported in column (f). Sales and other dispositions of capital assets. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule and to report the income deferral or exclusion of capital. Web these adjustment codes will be included on form 8949,. The codes that are noted as form 1040 are for informational. By forrest baumhover april 11, 2023 reading time: Go to www.irs.gov/form8949 for instructions and the latest information. Web file form 8949 with the schedule d for the return you are filing. For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and. Refer to this article for instructions on reporting multiple disposition items for form 8949, code m. Web if your form 8949 shows m in the code column, that is a summarized 8949. Sales and other dispositions of capital assets. Ad pdffiller.com has been visited by 1m+ users in the past month File form 8949 with the schedule d for the. Web form 8949 adjustment codes are reported in column (f). For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and (g) section of the. This article will help to report multiple disposition items without entering each one separately in the individual module,. The codes that are noted as form 1040 are for. Web solved•by intuit•181•updated 1 week ago. This article will help to report multiple disposition items without entering each one separately in the individual module,. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule and to report the income deferral or exclusion of capital. Web if your. Web if your form 8949 shows m in the code column, that is a summarized 8949. Web these adjustment codes will be included on form 8949, which will print along with schedule d. This article will help to report multiple disposition items without entering each one separately in the individual module,. File form 8949 with the schedule d for the return you are filing. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule and to report the income deferral or exclusion of capital. Web what is form 8949 used for? Ad pdffiller.com has been visited by 1m+ users in the past month Web form 8949 adjustment codes are reported in column (f). By forrest baumhover april 11, 2023 reading time: Web in the adjustment code (s) field enter code m. Complete, edit or print tax forms instantly. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Refer to this article for instructions on reporting multiple disposition items for form 8949, code m. For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and (g) section of the. Web solved•by intuit•181•updated 1 week ago. Web b, t, d, x, r, w, c, m, o, and z are valid choices. Web file form 8949 with the schedule d for the return you are filing. Web department of the treasury internal revenue service. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. These are the only codes that will be included on form 8949.Instructions For Form 8949 2016 printable pdf download

O que é o Formulário 8949 do IRS? Economia e Negocios

Form 8949 Fillable and Editable Digital Blanks in PDF

Fillable Irs Form 8949 Printable Forms Free Online

IRS Form 8949 SAMPLE 2013

Form 8949 Pillsbury Tax Page

IRS Form 8949 Instructions 📝 Get 8949 Tax Form for 2022 Printable PDF

IRS Form 8949 Download Fillable PDF or Fill Online Sales and Other

Online Generation Of Schedule D And Form 8949 For 10 00 2021 Tax

IRS Form 8949 instructions.

Related Post:

:max_bytes(150000):strip_icc()/2020Form8949-0791c2d868bc4a418fd342bb64d0ae91.jpg)