Form 8949 Code L

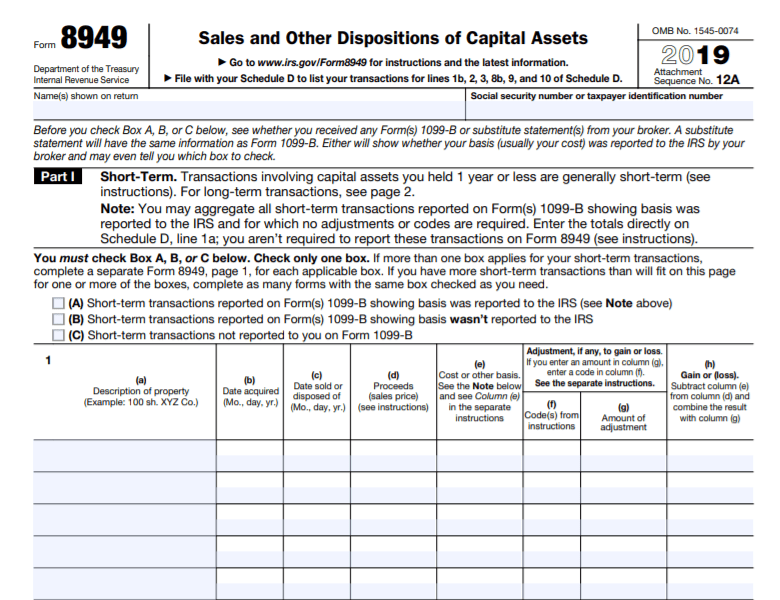

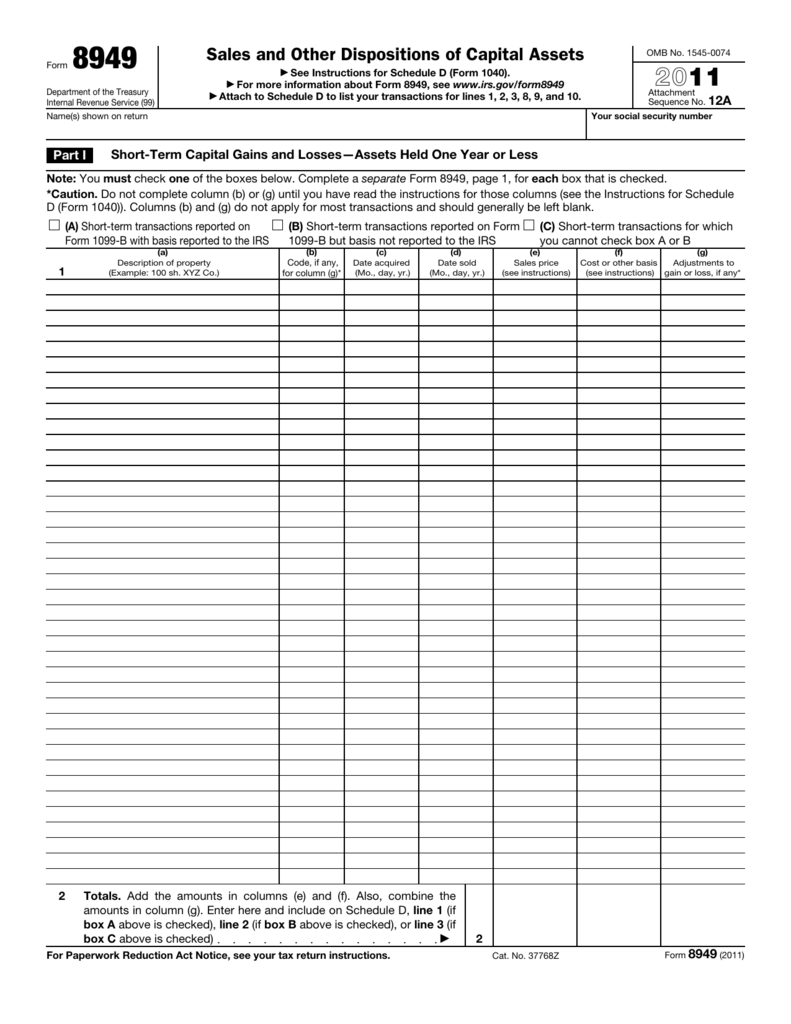

Form 8949 Code L - Web use form 8949 to report sales and exchanges of capital assets. For a complete list of column (f) requirements, see the how to. Column (f)—code in order to explain any adjustment to gain or. Web file form 8949 with the schedule d for the return you are filing. Web what does code el mean 8949 column f? Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule and to report the income deferral or exclusion of capital. Here is more information on how tax form 8949 is used from the irs: Web 17 rows if no part of the loss is a nondeductible loss from a wash sale transaction, enter. Web per the irs, you'll use form 8949 to report the following: Web you will report the totals of form 8949 on schedule d of form 1040. Web 17 rows if no part of the loss is a nondeductible loss from a wash sale transaction, enter. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Sales and other dispositions of capital assets. Follow the instructions for the code you need to generate below. Web use form 8949 to. Ad get ready for tax season deadlines by completing any required tax forms today. Web file form 8949 with the schedule d for the return you are filing. Web use form 8949 to report sales and exchanges of capital assets. Web you will report the totals of form 8949 on schedule d of form 1040. Web overview of form 8949: Web file form 8949 with the schedule d for the return you are filing. Web 17 rows if no part of the loss is a nondeductible loss from a wash sale transaction, enter. Web you will report the totals of form 8949 on schedule d of form 1040. Web use form 8949 to report sales and exchanges of capital assets.. Web you will report the totals of form 8949 on schedule d of form 1040. It's used in calculating schedule d lines 1b, 2, 3, 8b, 9, or 10. For a complete list of column (f) requirements, see the how to. Complete, edit or print tax forms instantly. Web 17 rows if no part of the loss is a nondeductible. For a complete list of column (f) requirements, see the how to. It's used in calculating schedule d lines 1b, 2, 3, 8b, 9, or 10. Web what is form 8949? Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule and to report the income deferral. Web what is form 8949? Xyz co.) (mo., day, yr.) disposed of (mo., day, yr.) (d) proceeds (sales price) (see instructions) adjustment, if. Web you will report the totals of form 8949 on schedule d of form 1040. Web form 8949(sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Web use. Web per the irs, you'll use form 8949 to report the following: Ad get ready for tax season deadlines by completing any required tax forms today. The sale or exchange of any capital asset that’s not reported on another form or schedule gains. Complete, edit or print tax forms instantly. Web use form 8949 to report sales and exchanges of. Web you will report the totals of form 8949 on schedule d of form 1040. Web file form 8949 with the schedule d for the return you are filing. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Web what is form 8949? Web use form 8949 to report the sale. Enter code t in column (f) then report the transaction on the correct. Here is more information on how tax form 8949 is used from the irs: They are two separate codes e & l. Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 8949 to report sales and exchanges of capital. The sale or exchange of any capital asset that’s not reported on another form or schedule gains. Xyz co.) (mo., day, yr.) disposed of (mo., day, yr.) (d) proceeds (sales price) (see instructions) adjustment, if. Web use form 8949 to report sales and exchanges of capital assets. Sales and other dispositions of capital assets. Web what does code el mean. For a complete list of column (f) requirements, see the how to. Web use form 8949 to report sales and exchanges of capital assets. It's used in calculating schedule d lines 1b, 2, 3, 8b, 9, or 10. Web form 8949(sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. The sale or exchange of any capital asset that’s not reported on another form or schedule gains. Web 8 rows support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Web what does code el mean 8949 column f? Xyz co.) (mo., day, yr.) disposed of (mo., day, yr.) (d) proceeds (sales price) (see instructions) adjustment, if. Web per the irs, you'll use form 8949 to report the following: Web description of property date acquired date sold or (example: Enter code t in column (f) then report the transaction on the correct. Web you will report the totals of form 8949 on schedule d of form 1040. Complete, edit or print tax forms instantly. Web file form 8949 with the schedule d for the return you are filing. They are two separate codes e & l. Here is more information on how tax form 8949 is used from the irs: Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule and to report the income deferral or exclusion of capital. Ad download or email irs 8949 & more fillable forms, register and subscribe now! Column (f)—code in order to explain any adjustment to gain or.Form 8949 Sales and Other Dispositions of Capital Assets (2014) Free

IRS Form 8949 instructions.

IRS Form 8949 instructions.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Crypto to US Dollar Gains Taxes and Form 8949 The Cryptocurrency Forums

Form 8949 Fillable Printable Forms Free Online

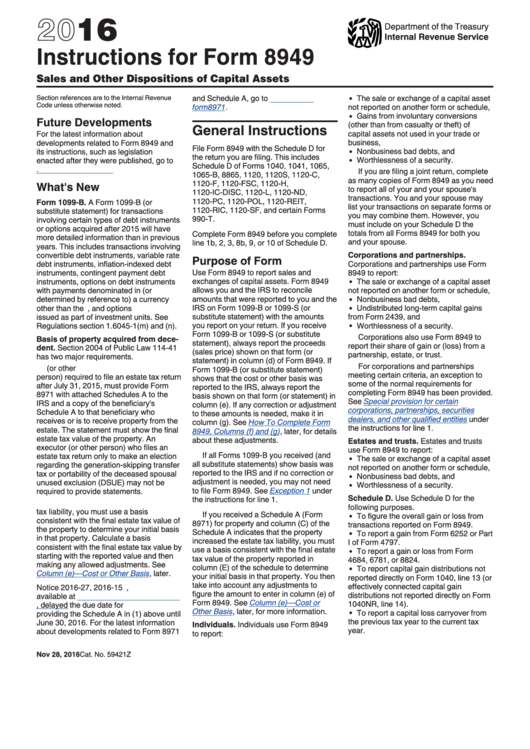

Instructions For Form 8949 2016 printable pdf download

8949 form 2016 Fill out & sign online DocHub

Irs Form 8949 Printable Printable Forms Free Online

Form 8949 Pillsbury Tax Page

Related Post: