Form 8938 Turbotax

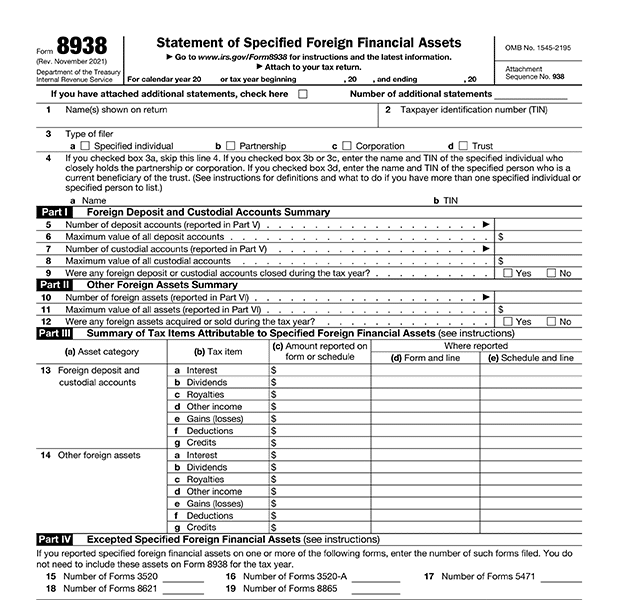

Form 8938 Turbotax - If it applies to you and it was not. Web in other words, when a couple files the us tax return as married filing jointly, they will only have to file irs form 8938 when you have a combined annual aggregate total of. Foreign account tax compliance act (fatca) the foreign account tax compliance act, more commonly. Filing form 8938is only available to those using turbotax deluxe or higher. Answer simple questions about your life, and we’ll fill out the. Web additionally, if the form 8938 is not filed within 90 days of receiving a formal notice from the irs then the irs may impose additional penalties of $10,000 for each 30. Per the forms availability faq, form 8938, statement of specified foreign financial assets, is scheduled to be. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. A form 8938 is used when you have specified foreign financial assets and. Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Statement of specified foreign financial assets. This article will help to report specified foreign financial assets in lacerte. December 14, 2021 | last updated: Web the biggest things you should know about form 8938 are: Web how do i file form 8938, statement of specified foreign financial assets? This article will help to report specified foreign financial assets in lacerte. Web page last reviewed or updated: Open the template in our online editor. Not every expat needs to fill it out—it depends on the types of assets you have and how much they’re. Answer simple questions about your life, and we’ll fill out the. Use form 8938 to report your. Find answers to basic questions about form 8938, statement of specified foreign financial assets. Web page last reviewed or updated: Web additionally, if the form 8938 is not filed within 90 days of receiving a formal notice from the irs then the irs may impose additional penalties of $10,000 for each 30. Web solved•by. Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report. December 14, 2021 | last updated: Statement of specified foreign financial assets. Please see the following information for filing form 8938. Select the form you require in the library of templates. Web additionally, if the form 8938 is not filed within 90 days of receiving a formal notice from the irs then the irs may impose additional penalties of $10,000 for each 30. Web turbotax / personal taxes / irs forms & schedules. Web form 8938, officially known as the “statement of specified foreign financial assets,” is the document individuals and. A form 8938 is used when you have specified foreign financial assets and. Web solved•by turbotax•968•updated january 13, 2023. November 2021) department of the treasury internal revenue service. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Ad signnow.com has been visited by 100k+ users in the past. Web the purpose of form 8938 is to keep the irs updated and current on a u.s. Web the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen form 114 (report of foreign bank and financial accounts). Web in other words, when a couple files the us tax return as married filing jointly,. It is a form that discloses accounts and assets held in other countries outside of the united states. Web 1 best answer. Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report. Per the forms availability faq, form 8938, statement of specified foreign financial assets, is scheduled to be. Web how do i file form 8938,. Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report. Web how do i file form 8938, statement of specified foreign financial assets? Select the form you require in the library of templates. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web form. Web follow these simple steps to get form 8938 turbotax ready for sending: Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Please see the following information for filing form 8938. Not every expat needs to fill it out—it depends on the types of assets. Web in other words, when a couple files the us tax return as married filing jointly, they will only have to file irs form 8938 when you have a combined annual aggregate total of. Web follow these simple steps to get form 8938 turbotax ready for sending: Comparison of form 8938 and fbar form 8938. Web form 8938 is part of the foreign account tax compliance act or fatca. To get to the 8938 section in. It is a form that discloses accounts and assets held in other countries outside of the united states. November 2021) department of the treasury internal revenue service. If it applies to you and it was not. Answer simple questions about your life, and we’ll fill out the. To get to the 8938 section in turbotax (requires deluxe or higher): Use form 8938 to report your. December 14, 2021 | last updated: Tax forms included with turbotax cd/download products. Please see the following information for filing form 8938. Not every expat needs to fill it out—it depends on the types of assets you have and how much they’re. Web the biggest things you should know about form 8938 are: Select the form you require in the library of templates. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you. Web generating form 8938, statement of specified foreign financial assets, in lacerte. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you.Form 8938, Statement of Specified Foreign Financial Assets YouTube

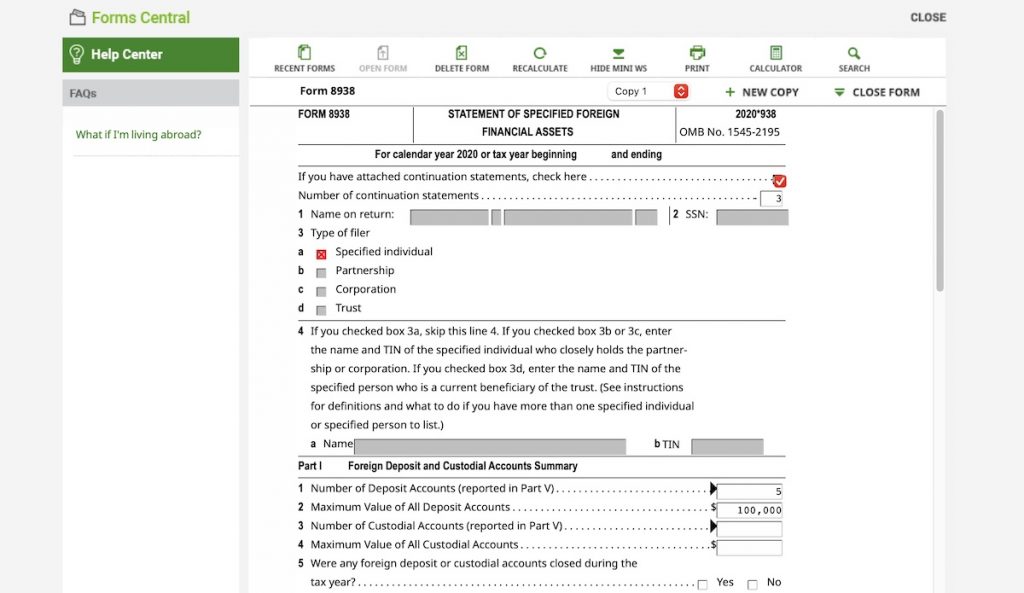

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

What is form 8938 and why do you need to file it? Expat US Tax

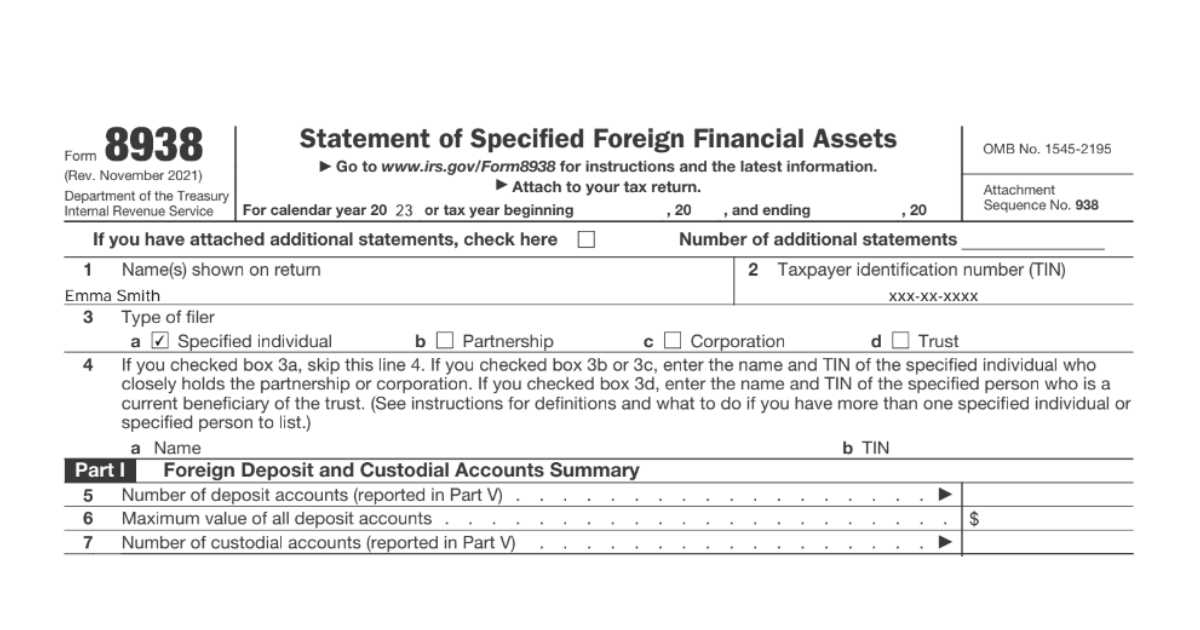

Your US Expat Tax Return and Filing FATCA Form 8938

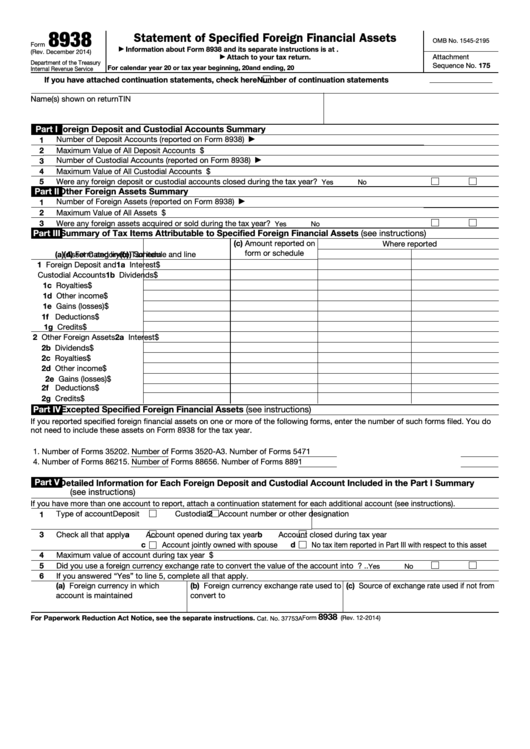

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Do YOU need to file Form 8938? “Statement of Specified Foreign

2018 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

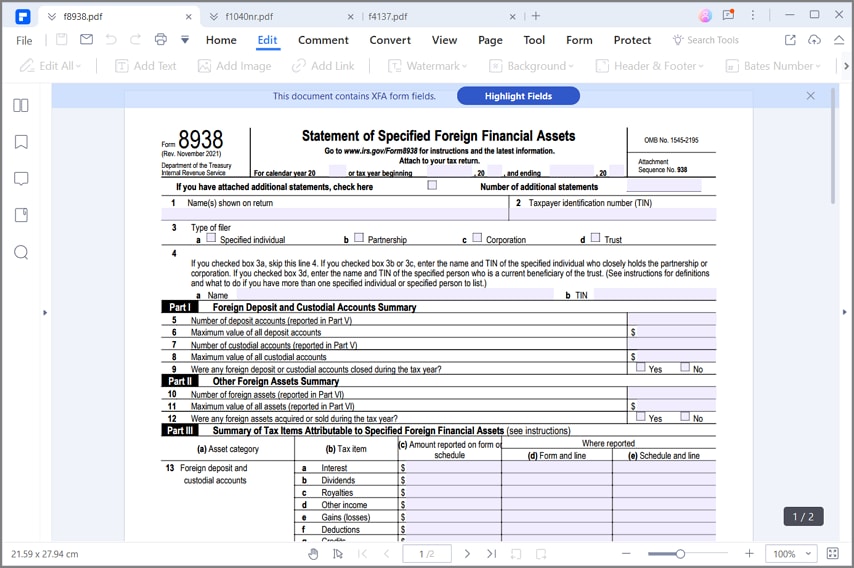

IRS Form 8938 How to Fill it with the Best Form Filler

Form 8938 Filing Requirements US Expats and FATCA Bright!Tax Expat

FATCA Reporting Filing Form 8938 Gordon Law Group

Related Post: