Form 8915 D

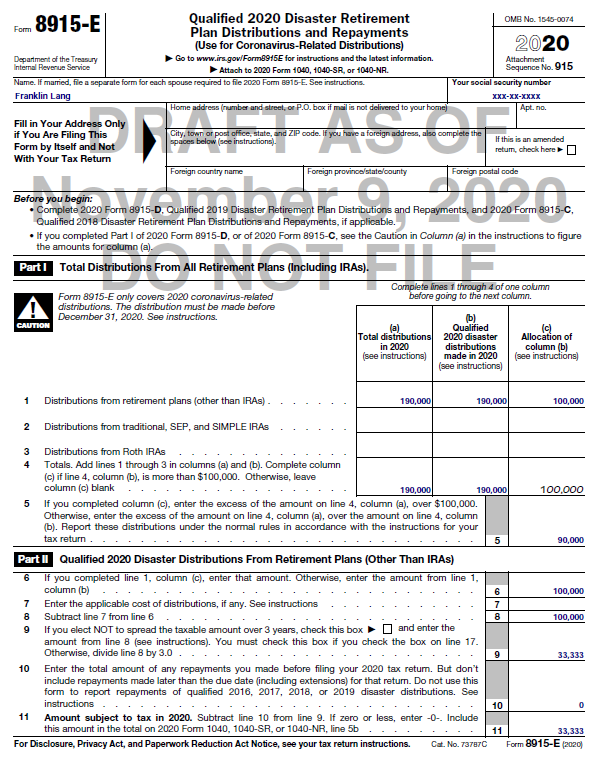

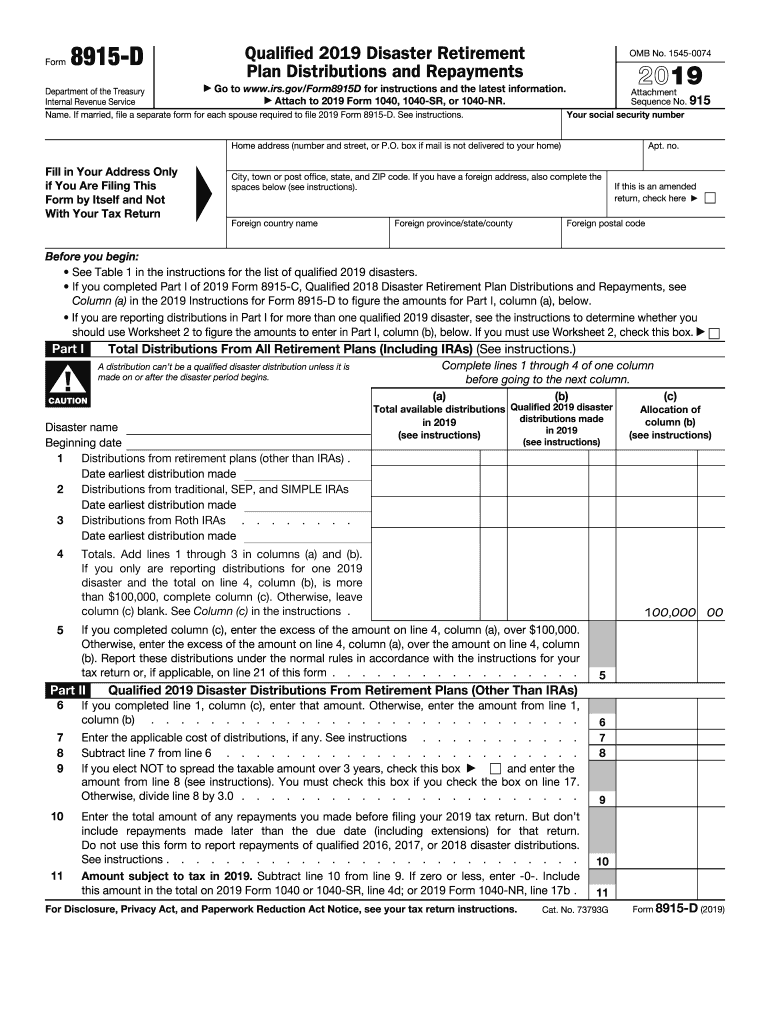

Form 8915 D - Qualified 2019 disaster retirement plan distributions and repayments. Distributions from retirement plans (other than iras) made in. Allocation of column (b) 2: This distribution must be made in 2019; Department of the treasury internal revenue service. In the left menu, select tax tools and then tools. The taxable amount of qualifying distributions can. The form is used for stating that you got the. Make sure to complete the payer information. Web open or continue your return in turbotax. The taxable amount of qualifying distributions can. Distributions from retirement plans (other than iras) made in. Qualified 2019 disaster retirement plan distributions and repayments. This distribution must be made in 2019; In the left menu, select tax tools and then tools. Make sure to complete the payer information. Web open or continue your return in turbotax. Allocation of column (b) 2: Distributions from retirement plans (other than iras) made in. Qualified 2019 disaster retirement plan distributions and repayments. Web what is the irs form 8915 d? Distributions from retirement plans (other than iras) made in. Web go to www.irs.gov/form8915d for instructions and the latest information. Department of the treasury internal revenue service. Qualified 2019 disaster retirement plan distributions and repayments. This distribution must be made in 2019; The taxable amount of qualifying distributions can. Qualified 2019 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. Web what is the irs form 8915 d? Allocation of column (b) 2: Qualified 2019 disaster retirement plan distributions and repayments. Web what is the irs form 8915 d? Department of the treasury internal revenue service. The form is used for stating that you got the. Qualified 2019 disaster retirement plan distributions and repayments. Qualified 2019 disaster retirement plan distributions and repayments. In the left menu, select tax tools and then tools. The form is used for stating that you got the. This distribution must be made in 2019; The taxable amount of qualifying distributions can. Allocation of column (b) 2: Department of the treasury internal revenue service. The form is used for stating that you got the. Qualified 2019 disaster retirement plan distributions and repayments. Web open or continue your return in turbotax. Allocation of column (b) 2: Make sure to complete the payer information. In the left menu, select tax tools and then tools. This distribution must be made in 2019; Web what is the irs form 8915 d? The form is used for stating that you got the. Distributions from retirement plans (other than iras) made in. The taxable amount of qualifying distributions can. Make sure to complete the payer information. The form is used for stating that you got the. Web what is the irs form 8915 d? Allocation of column (b) 2: The taxable amount of qualifying distributions can. Qualified 2019 disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. Make sure to complete the payer information. Web go to www.irs.gov/form8915d for instructions and the latest information. The form is used for stating that you got the. Distributions from retirement plans (other than iras) made in. Qualified 2019 disaster retirement plan distributions and repayments. Web what is the irs form 8915 d? Qualified 2019 disaster retirement plan distributions and repayments. This distribution must be made in 2019; Allocation of column (b) 2: Web open or continue your return in turbotax. The taxable amount of qualifying distributions can. In the left menu, select tax tools and then tools.National Association of Tax Professionals Blog

Form 8915 2023 Printable Forms Free Online

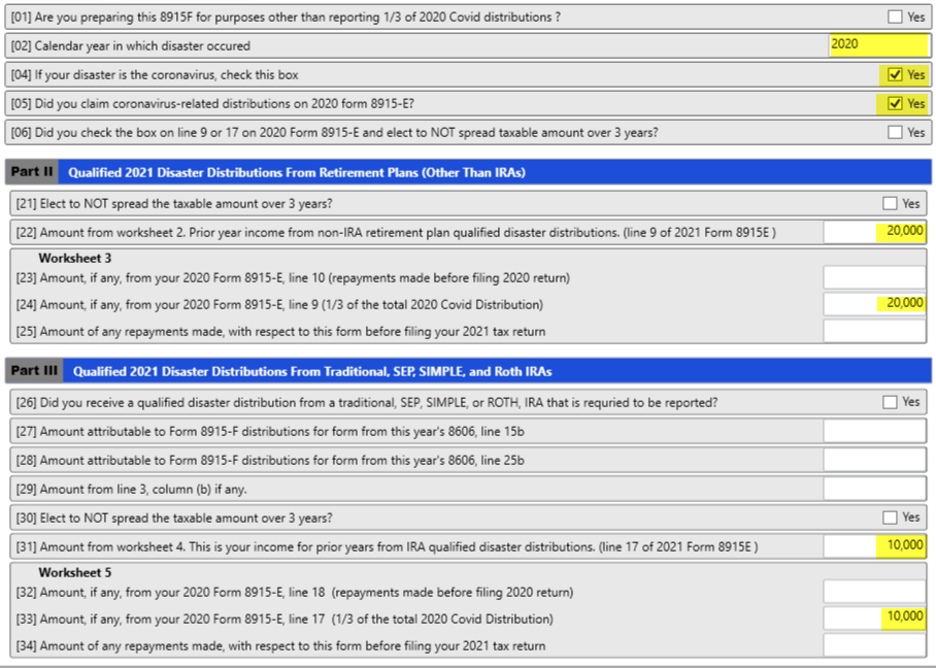

Basic 8915F Instructions for 2021 Taxware Systems

IRS Instructions 8915D 2020 Fill and Sign Printable Template Online

Fill Free fillable Form by Itself and Not 8915 D Qualified (IRS

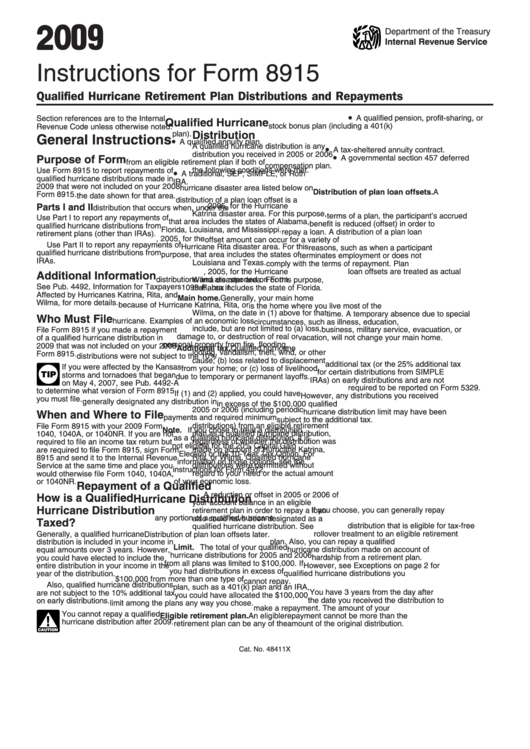

Instructions For Form 8915 Qualified Hurricane Retirement Plan

ME Worksheet For Form 1040ME 20202022 Fill and Sign Printable

8915 D Form Fill Out and Sign Printable PDF Template signNow

form 8915 e instructions turbotax Renita Wimberly

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

Related Post: