Form 8911 Instructions

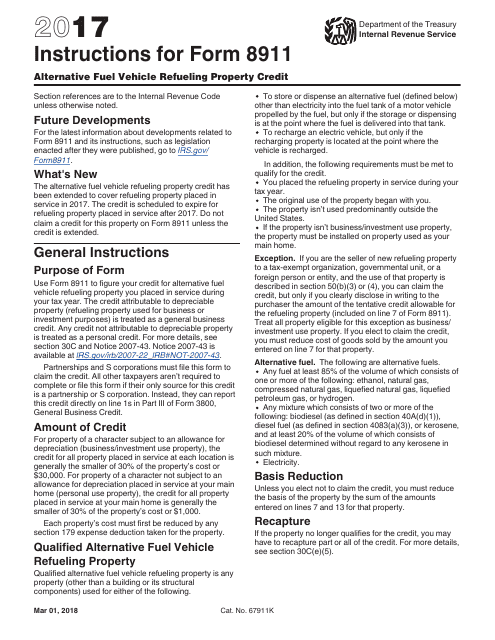

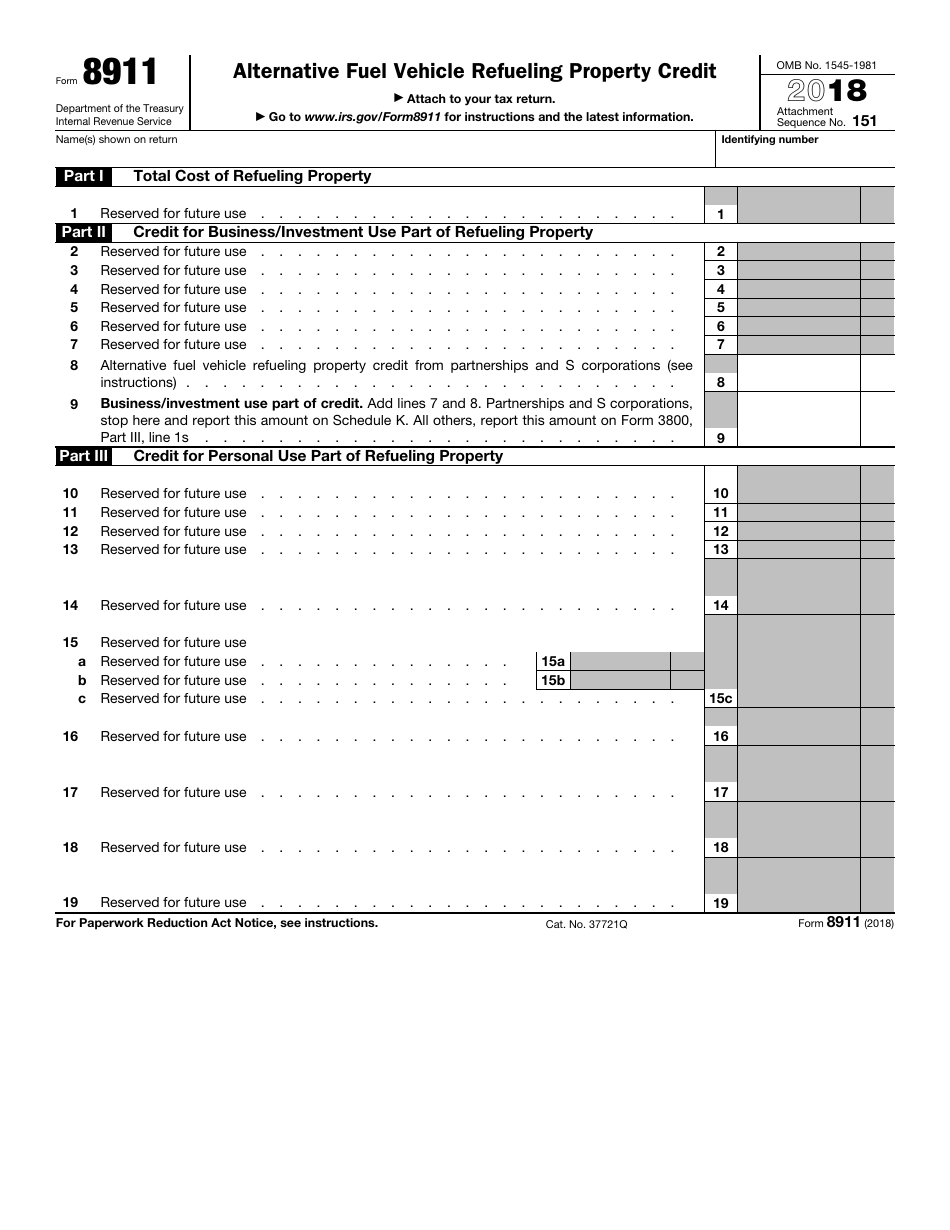

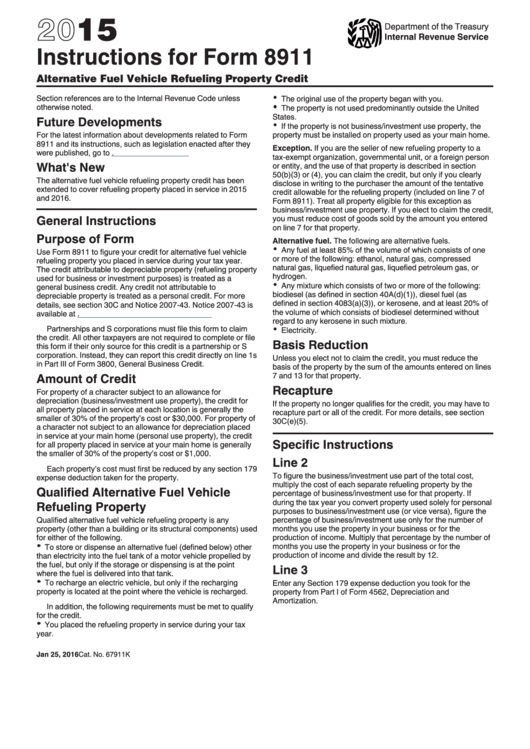

Form 8911 Instructions - Web solved•by intuit•86•updated june 08, 2023. Web form 8911 department of the treasury internal revenue service. However, the inflation reduction act (ira) extended the credit through. Web revised instructions for form 8911, alternative fuel vehicle refueling property credit, released nov. If the credit is associated with a schedule c business,. Ad access irs tax forms. 8 with changes to reflect inflation reduction act of 2022 (. Complete, edit or print tax forms instantly. This article will assist you with entering information related to form 8911, alternative fuel vehicle refueling property. Web 1 total cost of qualified alternative fuel vehicle refueling property placed in service during the tax year (see what’s newin the instructions).1 part ii credit for. January 2023) department of the treasury internal. Web show sources > form 8911 is a federal individual income tax form. Use prior revisions of the. Web draft instructions for form 8911, alternative fuel vehicle refueling property credit, released november 18 to reflect the scheduled expiration of the. Web general instructions purpose of form. Web general instructions purpose of form. Web which revision to use. Web 1 total cost of qualified alternative fuel vehicle refueling property placed in service during the tax year (see what’s newin the instructions).1 part ii credit for. Go to www.irs.gov/form8911 for instructions and the latest information. Web general instructions purpose of form use form 8911 to figure your credit. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a. Web general instructions purpose of form use form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. Use the december 2022 revision of form 8911 for tax years beginning in 2022 or later, until.. If the credit is associated with a schedule c business,. Web draft instructions for form 8911, alternative fuel vehicle refueling property credit, released november 18 to reflect the scheduled expiration of the. Web general instructions purpose of form. March 2020) (for use with form 8911 (rev. This article will assist you with entering information related to form 8911, alternative fuel. February 2020), alternative fuel vehicle. If the credit is associated with a schedule c business,. Go to www.irs.gov/form8911 for instructions and the latest information. January 2023) department of the treasury internal revenue service. For paperwork reduction act notice, see instructions. Get ready for tax season deadlines by completing any required tax forms today. Web attach to your tax return. Web which revision to use. Web form 8911, alternative fuel vehicle refueling property credit, and instructions released january 21 to note that the taxpayer certainty and disaster tax. Attach to your tax return. Web instructions for form 8911 department of the treasury internal revenue service (rev. Ultratax cs automatically transfers the information needed to complete form 8911, part. Web general instructions purpose of form use form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. If the credit is associated with a schedule. Web form 8911 department of the treasury internal revenue service. Web 1 total cost of qualified alternative fuel vehicle refueling property placed in service during the tax year (see what’s newin the instructions).1 part ii credit for. Attach to your tax return. Web when this video was first published, the credit was set to expire at the end of 2021.. Web attach to your tax return. Web form 8911 department of the treasury internal revenue service. January 2023) department of the treasury internal. Complete, edit or print tax forms instantly. Use form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in. Web solved•by intuit•86•updated june 08, 2023. Go to www.irs.gov/form8911 for instructions and the latest information. January 2023) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web draft instructions for form 8911, alternative fuel vehicle refueling property credit, released november 18 to reflect the scheduled expiration of the. Web form 8911, alternative fuel vehicle refueling property credit, and instructions released january 21 to note that the taxpayer certainty and disaster tax. For paperwork reduction act notice, see instructions. Web form 8911 department of the treasury internal revenue service. Use prior revisions of the. Ad access irs tax forms. Web 1 total cost of qualified alternative fuel vehicle refueling property placed in service during the tax year (see what’s newin the instructions).1 part ii credit for. Go to www.irs.gov/form8911 for instructions and the latest information. Web when this video was first published, the credit was set to expire at the end of 2021. Web general instructions purpose of form use form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year. However, the inflation reduction act (ira) extended the credit through. Use form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in. March 2020) (for use with form 8911 (rev. 8 with changes to reflect inflation reduction act of 2022 (. Attach to your tax return. If the credit is associated with a schedule c business,. Web which revision to use. Alternative fuel vehicle refueling property credit. Use the january 2022 revision of form 8911 for tax years beginning in 2021 or later, until a later revision is issued. Web general instructions purpose of form. Web draft instructions for form 8911, alternative fuel vehicle refueling property credit, released november 18 to reflect the scheduled expiration of the.IRS Form 8911 Instructions Alternative Fuel Refueling Credit

Fillable Online Instructions for Form 8911 (Rev. January 2022) IRS

H&R Block Software missing charger credit form (8911) Page 4

Form 7004 Printable PDF Sample

Download Instructions for IRS Form 8911 Alternative Fuel Vehicle

Download Instructions for IRS Form 8911 Alternative Fuel Vehicle

IRS Form 8911 2018 Fill Out, Sign Online and Download Fillable PDF

Form 8911 2023 Printable Forms Free Online

Form 8911 Alternative Fuel Vehicle Refueling Property Credit (2014

Form 8911 Instructions Alternative Fuel Vehicle Refueling Property

Related Post: