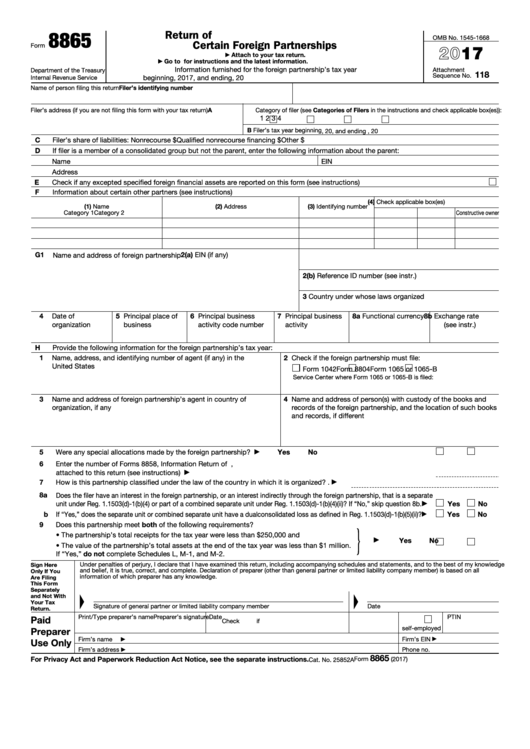

Form 8865 Schedule G

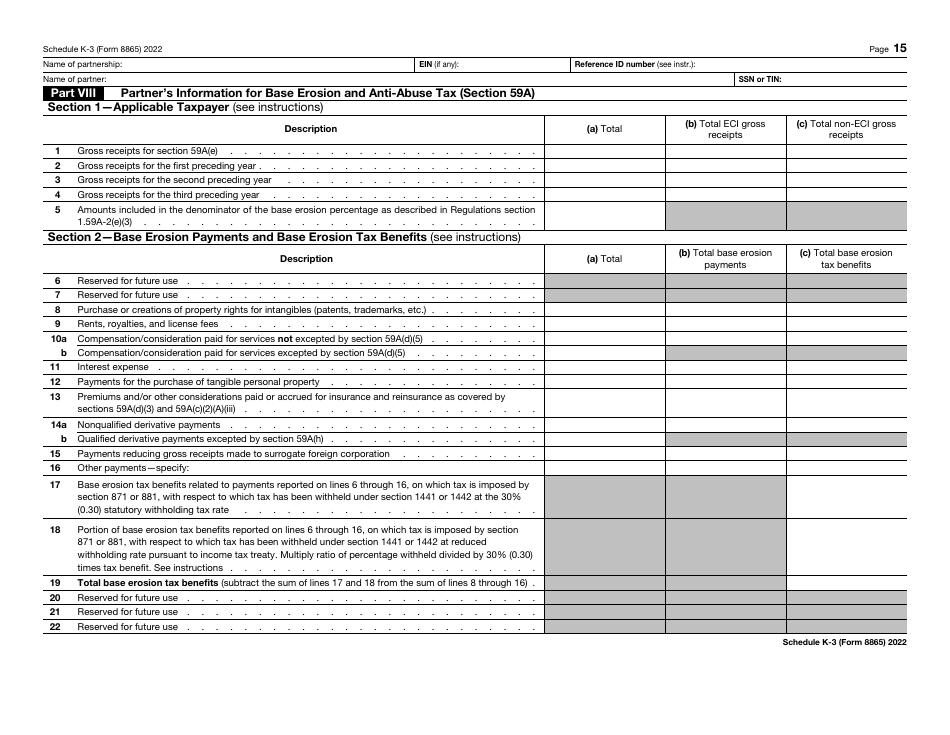

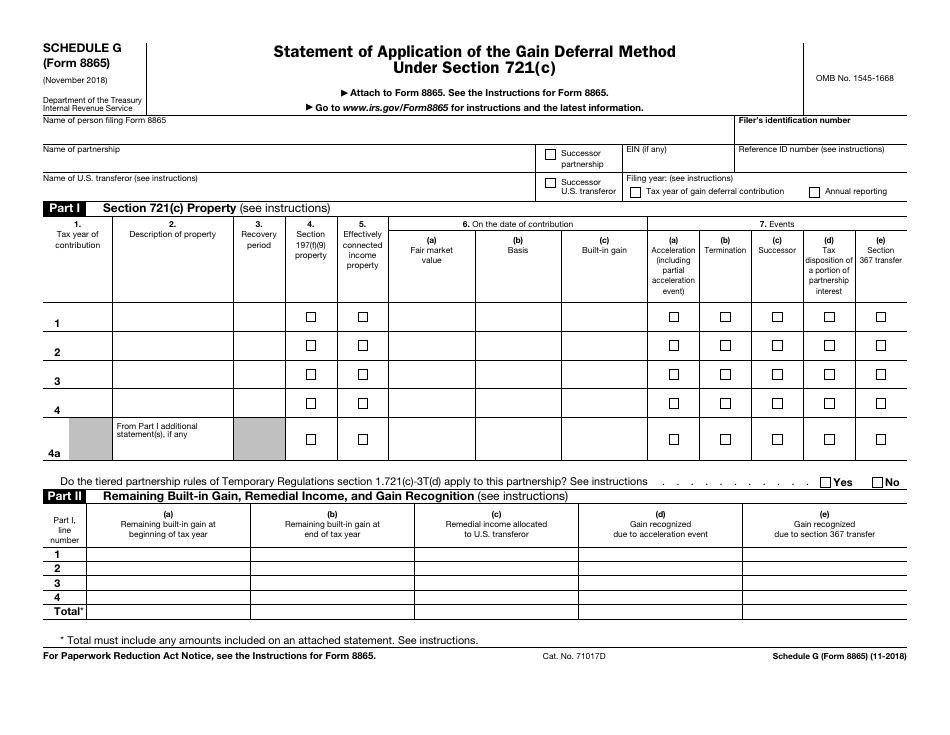

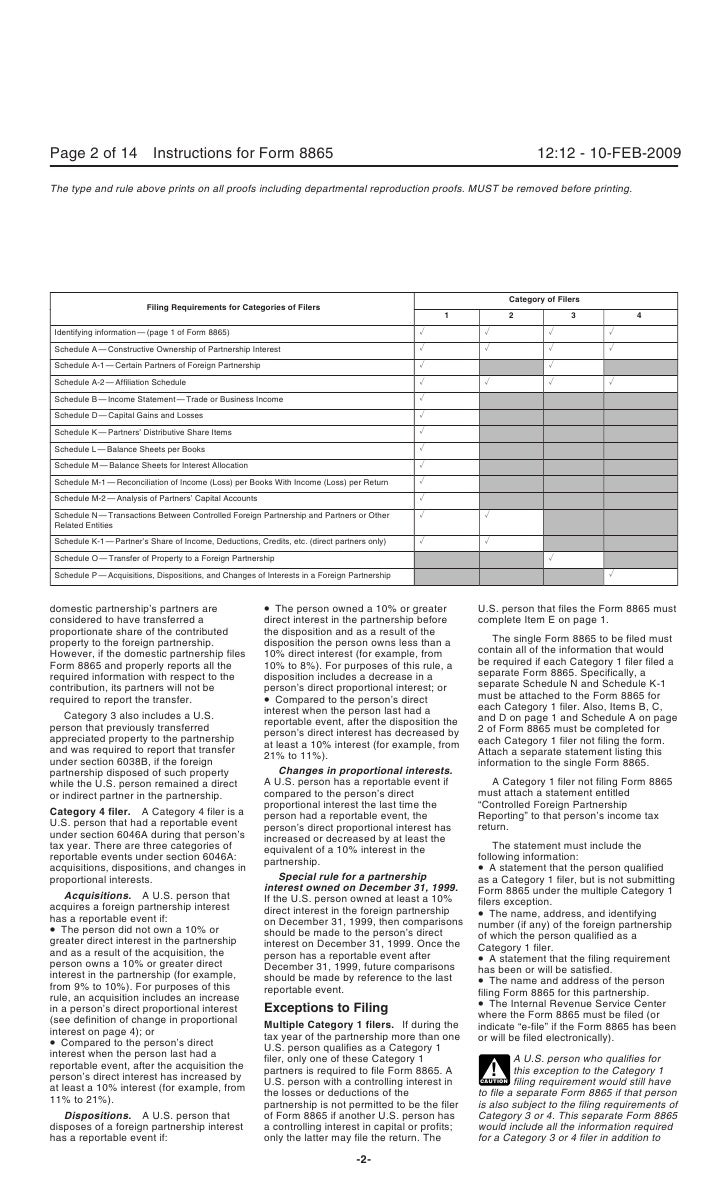

Form 8865 Schedule G - Web july 20, 2023. Likewise for a category 4 filer, check that category and complete information for schedule p. You should complete only the input screens necessary to complete the required information,. Ein (if any) reference id number (see instr.)part i acquisitions (a). Then use the instructions for form 1065. Statement of application of the gain deferral method under section 721(c) form 8865: Statement of application of the gain deferral method under section 721 (c) schedule h: Web schedule h (form 8865) (november 2018) department of the treasury internal revenue service. Web how do i generate form 8865 schedule o using worksheet view? Acceleration events and exceptions reporting relating to gain deferral method under section 721 (c) schedule k: Filing requirements for form 8865 depend on ownership. Schedule g—statement of application of the gain deferral method under section 721: Web if the 8865 is a category 3 filer, we need to indicate this as an additional information, include additional input for schedule o. Statement of application of the gain deferral method under section 721. Web july 20, 2023. Attach to your tax return. Likewise for a category 4 filer, check that category and complete information for schedule p. Web july 20, 2023. Transferor (b) related domestic partners (c) related foreign. Persons in foreign partnerships not formed or registered under u.s. If schedule n (form 8865) is required, the. Filing requirements for form 8865 depend on ownership. Ein (if any) reference id number (see instr.)part i acquisitions (a). Web (i) for each deferral contribution, the u.s. Application for automatic extension of time to file an exempt organization return 0122 01/11/2022 form 8864 Ad download or email irs 8865 & more fillable forms, register and subscribe now! Persons in foreign partnerships not formed or registered under u.s. If schedule n (form 8865) is required, the. Statement of application of the gain deferral method under section 721. Acceleration events and exceptions reporting related to gain deferral method under section 721(c) form 8865: Acceleration events and exceptions reporting relating to gain deferral method under section 721 (c) schedule k: Transferor must report the following information on schedule g and schedule h (for each schedule, with respect to form 8865), as applicable: Likewise for a category 4 filer, check that category and complete information for schedule p. Then use the instructions for form 1065.. Acceleration events and exceptions reporting relating to gain. Filing requirements for form 8865 depend on ownership. You should complete only the input screens necessary to complete the required information,. Web how do i generate form 8865 schedule o using worksheet view? Acceleration events and exceptions reporting relating to gain deferral method under section 721 (c) schedule k: Transferor uses schedule g to comply with the reporting requirements that must be satisfied in applying the gain deferral method. If you are completing form 8865. Likewise for a category 4 filer, check that category and complete information for schedule p. This table is also available in the form 8865 instructions. Acceleration events and exceptions reporting relating to gain deferral. Transferor (b) related domestic partners (c) related foreign. Likewise for a category 4 filer, check that category and complete information for schedule p. Then use the instructions for form 1065. Statement of application of the gain deferral method under section 721(c) form 8865: December 2019) department of the treasury internal revenue service. Web how do i generate form 8865 schedule o using worksheet view? Web schedule g (form 8865)—statement of application of the gain deferral method under section 721 schedule h (form 8865)—acceleration events and exceptions reporting relating to gain deferral method under section 721(c) schedule k—partners'. Statement of application of the gain deferral method under section 721. See the instructions for. Web (i) for each deferral contribution, the u.s. Persons with respect to certain foreign partnerships. Department of the treasury internal revenue service. For instructions and the latest information. Transferor (b) related domestic partners (c) related foreign. This table is also available in the form 8865 instructions. Web complete these schedules for form 8865, use the specific instructions for the corresponding schedules of form 1065, u.s. December 2019) department of the treasury internal revenue service. If you are completing form 8865. Web entering code csh will only fill out schedule o, part i, columns a, c, and g. Instructions for form 8865 ( print version pdf) recent developments. Persons in foreign partnerships not formed or registered under u.s. See the instructions for form 8865. Web schedule g (form 8865). Determines which line in part i is populated. For instructions and the latest information. Transferor uses schedule g to comply with the reporting requirements that must be satisfied in applying the gain deferral method. Schedule b form 1065, page 1. Schedule g—statement of application of the gain deferral method under section 721: You should complete only the input screens necessary to complete the required information,. Likewise for a category 4 filer, check that category and complete information for schedule p. Then use the instructions for form 1065. If schedule n (form 8865) is required, the. Whether or not a filer of a form 8865 is required to complete a specific schedule depends on a category of filer can be classified. Allocation percentages of partnership items with respect to section 721(c) property (see instructions) part i, line number:2021 Form IRS 8865 Schedule K1 Fill Online, Printable, Fillable

Fillable Form 8865 Return Of U.s. Persons With Respect To Certain

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

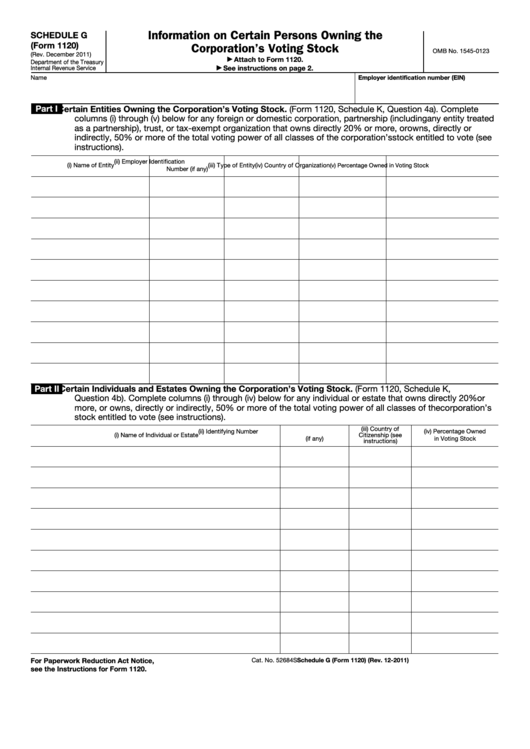

Fillable Schedule G (Form 1120) Information On Certain Persons Owning

8865 schedule g Fill online, Printable, Fillable Blank

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

IRS Form 8865 Schedule K3 Download Fillable PDF or Fill Online Partner

IRS Form 8865 Schedule G Download Fillable PDF or Fill Online Statement

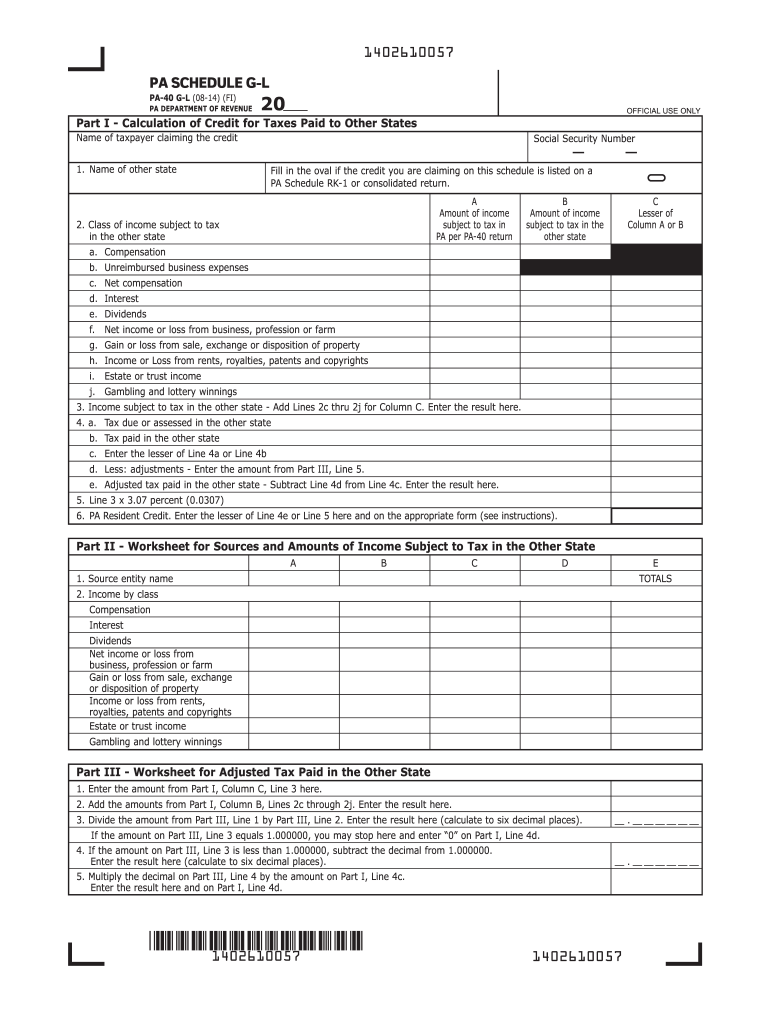

PA Schedule GL Resident Credit for Taxes Paid (PA40 GL) Fill out

Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

Related Post: