Form 8865 Instructions

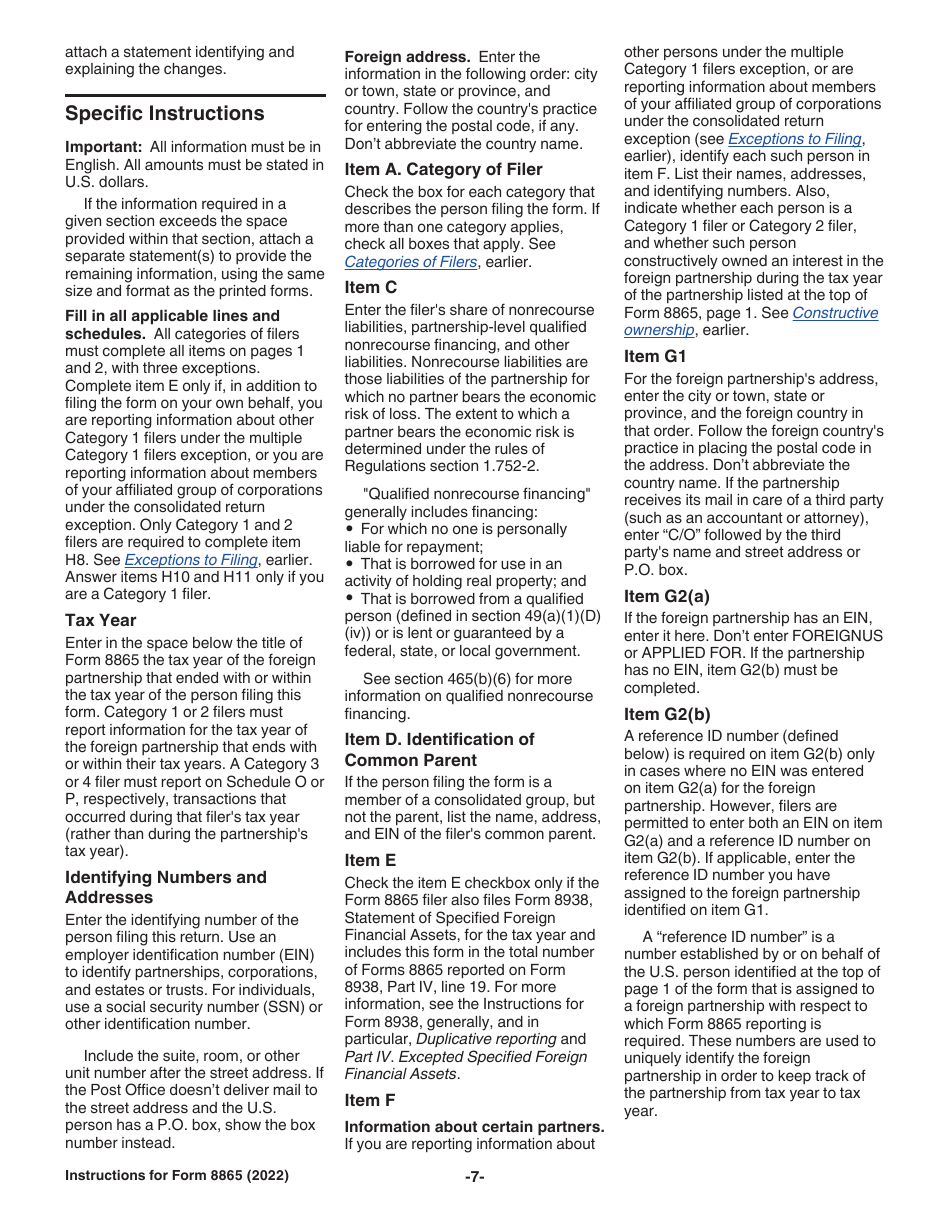

Form 8865 Instructions - Web department of the treasury internal revenue service. Web who has to file form 8865? Web form 8865 & instructions. Details of any capital gains (long or short term) a. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file. The form cannot be electronically filed separately. Web what is form 8865? Persons with respect to certain foreign partnerships. This table is also available in the form 8865 instructions. Persons to report information regarding controlled foreign partnerships ( irc section 6038 ), transfers to foreign partnerships. You can view or download the instructions for form 1065 at irs.gov/scheduled(form1065). If a foreign partnership is considered a controlled. Web in general, a u.s. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through. Complete, edit or print tax forms instantly. Web if required to file, the taxpayers must attach form 8865 to their timely filed income tax return. Web what information do you need for form 8865? Ad access irs tax forms. Web department of the treasury internal revenue service. Web form 8865 is a crucial tax form from the irs utilized to oversee u.s. If a foreign partnership is considered a controlled. Attach to your tax return. Department of the treasury internal revenue service. Upload, modify or create forms. Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file. If a foreign partnership is considered a controlled. Web in general, a u.s. Get ready for tax season deadlines by completing any required tax forms today. Web if required to file, the taxpayers must attach form 8865 to their timely filed income. If a foreign partnership is considered a controlled. The form cannot be electronically filed separately. Form 8865 is used by u.s. Also, these instructions can be. Web the following table details the information, statements, and schedules that are required for each category of filer. Web what is form 8865? Persons with respect to certain foreign partnerships. Web if a foreign partnership has income from the u.s., they may be required to file form 1065 to report that u.s. Persons with respect to certain foreign partnerships 2022 02/08/2023 inst 8866: Form 8865 refers to the irs’ return of u.s. Person who is a partner in a foreign partnership must file form 8865 to report the income and financial position of the partnership and to report certain. Persons with respect to certain foreign partnerships. Also, these instructions can be. Web if required to file, the taxpayers must attach form 8865 to their timely filed income tax return. Complete, edit or. Instructions for form 8866, interest. Upload, modify or create forms. Web (a) the person undertaking the filing obligation must file form 8865 with that person's income tax return in the manner provided by form 8865 and the accompanying. You must have a separate ultratax. Web what information do you need for form 8865? Attach to your tax return. Also, these instructions can be. Form 8865 refers to the irs’ return of u.s. Web department of the treasury internal revenue service. Person who is a partner in a foreign partnership must file form 8865 to report the income and financial position of the partnership and to report certain. Web if required to file, the taxpayers must attach form 8865 to their timely filed income tax return. Check box a if the person filing the return owns a direct interest in the foreign partnership. Instructions for form 8865, return of u.s. Web what information do you need for form 8865? Form 8865 refers to the irs’ return of u.s. Web what information do you need for form 8865? Persons with respect to certain foreign partnerships. Web department of the treasury internal revenue service. A person will file form 8865 when they qualify as one of the four (4) categories of filers indicated in the instructions. Web what is form 8865? Get ready for tax season deadlines by completing any required tax forms today. Attach to your tax return. Web form 8865 & instructions. Try it for free now! Form 8865 is used by u.s. Also, these instructions can be. Persons with respect to certain foreign partnerships 2022 02/08/2023 inst 8866: Web all filers must complete schedule a. Persons with respect to certain foreign partnerships. Person who is a partner in a foreign partnership must file form 8865 to report the income and financial position of the partnership and to report certain. Persons in foreign partnerships not formed or registered under u.s. Ad access irs tax forms. Attach to your tax return. Check box b if the person filing the. Department of the treasury internal revenue service.Inst 8865Instructions for Form 8865, Return of U.S. Persons With Res…

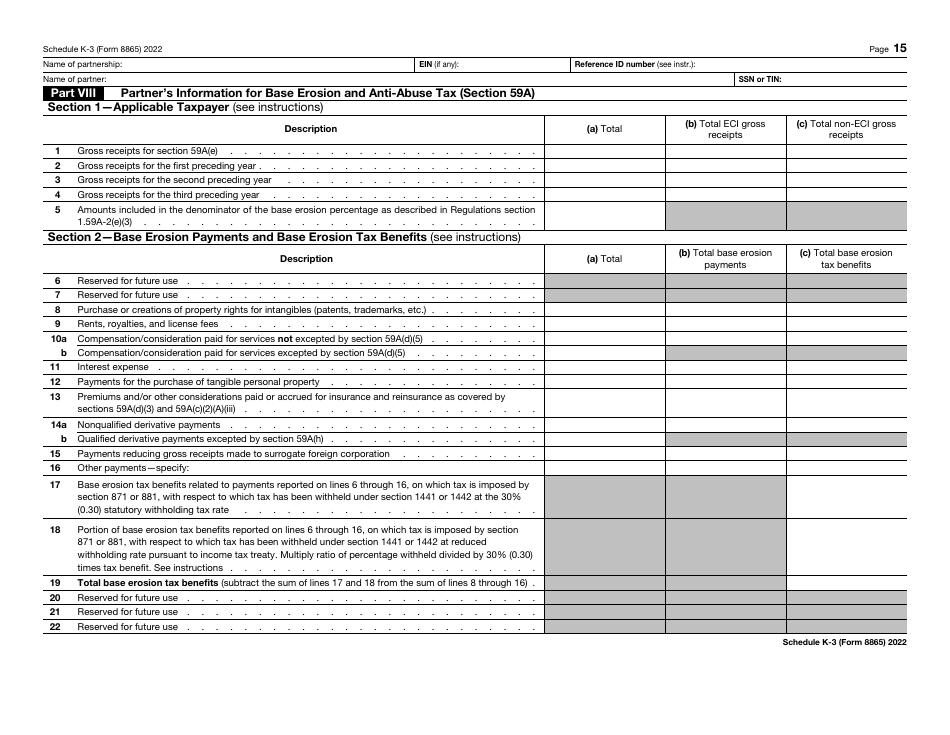

IRS Form 8865 Schedule K3 Download Fillable PDF or Fill Online Partner

IRS Form 8865 Returns WRT Certain Foreign Partnerships

IRS Form 8865 Returns WRT Certain Foreign Partnerships

Download Instructions for Form 8865 Return of U.S. Persons With Respect

20212023 Form IRS Instructions 8865 Fill Online, Printable, Fillable

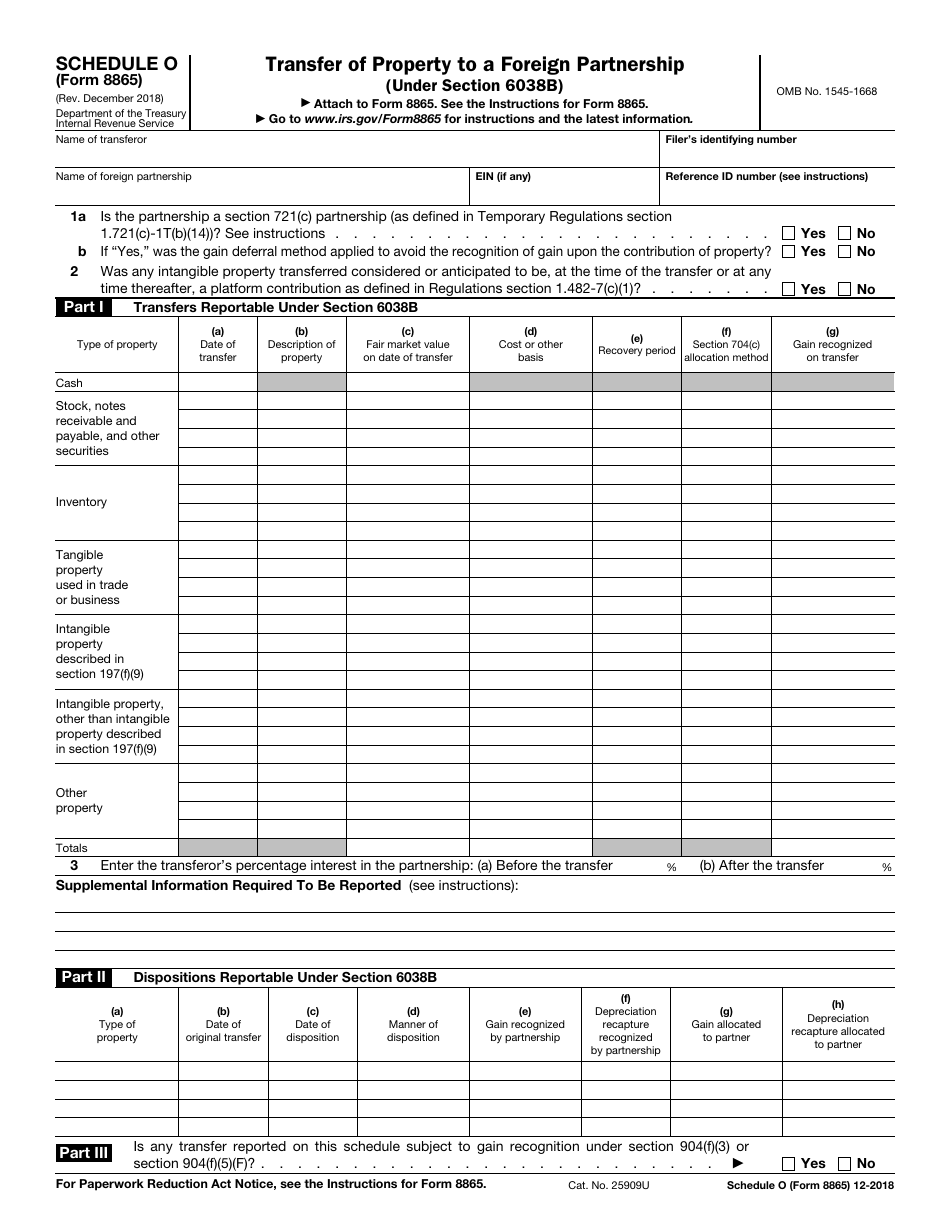

IRS Form 8865 Schedule O Fill Out, Sign Online and Download Fillable

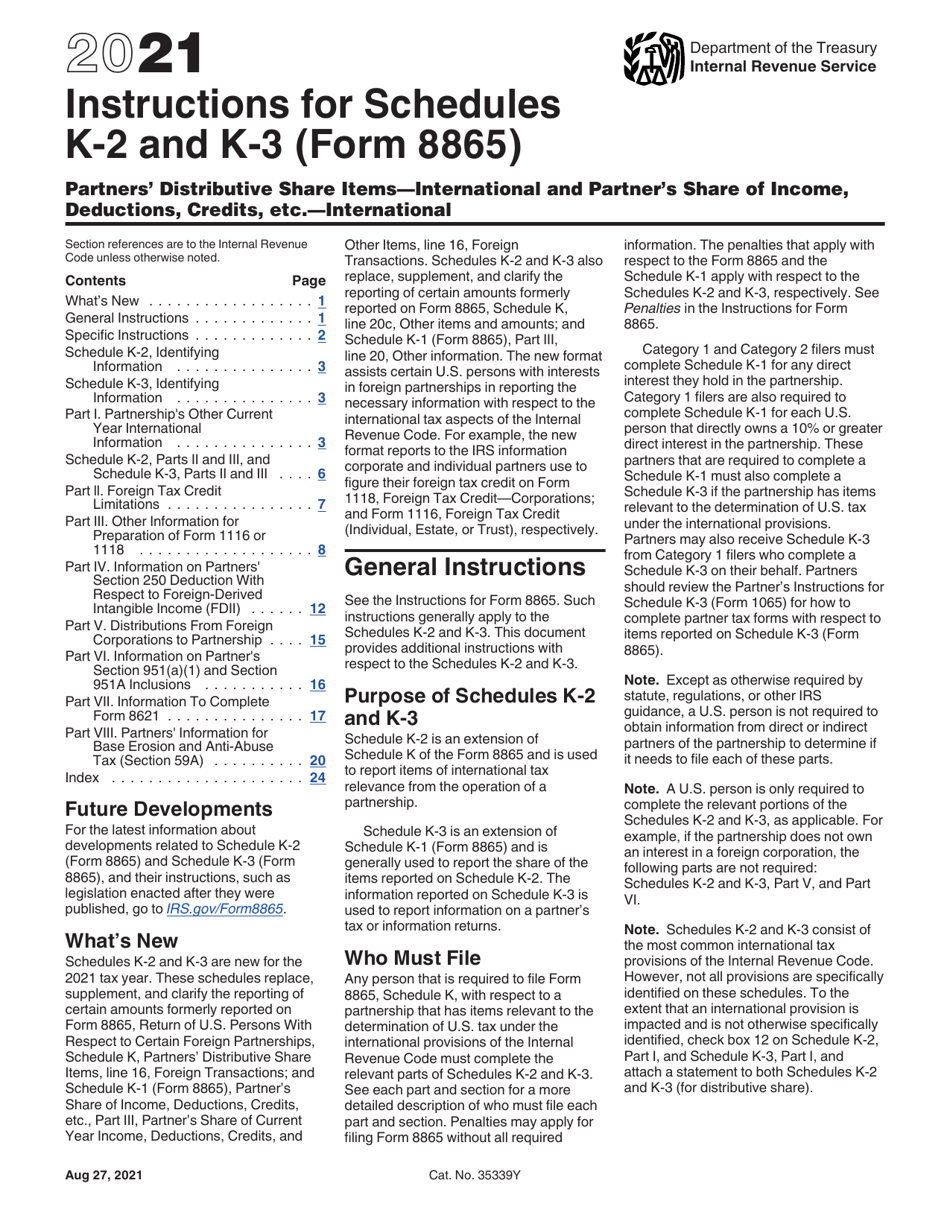

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF, 2021

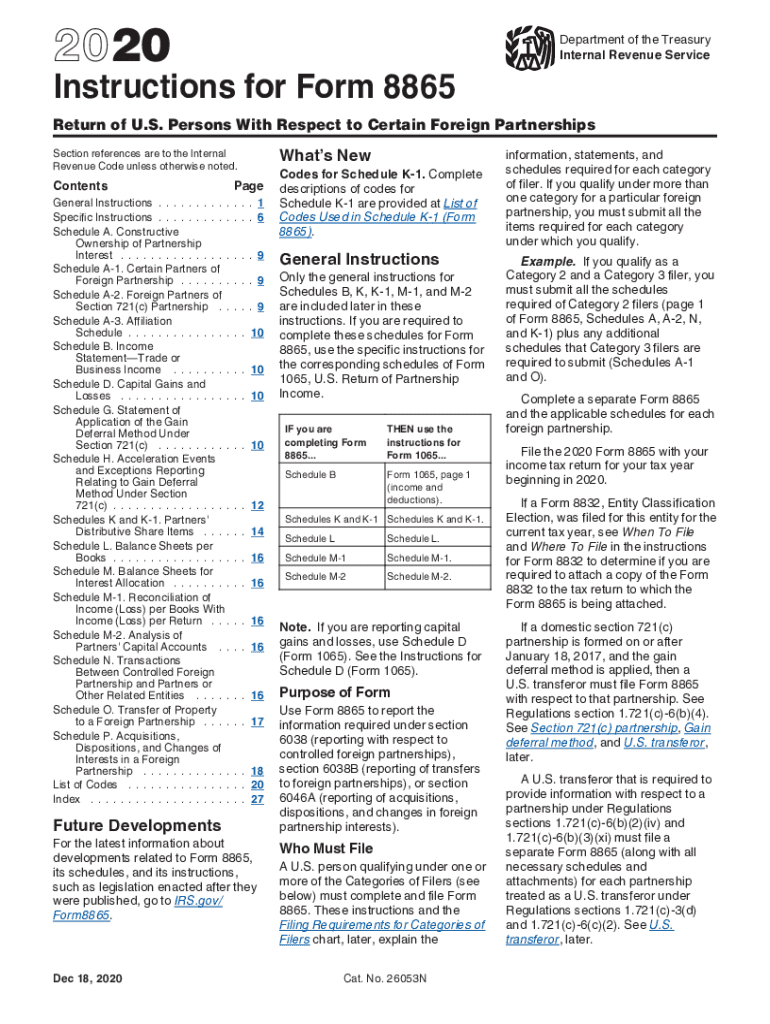

form 8865 instructions 2020 Fill Online, Printable, Fillable Blank

2020 Form IRS Instructions 8865 Fill Online, Printable, Fillable, Blank

Related Post: