Form 8863 Vs 1098 T

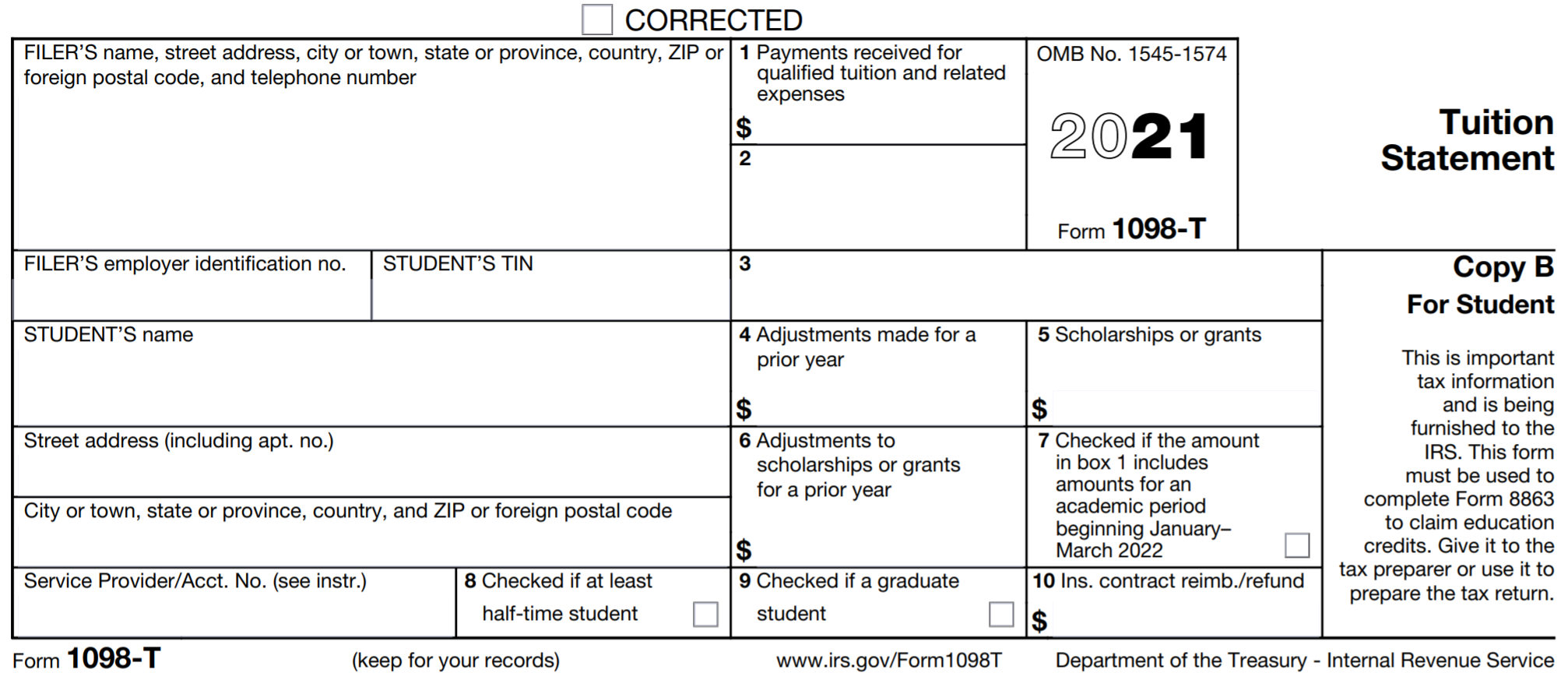

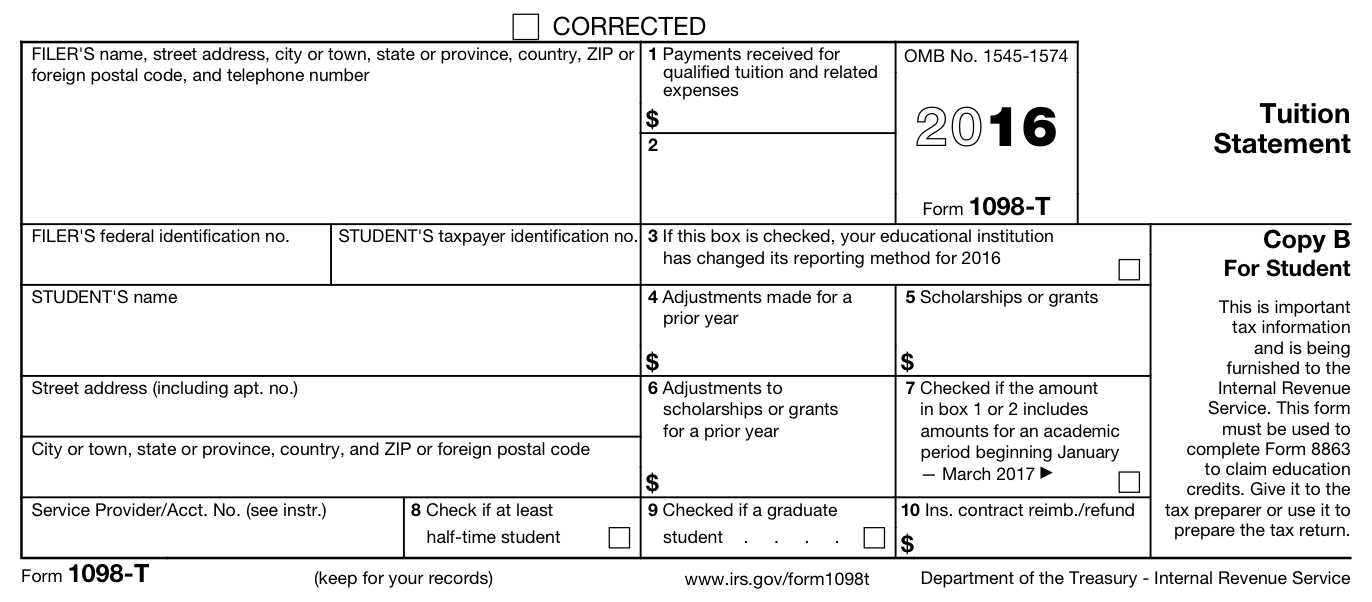

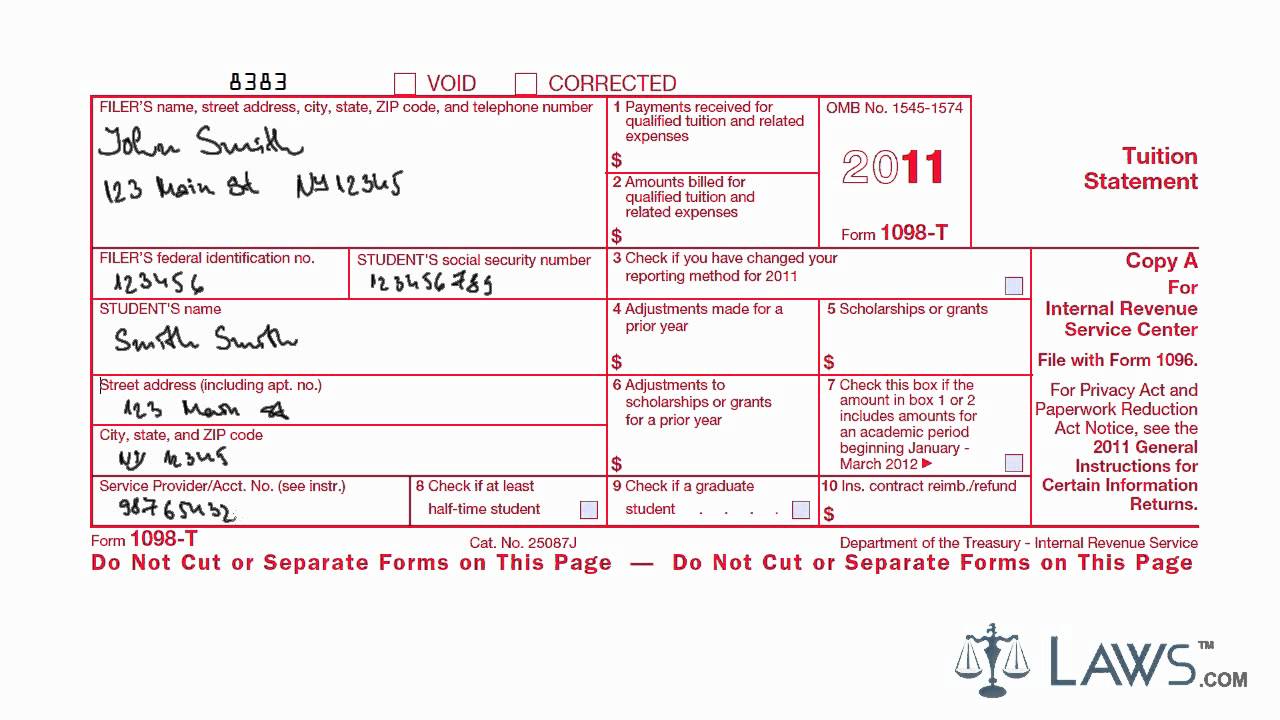

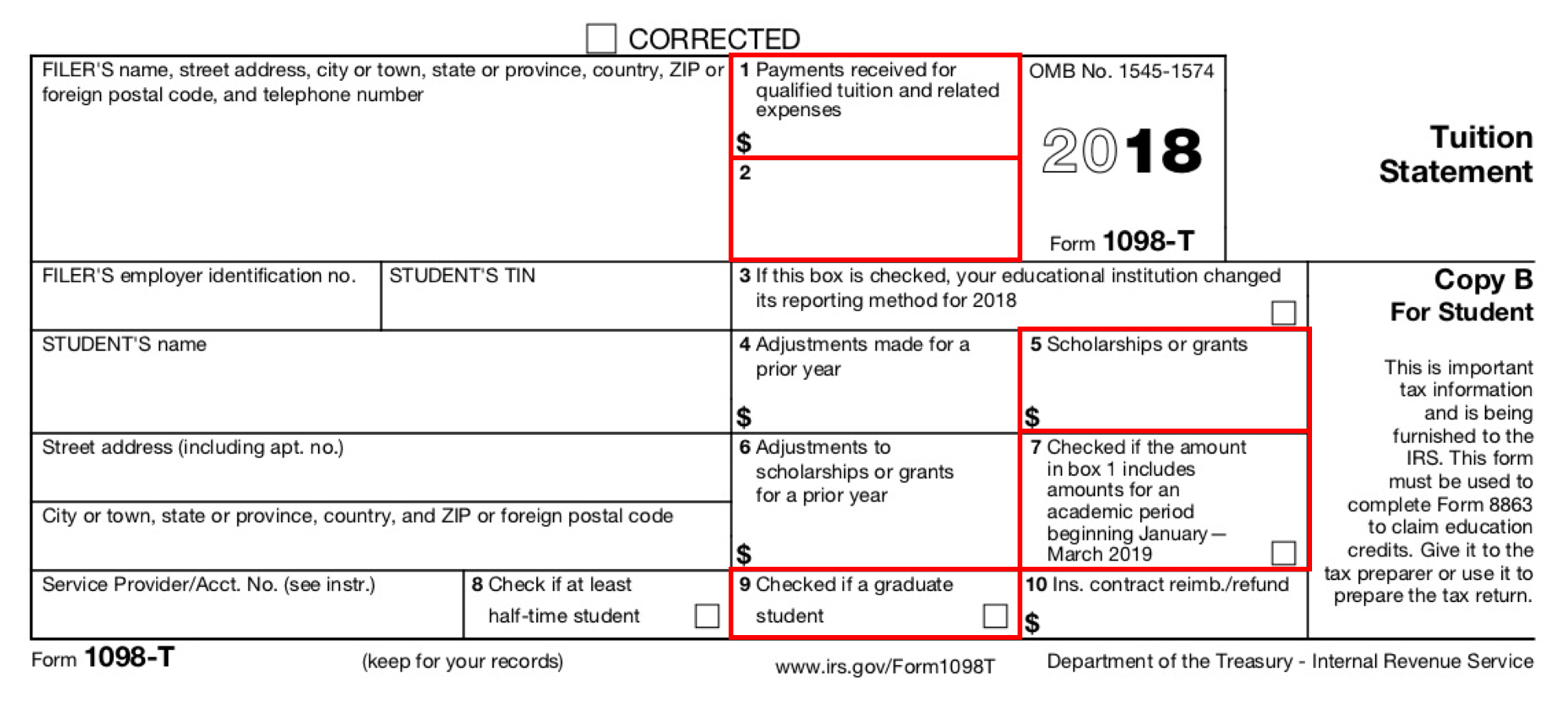

Form 8863 Vs 1098 T - Web updated for tax year 2022 • december 1, 2022 9:07 am. Web form 8863 is used to figure and claim education credits, either the american opportunity credit or the lifetime learning credit. Web to claim an education credit, you must file form 1040 or 1040a with form 8863, education credits (american opportunity and lifetime learning credits). If you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and. Here are some of the main differences between the two forms: When you transfer this client to next year, we'll use this entry to. This box doesn't affect this year's return. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Eligible institutions are required by the irs to. See form 8863 or the irs pub. Give it to the tax preparer or use it to prepare the tax return. Eligible institutions are required by the irs to. The following articles are the top questions referring to education credits, form 8863. When you transfer this client to next year, we'll use this entry to. Web use form 8863 to figure and claim your education credits, which. Web updated for tax year 2022 • july 18, 2023 1:53 pm. See form 8863 or the irs pub. Web form 8863 is used to figure and claim education credits, either the american opportunity credit or the lifetime learning credit. Here are some of the main differences between the two forms: Web in fact, the irs' instructions for form 8863. Web updated for tax year 2022 • december 1, 2022 9:07 am. See form 8863 or the irs pub. Web this form must be used to complete form 8863 to claim education credits. Web form 8863 is used to figure and claim education credits, either the american opportunity credit or the lifetime learning credit. Here are some of the main. Web in fact, the irs' instructions for form 8863 ask you to calculate your qualified higher education expenses and enter that amount, not the amount shown on your. Web updated for tax year 2022 • december 1, 2022 9:07 am. American opportunity credit & lifetime learning credit (form 8863). Eligible institutions are required by the irs to. When you transfer. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Give it to the tax preparer or use it to prepare the tax return. American opportunity credit & lifetime learning credit (form 8863). If you plan on claiming one of the irs educational tax credits,. Web in fact, the irs' instructions for form 8863 ask you to calculate your qualified higher education expenses and enter that amount, not the amount shown on your. Eligible institutions are required by the irs to. During your interview with bill and sue, you determine that $3,000 was paid in september 2021. Web use form 8863 to figure and claim. Web to claim an education credit, you must file form 1040 or 1040a with form 8863, education credits (american opportunity and lifetime learning credits). Web form 8863 is used to figure and claim education credits, either the american opportunity credit or the lifetime learning credit. Web use form 8863 to figure and claim your education credits, which are based on. Web in fact, the irs' instructions for form 8863 ask you to calculate your qualified higher education expenses and enter that amount, not the amount shown on your. It is an informational document required from the educational institution by the irs. See form 8863 or the irs pub. Web updated for tax year 2022 • december 1, 2022 9:07 am.. Eligible institutions are required by the irs to. This box doesn't affect this year's return. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. American opportunity credit & lifetime learning credit (form 8863). Give it to the tax preparer or use it to prepare. Here are some of the main differences between the two forms: During your interview with bill and sue, you determine that $3,000 was paid in september 2021. The following articles are the top questions referring to education credits, form 8863. Web updated for tax year 2022 • july 18, 2023 1:53 pm. Web updated for tax year 2022 • december. Give it to the tax preparer or use it to prepare the tax return. Web in fact, the irs' instructions for form 8863 ask you to calculate your qualified higher education expenses and enter that amount, not the amount shown on your. Web tuition and fees deduction (form 8917) has been repealed starting in tax year 2021. If you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web form 8863 is used to figure and claim education credits, either the american opportunity credit or the lifetime learning credit. When you transfer this client to next year, we'll use this entry to. Web updated for tax year 2022 • july 18, 2023 1:53 pm. This box doesn't affect this year's return. Web to claim an education credit, you must file form 1040 or 1040a with form 8863, education credits (american opportunity and lifetime learning credits). Here are some of the main differences between the two forms: Web this form must be used to complete form 8863 to claim education credits. The following articles are the top questions referring to education credits, form 8863. Eligible institutions are required by the irs to. See form 8863 or the irs pub. American opportunity credit & lifetime learning credit (form 8863). It is an informational document required from the educational institution by the irs. Web solved•by intuit•2•updated february 13, 2023. During your interview with bill and sue, you determine that $3,000 was paid in september 2021. Web updated for tax year 2022 • december 1, 2022 9:07 am.Education Credits and Deductions (Form 1098T) Support

What Is a 1098T? Personal Finance for PhDs

Form 8863 Instructions & Information on the Education Credit Form

How To File Your 1098 T Form Universal Network

Learn How to Fill the Form 1098T Tuition Statement YouTube

1098 T Form 2023 Pdf Printable Forms Free Online

1098T IRS Tax Form Instructions 1098T Forms

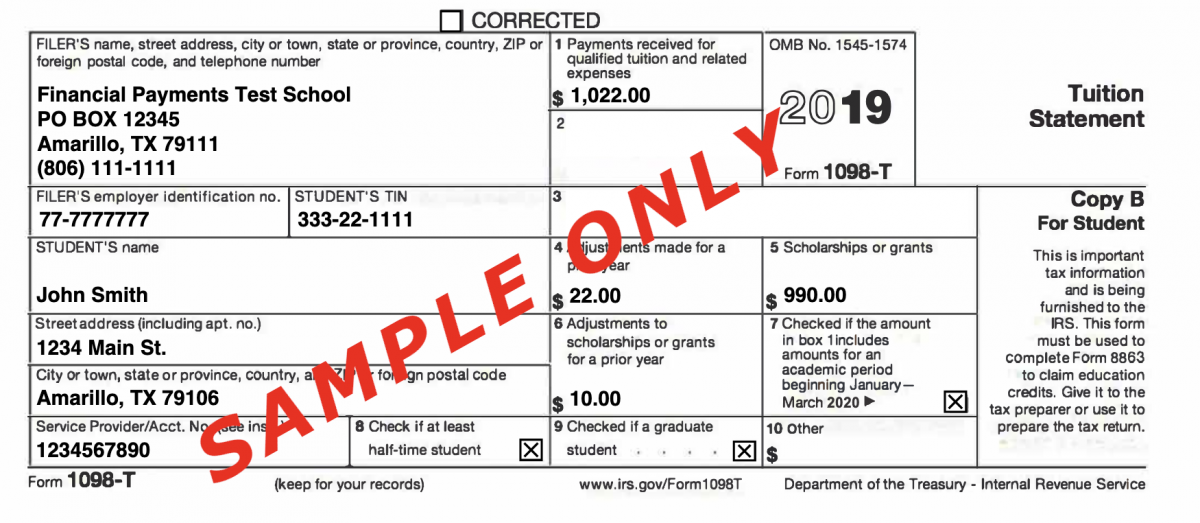

1098T Form How to Complete and File Your Tuition Statement

Form 8863 Edit, Fill, Sign Online Handypdf

1098 T Form Printable Blank PDF Online

Related Post: