Form 8832 Late Election Relief Reasonable Cause Examples

Form 8832 Late Election Relief Reasonable Cause Examples - Yes § 4.01(3) 3 years & 75 days. Web i need some guidance on the wording for the late election relief explanation for reasonable cause in my form 8832. I've composed a draft version of the explanation. 3 years and 75 day rule for late s election relief, can llc be taxed as a s. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. You’re still within a window of three years and 75 days from your. If not the relief should work. Web the entity has reasonable cause for its failure to make the election timely; Web to request relief for a late election, an entity that meets the following requirements must explain the reasonable cause for failure to timely file the election. The irs on thursday released revenue. Web to qualify for relief: Web revenue procedure for a late classification election if the following requirements are met: Web to request relief for a late election, an entity that meets the following requirements must explain the reasonable cause for failure to timely file the election. Did the eligible entity have reasonable cause for its failure to timely make the. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Did you file a return already for 2021 inconsistent with what you want to file. You llc failed to file form 8832 on time; If not the relief should work. Form 8832 is used by. Web revenue procedure for a late classification election if the following requirements are met: Web form 8832 late election relief reasonable cause examples primarily include two categories of events: Web the entity has reasonable cause for its failure to make the election timely; Web i need some guidance on the wording for the late election relief explanation for reasonable cause. 28, 2009, for requests pending with the irs on that date and requests made after that date. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Web upon receipt of a completed form 8832 requesting relief under section 4.01 of this revenue procedure, the irs will determine whether the requirements. Did you file a return already for 2021 inconsistent with what you want to file. Web revenue procedure for a late classification election if the following requirements are met: Web upon receipt of a completed form 8832 requesting relief under section 4.01 of this revenue procedure, the irs will determine whether the requirements for granting. Web to make a late. The entity and all shareholders reported their income consistent with an s corporation. 3 years and 75 day rule for late s election relief, can llc be taxed as a s. I've composed a draft version of the explanation. If not the relief should work. 28, 2009, for requests pending with the irs on that date and requests made after. Web you can provide a reasonable cause explaining why you couldn’t file form 8832 on time. The irs on thursday released revenue. Web upon receipt of a completed form 8832 requesting relief under section 4.01 of this revenue procedure, the irs will determine whether the requirements for granting. Web information about form 8832, entity classification election, including recent updates, related. You llc failed to file form 8832 on time; Web form 8832 late election relief reasonable cause examples primarily include two categories of events: Web under the old rules (in rev. Web you can provide a reasonable cause explaining why you couldn’t file form 8832 on time. Did the eligible entity have reasonable cause for its failure to timely make. Did the eligible entity have reasonable cause for its failure to timely make the entity classification election? Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. If not the relief should work. Web revenue procedure for a late classification election if the following requirements are met: Web you can provide. (1)(a) the entity failed to obtain its requested classification as of the date of its formation. 3 years and 75 day rule for late s election relief, can llc be taxed as a s. Yes § 4.01(3) 3 years & 75 days. Form 8832 is used by. Web to qualify for relief: 3 years and 75 day rule for late s election relief, can llc be taxed as a s. The irs on thursday released revenue. Web revenue procedure for a late classification election if the following requirements are met: Did you file a return already for 2021 inconsistent with what you want to file. I've composed a draft version of the explanation. Web upon receipt of a completed form 8832 requesting relief under section 4.01 of this revenue procedure, the irs will determine whether the requirements for granting. If not the relief should work. Web to request relief for a late election, an entity that meets the following requirements must explain the reasonable cause for failure to timely file the election. Web to qualify for relief: Web up to $32 cash back form 8832 (part ii) late election relief. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center within 3 years. (1)(a) the entity failed to obtain its requested classification as of the date of its formation. Web to make a late election under the provisions of the revenue procedure, an eligible entity must file a completed form 8832 with the applicable irs service center. Form 8832 is used by. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. The entity and all shareholders reported their income consistent with an s corporation. Web under the old rules (in rev. Web you can provide a reasonable cause explaining why you couldn’t file form 8832 on time. Web the entity has reasonable cause for its failure to make the election timely; You llc failed to file form 8832 on time;form 8832 late election relief reasonable cause examples Fill Online

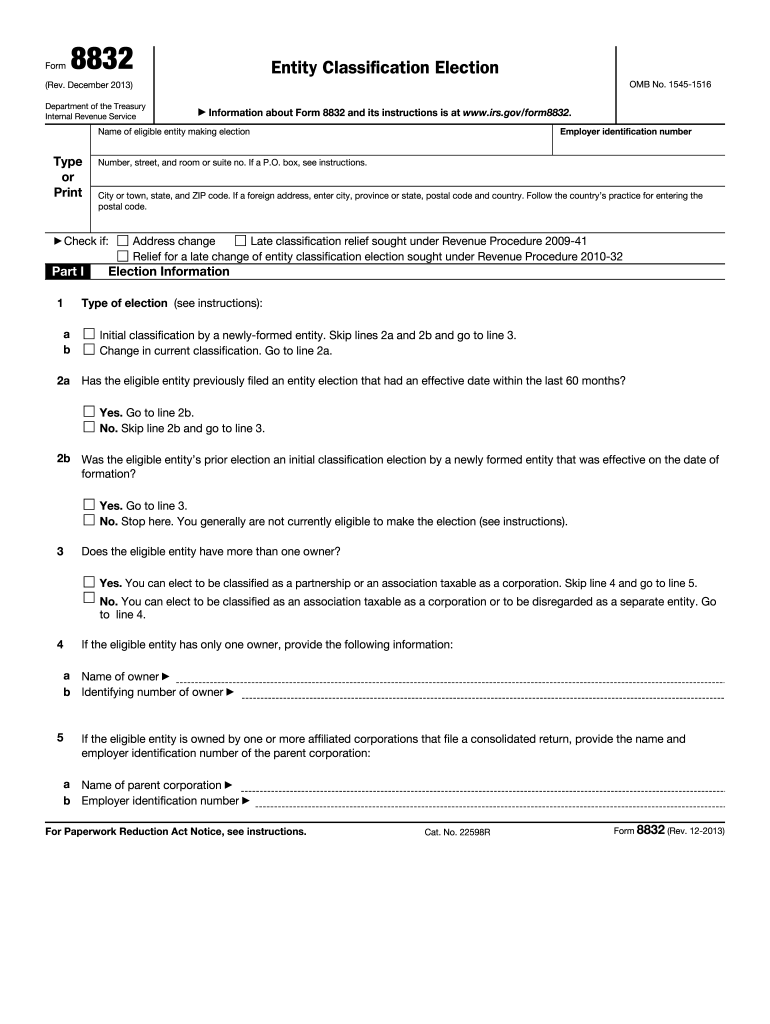

IRS Form 8832A Guide to Entity Classification Election

Classification Election. See Form 8832 and Its Instructions For

Form 8832 late election relief reasonable cause examples Fill online

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Form 8832 Fill Out and Sign Printable PDF Template signNow

Form 8832 Entity Classification Election (2013) Free Download

IRS Form 8832 Late Election Relief Disregarded LLC to Corporation

IRS Form 8832A Guide to Entity Classification Election

Form 8832 All About It and How to File It?

Related Post: