Form 8814 And 4972

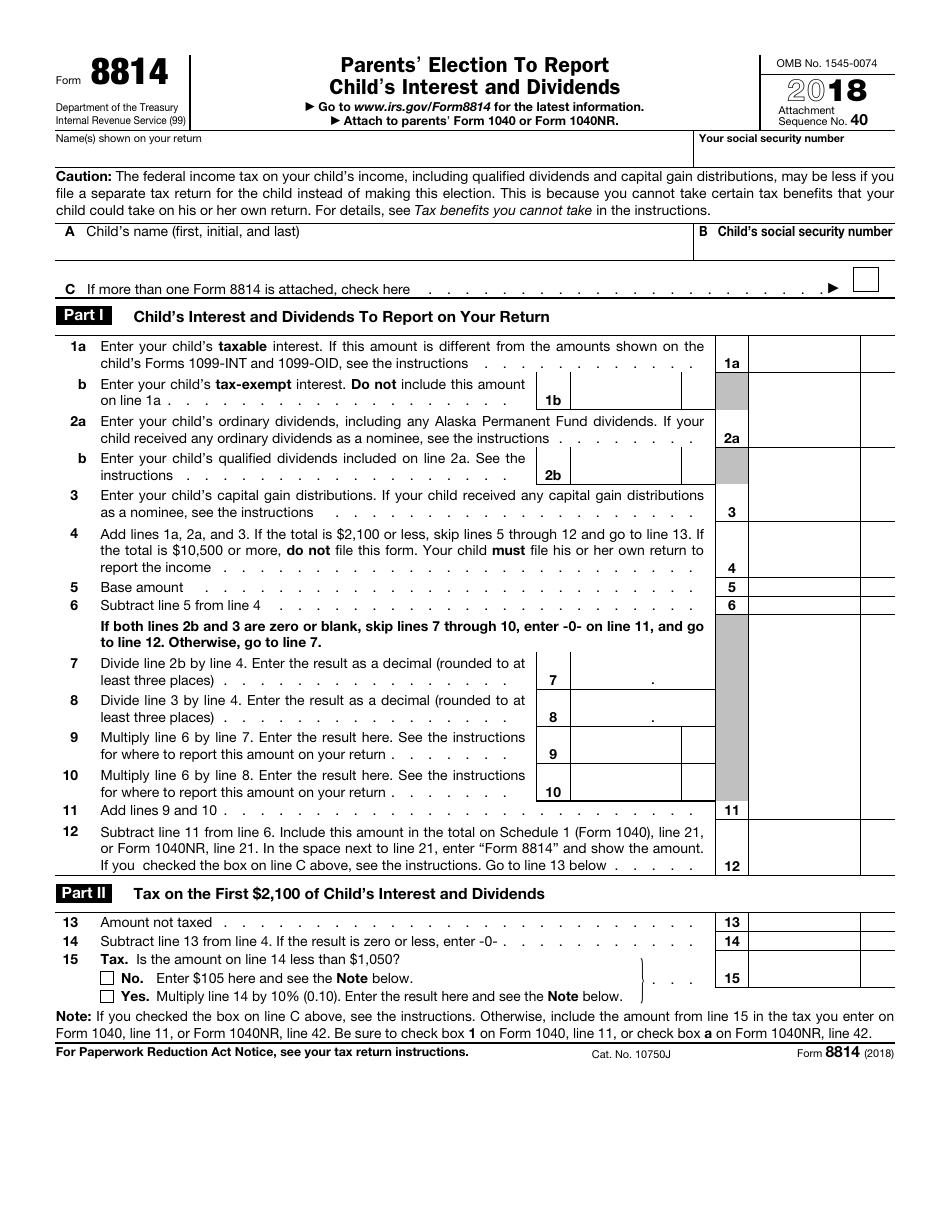

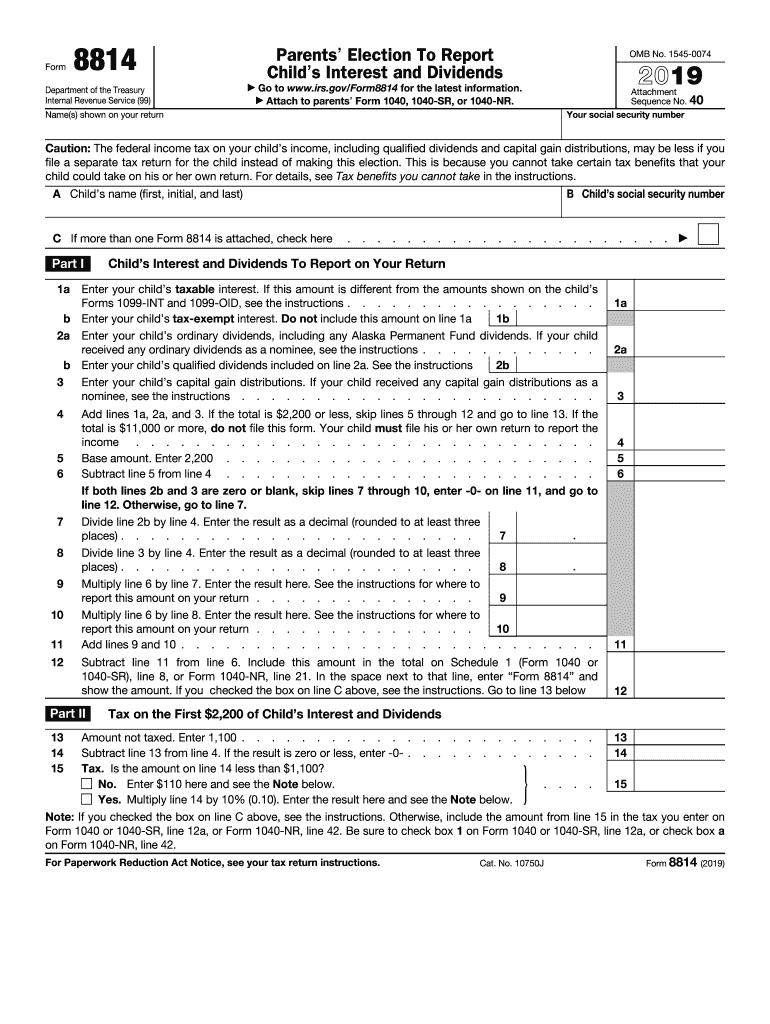

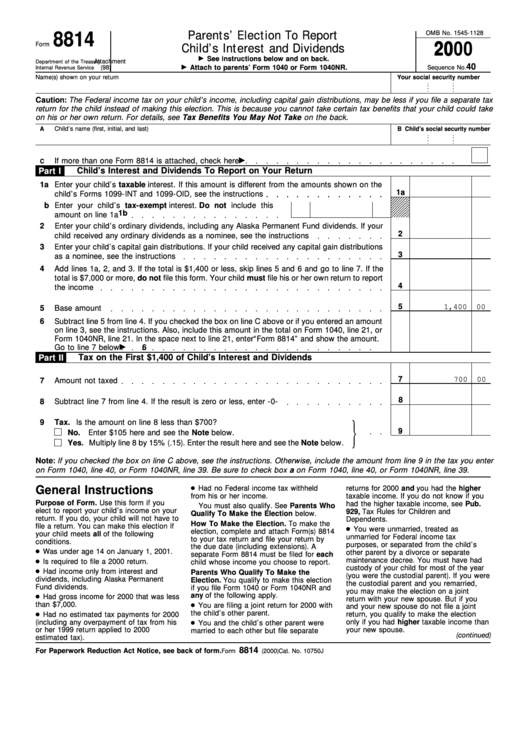

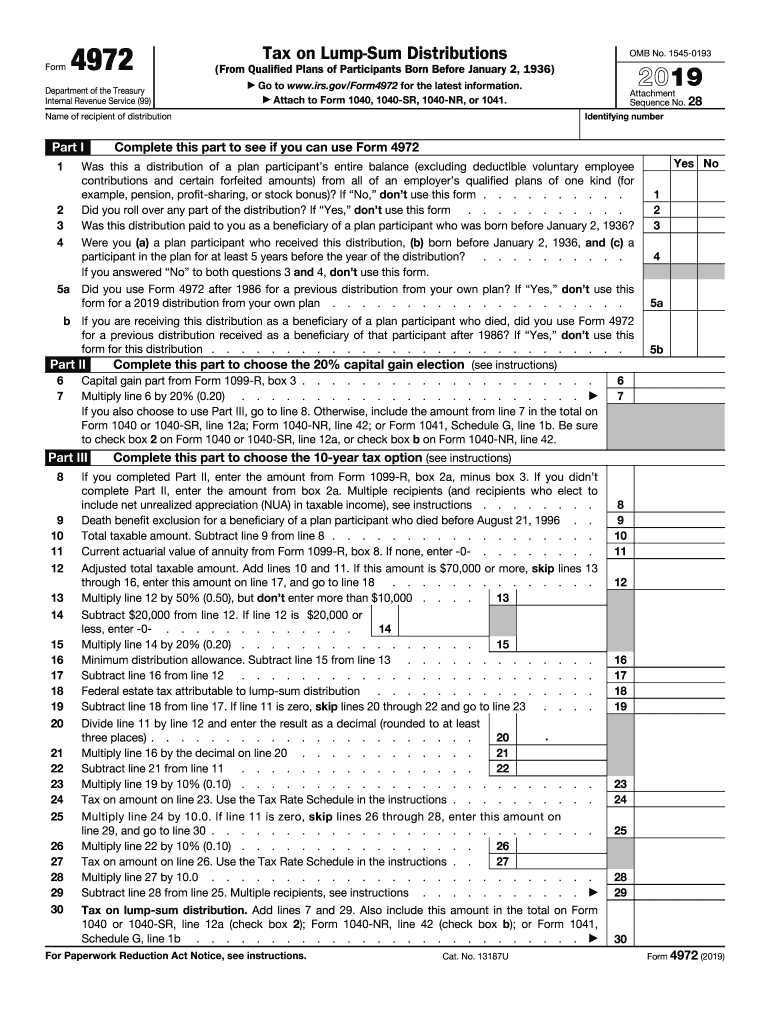

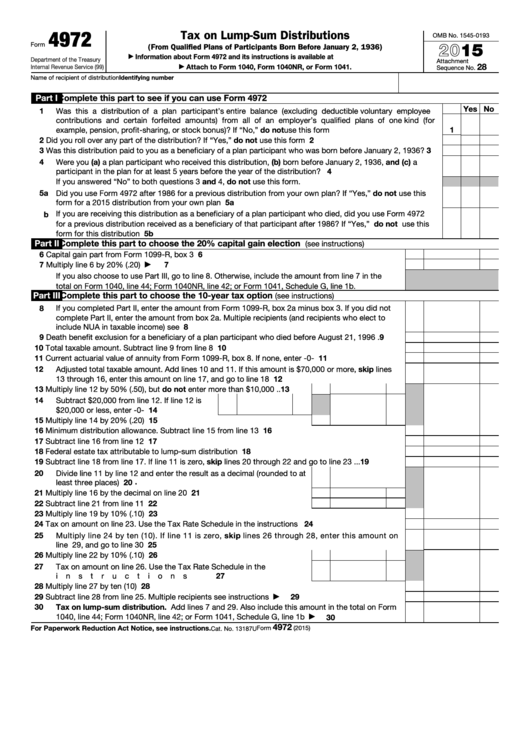

Form 8814 And 4972 - Web the advanced tools of the editor will guide you through the editable pdf template. Check if any from form (s): The following political organizations are not required to file form 8872: Web form 8942 must be signed by the same person who signs the attached project information memorandum. Web the purpose tax form 4972 is used for reducing taxes. Complete line 7b if applicable. A separate form 8814 must. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Enter your official contact and identification details. Web to make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). If you choose this election, your child may not have to file a return. Parents may elect to include their child's income from interest, dividends, and capital gains with. Easy to use and ready to print; Released on december 1, 2017; Web these are calculations from forms 8814, 4972 or the schedule d tax worksheet, or the qualified dividends and. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. Check if any from form (s): Web a separate form 8814 must be filed for each child. If you file form 8814 with your income tax return to report. For a corporation, the form must be signed and dated by: 1 8814 2 4972 3 if you could provide a breakdown of how to solve. If you do, your child will not have to file a return. Utilize a check mark to point the choice. Web form 8814 will be used if you elect to report your child's interest/dividend income on your tax return. How can i find this: A separate form 8814 must. Check if any from form (s): A separate form 8814 must. Web 8814 is parents election to report child's interest and dividendss 6251 is alternative minimum tax 4972 is tax on lump sum distributions ask your own tax. Web the purpose tax form 4972 is used for reducing taxes. Ad download or email irs 4972 & more fillable forms, register and subscribe now! The latest edition provided by the arizona department of revenue; Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Web form 8814 will be used if you elect to report your child's interest/dividend income. Web 8814 is parents election to report child's interest and dividendss 6251 is alternative minimum tax 4972 is tax on lump sum distributions ask your own tax. Web the purpose tax form 4972 is used for reducing taxes. Web a separate form 8814 must be filed for each child. The latest edition provided by the arizona department of revenue; 1. The following political organizations are not required to file form 8872: Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web a separate form 8814 must be filed for each child. 1 8814 2 4972 3 if you could provide a breakdown of how to. If you choose this election, your child may not have to file a return. Web a separate form 8814 must be filed for each child. Use this form to figure the. Utilize a check mark to point the choice. Web the advanced tools of the editor will guide you through the editable pdf template. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web these are calculations from forms 8814, 4972 or the schedule d tax worksheet, or the qualified dividends and capital gain tax worksheet. If you choose this election, your child may not have to file a. Complete line 7b if applicable. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web accounting questions and answers. Web form 8942 must be signed by the same person who signs the attached project information memorandum. For a corporation, the form must be signed and dated by: You can download or print current. Web these are calculations from forms 8814, 4972 or the schedule d tax worksheet, or the qualified dividends and capital gain tax worksheet. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. A separate form 8814 must. A separate form 8814 must. Use this form to figure the. Released on december 1, 2017; Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Web form 8942 must be signed by the same person who signs the attached project information memorandum. Web the purpose tax form 4972 is used for reducing taxes. Web general instructions purpose of form use this form if you elect to report your child’s income on your return. Utilize a check mark to point the choice. Web the advanced tools of the editor will guide you through the editable pdf template. Parents may elect to include their child's income from interest, dividends, and capital gains with. Check if any from form (s): Get ready for tax season deadlines by completing any required tax forms today. If you choose this election, your child may not have to file a return. Web a separate form 8814 must be filed for each child. Web 8814 is parents election to report child's interest and dividendss 6251 is alternative minimum tax 4972 is tax on lump sum distributions ask your own tax. Complete line 7b if applicable.Form 4972 Tax on LumpSum Distributions (2015) Free Download

IRS Form 8814 Download Fillable PDF or Fill Online Parents' Election to

8814 2019 Form Fill Out and Sign Printable PDF Template signNow

Fillable Form 8814 Parents' Election To Report Child'S Interest And

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Form 4972 Fill out & sign online DocHub

Fillable Tax On LumpSum Distributions The Benefit Bank SelfServe

Publication 17, Your Federal Tax; Part 6 Figuring Your Taxes

Form 8814 Instructions 2010

Fill Free fillable Form 8814 Parents’ Election To Report Child’s

Related Post: