Form 8615 Turbotax

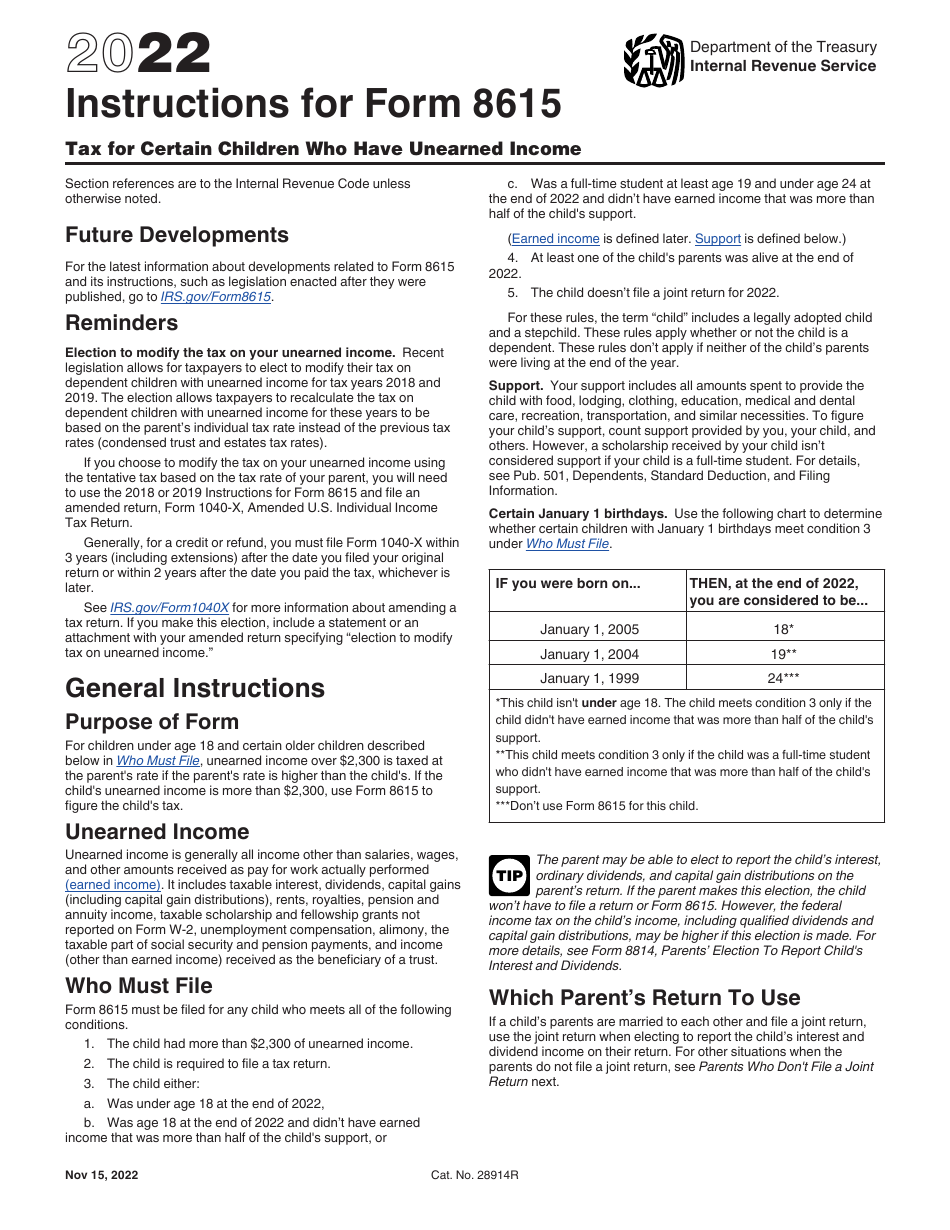

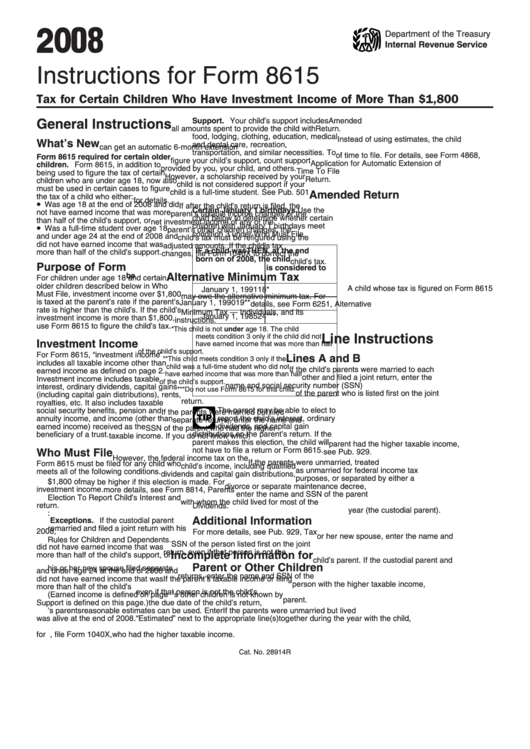

Form 8615 Turbotax - Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: I complete the return and for the. 33 child’s name shown on return child’s social. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. Easily sort by irs forms to find the product that best fits your tax situation. Web who's required to file form 8615? This would mean that he would have had to have more than $2,200. Under age 18, age 18 and did. Try it for free now! Web level 15 check no since the question concerns earned income. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. She did not support herself with the earned income and the amount of unearned income from. Turbo tax says it will walk you through fixing it (never does), but i reenter/verify the. Web who's required to file form 8615? Web i started a new. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web why does my tax return keep getting rejected? Turbo tax says it will walk you through fixing it (never does), but i reenter/verify the. Web for form 8615, “unearned income” includes all taxable income other than earned income. Web use form. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Web per irs instructions for form 8615 on page 1: I have. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: She did not support herself with the earned income and the amount of unearned income from. I have also included additional information as it pertains to. Try it for free now! Web why does my tax return keep getting rejected? A few other things we need to know @susannekant. Web form 8615 must be filed for any child who meets all of the following conditions. This would mean that he would have had to have more than $2,200. Web for form 8615, “unearned income” includes all taxable income other than earned income. Web per irs instructions for form 8615 on. 2) the child is required to file a. Web form 8615 is used to calculate taxes on certain children's unearned income. Web level 15 check no since the question concerns earned income. To find form 8615 please follow the steps below. I have elected to calculate at the new tcja rules by answering no to the question. Upload, modify or create forms. The child had more than $2,300 of unearned income. Web form 8615 is tax for certain children who have unearned income. This would mean that he would have had to have more than $2,200. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Under age 18, age 18 and did. Unearned income typically refers to investment income such as interest, dividends,. This would mean that he would have had to have more than $2,200. 2) the child is required to file a. Web form 8615 is tax for certain children who have unearned income. Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Web who's required to file form 8615? I want to tell the system my. Web turbotax live en español. Web see what tax forms are included in turbotax basic, deluxe,. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Web for form 8615, “unearned income” includes all taxable income other than earned income. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. Try. Upload, modify or create forms. Web go to www.irs.gov/form8615 for instructions and the latest information. I want to tell the system my. I complete the return and for the. Tax law & stimulus updates. This would mean that he would have had to have more than $2,200. Web general instructions purpose of form for children under age 18 and certain older children described below in who must file, unearned income over $2,200 is taxed at the parent's. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Ad register and subscribe now to work on your irs form 8615 & more fillable forms. I have also included additional information as it pertains to. While there have been other changes to the. Web turbotax live en español. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Unearned income typically refers to investment income such as interest, dividends,. The child is required to file a tax return. Easily sort by irs forms to find the product that best fits your tax situation. Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's. She did not support herself with the earned income and the amount of unearned income from. The child has more than $2,500 in unearned income;. Web form 8615 must be filed for a child if all of the following statements are true.Form 8615 Tax for Certain Children Who Have Unearned (2015

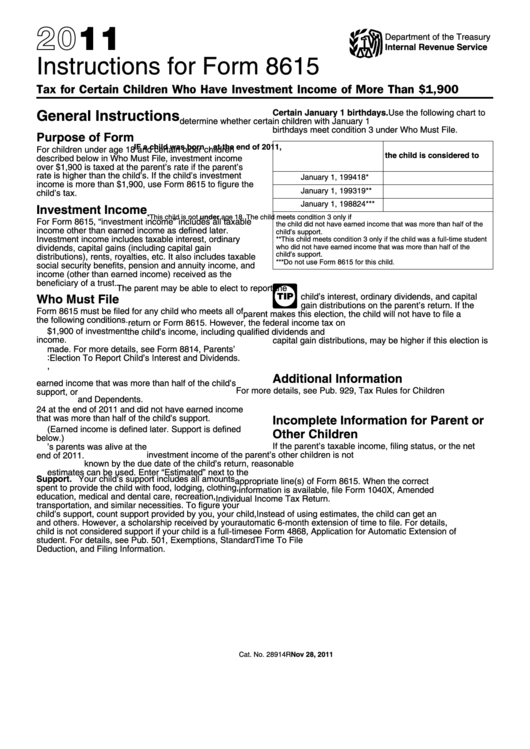

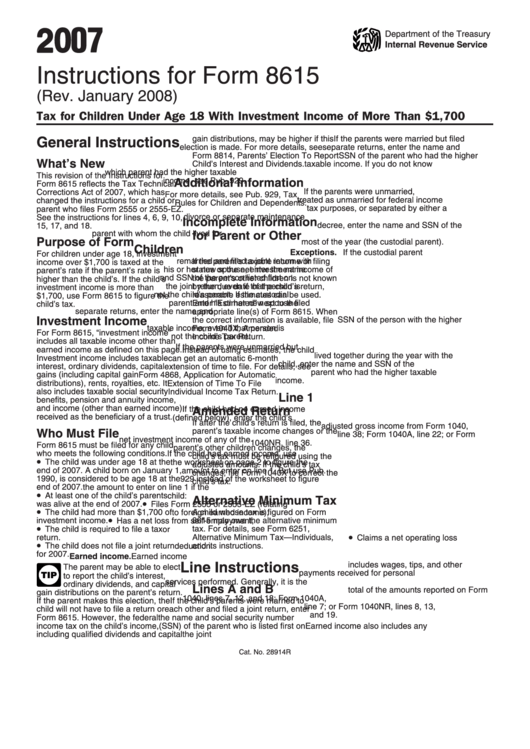

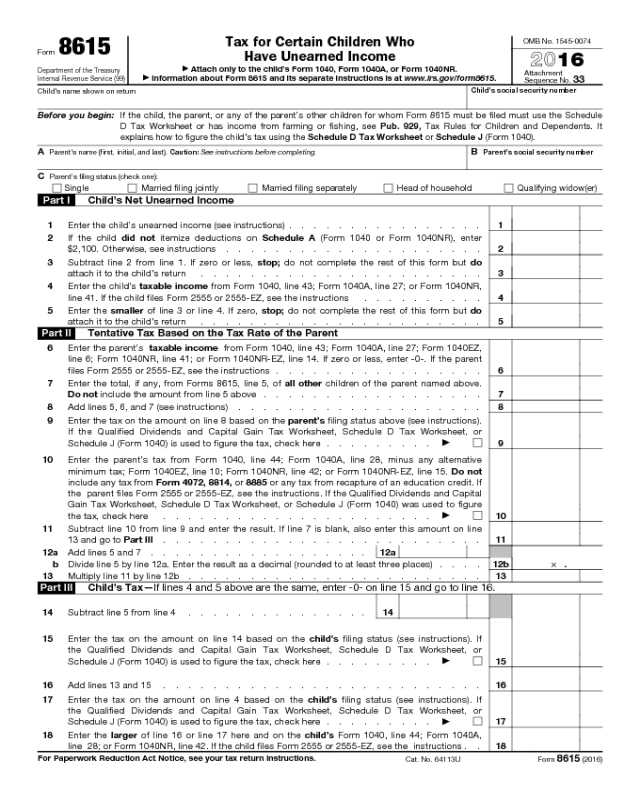

Instructions For Form 8615 Tax For Certain Children Who Have

Download Instructions for IRS Form 8615 Tax for Certain Children Who

How To Upload Your Form 1099 To Turbotax Turbo Tax

Instructions For Form 8615 Tax For Certain Children Who Have

Instructions For Form 8615 Tax For Children Under Age 18 With

What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Form 8615 Edit, Fill, Sign Online Handypdf

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Related Post: