Form 8594 Instructions

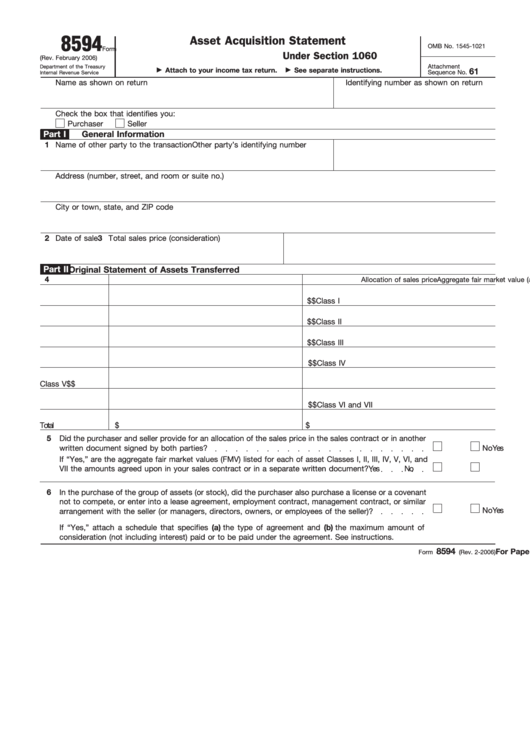

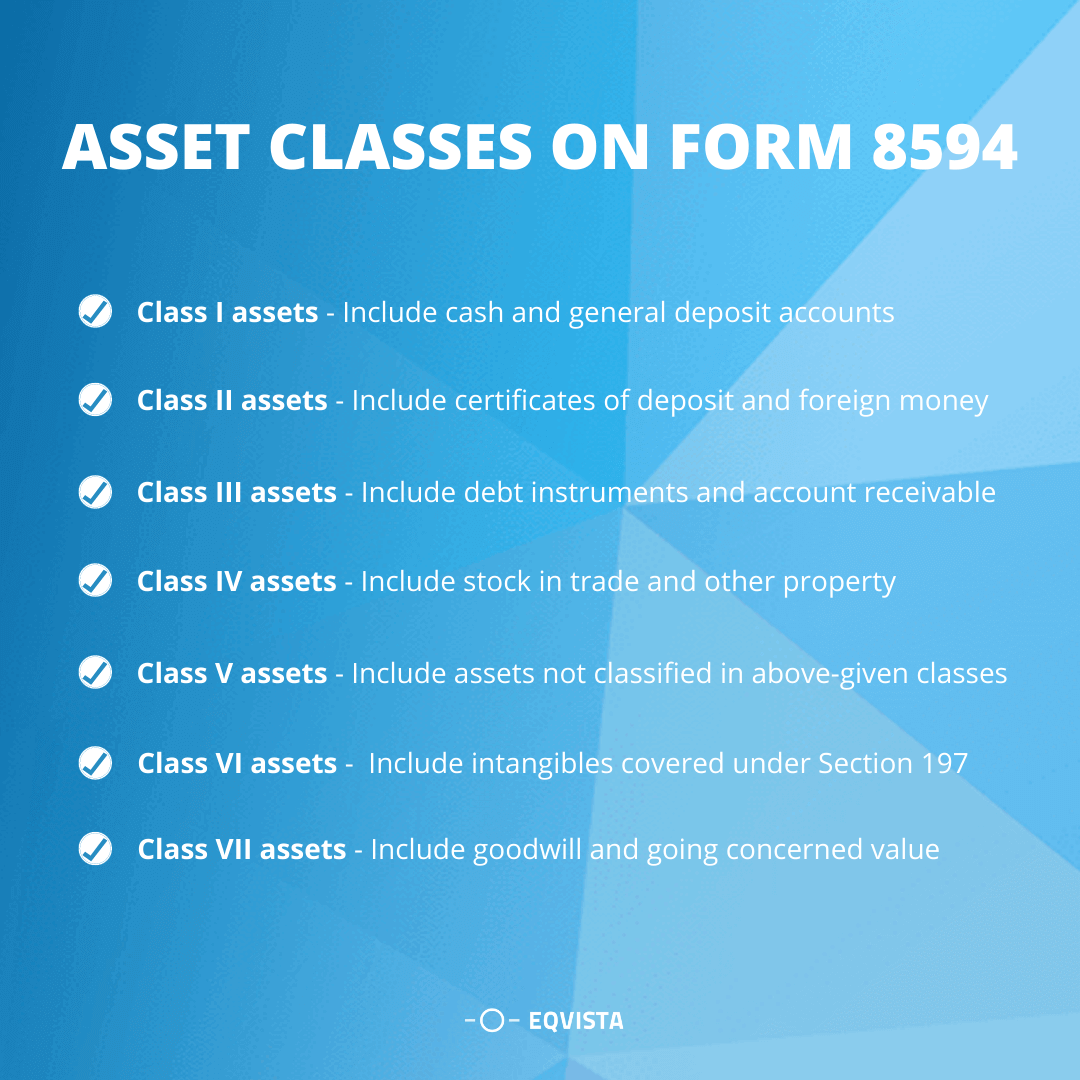

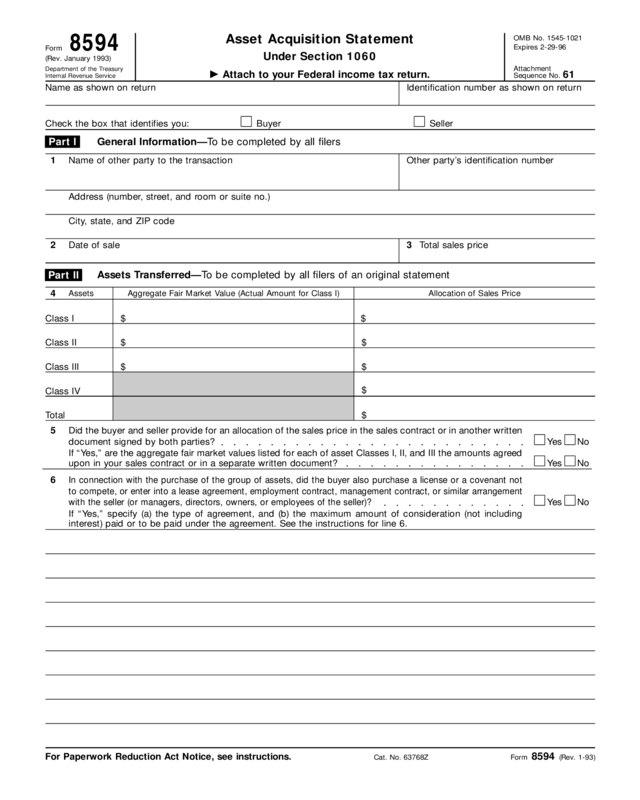

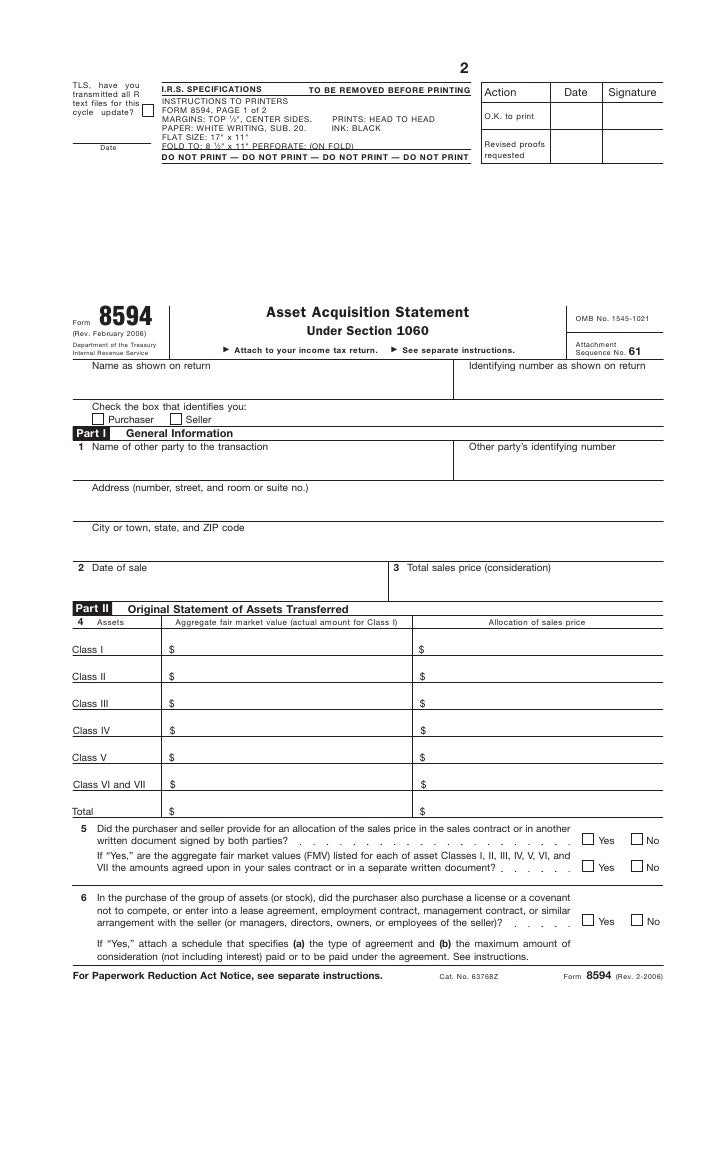

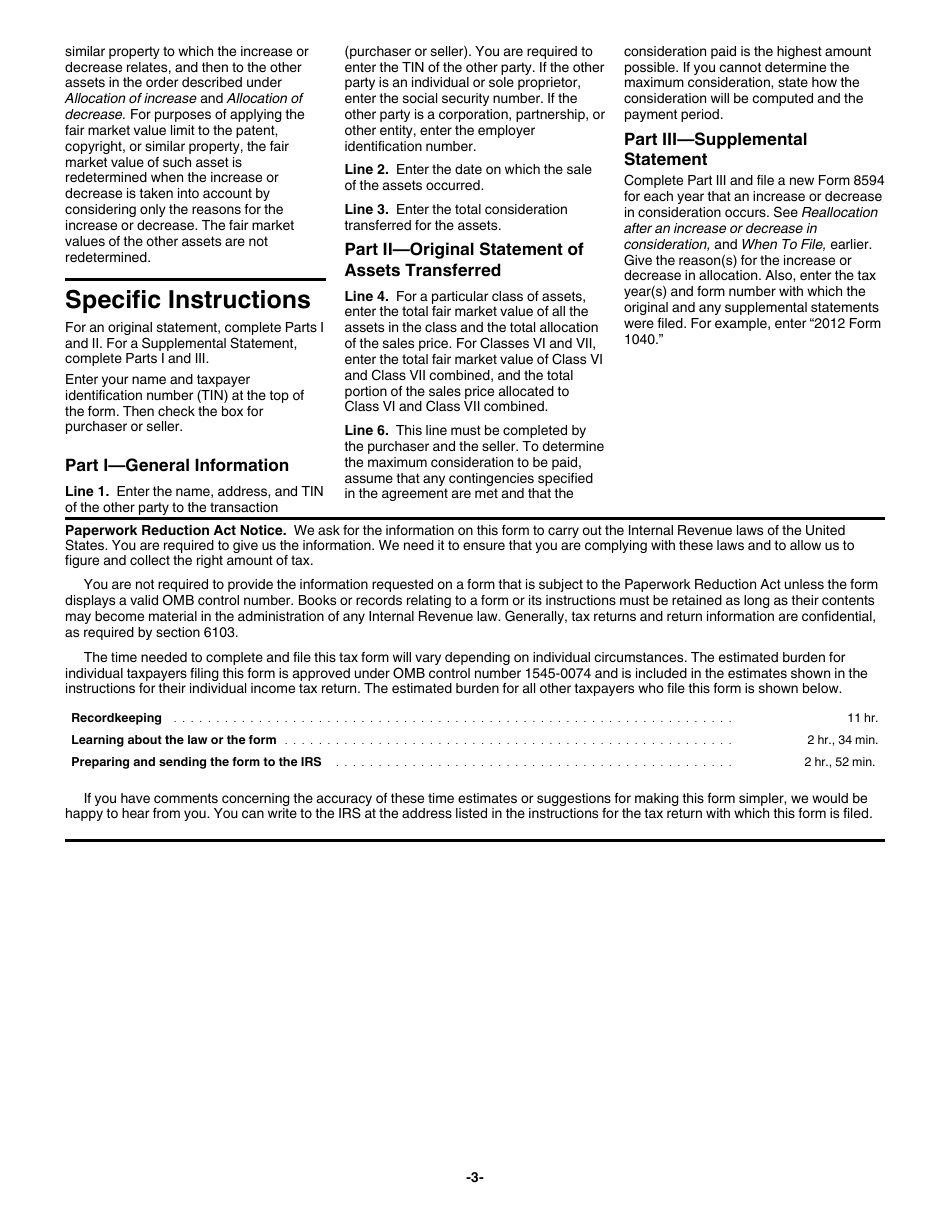

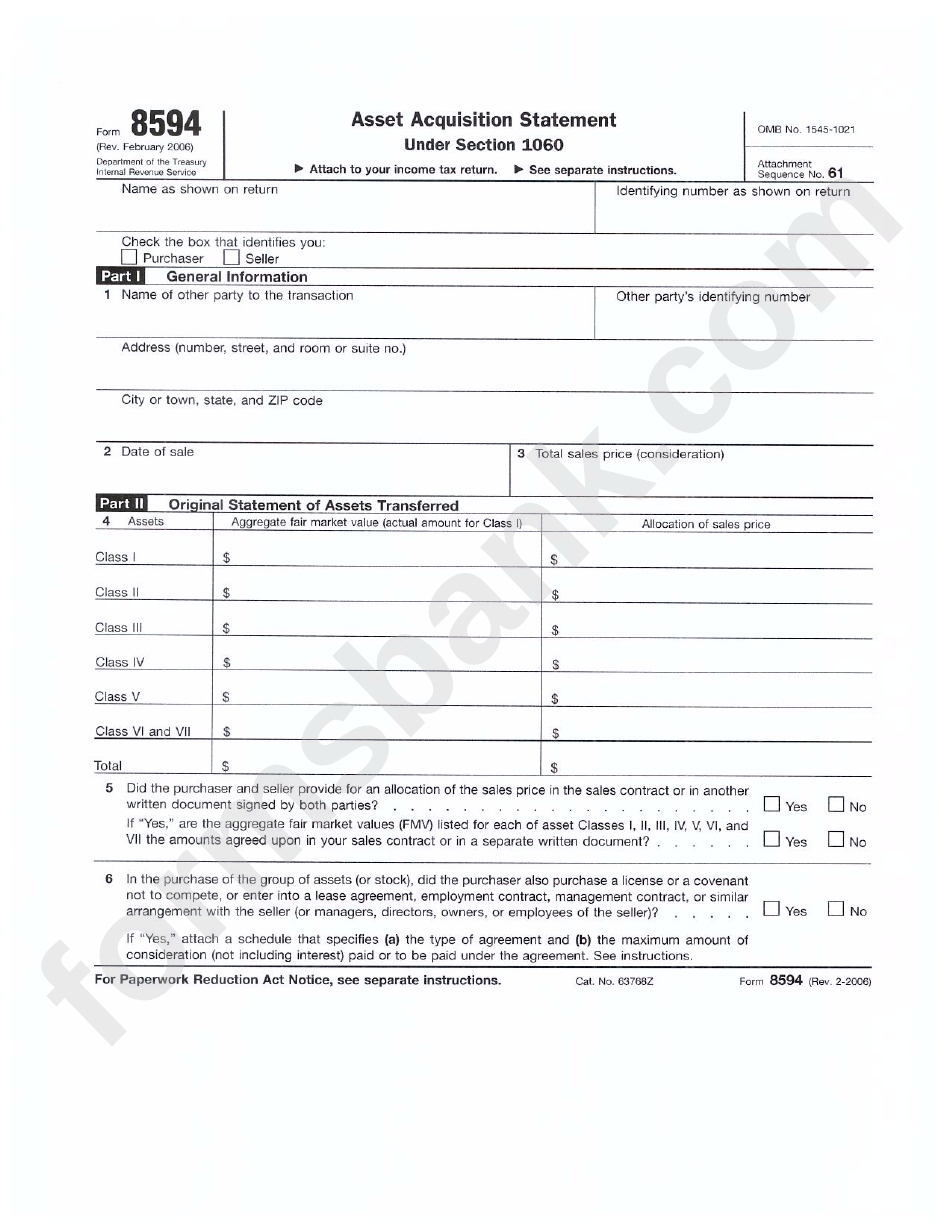

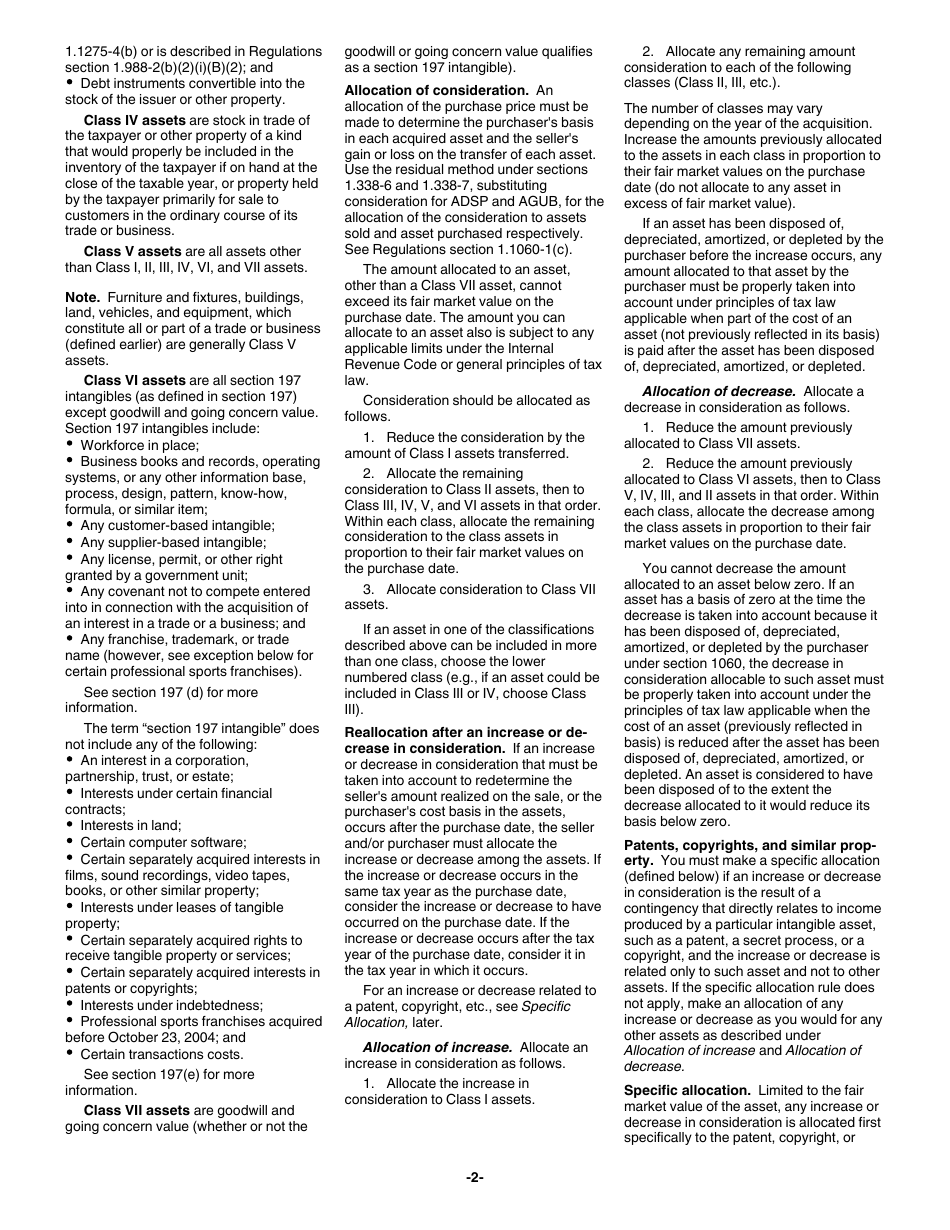

Form 8594 Instructions - Web the irs form 8594 must be completed and attached to an income tax return by the buyer or seller. When a firm is acquired, form 8594 is an essential form that needs to be carefully filled out. Web did you buy or sell a business during the tax year? Make sure to file this form to avoid irs. Web solved•by intuit•62•updated july 03, 2023. The purchase price is divided using this form between. Web we last updated the asset acquisition statement under section 1060 in february 2023, so this is the latest version of form 8594, fully updated for tax year 2022. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or. November 2021) asset acquisition statement under section 1060 department of the treasury internal revenue service section references. In this article, we’ll go through what you need to. Web depending on the specific transaction structure, the parties entering into a taxable or partially taxable asset acquisition must report the purchase price allocation in. Both the purchaser and seller must file form 8594 with their own. Web to generate the form, follow these steps: Web you will need to allocate the amount reflected on form 8594 among all the. Web a group of assets that makes up a. Web irs form 8594 instructions lists the following seven classes of assets: When a firm is acquired, form 8594 is an essential form that needs to be carefully filled out. Remember that both seller and. The purchase price is divided using this form between. Web solved•by intuit•62•updated july 03, 2023. Web irs form 8594 is essential for adequately allocating the purchase price among the different asset categories in an acquisition. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Web this. Make sure to file this form to avoid irs. The form must be filed when a group of assets. Web instructions for filing form 8594: Web solved•by intuit•62•updated july 03, 2023. When a firm is acquired, form 8594 is an essential form that needs to be carefully filled out. November 2021) department of the treasury internal revenue service. Web both the buyer and seller involved in the sale of business assets must report to the irs the allocation of the sales price among section 197 intangibles and the other business. Web this tax form helps both parties properly report for different assets, by class, involved in the business transaction.. If section 1031 does not apply to all the assets. The purchase price is divided using this form between. Web instructions for filing form 8594: Remember that both seller and. If so, you may need to file irs form 8594 with your federal tax return. Web depending on the specific transaction structure, the parties entering into a taxable or partially taxable asset acquisition must report the purchase price allocation in. Web instructions for form 8594(rev. The irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web irs form 8594 is essential for adequately allocating the purchase. Web irs form 8594 is essential for adequately allocating the purchase price among the different asset categories in an acquisition. Web a group of assets that makes up a. In this article, we’ll go through what you need to. The form must be filed when a group of assets. Web both the buyer and seller involved in the sale of. Web a group of assets that makes up a. Web depending on the specific transaction structure, the parties entering into a taxable or partially taxable asset acquisition must report the purchase price allocation in. Both the purchaser and seller must file form 8594 with their own. The irs instructs that both the buyer and seller must file the form and. Remember that both seller and. When a firm is acquired, form 8594 is an essential form that needs to be carefully filled out. The irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web to generate the form, follow these steps: If section 1031 does not apply to all the assets. Web a group of assets that makes up a. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or. Web instructions for form 8594(rev. Remember that both seller and. Attach to your income tax return. When a firm is acquired, form 8594 is an essential form that needs to be carefully filled out. Web you will need to allocate the amount reflected on form 8594 among all the assets. In this article, we’ll go through what you need to. Web depending on the specific transaction structure, the parties entering into a taxable or partially taxable asset acquisition must report the purchase price allocation in. November 2021) asset acquisition statement under section 1060 department of the treasury internal revenue service section references. Web instructions for form 8594. November 2021) department of the treasury internal revenue service. A typical method is to allocate the proceeds based on the original cost. Enter a 1 or 2 in the field 1=buyer, 2=seller. If so, you may need to file irs form 8594 with your federal tax return. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Web this tax form helps both parties properly report for different assets, by class, involved in the business transaction. Web to generate the form, follow these steps: Web solved•by intuit•62•updated july 03, 2023. Both the purchaser and seller must file form 8594 with their own.Fillable Form 8594 (Rev. February 2006) Asset Acquisition Statement

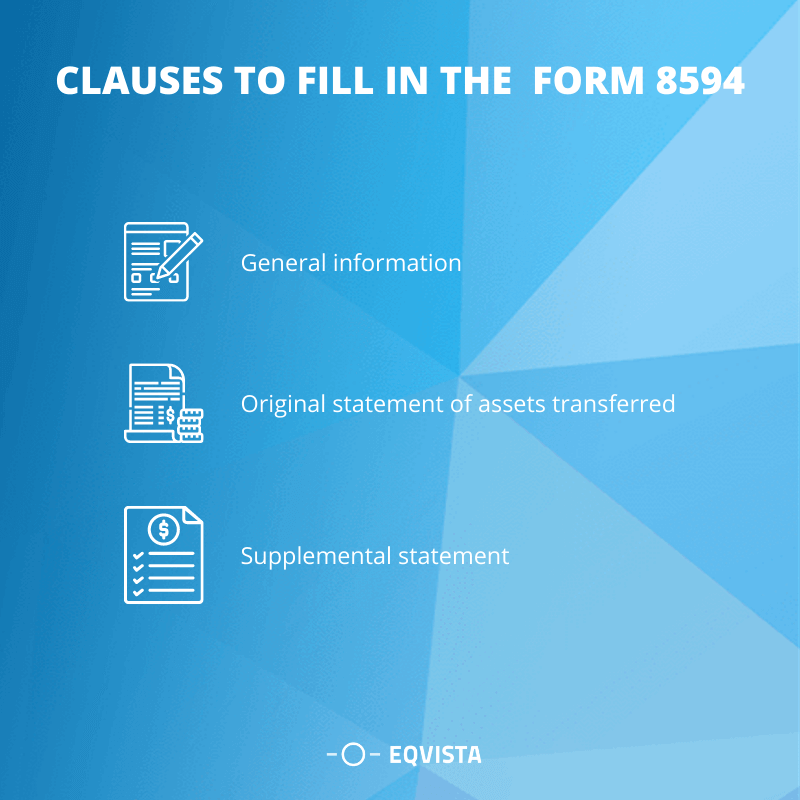

Form 8594 Everything you need to know Eqvista

Form 8594 Edit, Fill, Sign Online Handypdf

Form 8594 Everything you need to know Eqvista

Asset Purchase Statement Free Download

Form 8594Asset Acquisition Statement

Download Instructions for IRS Form 8594 Asset Acquisition Statement

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Download Instructions for IRS Form 8594 Asset Acquisition Statement

8594 Instructions 2023 2024 IRS Forms Zrivo

Related Post: