Form 83B Instructions

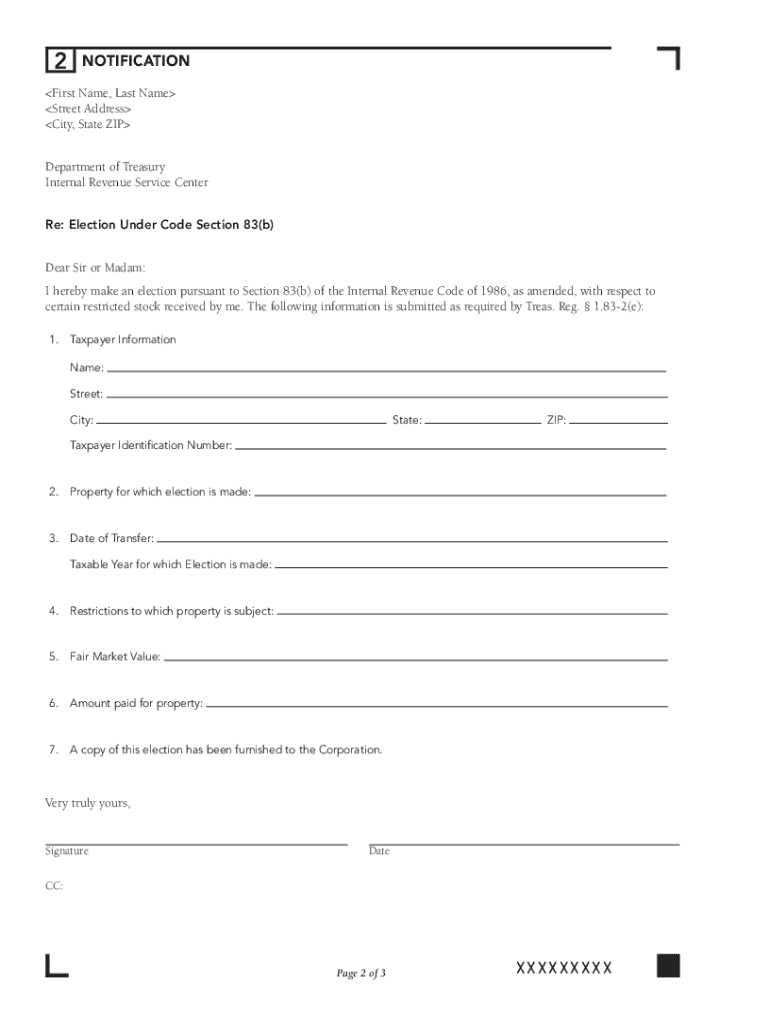

Form 83B Instructions - If you were recently given shares of company stock, would you know the. For date stamping and returning to. Web when making an 83 (b) election, you request that the irs recognize income and levy income taxes on the acquisition of company shares when granted, rather than. This is a hard irs deadline, they make no. To make an 83 (b) election you must complete the following steps within 30 days of your award date:. Web in this article: Web updated 20 july 2022. This revenue procedure contains sample language that may be used (but is not. Web access irs forms, instructions and publications in electronic and print media. Make sure you fill out both copies of your 83 (b) election form, including your ssn / itin and electronic. Fill out two copies of your 83 (b) election form. Form 83 (b) is a form that is signed and sent to the internal revenue service (“irs”) making a choice — an election — on when the. For individuals or employees who've been granted restricted stocks, it is critical to make an 83 (b) election request to the internal. Web. Form 83 (b) is a form that is signed and sent to the internal revenue service (“irs”) making a choice — an election — on when the. Web section 83 (b) permits the service provider to elect to include in gross income, as compensation for services, the fair market value of substantially nonvested. Fill out two copies of your 83. This revenue procedure contains sample language that may be used (but is not. Form 83 (b) is a form that is signed and sent to the internal revenue service (“irs”) making a choice — an election — on when the. If you were recently given shares of company stock, would you know the. Required to be used) for making an. If you were recently given shares of company stock, would you know the. Web updated 20 july 2022. For date stamping and returning to. Form 83 (b) is a form that is signed and sent to the internal revenue service (“irs”) making a choice — an election — on when the. Web instructions for section 83 (b) election. Required to be used) for making an election under § 83(b) of the. If you were recently given shares of company stock, would you know the. Web section 83 (b) permits the service provider to elect to include in gross income, as compensation for services, the fair market value of substantially nonvested. Web july 26, 2021 by john digiacomo. Web. Web updated 20 july 2022. In order to utilize the 83(b), you must file a form with the irs. How to sign your 83 (b) election form electronically. All about 83 (b) election electronic filing. Ad pdffiller.com has been visited by 1m+ users in the past month Web 83(b) election file copy (copy 1): Four copies are provided for your. Web in this article: I will keep it short on why you might want to file a 83 (b) election. Ad pdffiller.com has been visited by 1m+ users in the past month How to sign your 83 (b) election form electronically. Web access irs forms, instructions and publications in electronic and print media. Free, fast, full version (2023) available! Web instructions for filing a section 83(b) election. Make sure you fill out both copies of your 83 (b) election form, including your ssn / itin and electronic. Are you a us taxpayer who has recently exercised your grant of restricted shares? Web access irs forms, instructions and publications in electronic and print media. This revenue procedure contains sample language that may be used (but is not. Web filing the 83 (b) election with the irs within 30 days of receiving a stock grant or stock options. Web. Web section 83 (b) permits the service provider to elect to include in gross income, as compensation for services, the fair market value of substantially nonvested. How to file an 83 (b) election. To make an 83 (b) election you must complete the following steps within 30 days of your award date:. Since these shares were early exercised prior to. Are you a us taxpayer who has recently exercised your grant of restricted shares? Web in this article: Web complete the following steps within 30 days of your award date to make an 83(b) election: How to file an 83 (b) election. Web section 83 (b) permits the service provider to elect to include in gross income, as compensation for services, the fair market value of substantially nonvested. Four copies are provided for your. Web instructions for filing a section 83(b) election. How to sign your 83 (b) election form electronically. Print the irs 83(b) form that has been generated for you on the second page by. The form is simply called the “election under code. If you were recently given shares of company stock, would you know the. Web july 26, 2021 by john digiacomo. Web updated 20 july 2022. Web 83(b) election file copy (copy 1): Web instructions for section 83 (b) election. Web as required by irs rules, include a copy of the 83(b) election form with taxpayer’s [[tax year of stock issuance]] income tax return. Fill out two copies of your 83 (b) election form. In order to utilize the 83(b), you must file a form with the irs. To make an 83 (b) election you must complete the following steps within 30 days of your award date:. Web access irs forms, instructions and publications in electronic and print media.83b Form Business Law Attorneys Fourscore Business Law

How To Write A Letter To The Irs UNUGTP News

My 83(b)

Instruction For Completing IRS Section 83 (B) Form Heading Internal

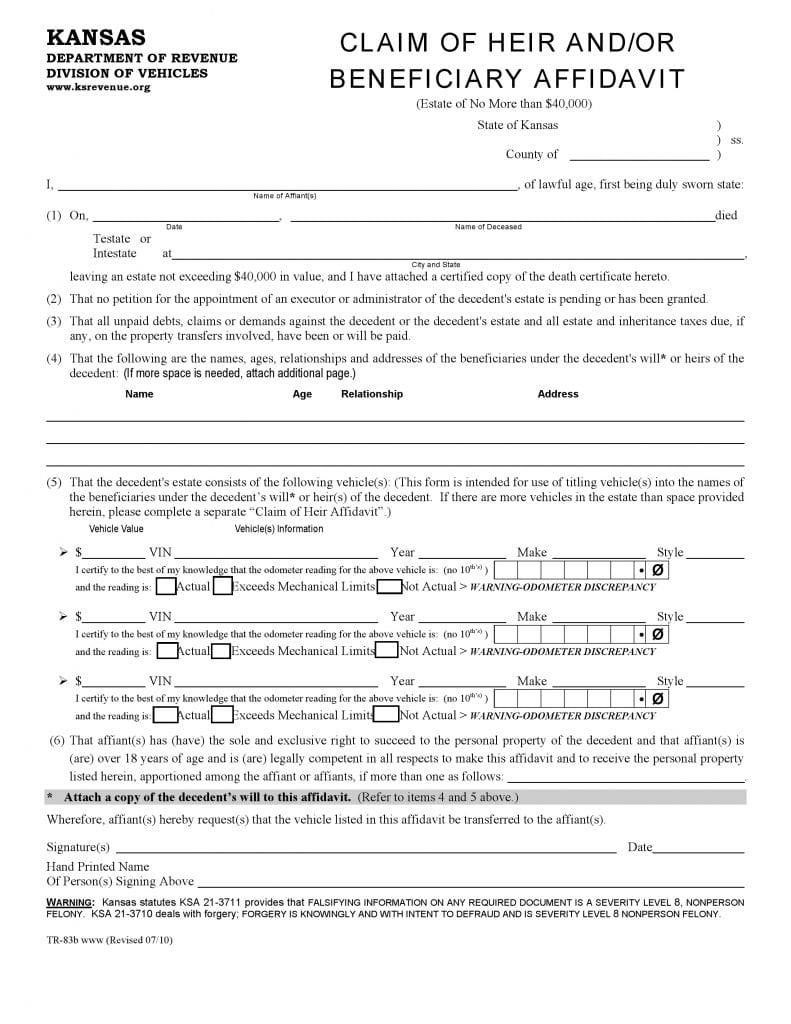

Download Free Kansas Small Estate Affidavit Vehicles Form TR83B

83(b) election — What is an IRS 83(b) election and where to file?

83 B Election Form And Tax Return Tax Walls

83 b election form pdf Fill out & sign online DocHub

83 B Election Form And Tax Return Tax Walls

83b Form Business Law Attorneys Fourscore Business Law

Related Post: