Form 8379 Instructions

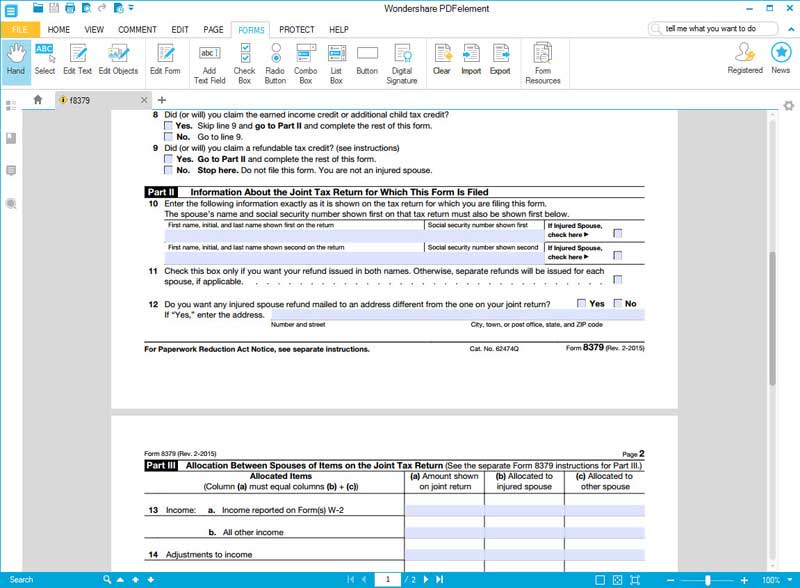

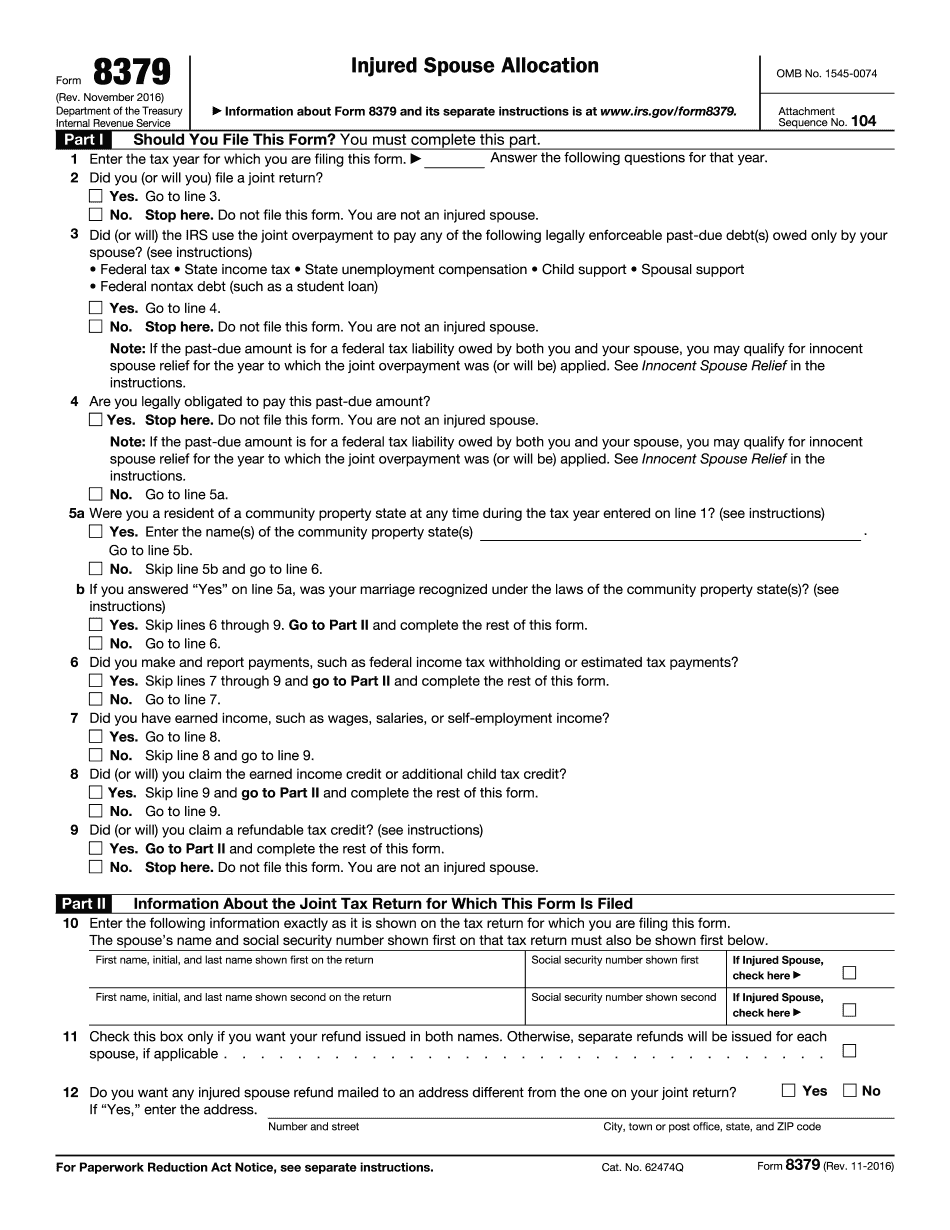

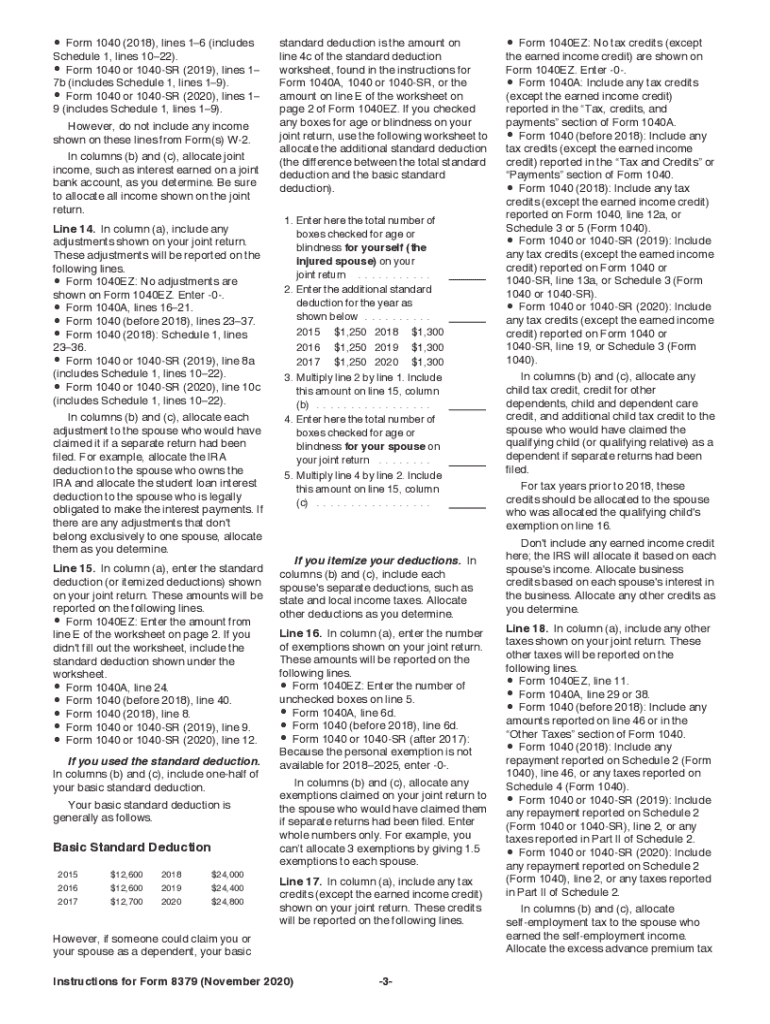

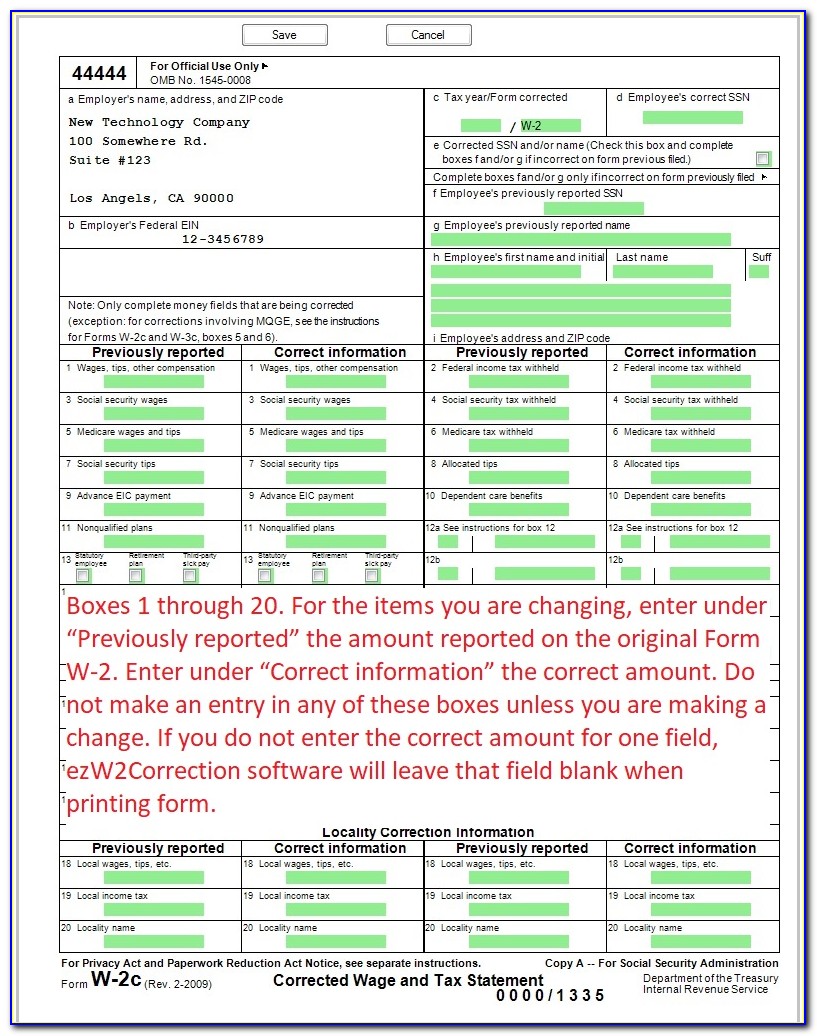

Form 8379 Instructions - The injured spouse on a jointly filed tax return files form 8379 to get back. Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Web per irs instructions for form 8379, page 1: Make sure you read the instructions below. To get started on the blank, use the fill camp; If you file form 8379 by itself, you must write or enter both spouses'. Web the bottom portion of the form is used to allocate the income, deductions, withholdings, exemptions and credits to the correct taxpayers. Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. Are you an injured spouse? Alternatively, the injured spouse can file it. A couple can file form 8379 along with their joint tax return if they expect their refund to be seized. Adjustments to income are taken from that section of the. The injured spouse on a jointly filed tax return files form 8379 to get back. November 2021) department of the treasury internal revenue service. Easily fill out pdf blank, edit,. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. Web what is irs form 8379? Alternatively, the injured spouse can file it. You may be an injured spouse if you file a joint return and all or. A couple can file form 8379 along with their joint tax return if they expect their refund to be seized. You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment. Web what is irs form 8379? Sign online button or tick the preview image of the blank. The. Web it might take up to 8 weeks for the irs to process the form by itself. Web what is irs form 8379? You must file a new form 8379 for each year when you want. Sign online button or tick the preview image of the blank. Go to www.irs.gov/form8379 for instructions and the latest. Alternatively, the injured spouse can file it. Web it might take up to 8 weeks for the irs to process the form by itself. Ad download or email irs 8379 & more fillable forms, register and subscribe now! Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was. Save or instantly send your ready documents. The injured spouse has reported income such as wages, taxable interest, etc., on the joint return, and. Web per irs instructions for form 8379, page 1: Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be). Injured spouses may file form 8379 to receive their share of the refund shown on the joint return. The injured spouse on a jointly filed tax return files form 8379 to get back. You must file form 8379 for each year you. Web filling out the form. Must not be legally obligated. Web per irs instructions for form 8379, page 1: Web you need to file form 8379 for each year you’re an injured spouse and want your portion of the refund. Web it might take up to 8 weeks for the irs to process the form by itself. Save or instantly send your ready documents. Ad download or email irs 8379. If you did not electronically file form 8379 injured spouse allocation when you filed your original tax return, you need to send. Must not be legally obligated. The injured spouse on a jointly filed tax return files form 8379 to get back. Web you need to file form 8379 for each year you’re an injured spouse and want your portion. Alternatively, the injured spouse can file it. November 2021) department of the treasury internal revenue service. You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment. Save or instantly send your ready documents. Sign online button or tick the preview image of the blank. Web filling out the form. You must file a new form 8379 for each year when you want. If you did not electronically file form 8379 injured spouse allocation when you filed your original tax return, you need to send. Are you an injured spouse? Ad download or email irs 8379 & more fillable forms, register and subscribe now! Web form 8379 is used by injured spouses to compute their share of a joint tax refund. Complete, edit or print tax forms instantly. The injured spouse has reported income such as wages, taxable interest, etc., on the joint return, and. You can file this form before or after the offset occurs,. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. Adjustments to income are taken from that section of the. Web per irs instructions for form 8379, page 1: Make sure you read the instructions below. You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment. Web you'll need to look at the line instructions in the instructions for form 8379, but here are some tips. Injured spouses may file form 8379 to receive their share of the refund shown on the joint return. Web it might take up to 8 weeks for the irs to process the form by itself. Alternatively, the injured spouse can file it. Save or instantly send your ready documents. Web considered an injured spouse.IRS Form 8379 Fill it Right

F8379 injure spouse form

OCR 8379 Form And Cope With Bureaucracy

Instructions for Completing Form 8379 Injured Spouse Allocation

Form 8379 printable Fill out & sign online DocHub

Fillable Form 8379 Injured Spouse Allocation Printable Pdf Download

Irs Form 8379 Line 20 Universal Network

Irs Forms 8379 Instructions Form Resume Examples wQOj93g5x4

example of form 8379 filled out Fill Online, Printable, Fillable

Printable Irs Form 8379 Printable Forms Free Online

Related Post: