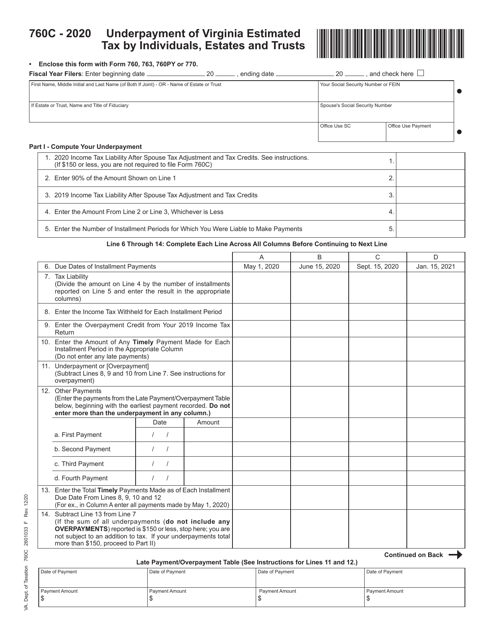

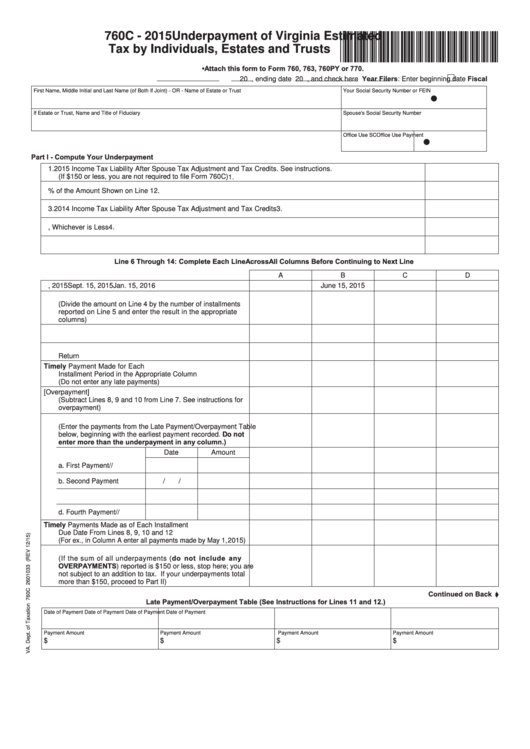

Form 760C Line 3

Form 760C Line 3 - Enter 90% of the amount shown on line 1. 2019 income tax liability after spouse tax adjustment. Taxpayers extensively utilize virginia tax. Use form 760f if at least 66 2/3% of your income is. Income tax liability after spouse tax adjustment and tax credits (if $150 or less, you are not required to file form 760c) enter 90% of the amount shown. 760c line 3 asks for the 2013. Web i'm filling in virginia 760c 2014 form to complete back taxes. Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Enter 90% of the amount shown on line 1. (if $150 or less, you are not required to file form 760c). Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Enter 90% of the amount shown on line 1. Web i'm filling in virginia 760c 2014 form to complete back taxes. Web if you are single, line 3 is the same. 2020 income tax liability after spouse tax adjustment and tax credits. 03 export or print immediately. Income tax liability after spouse tax adjustment and tax credits Web 2021 income tax liability after spouse tax adjustment and tax credits. Web get your form 760c in 3 easy steps. Web get your form 760c in 3 easy steps. Apparently unprecedented tax question (form 760c line 3) apparently i missed tax tuesday, but this also isn't a basic tax question either, i've. 2020 income tax liability after spouse tax adjustment and tax credits. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023,. Web 2021 income tax liability after spouse tax adjustment and tax credits. Web (if $150 or less, you are not required to file form 760c). Use form 760f if at least 66 2/3% of your income is. Web 2020 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts. Web purpose of form 760c. I’ve never had to do this. Web if you are single, line 3 is the same as line 1, or you can leave it blank. Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Use form 760f if at least 66 2/3% of your income is. It appears you don't have a. Form 760c underpayment of estimated tax; Web for line 3 of your 2020 form 760c, you need to enter the 2019 income tax liability after spouse tax adjustment and tax credits. Income tax liability after spouse tax adjustment and tax credits Web purpose of form 760c. 2014 if the first year i lived in the us and va, i didn't. Income tax liability after spouse tax adjustment and tax credits I’ve never had to do this. Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. Web (if $150 or less, you are not required to file form 760c). It appears you don't have a pdf plugin for this. Web purpose of form 760c. Web (if $150 or less, you are not required to file form 760c). Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. It appears you don't have a pdf plugin for this. Income tax liability after spouse tax adjustment and tax credits If you'll look at your 2019 form. Web 2020 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts. (if $150 or less, you are not required to file form 760c). 2020 income tax liability after spouse tax adjustment and tax credits. 03 export or print immediately. Virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. Virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or. Web i'm filling in virginia 760c 2014 form to complete back taxes. 2019 income tax. Web if you are single, line 3 is the same as line 1, or you can leave it blank. 2019 income tax liability after spouse tax adjustment. (if $150 or less, you are not required to file form 760c) enter 90% of the amount shown. Web for line 3 of your 2020 form 760c, you need to enter the 2019 income tax liability after spouse tax adjustment and tax credits. (if $150 or less, you are not required to file form 760c). If you'll look at your 2019 form. Use form 760c to compute any addition to tax you may owe for underpayment of estimated taxes. 2014 if the first year i lived in the us and va, i didn't live in the us before. Web (if $150 or less, you are not required to file form 760c). Enter 90% of the amount shown on line 1. Select yes to complete the form; 2020 income tax liability after spouse tax adjustment and tax credits. Enter 90% of the amount shown on line 1. 760c line 3 asks for the 2013. 01 fill and edit template. I’ve never had to do this. Enter 90% of the amount shown on line 1. Web 2020 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts. Web complete form 760c by visiting: It appears you don't have a pdf plugin for this.Compilation Instructions MOD Form 760 Narrative Fault

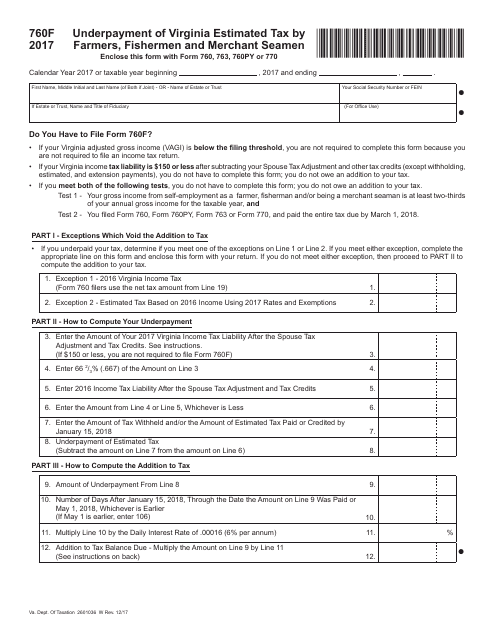

Form 760F Download Fillable PDF or Fill Online Underpayment of Virginia

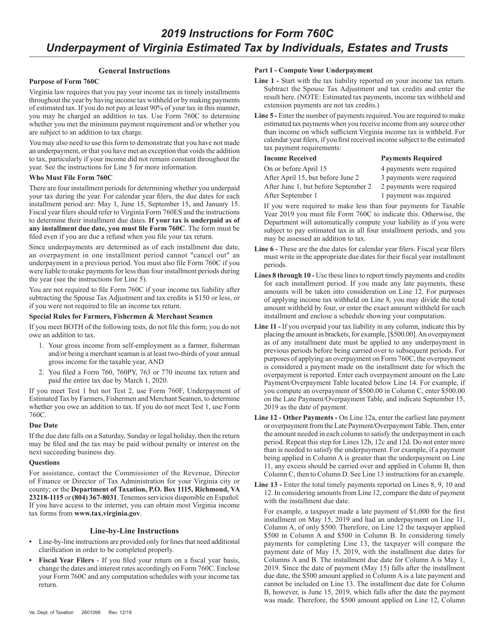

Download Instructions for Form 760C Underpayment of Virginia Estimated

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

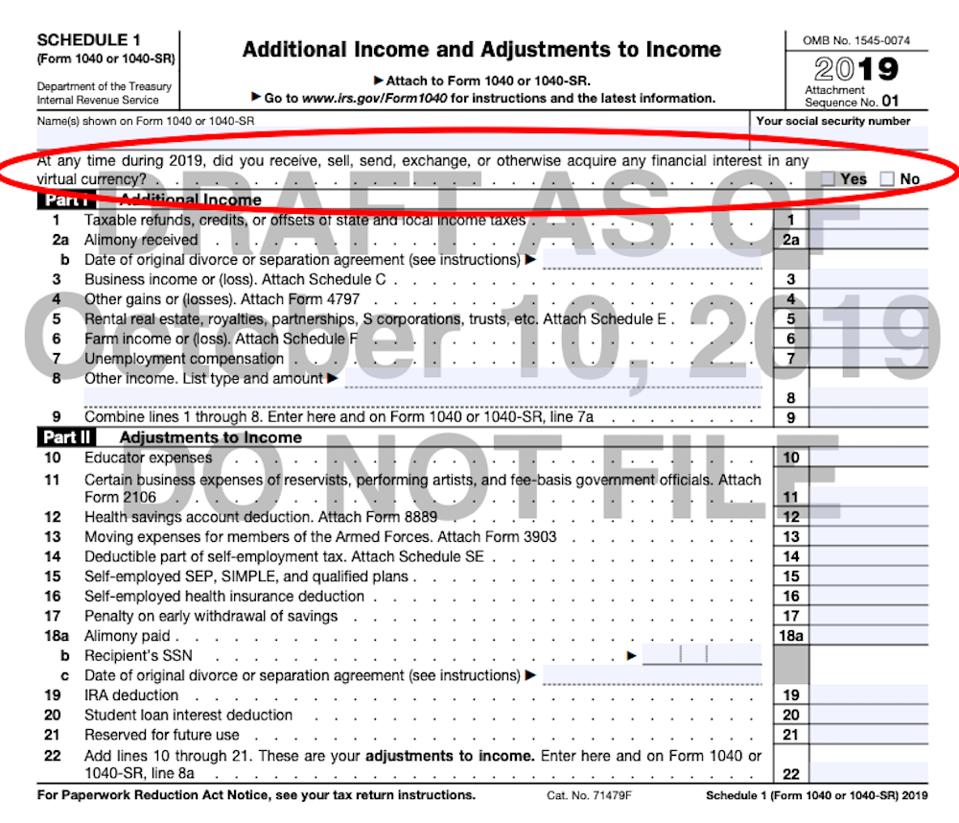

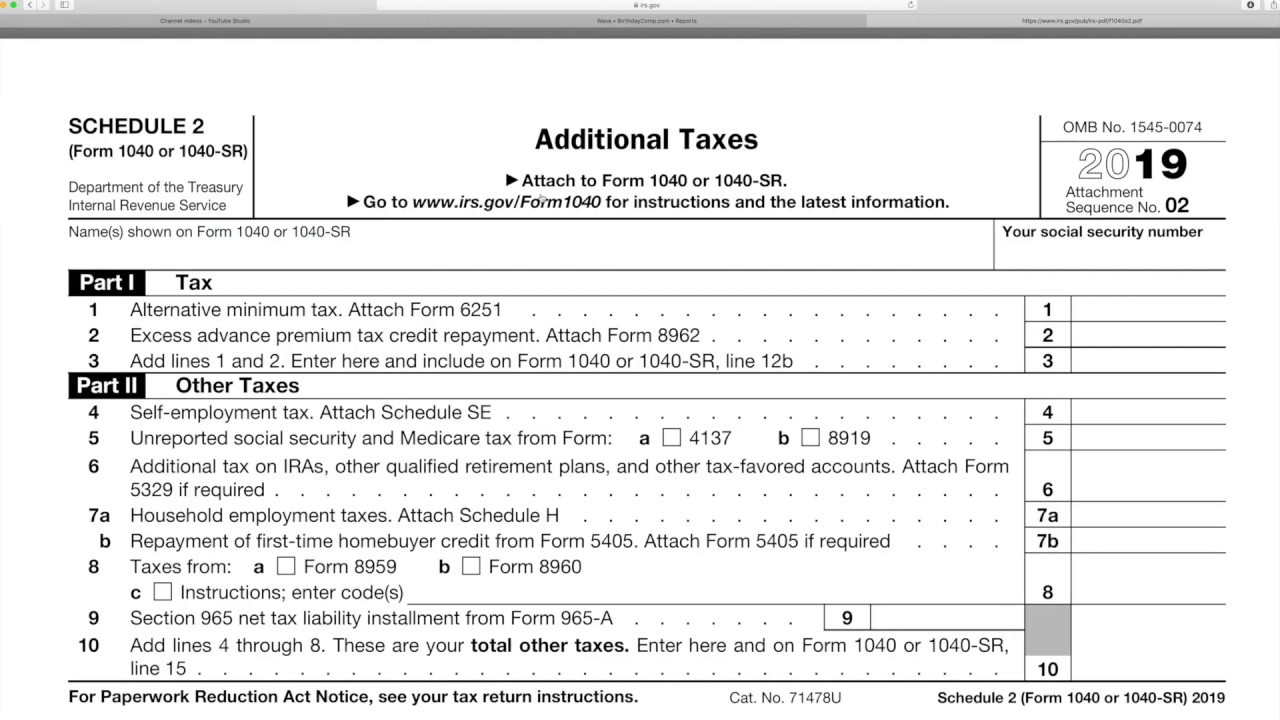

There’s A New Question On Your 1040 As IRS Gets Serious About

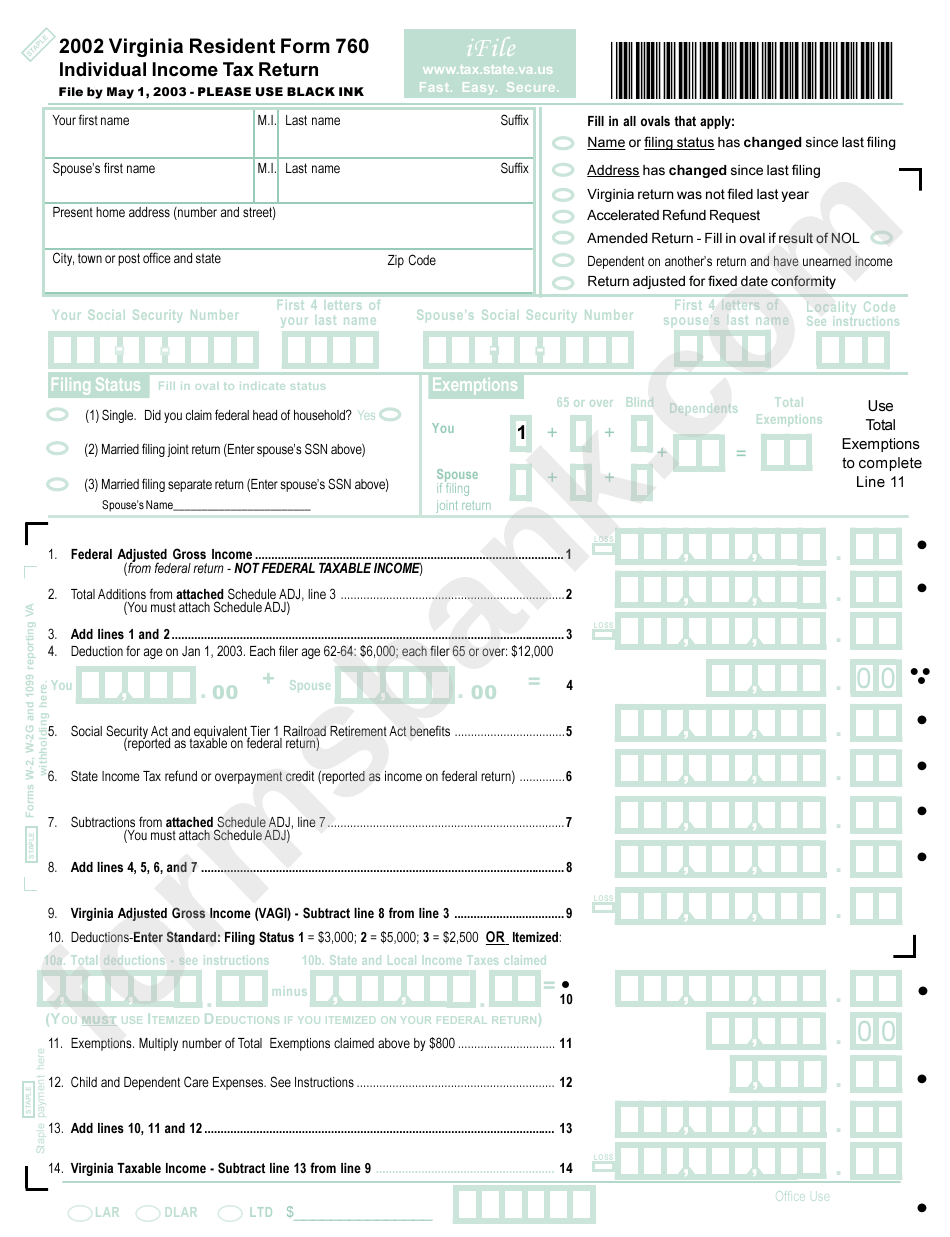

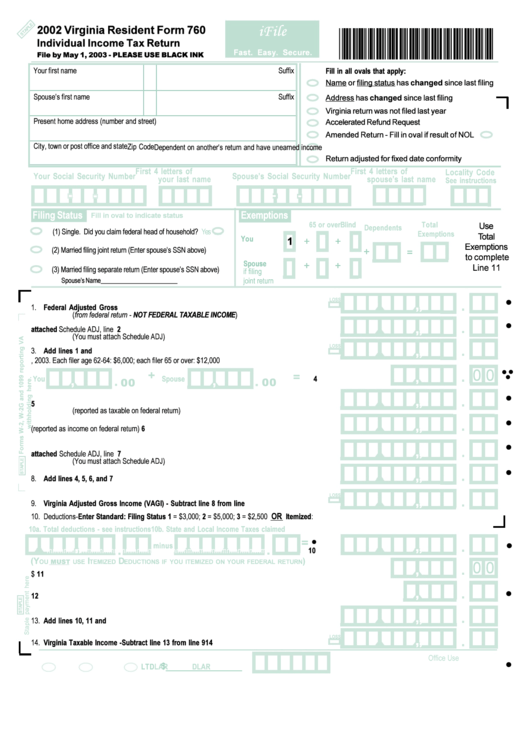

Virginia Printable Tax Forms Printable Forms Free Online

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Irs Form 1040 Line 16a And 16b Form Resume Examples

Virginia Printable Tax Forms Printable Forms Free Online

How to find 1040 schedule 2 Additional Premium Tax credit for

Related Post: