Form 7203 Stock Block

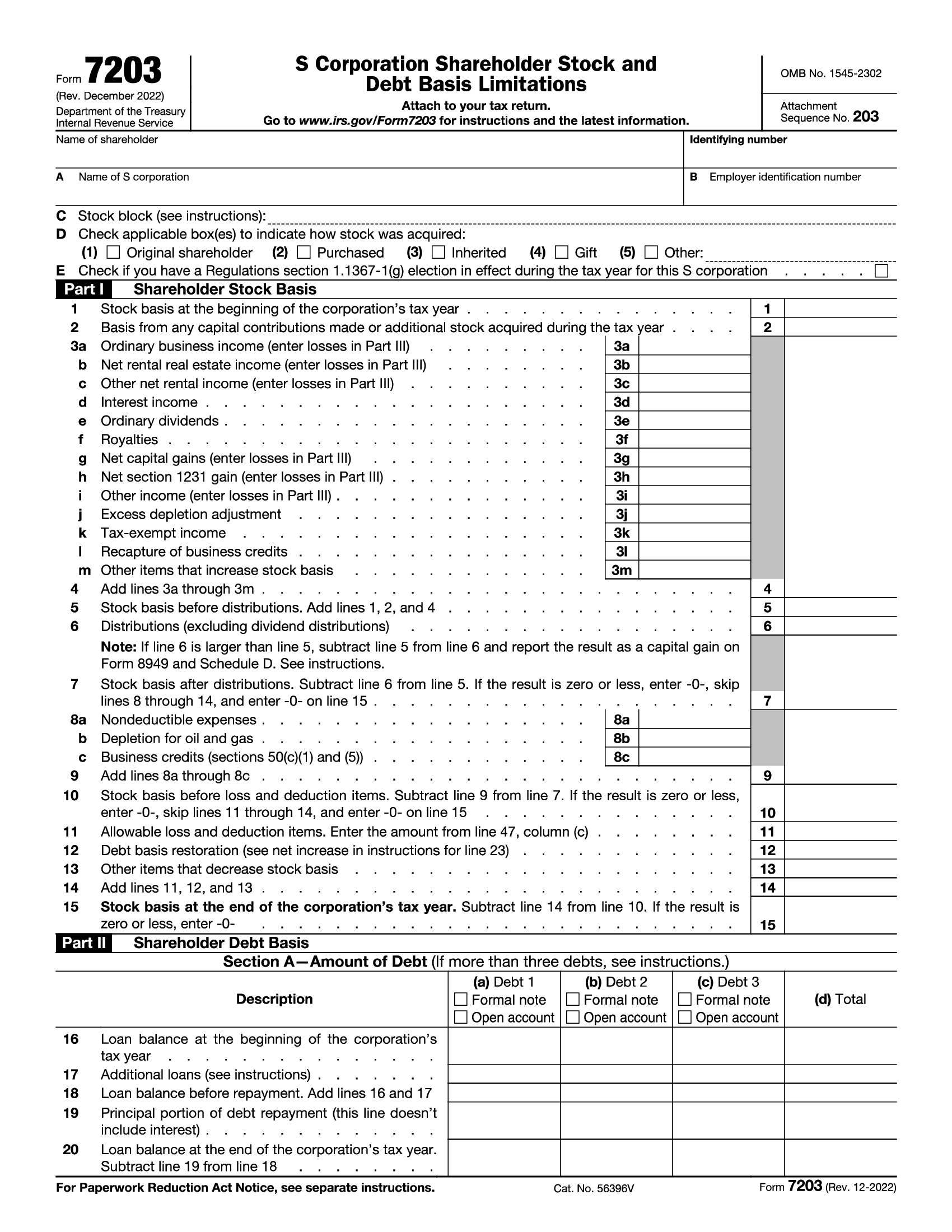

Form 7203 Stock Block - Web stock block (see instructions): Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: Go to income > s corporation passthrough worksheet. D check applicable box(es) to indicate how stock was acquired: Attach to your tax return. Go to www.irs.gov/form7203 for instructions and the latest information. Web s corporation shareholder stock and debt basis limitations. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web irs issues guidance for s corporation shareholders. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web irs issues guidance for s corporation shareholders. In 2022, john decides to sell 50 shares of company a stock. In lines stock block, input applicable description. Go to income > s corporation passthrough worksheet. Attach to your tax return. S corporation shareholders use form 7203 to figure the potential limitations. Web s corporation shareholder stock and debt basis limitations. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. D check applicable box(es) to indicate how stock was acquired: Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Go to www.irs.gov/form7203 for. S corporation shareholders use form 7203 to figure the potential limitations. Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. Web using form 7203, john can track the basis of each stock block separately directly on his income. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items. Web irs issues guidance for s corporation shareholders. Web s corporation shareholder stock and debt basis limitations. Web about form 7203, s corporation shareholder stock and debt basis limitations. (1) original shareholder (2). Web c stock block (see instructions): S corporation shareholders use form 7203 to figure the potential limitations. In lines stock block, input applicable description. Web once the form is saved to your computer, go to the tab and click on the critical diagnostic beginning form 7203 to upload and attach your pdf. Go to www.irs.gov/form7203 for instructions and the latest. If there is a partial stock sale or partial redemption, you may file more. Attach to your tax return. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: S corporation shareholders use form 7203 to figure the potential limitations. Web irs issues guidance for s corporation shareholders. In lines stock block, input applicable description. Go to income > s corporation passthrough worksheet. In 2022, john decides to sell 50 shares of company a stock. Web s corporation shareholder stock and debt basis limitations. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: D check applicable box(es) to indicate how stock was acquired: Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Web form 7203 is used to calculate any limits on the deductions you can take for your share of an s corporation's deductions, credits, and other items.. Web about form 7203, s corporation shareholder stock and debt basis limitations. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: If there is a partial stock sale or partial redemption, you may file more. Go to income > s corporation passthrough worksheet. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s. Web about form 7203, s corporation shareholder stock and debt basis limitations. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: Web the stock block line is a description for your use, so if you have more than one form 7203, you can identify the stock that is reported on each copy. Web stock block (see instructions): Web irs issues guidance for s corporation shareholders. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: Web once the form is saved to your computer, go to the tab and click on the critical diagnostic beginning form 7203 to upload and attach your pdf. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. S corporation shareholders use form 7203 to figure the potential limitations. Web purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Go to income > s corporation passthrough worksheet. Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web starting with the 2021 tax year, a new form 7203 replaces the supplemental worksheet for figuring a shareholder’s stock and debt basis. Check applicable box(es) to indicate how stock was acquired: D check applicable box(es) to indicate how stock was acquired: In 2022, john decides to sell 50 shares of company a stock. Web s corporation shareholder stock and debt basis limitations. Web c stock block (see instructions): If there is a partial stock sale or partial redemption, you may file more. Go to www.irs.gov/form7203 for instructions and the latest information.Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

IRS Form 7203. S Corporation Shareholder Stock and Debt Basis

IRS Form 7203 S Corporation Loss Limitations on Stock Basis YouTube

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Form7203PartI PBMares

More Basis Disclosures This Year for S corporation Shareholders Need

IRS Form 7203 Multiple Blocks of S Corporation Stock YouTube

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

National Association of Tax Professionals Blog

Related Post: