Form 7202 Taxslayer

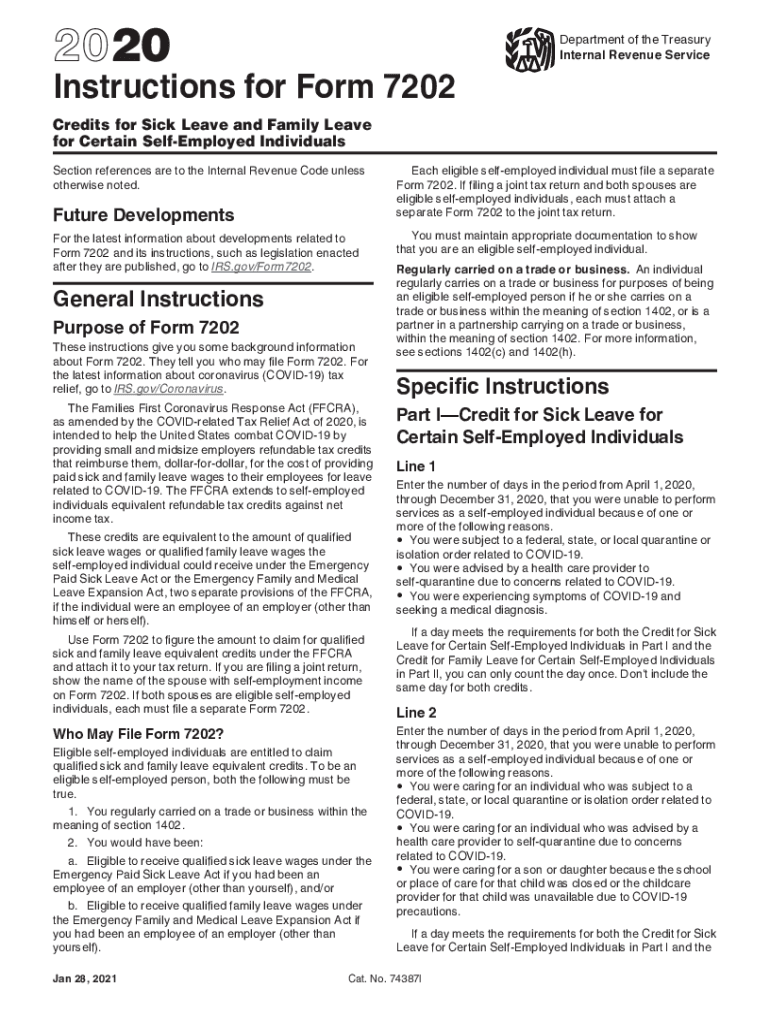

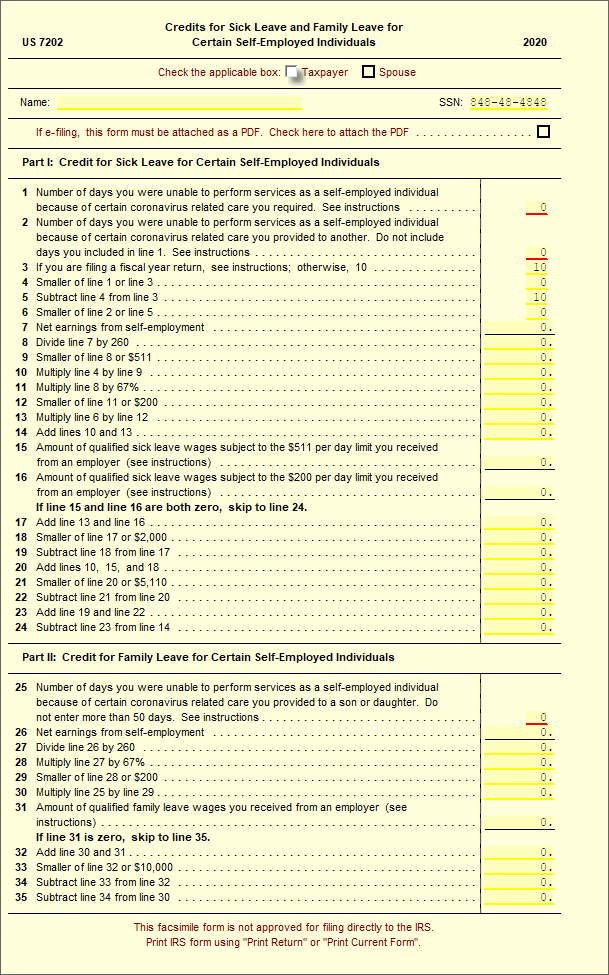

Form 7202 Taxslayer - Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Web what are the retirement savings contributions credit (form 8880) requirements? Web where is form 7202 on taxslayer? Credits for sick leave and family leave. Premium tax credit for 2020, taxpayers were not. This form will be used to calculate the refundable credits for sick. To access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web to access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web purpose of form 7202. Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Premium tax credit for 2020, taxpayers were not. Web what are the retirement savings contributions credit (form 8880) requirements? Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Web form 7202 has been expanded to account for both of these periods. On the left side of the screen, click tax tools, then tools, under. On the left side of the screen, click tax tools, then tools, under tools center, scroll down and click. How do i fill out form 7202 in 2023? Web what are the retirement savings contributions credit (form 8880) requirements? Credits related to offering sick pay and family. Maximize revenue with the professional look of our tax folders. What is the paid sick leave credi. Web what are the retirement savings contributions credit (form 8880) requirements? Web where is form 7202 on taxslayer? Credits related to offering sick pay and family. Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Credits related to offering sick pay and family. Web what are the retirement savings contributions credit (form 8880) requirements? Web where is form 7202 on taxslayer? Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. To access form 7202 in taxslayer pro, from the main. Web what are the retirement savings contributions credit (form 8880) requirements? The consolidated appropriations act increased the income thresholds. On the left side of the screen, click tax tools, then tools, under tools center, scroll down and click. What is the paid sick leave credi. Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been. Web this credit was also reported on form 7202 on the 2020 return and will also be available to taxpayers in 2021. Maximize revenue with the professional look of our tax folders. Web where is form 7202 on taxslayer? The features you want, the price you expect, the refund you deserve. Credits related to offering sick pay and family. Credits related to offering sick pay and family. Web below are steps how to delete the form. To access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Credits. Credits related to offering sick pay and family. Web purpose of form 7202. Credits related to offering sick pay and family. What is the paid sick leave credi. How do i fill out form 7202 in 2023? The features you want, the price you expect, the refund you deserve. Web where is form 7202 on taxslayer? Credits related to offering sick pay and family. Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Web to access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040). Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. Web form 7202 has been expanded to account for both of these periods. The consolidated appropriations act increased the income thresholds. Ad taxcalcusa has a wide selection of quality tax return folders for a professional look.. Credits related to offering sick pay and family. Premium tax credit for 2020, taxpayers were not. Web to access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web where is form 7202 on taxslayer? Web this credit was also reported on form 7202 on the 2020 return and will also be available to taxpayers in 2021. Credits for sick leave and family leave. What is the paid sick leave credi. The features you want, the price you expect, the refund you deserve. To access form 7202 in taxslayer pro, from the main menu of the tax return (form 1040) select: Maximize revenue with the professional look of our tax folders. On the left side of the screen, click tax tools, then tools, under tools center, scroll down and click. Web purpose of form 7202. Ad taxcalcusa has a wide selection of quality tax return folders for a professional look. Web form 7202 has been expanded to account for both of these periods. Department of the treasury internal revenue service. Web below are steps how to delete the form. Form 7202 premium tax credit for 2021 and 2022, the premium tax credit has been adjusted to allow households with income above 400% of. How do i fill out form 7202 in 2023? This form will be used to calculate the refundable credits for sick. The features you want, the price you expect, the refund you deserve.Fillable Online Form 7202 Instructions Fill Online, Printable

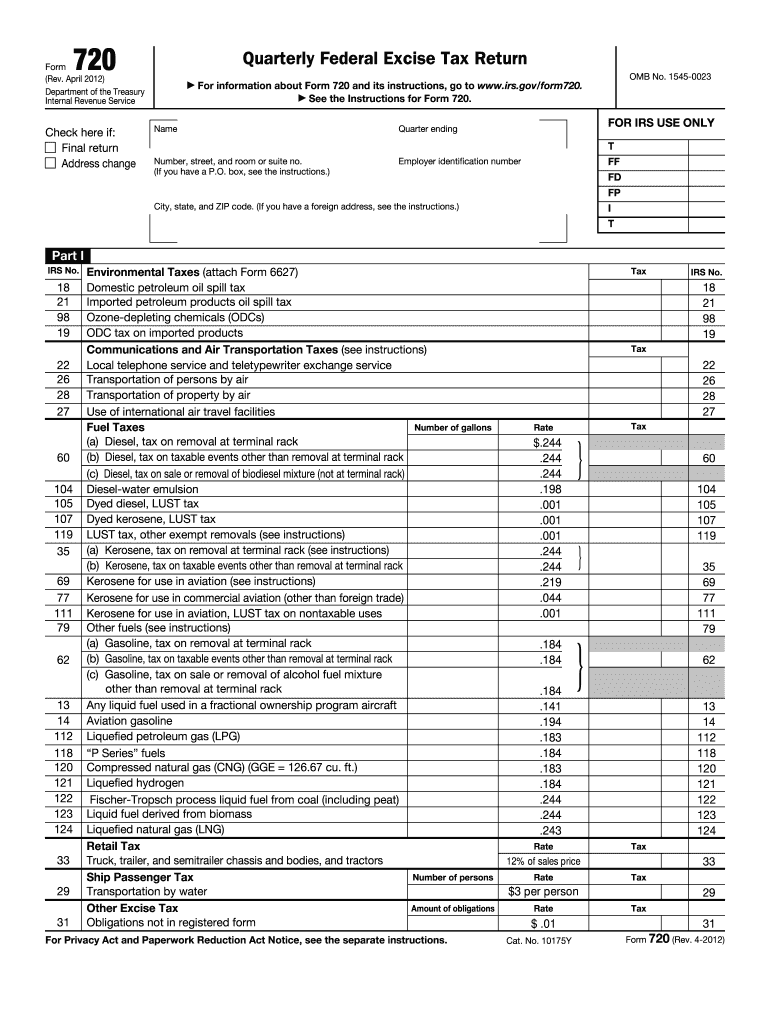

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

COVID19 tax relief What is IRS Form 7202, and how it could help if

IRS Form 7202 Examples

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

IRS Form 7202 Examples

2020 Form IRS Instructions 7202 Fill Online, Printable, Fillable, Blank

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

7202 Credits for Sick Leave and Family Leave UltimateTax Solution

Related Post: