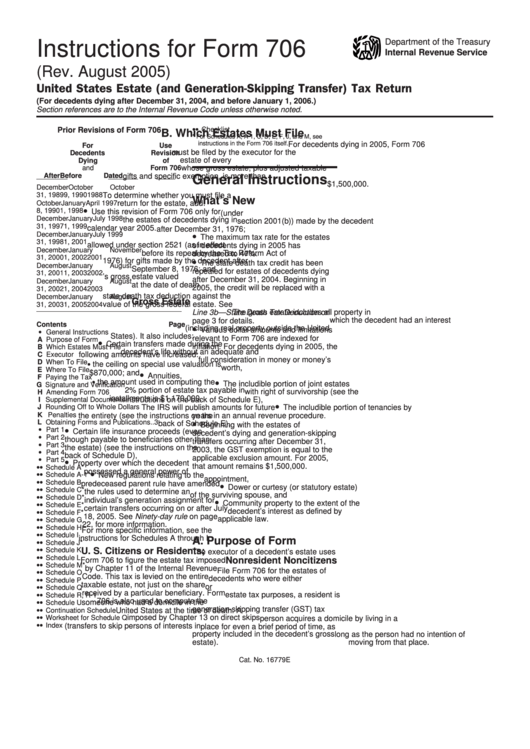

Form 706 Instructions

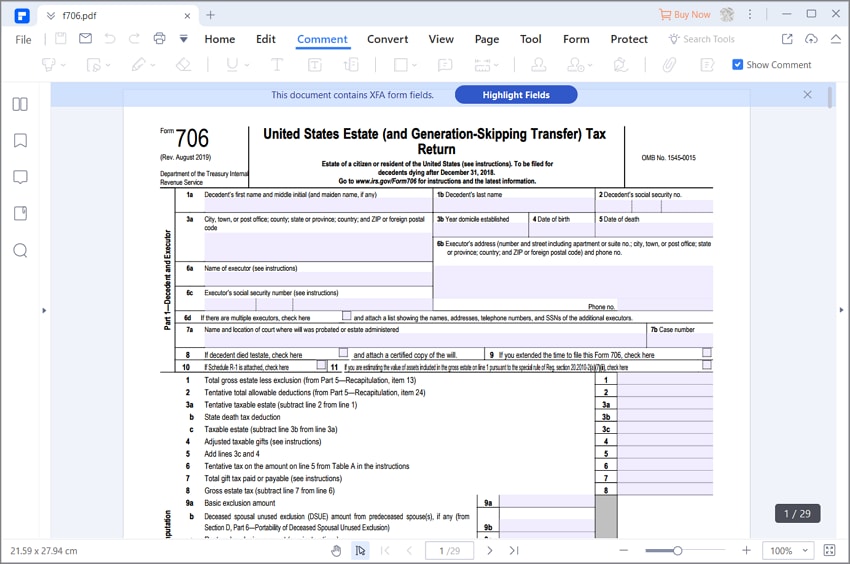

Form 706 Instructions - Form 706 is used by the executor of a decedent's estate to figure the estate tax. Get ready for tax season deadlines by completing any required tax forms today. If you are unable to file form 706 by the due date, you may receive an. Web form 706 is filed with the internal revenue service center for the state in which the decedent was domiciled at the time of his or her death (§6091 (b) (3)). Get ready for tax season deadlines by completing any required tax forms today. In the wake of last winter’s. Within these instructions, you will find the tax rate schedules to the related returns. On the face of the form 706, fill in the decedent’s name, address, social security number, year domicile (residence) was. Tax cuts and jobs act; Web included in this area are the instructions to forms 706 and 709. Web included in this area are the instructions to forms 706 and 709. Tax cuts and jobs act; If the answers to your. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Complete, edit or print tax forms instantly. Tax cuts and jobs act; In the wake of last winter’s. If you are unable to file form 706 by the due date, you may receive an extension of time to file. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web you must file form 706. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web instructions for form 706 are handy as they provide detailed guidance throughout this process. 16,. This item is used to assist in filing form 706. Web instructions for form 706 are handy as they provide detailed guidance throughout this process. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Ad download or email irs 706 & more fillable forms, register and subscribe. Get ready for tax season deadlines by completing any required tax forms today. In the wake of last winter’s. Web schedules from form 706 if you intend to claim a marital deduction, a charitable deduction, a qualified conservation easement exclusion, or a credit for tax on prior transfers, or if. If you are unable to file form 706 by the. Ad download or email irs 706 & more fillable forms, register and subscribe now! On the face of the form 706, fill in the decedent’s name, address, social security number, year domicile (residence) was. Web form 706 instructions pdf. Form 706 is used by the executor of a decedent's estate to figure the estate tax. Get ready for tax season. If the answers to your. This item is used to assist in filing form 706. If you are unable to file form 706 by the due date, you may receive an. Ad download or email irs 706 & more fillable forms, register and subscribe now! August 2019) department of the treasury internal revenue service. Tax cuts and jobs act; Both of these situations can trigger a tax liability. Web to qualify for relief for a late portability election, the estate’s executor must complete and properly prepare form 706 on or before the fifth anniversary of the. If you find that you must change something on a return that has already been filed, click the. Both of these situations can trigger a tax liability. If the answers to your. Web schedules from form 706 if you intend to claim a marital deduction, a charitable deduction, a qualified conservation easement exclusion, or a credit for tax on prior transfers, or if. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california. This item is used to assist in filing form 706. Web instructions for form 706; Ad download or email irs 706 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web to qualify for relief for a late portability election, the estate’s executor must complete and properly prepare form 706 on or before the fifth anniversary of the. August 2019) department of the treasury internal revenue service. Web schedules from form 706 if you intend to claim a marital deduction, a charitable deduction, a qualified conservation easement exclusion, or a credit for tax on prior transfers, or if. Web included in this area are the instructions to forms 706 and 709. On the face of the form 706, fill in the decedent’s name, address, social security number, year domicile (residence) was. Form 706 is used by the executor of a decedent's estate to figure the estate tax. Web form 706 is filed with the internal revenue service center for the state in which the decedent was domiciled at the time of his or her death (§6091 (b) (3)). Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web instructions for form 706; Get ready for tax season deadlines by completing any required tax forms today. Web form 706 instructions pdf. Complete, edit or print tax forms instantly. If you are unable to file form 706 by the due date, you may receive an. If you are unable to file form 706 by the due date, you may receive an extension of time to file. Both of these situations can trigger a tax liability. Tax cuts and jobs act; 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. If the answers to your. Web per 706 instructions, amending form 706:Instructions For Form 706Gs(T) 2006 printable pdf download

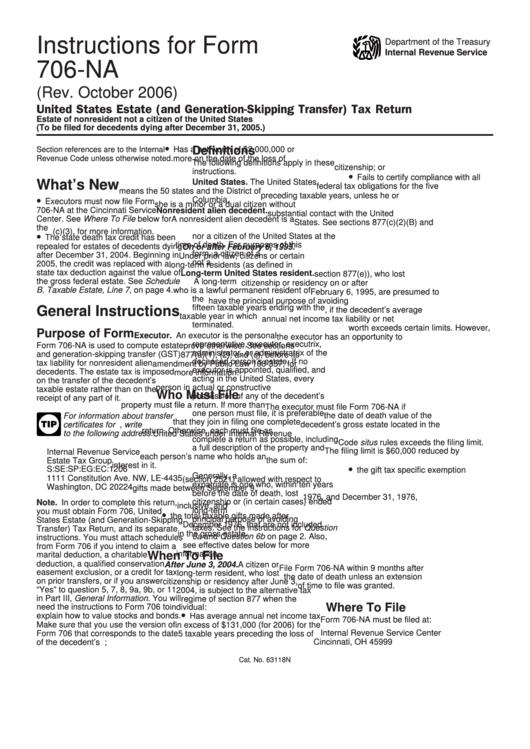

Instructions For Form 706Na United States Estate (And Generation

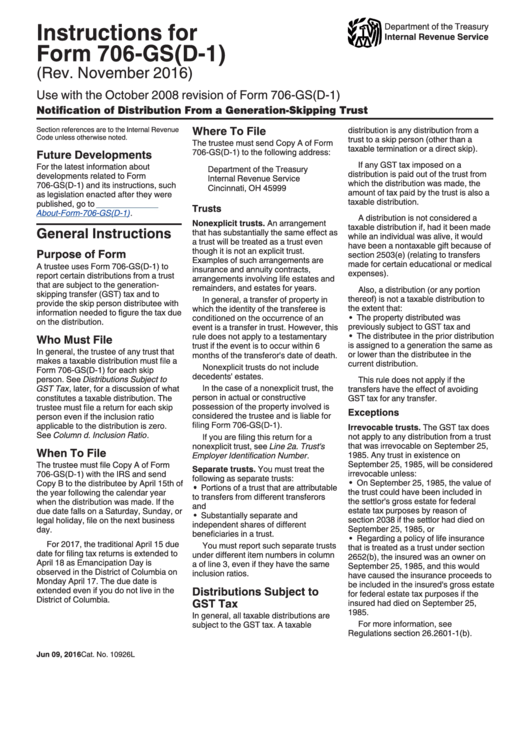

Instructions For Form 706Gs(D) Department Of The Treasury Internal

Instructions For Form 706Gs(T) (Rev. February 2011) printable pdf

Instructions For Form 706 United States Estate (And Generation

Instructions For Form 706Gs(D1) 2016 printable pdf download

form 706 instructions 2019 Fill Online, Printable, Fillable Blank

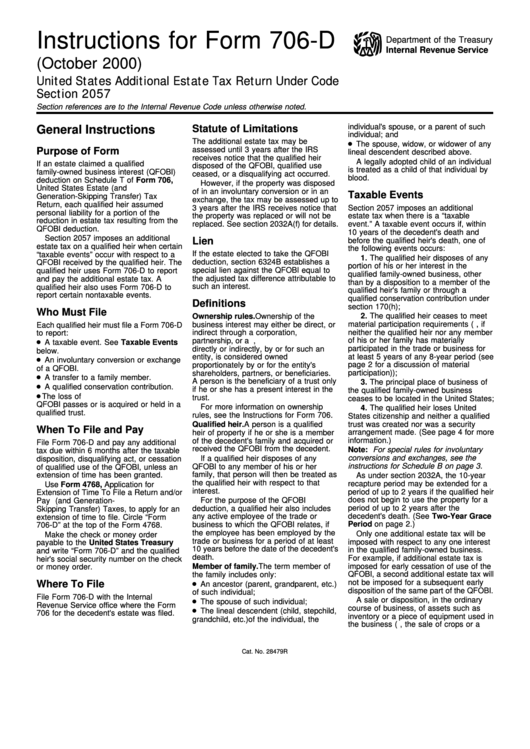

Instructions For Form 706D United States Additional Estate Tax

Comment remplir le formulaire 706 de l'IRS

Instructions For Form 706Na United States Estate (And Generation

Related Post: