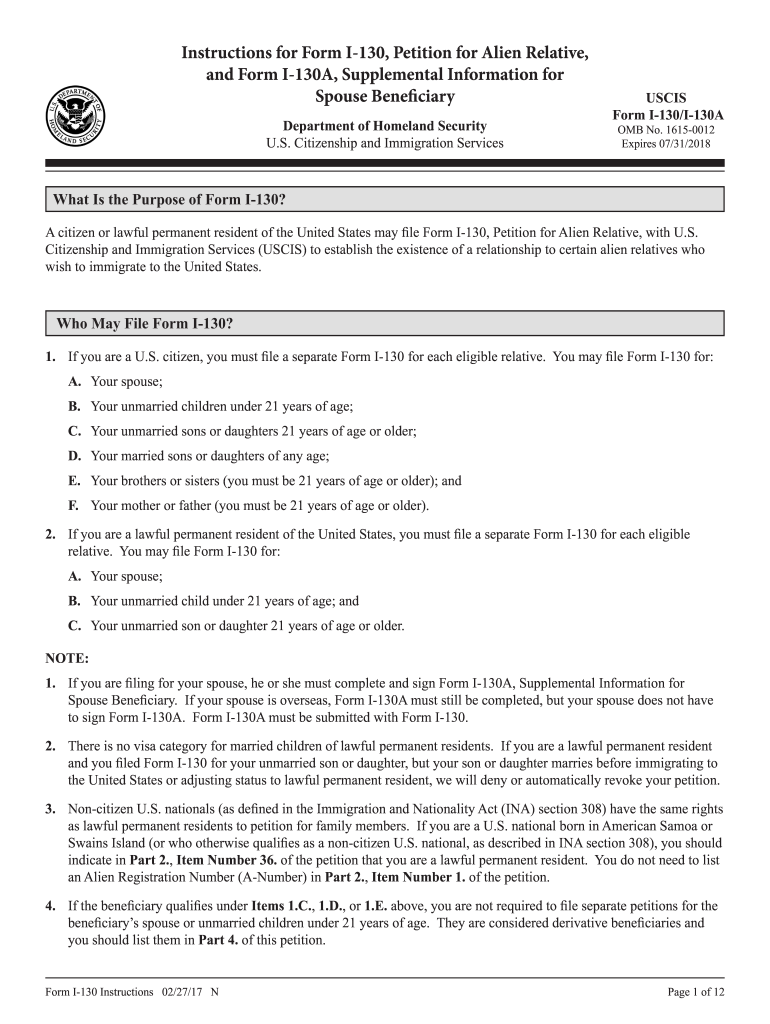

Form 6198 Instructions

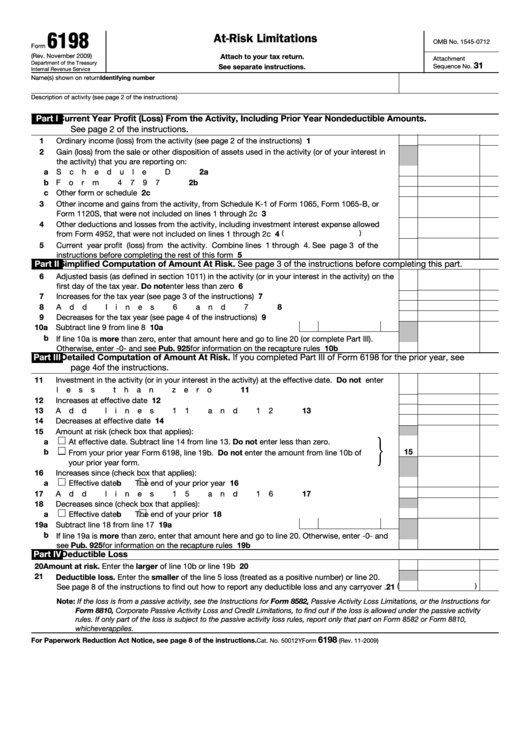

Form 6198 Instructions - (part i), the amount at risk for the current year (part ii or part iii), and. Make an assessment of the amount at risk in the business. You can download or print current or past. Form 6198 is filed by individuals (including filers of schedules c, e, and f (form 1040)), estates, trusts, and certain closely held c corporations. Web best strategies when drafting a form 6198. Web up to $40 cash back open the form: Web form 6198 consists of four sections and allows you to: Get ready for tax season deadlines by completing any required tax forms today. Web how do i complete irs form 6198? Form 6198 must be completed if there is an entry on line 19 above. Web form 6198 consists of four sections and allows you to: (part i), the amount at risk for the current year (part ii or part iii), and. Form 6198 is filed by individuals (including filers of schedules c, e, and f (form 1040)), estates, trusts, and certain closely held c corporations. Attach to your tax return. Form 6198 should be. Form 6198 is used by individuals, estates,. Complete, edit or print tax forms instantly. Web use form 6198 to figure: Make an assessment of the amount at risk in the business. Attach to your tax return. Web best strategies when drafting a form 6198. Fortunately, this tax form is only one page long, so it’s not terribly long. Remember that when you are creating form 6198, there are some things that you should do to make the process easier: Form 6198 is used by individuals, estates,. Use a pdf reader or editor software such as adobe. Web the passive loss rules. Make an assessment of the amount at risk in the business. There are 4 parts to irs form 6198, which we’ll go. Web best strategies when drafting a form 6198. Attach to your tax return. Web use form 6198 to figure: Estimate your current year's business losses. There are 4 parts to irs form 6198, which we’ll go. Complete, edit or print tax forms instantly. You can download or print current or past. Web up to $40 cash back open the form: Web the passive loss rules. Web best strategies when drafting a form 6198. Web how do i complete irs form 6198? Fortunately, this tax form is only one page long, so it’s not terribly long. Make an assessment of the amount at risk in the business. Web best strategies when drafting a form 6198. Attach to your tax return. Use a pdf reader or editor software such as adobe acrobat or a web browser capable of opening pdf files to access the form. Form 6198 should be filed when a taxpayer has a loss in. Form 6198 must be completed if there is an entry on line 19 above. Use a pdf reader or editor software such as adobe acrobat or a web browser capable of opening pdf files to access the form. Attach to your tax return. Complete, edit or print tax forms instantly. Form 6198 should be filed when a taxpayer has a. December 2020) department of the treasury internal revenue service. Generally, any loss from an activity (such as a rental). Estimate your current year's business losses. Web the passive loss rules. There are 4 parts to irs form 6198, which we’ll go. You can download or print current or past. Form 6198 is used by individuals, estates,. Web the passive loss rules. Form 6198 is filed by individuals (including filers of schedules c, e, and f (form 1040)), estates, trusts, and certain closely held c corporations. We have no way of. Estimate your current year's business losses. Complete, edit or print tax forms instantly. Make an assessment of the amount at risk in the business. There are 4 parts to irs form 6198, which we’ll go. Web best strategies when drafting a form 6198. Web how do i complete irs form 6198? (part i), the amount at risk for the current year (part ii or part iii), and. Generally, any loss from an activity (such as a rental). You can download or print current or past. Department of the treasury internal revenue service attachment sequence no.31 ' see separate instructions. Web form 6198 consists of four sections and allows you to: Form 6198 is used by individuals, estates,. We have no way of. Remember that when you are creating form 6198, there are some things that you should do to make the process easier: Web the passive loss rules. Web up to $40 cash back open the form: Use a pdf reader or editor software such as adobe acrobat or a web browser capable of opening pdf files to access the form. Form 6198 must be completed if there is an entry on line 19 above. December 2020) department of the treasury internal revenue service. Attach to your tax return.USCIS I130 Instructions 2015 Fill and Sign Printable Template Online

IRS Tax Form 6198 Guide TFX.tax

Form 6198 ≡ Fill Out Printable PDF Forms Online

Fillable Form 6198 AtRisk Limitations printable pdf download

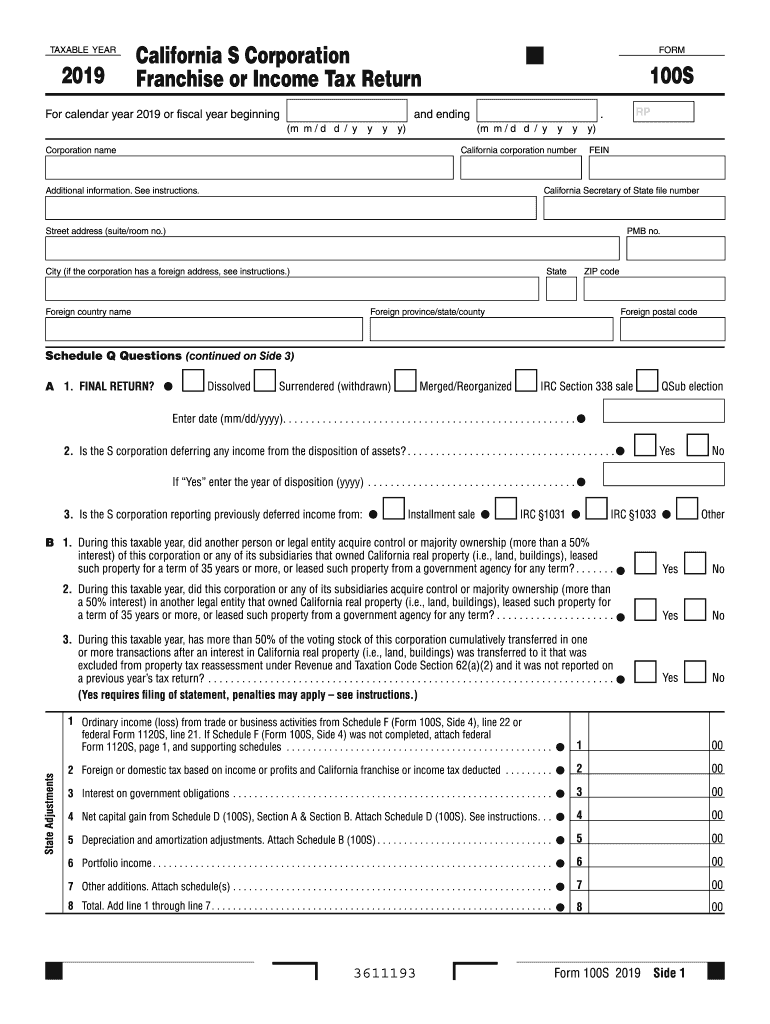

Form 100s Fillable Printable Forms Free Online

Form 6198 Instructions Fill Out and Sign Printable PDF Template signNow

IRS Instructions 8938 2018 2019 Fillable and Editable PDF Template

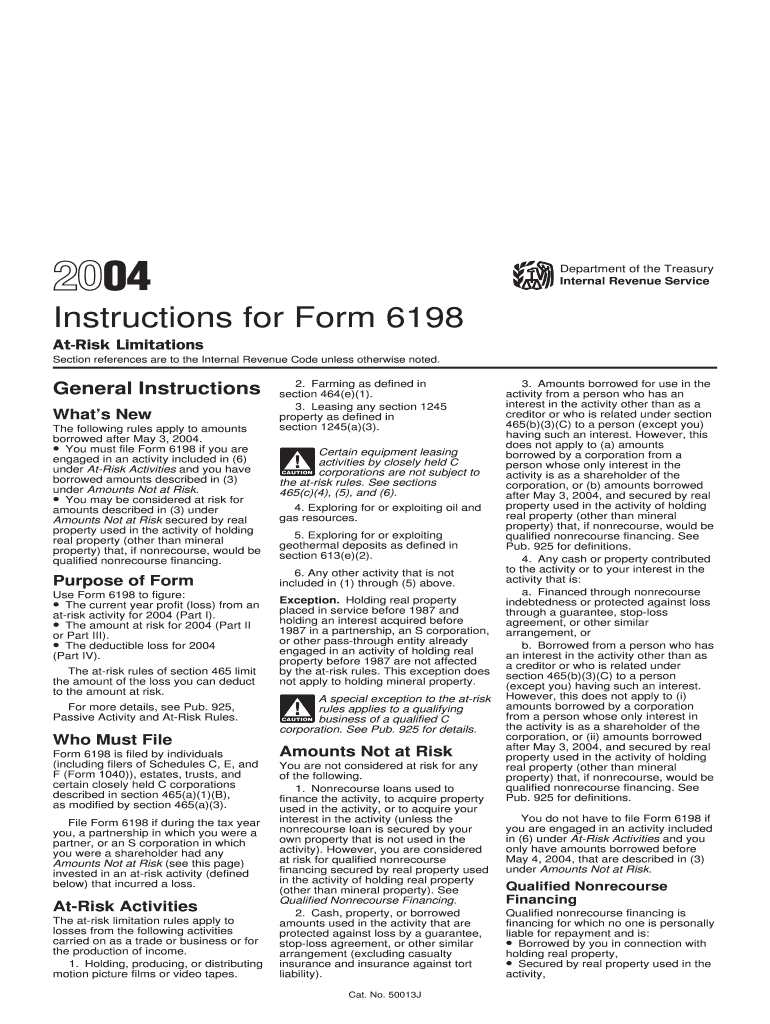

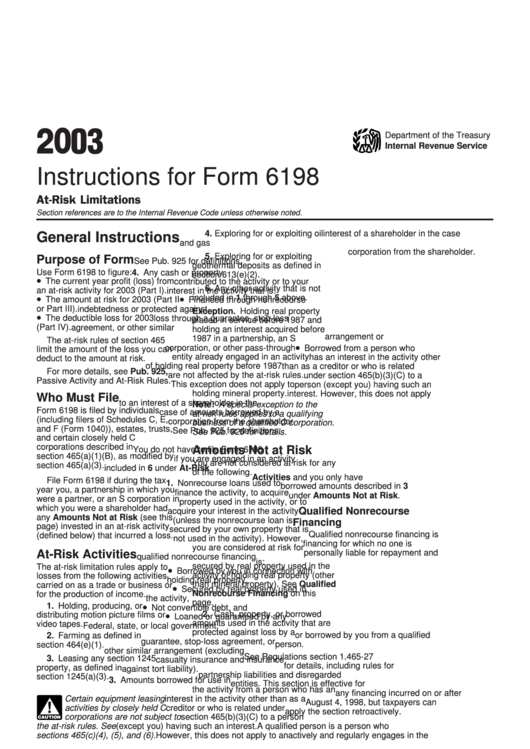

Instructions For Form 6198 AtRisk Limitations 2003 printable pdf

IRS Form 6198 Instructions AtRisk Limitations

Form 6198 atRisk Limitations Inscription on the Piece of Paper Stock

Related Post: