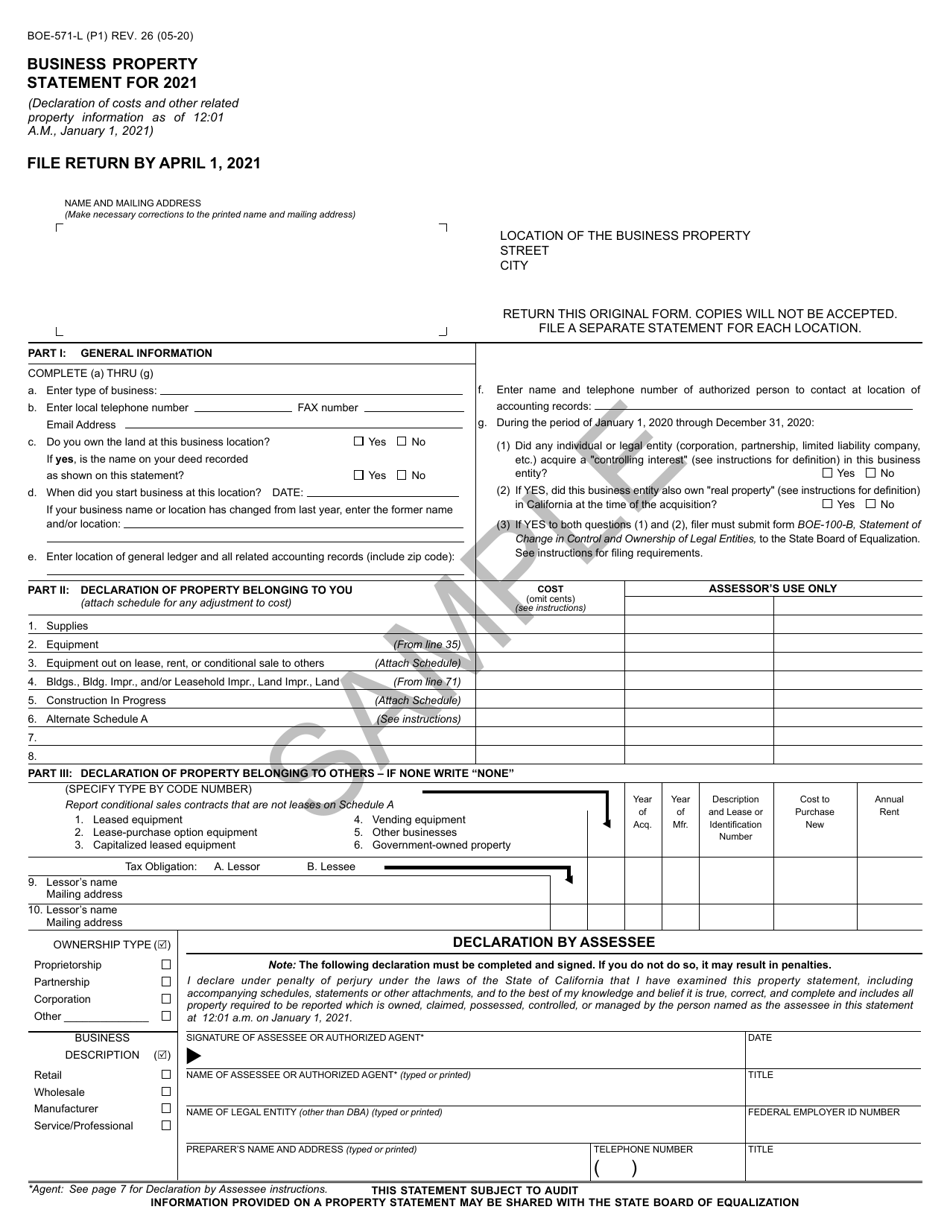

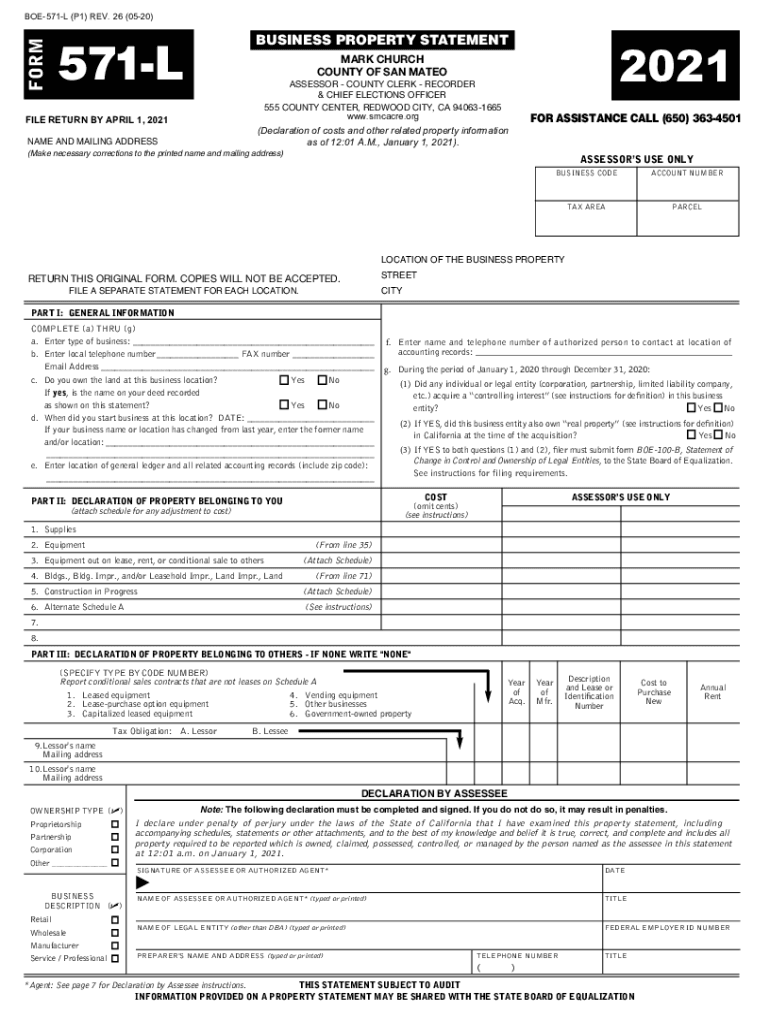

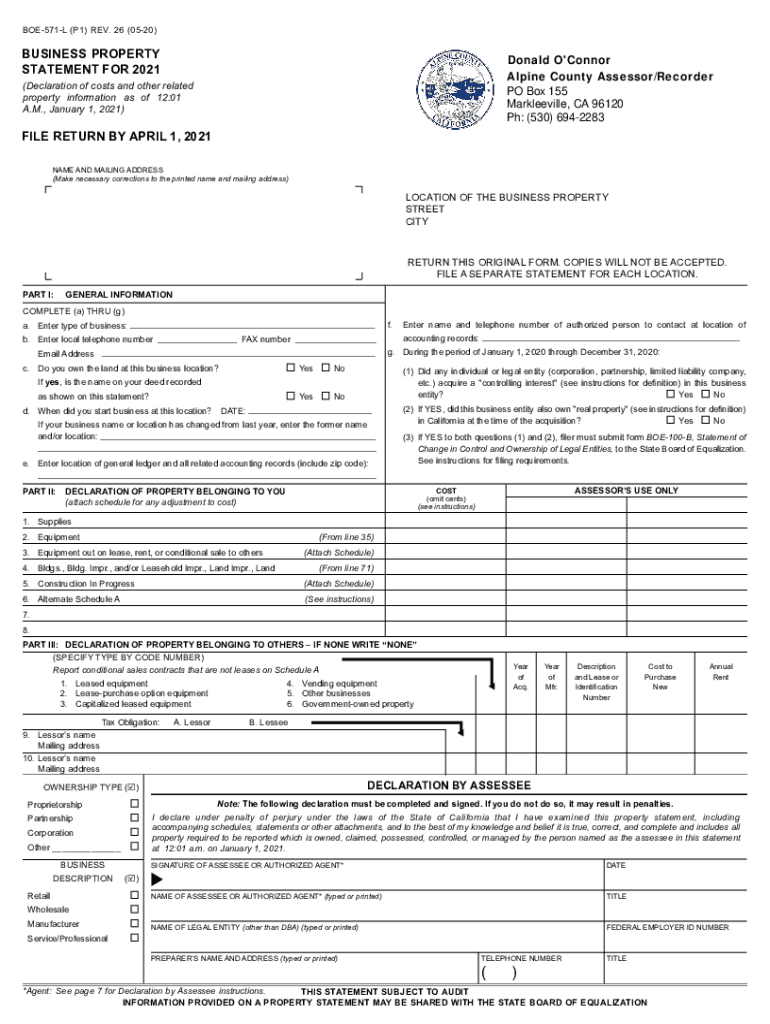

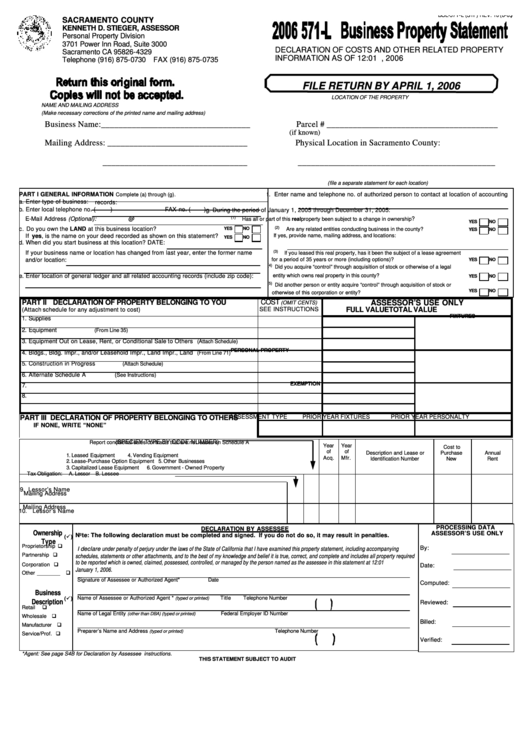

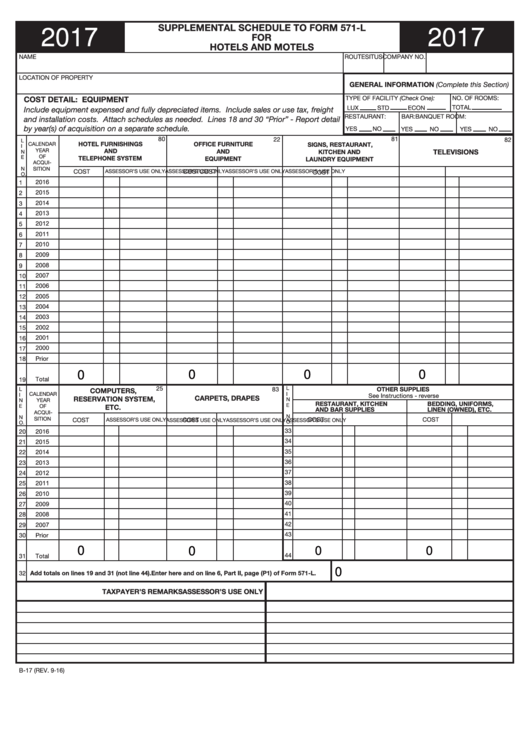

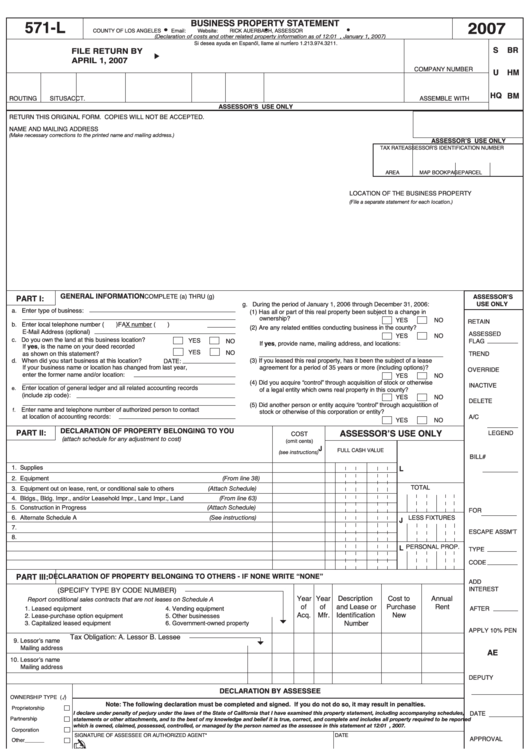

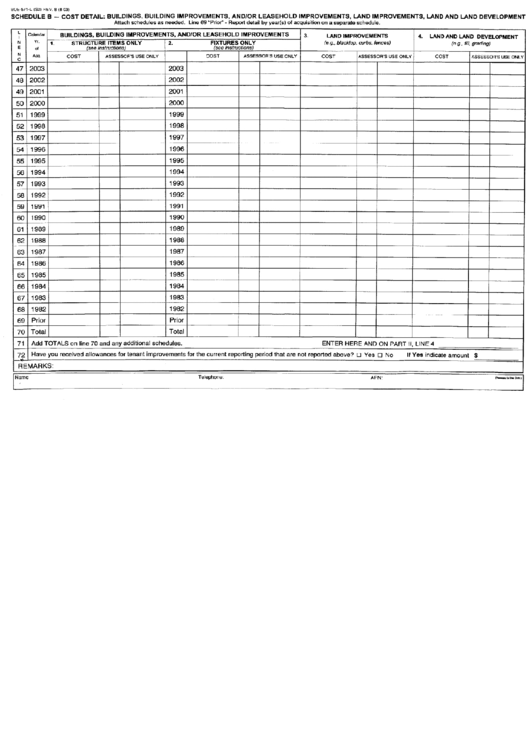

Form 571-L California

Form 571-L California - The 571l (bps) form is used to declare cost information. (declaration of costs and other related property information as of 12:01 a.m., january 1,. If none apply click submit to. Businesses are required by law to file an annual business property. Please check the boxes below that apply. 2 (0 official request do not return these instructions california law prescribes a yearly ad valorem tax based on property as. Learn about the different methods available for filing your. Ad pdffiller.com has been visited by 1m+ users in the past month Ad signnow.com has been visited by 100k+ users in the past month Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Please check the boxes below that apply. Web this is an annual filing that is required in each of the california counties where your business(es) is located. Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Business property statement (declaration of costs and other related property information as of 12:01. The 571l (bps) form is used to declare. Per revenue and taxation code, section 441, you must file a statement if: You are required to report the total cost of all. This link takes you to the centralized. If none apply click submit to. A) the assessor’s office has sent you a notice of requirement. Business property statement (declaration of costs and other related property information as of 12:01. Learn about the different methods available for filing your. Business property statement, long form: Ad pdffiller.com has been visited by 1m+ users in the past month You are required to report the total cost of all. Business property statement (declaration of costs and other related property information as of 12:01. This link takes you to the centralized. Please check the boxes below that apply. Businesses are required by law to file an annual business property. A) the assessor’s office has sent you a notice of requirement. Please check the boxes below that apply. Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Per revenue and taxation code, section 441, you must file a statement if: Web this is an annual filing that is required in each of the california counties where your business(es) is located. Businesses are required by law to file an annual. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if. This link takes you to the centralized. Please check the boxes below that apply. Businesses are required by law to file an annual business property. The 571l (bps) form is used to declare cost information. Business property statement (declaration of costs and other related property information as of 12:01. Web this is an annual filing that is required in each of the california counties where your business(es) is located. Business property statement for 2023. The 571l (bps) form is used to declare cost information. Filing form 571l business property statement. Business property statement for 2023. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if. 2 (0 official request do not return these instructions california law prescribes a yearly ad valorem tax based on property as. Learn about the different methods available for filing your.. Filing form 571l business property statement. Business property statement, long form: Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if. Business property statement for 2023. Ad signnow.com has been visited by 100k+ users in the past month You are required to report the total cost of all. Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if. Please check the boxes below that apply. Filing form 571l business property statement. If none apply click submit to. A) the assessor’s office has sent you a notice of requirement. You are required to report the total cost of all. Businesses are required by law to file an annual business property. Filing form 571l business property statement. Business property statement for 2023. Businesses are required by law to file a business property statement if the aggregate cost of business personal property is $100,000 or more or if. The 571l (bps) form is used to declare cost information. Alternate schedule a for bank, insurance company, or financial corporation fixtures:. Business property statement (declaration of costs and other related property information as of 12:01. 2 (0 official request do not return these instructions california law prescribes a yearly ad valorem tax based on property as. This link takes you to the centralized. Learn about the different methods available for filing your. Ad pdffiller.com has been visited by 1m+ users in the past month Business property statement, long form: Please check the boxes below that apply. Per revenue and taxation code, section 441, you must file a statement if: (declaration of costs and other related property information as of 12:01 a.m., january 1,. Web this is an annual filing that is required in each of the california counties where your business(es) is located. Ad signnow.com has been visited by 100k+ users in the past monthForm BOE571L Download Printable PDF or Fill Online Business Property

20212023 Form CA BOE571L Fill Online, Printable, Fillable, Blank

2020 Form CA BOE571L (P1) Fill Online, Printable, Fillable, Blank

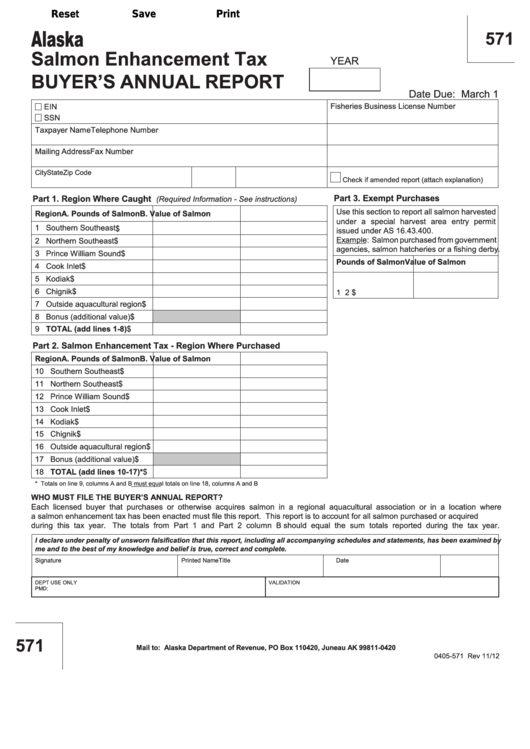

Fillable Form 571 Salmon Enhancement Tax Buyer'S Annual Report

CA BOE571L (P1) 2015 Fill and Sign Printable Template Online US

2011 Form CA BOE571LFill Online, Printable, Fillable, Blank pdfFiller

Form Boe571L Business Property Statement 2006 printable pdf download

Fillable Supplemental Schedule To Form 571L For Hotels And Motels

Form 571L Business Property Statement 2007 printable pdf download

Form Boe571L Schedule B Cost Detail Buildings, Building

Related Post: