Form 568 Extension

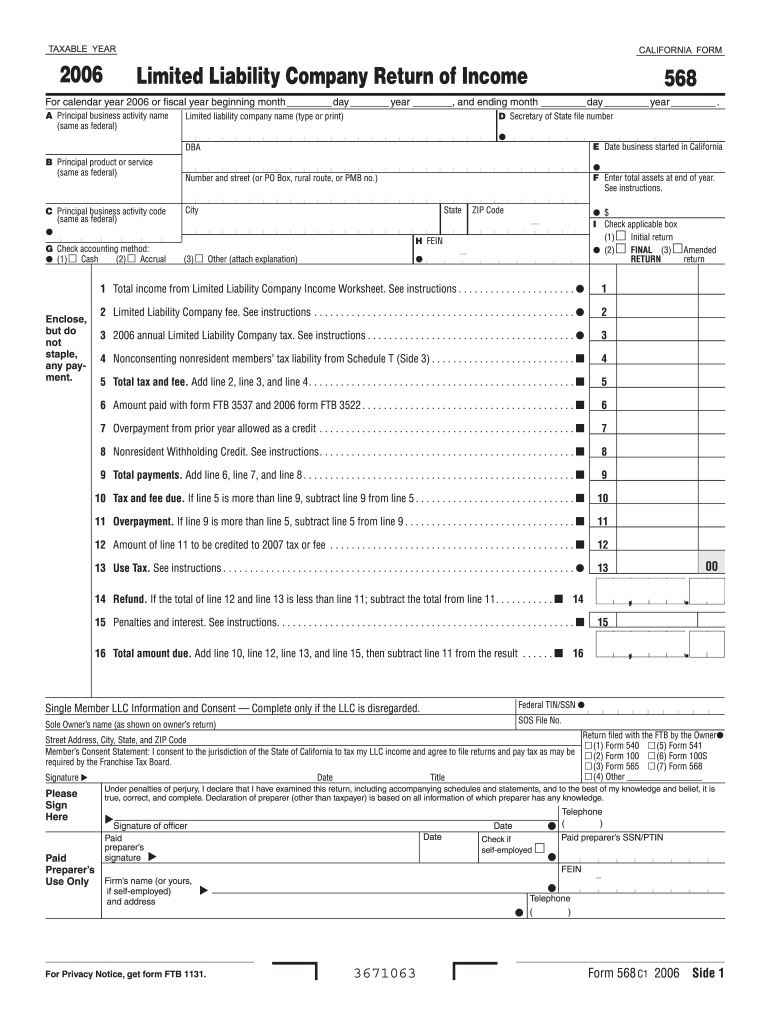

Form 568 Extension - 3537 (llc), payment for automatic extension for llcs. California grants an automatic extension of time to file a return;. Send filled & signed form or save. Web file limited liability company return of income (form 568) by the original return due date. Open form follow the instructions. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Ftb 3522, llc tax voucher. Web besides the annual tax of $800, a business will have to file form 568 if it has grossed $250,000 or more during the year. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. If your llc files on an extension, refer to payment for automatic extension for llcs. Web do not mail the $800 annual tax with form 568. If a company has members who are not. Web besides the annual tax of $800, a business will have to file form 568 if it has grossed $250,000 or more during the year. Registration after the year begins. Ad edit, fill & esign pdf documents online. Llc and partnership tax return and payments. Exempt organizations forms and payments. Web solved•by intuit•97•updated august 22, 2023. (m m / d d /. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. One thing to know about form 568 is that all llcs are required to pay an $800. Web ftb 568, limited liability company return of income. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. Exempt organizations forms and payments. Due to the federal emancipation day holiday observed. When is the annual tax due? Due to the federal emancipation day holiday observed on april 17, 2023, tax returns filed. Llc and partnership tax return and payments. What is the limited liability company annual tax? A statement will generate indicating what form (s) the amount (s). When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Web california form 568, line 6 is populated with amounts from ftb 3537, and 2015 forms ftb 3522 and ftb 3536. Due to the federal emancipation day holiday observed on april 17, 2023, tax returns. Web form 568, limited liability company return of income ftb. Ad edit, fill & esign pdf documents online. Web california form 568, line 6 is populated with amounts from ftb 3537, and 2015 forms ftb 3522 and ftb 3536. While you can submit your state income tax return and federal income tax return by april 15,. Web solved•by intuit•15•updated november. Web file limited liability company return of income (form 568) by the original return due date. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. Web solved•by intuit•97•updated august 22, 2023. Registration after the year begins. Web form 568, limited liability company return of income ftb. When is the annual tax due? Due to the federal emancipation day holiday observed on april 17, 2023, tax returns filed. 2021, form 568, limited liability company return of income: If a company has members who are not. 3537 (llc), payment for automatic extension for llcs. One thing to know about form 568 is that all llcs are required to pay an $800. If a company has members who are not. 1040 california (ca) adding a limited liability return (form 568) to add limited liability, form. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company,. Web 3671213 form 568 2021 side 1 taxable year 2021 limited liability company return of income california form 568 i (1) during this taxable year, did another person or. Web do not mail the $800 annual tax with form 568. Form 568 is something that business owners interested in forming an llc frequently have questions about. Web form 568, limited. Due to the federal emancipation day holiday observed on april 17, 2023, tax returns filed. Web updated june 24, 2020: 3537 (llc), payment for automatic extension for llcs. What is the limited liability company annual tax? Form 568 is due on march 31st following the end of the tax year. Form 568 is the return of. This article will show you how to access california form 568 for a ca llc return in proseries professional. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Best pdf fillable form builder. Web generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. 1040 california (ca) adding a limited liability return (form 568) to add limited liability, form. California grants an automatic extension of time to file a return;. (m m / d d /. Web california form 568, line 6 is populated with amounts from ftb 3537, and 2015 forms ftb 3522 and ftb 3536. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. Web file limited liability company return of income (form 568) by the original return due date. Registration after the year begins. Web besides the annual tax of $800, a business will have to file form 568 if it has grossed $250,000 or more during the year. While you can submit your state income tax return and federal income tax return by april 15,. Easily sign the form with your finger.Form 3537 (Llc) Payment For Automatic Extension For Llcs 2012

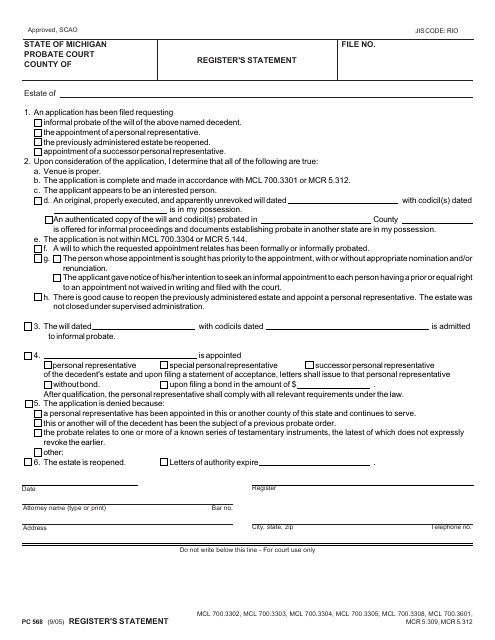

Form PC568 Download Fillable PDF or Fill Online Register's Statement

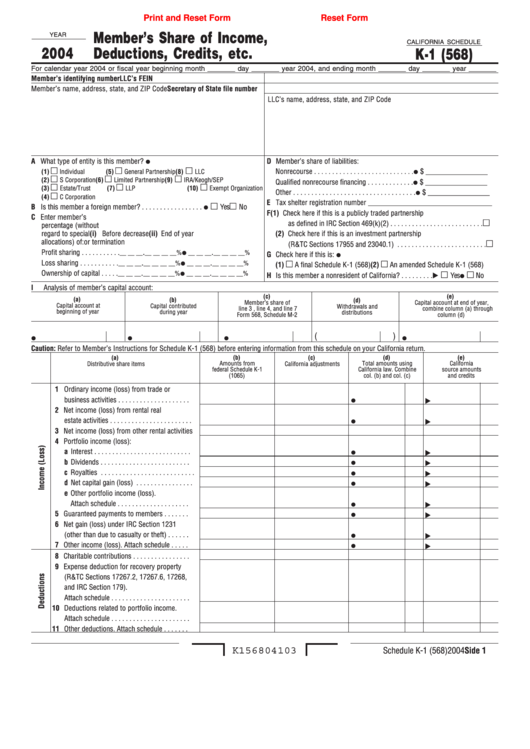

Fillable California Schedule K1(568) Member'S Share Of

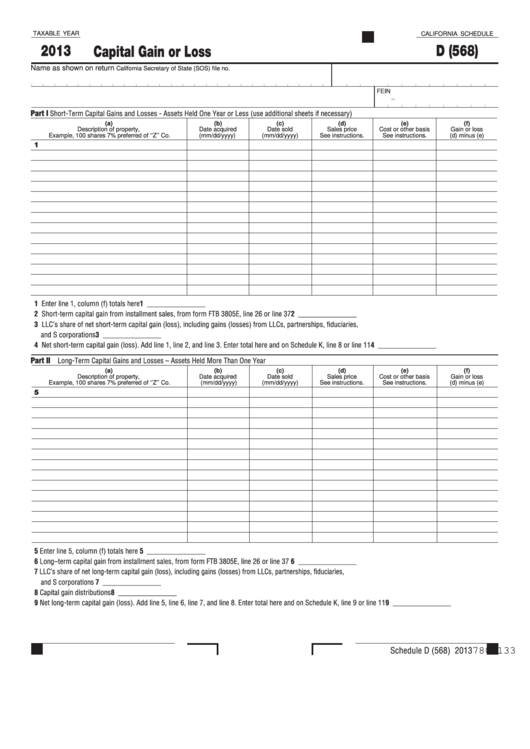

Fillable California Schedule D (Form 568) Capital Gain Or Loss 2013

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Printable Form 568 Printable Forms Free Online

How do I Get Form 568 after I completed my State Taxes in TT Self Employed

Fillable Form 568 Fisheries Business Monthly Payment And Report

Tax Extension Deadline 2021 Form 4868 4868 Form 📝 IRS Extension Form

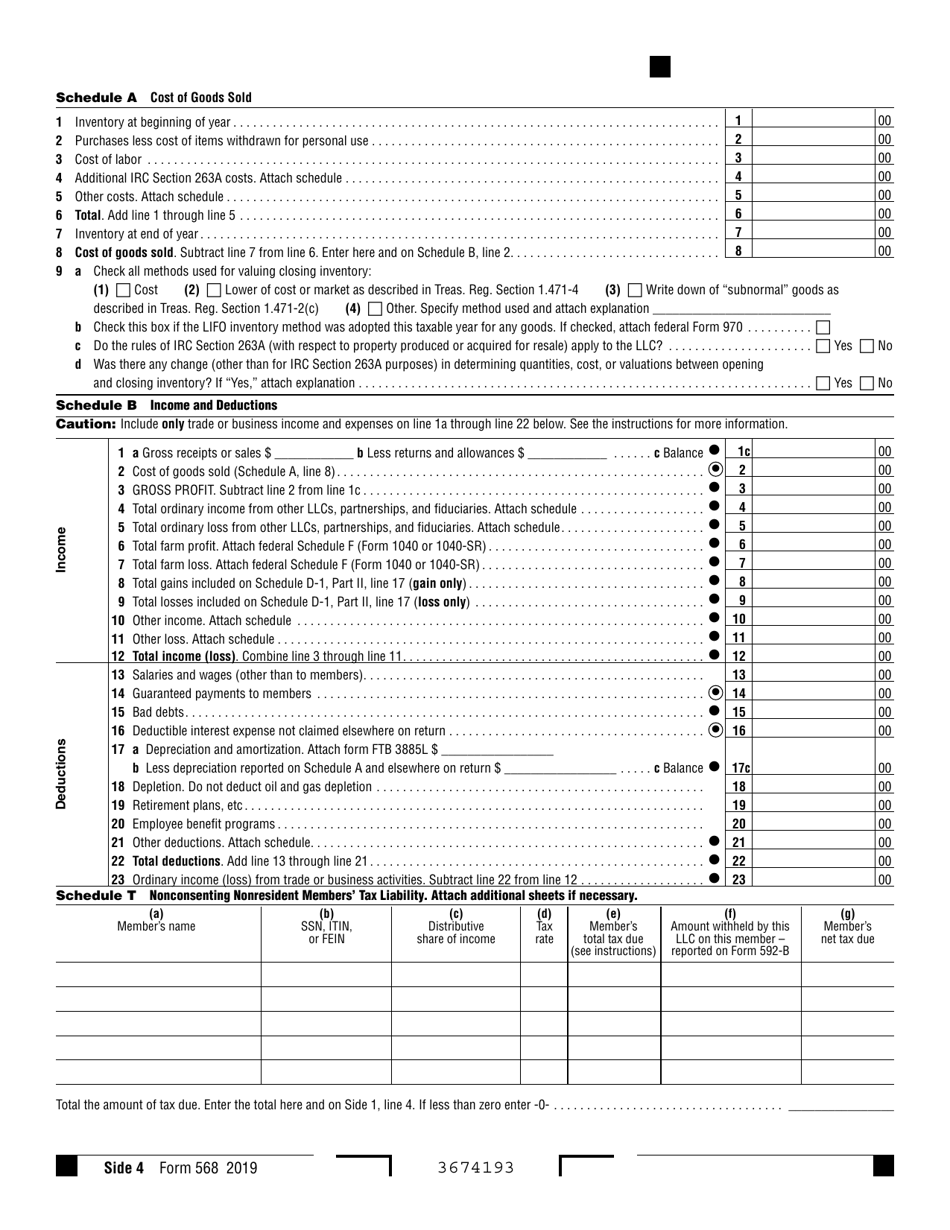

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Related Post: