Form 5498 Lacerte

Form 5498 Lacerte - Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Ad intuit.com has been visited by 100k+ users in the past month Ad prepare more tax returns with greater accuracy and efficiency with taxwise®. Form 5498 is an informational form. Where does the information on form 5498 go in turbotax? Web solved•by intuit•680•updated march 24, 2023. Solved•by intuit•102•updated 1 year ago. Web solved•by intuit•1427•updated 1 year ago. Web 2 min read. Ad prepare more tax returns with greater accuracy and efficiency with taxwise®. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. However, i have not received a 1099r form with this rollover information. Web address autofill allows you to input the zip code for a client's address, and the program will automatically fill in the city and state. Use this. Tax returns in less time. What is irs form 5498? Use this form to report a late payment received by your slate mailer organization. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. But for 2019, the deadline has been moved to july 15. Go to screen 24, adjustments to income. The irs requires the form be filed by companies that maintain an individual retirement. Tools and resources to help you prepare and file more u.s. Web solved•by intuit•97•updated december 13, 2022. Web form 5498 for my traditional ira shows a value in line 2 (rollover contributions). In the deductions section, choose 10. Web the information on a form 5498 that is relevant to the preparation of the tax return (such as contributions to an ira or a health savings account) is on other taxpayer. Complete, edit or print tax forms instantly. Form 5498 is an informational form. Web the end of may is normally when the. Web when you make contributions to an ira, it’s likely that you will receive a form 5498 from the organization that manages your retirement account. Ad intuit.com has been visited by 100k+ users in the past month Web the information on a form 5498 that is relevant to the preparation of the tax return (such as contributions to an ira. The irs requires the form be filed by companies that maintain an individual retirement. Where does the information on form 5498 go in turbotax? Tools and resources to help you prepare and file more u.s. Ad prepare more tax returns with greater accuracy and efficiency with taxwise®. Complete, edit or print tax forms instantly. Tools and resources to help you prepare and file more u.s. Use this form to report a late payment received by your slate mailer organization. Select traditional irafrom the left panel. Tools and resources to help you prepare and file more u.s. Web 2 min read. Solved•by intuit•102•updated 1 year ago. But for 2019, the deadline has been moved to july 15. Web address autofill allows you to input the zip code for a client's address, and the program will automatically fill in the city and state. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on. Ad prepare more tax returns with greater accuracy and efficiency with taxwise®. Tax returns in less time. Web filing form 5498 with the irs. Form 5498 is an informational form. The irs form 5498 exists so that financial institutions can report ira information. Select traditional irafrom the left panel. Web the information on a form 5498 that is relevant to the preparation of the tax return (such as contributions to an ira or a health savings account) is on other taxpayer. Web filing form 5498 with the irs. In the deductions section, choose 10. Proseries doesn't have a 5498 worksheet. Ad prepare more tax returns with greater accuracy and efficiency with taxwise®. Tax returns in less time. Web filing form 5498 with the irs. Tax returns in less time. Form 5498 is an informational form. File this form for each. Go to screen 24, adjustments to income. Solved•by intuit•102•updated 1 year ago. But for 2019, the deadline has been moved to july 15. Tools and resources to help you prepare and file more u.s. Web follow these steps: Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Proseries doesn't have a 5498 worksheet. This feature works on individual. Complete, edit or print tax forms instantly. Where does the information on form 5498 go in turbotax? The irs requires the form be filed by companies that maintain an individual retirement. Tools and resources to help you prepare and file more u.s. Use this form to report a late payment received by your slate mailer organization. The irs form 5498 exists so that financial institutions can report ira information.5498 Software to Create, Print & EFile IRS Form 5498

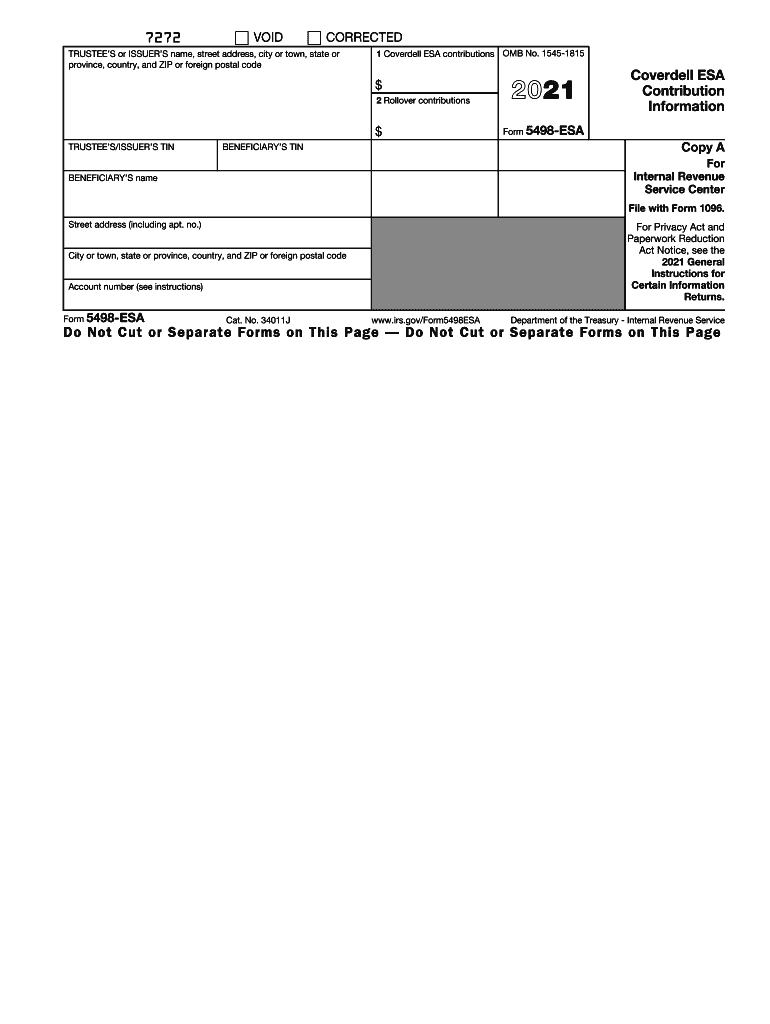

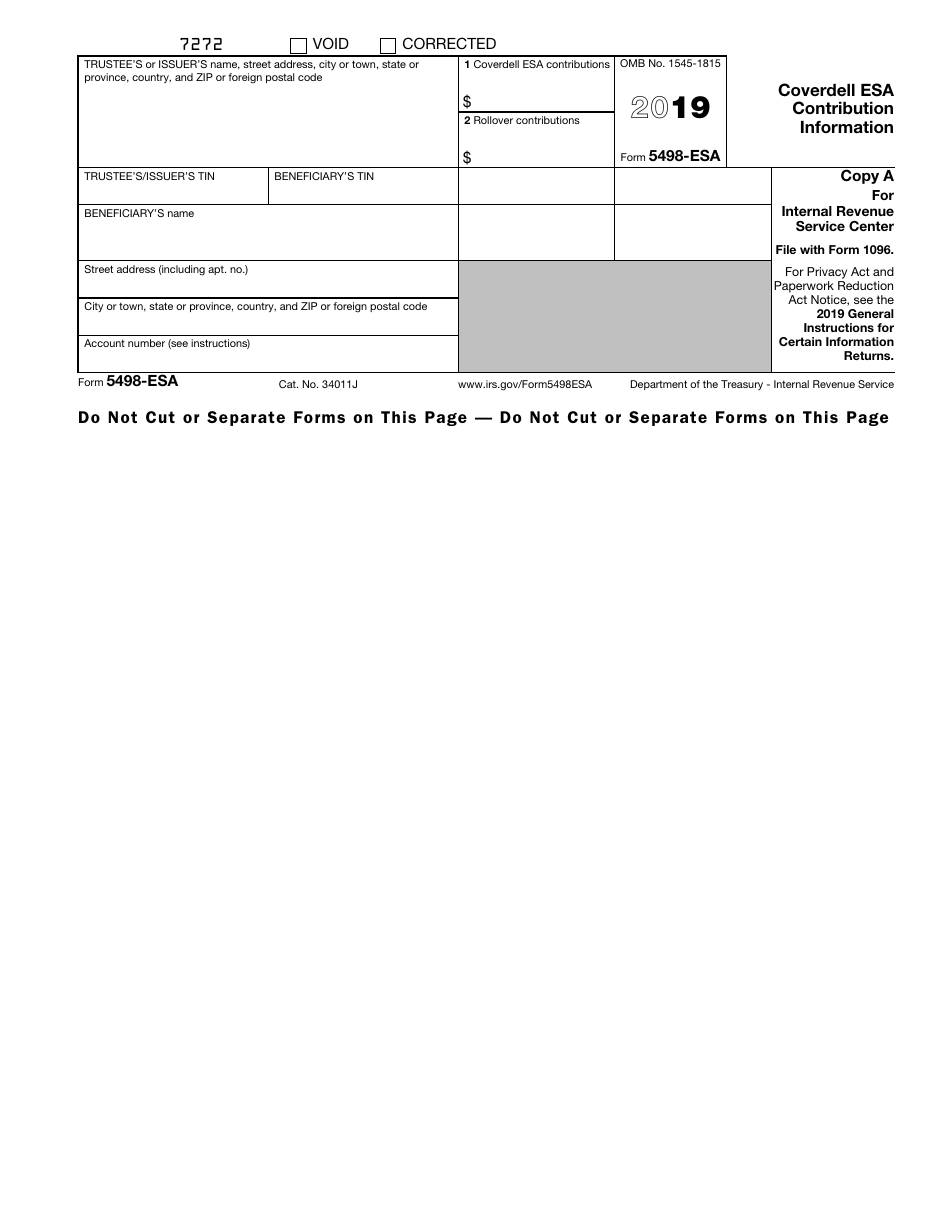

Form 5498 Esa Fill Out and Sign Printable PDF Template signNow

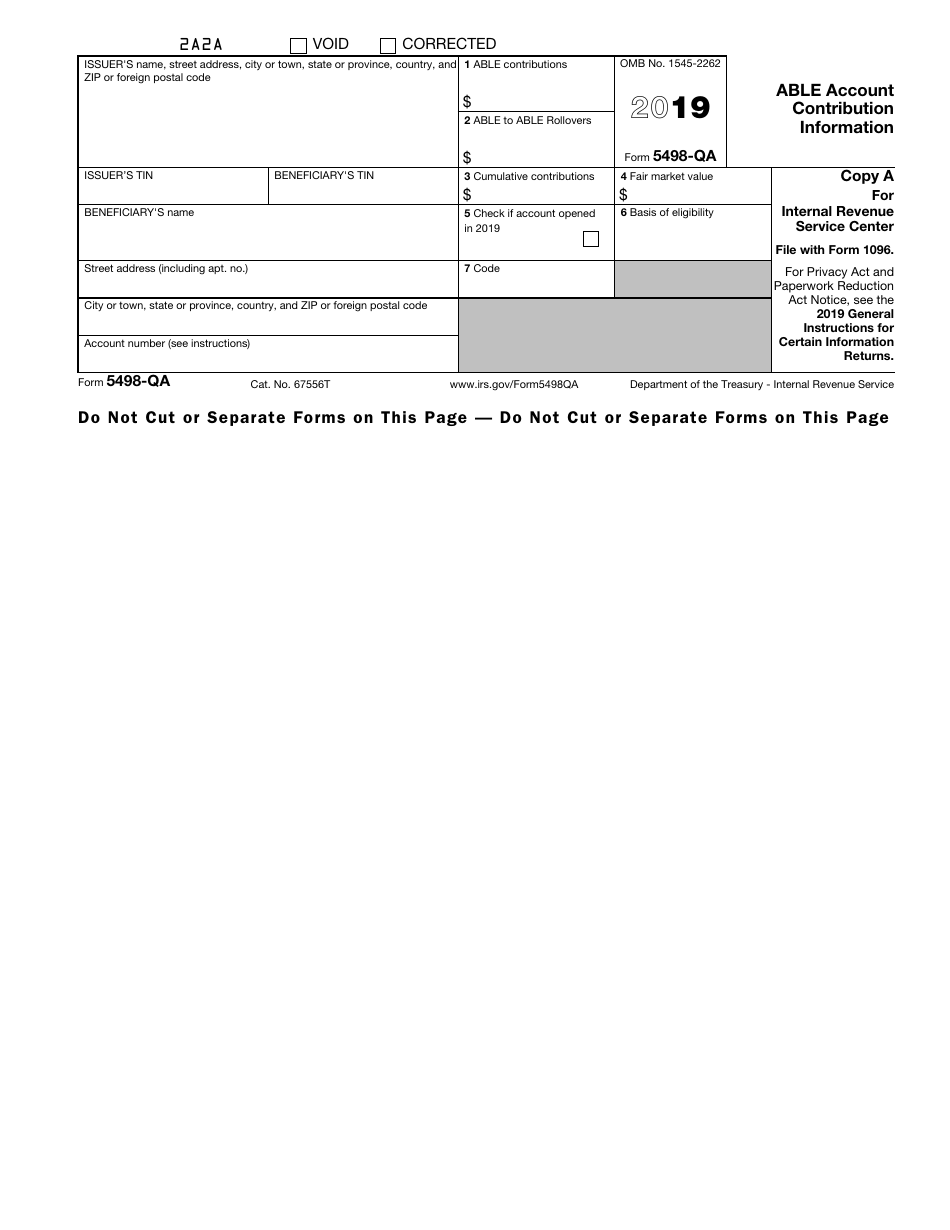

IRS Form 5498QA Download Fillable PDF or Fill Online Able Account

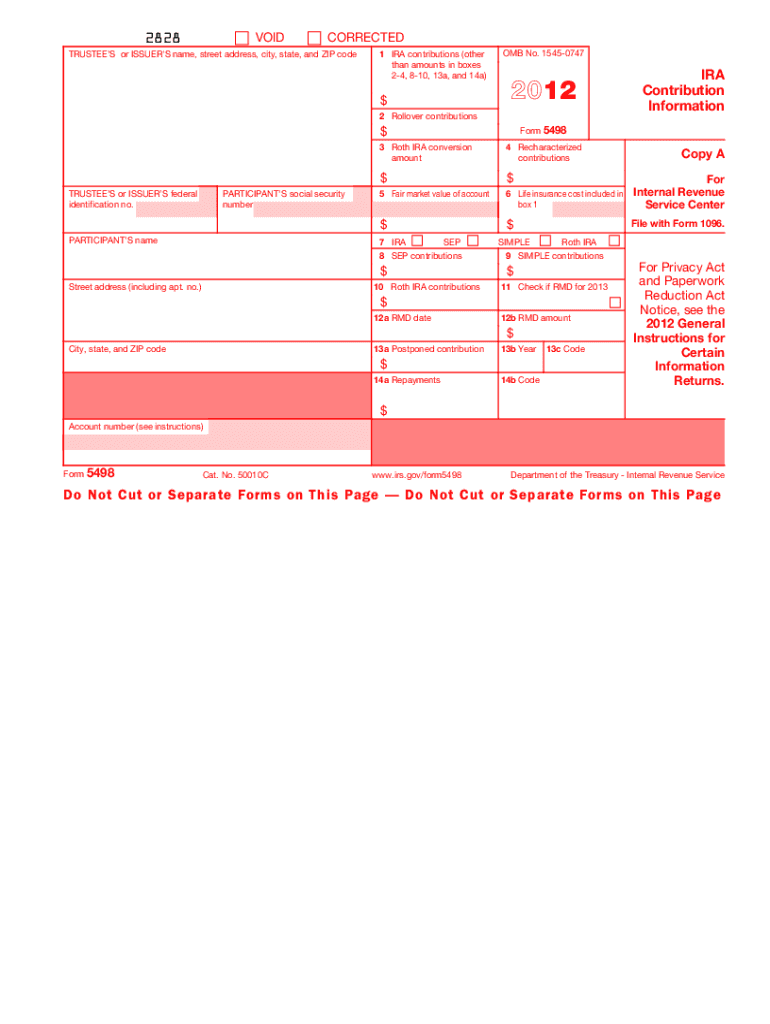

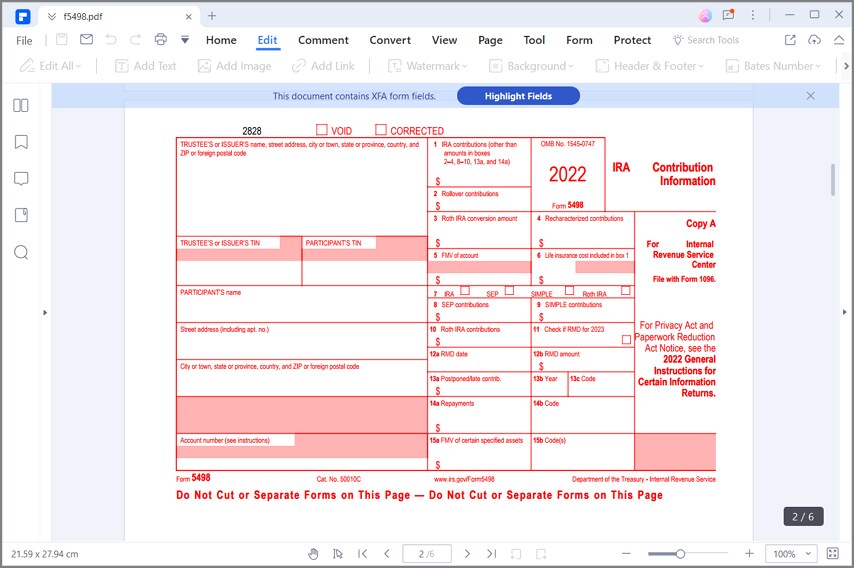

Form 5498 IRA Contribution Information Instructions and Guidelines

What is Form 5498? TaxBandits YouTube

for How to Fill in IRS Form 5498

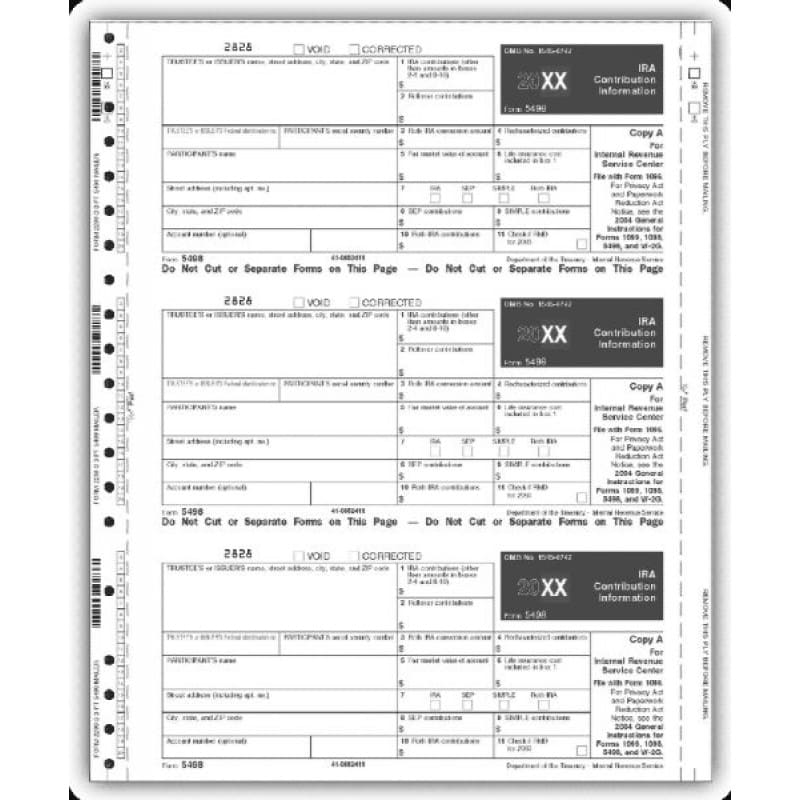

5498 Pressure Seal Tax Form

IRS Form 5498ESA 2019 Fill Out, Sign Online and Download Fillable

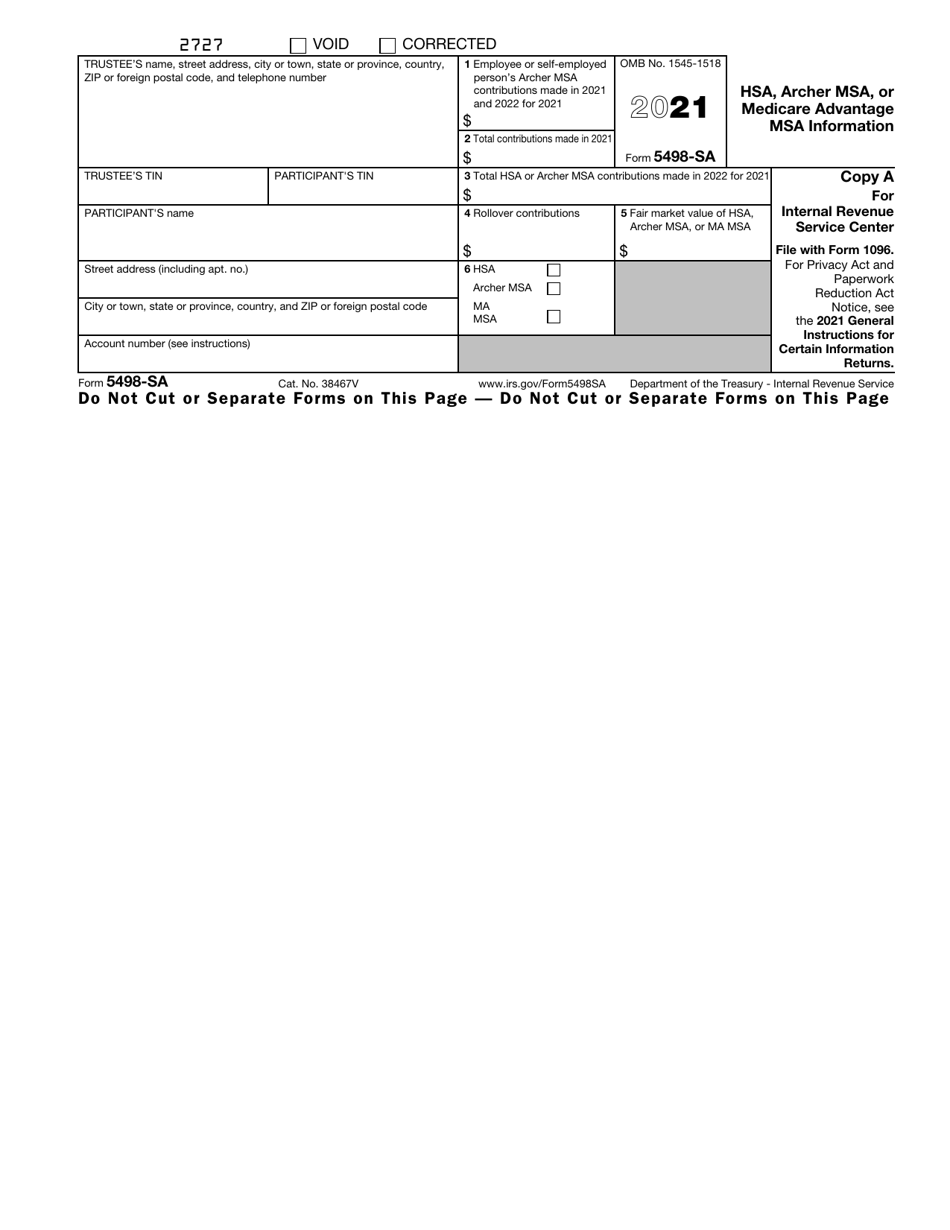

IRS Form 5498SA Download Fillable PDF or Fill Online Hsa, Archer Msa

What Is Form 5498 For Taxes

Related Post: