Form 5471 Schedule Q Instructions

Form 5471 Schedule Q Instructions - The december 2021 revision of separate. December 2022) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. Web these instructions have been updated for the aforementioned changes to form 5471 and separate schedule q. Persons with respect to certain foreign corporations. Web introduction to schedule q of form 5471. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Web for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Claim for reimbursement of bank charges incurred due to erroneous service. Let's quickly review these three categories. Web instructions for form 5471(rev. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Persons with respect to certain foreign corporations 1222 01/03/2023 form 5471 (schedule q) cfc income by cfc income. Web who must complete the form 5471 schedule e anyone. Schedule e is just one schedule of the. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. Complete, edit or print tax forms instantly. Web separate schedule(s) q (form 5471) are required to be filed only by category 4, 5a, and 5b filers. Claim for reimbursement of bank charges incurred due. Persons with respect to certain foreign corporations 1222 01/03/2023 form 5471 (schedule q) cfc income by cfc income. Let's quickly review these three categories. Web separate schedule(s) q (form 5471) are required to be filed only by category 4, 5a, and 5b filers. December 2020) department of the treasury internal revenue service. January 2023) (use with the december 2022 revision. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. The article is based on the instructions promulgated by the internal revenue. Ad access irs tax forms. Complete, edit or print tax forms instantly. Persons with respect to. Web separate schedule(s) q (form 5471) are required to be filed only by category 4, 5a, and 5b filers. Claim for reimbursement of bank charges incurred due to erroneous service. The “categories of filers,” “exceptions from filing,” and “additional filing requirements” sections have. Web form 5471 (schedule q) cfc income by cfc income groups 1222 12/01/2022 form 8546: The december. Web for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to. Let's quickly review these three categories. Web this article will take a deep dive into each column and line of 2021 schedule q of the form 5471. This information is required by t.d. Complete,. Web form 5471 (schedule q) cfc income by cfc income groups 1222 12/01/2022 form 8546: December 2022) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. Web schedule q (form 5471) (december 2020) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. In addition,. Web form 5471 (schedule q) cfc income by cfc income groups 1222 12/01/2022 form 8546: December 2020) department of the treasury internal revenue service. Web this article will take a deep dive into each column and line of 2021 schedule q of the form 5471. Ad access irs tax forms. December 2022) cfc income by cfc income groups department of. 9882, which finalized regulations sections. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Claim for reimbursement of bank charges incurred due to erroneous service. This information is required by t.d. Web these instructions have been updated for the aforementioned changes to form 5471 and separate schedule q. Web these instructions have been updated for the aforementioned changes to form 5471 and separate schedule q. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. December 2020) department of the treasury internal revenue service. January 2021) (use with the december 2020. Web form 5471 (schedule q) cfc income by cfc income groups 1222 12/01/2022 form 8546: Web who must complete the form 5471 schedule e anyone preparing a form 5471 knows that the return consists of many schedules. Web introduction to schedule q of form 5471. Web instructions for form 5471(rev. Persons with respect to certain foreign corporations. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; 9882, which finalized regulations sections. The article is based on the instructions promulgated by the internal revenue. Web separate schedule(s) q (form 5471) are required to be filed only by category 4, 5a, and 5b filers. Web for the latest information about developments related to form 5471, its schedules, and its instructions, such as legislation enacted after they were published, go to. Persons with respect to certain foreign corporations 1222 01/03/2023 form 5471 (schedule q) cfc income by cfc income. In addition, the following changes have been made. Web so, schedule q is a required schedule for categories 4, 5a and 5b filers of the 5471. Get ready for tax season deadlines by completing any required tax forms today. The “categories of filers,” “exceptions from filing,” and “additional filing requirements” sections have. Web schedule q (form 5471) (december 2020) cfc income by cfc income groups department of the treasury internal revenue service attach to form 5471. Let's quickly review these three categories. Web on its webpage, the irs has clarified its instructions for 2020 schedule q (cfc income by cfc income groups) of form 5471 (information return of u.s. Web schedule q is used to report controlled foreign corporation (cfc) income by cfc income groups. Web at this time, the irs has yet to release draft instructions for forms 5471 and 5471 (schedule q) so it is difficult to comment further on the forthcoming impact.2012 form 5471 instructions Fill out & sign online DocHub

5471 Worksheet A

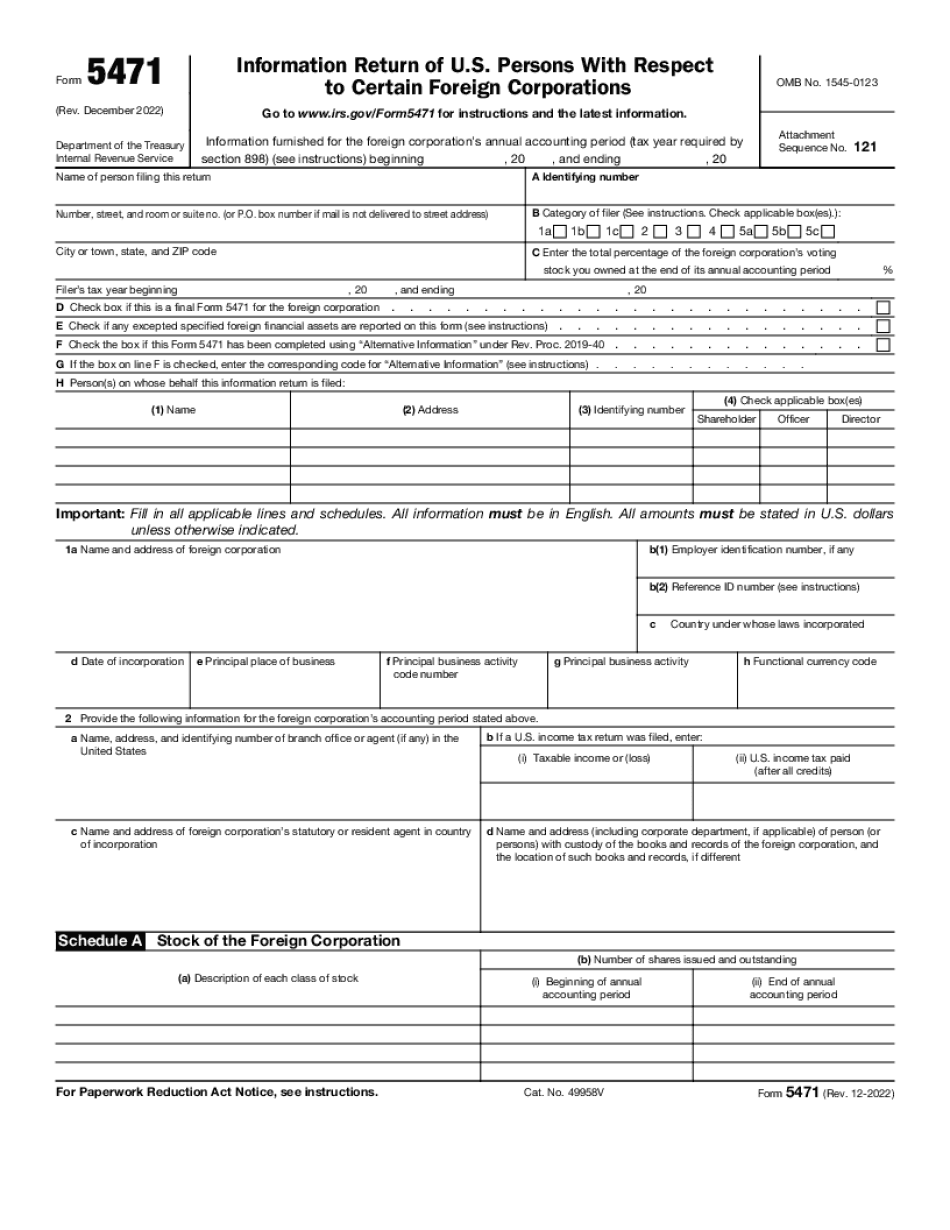

IRS Issues Updated New Form 5471 What's New?

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

Schedule Q CFC by Groups IRS Form 5471 YouTube

Form 5471 Filing Requirements with Your Expat Taxes

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Instructions for Form 5471 (01/2022) Internal Revenue Service

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Related Post: