Form 5471 Sch J

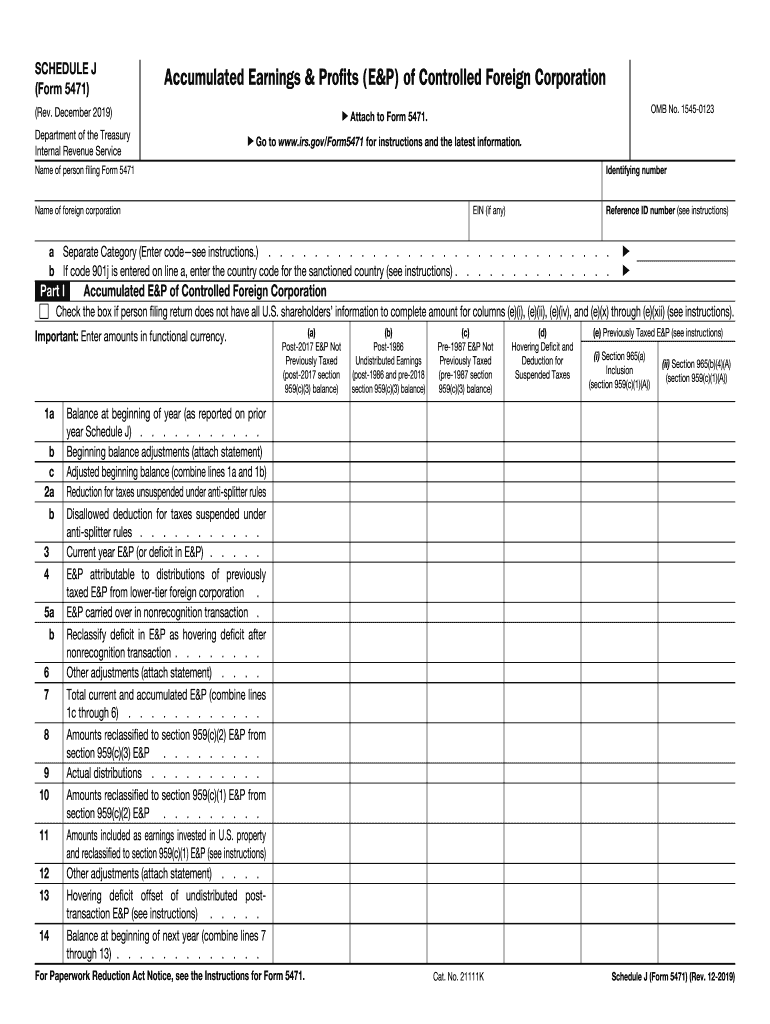

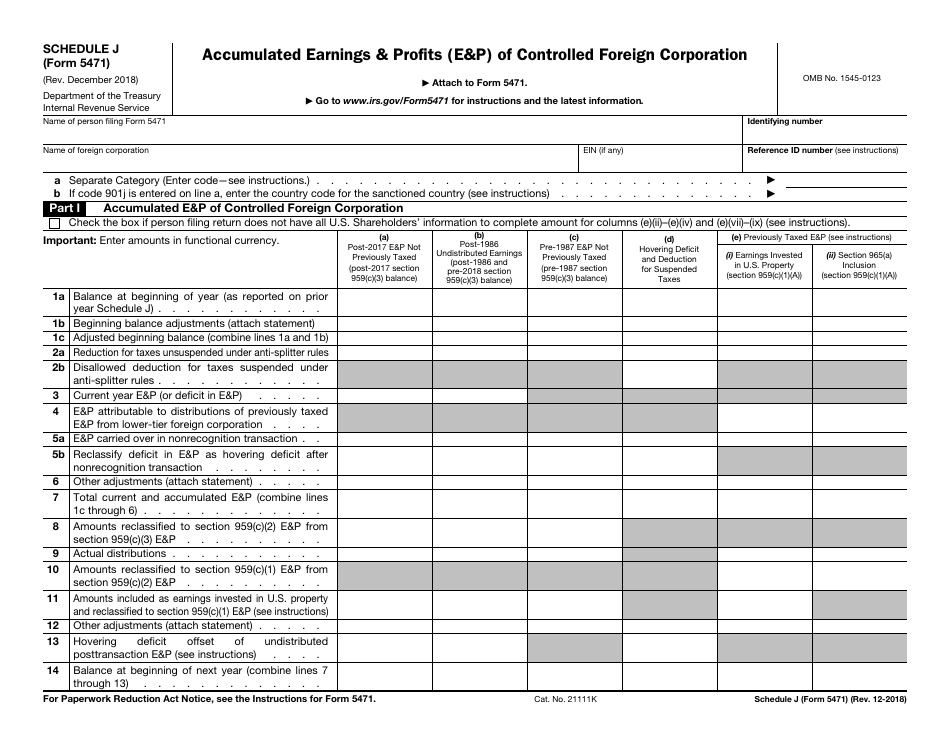

Form 5471 Sch J - Web schedule j (form 5471), or • the u.s. Web schedule j (form 5471) (rev. Schedule e, income, war profits, and excess profits taxes paid. In most cases, special ordering rules under. 3 what is earnings & profit (e&p) for form 5471 schedule j? Shareholders, the corresponding reporting for these. Persons with respect to foreign corp worksheet. Web schedule j is used to report accumulated earnings and profits (“e&p”) of controlled foreign corporations. Person filing return does not have all u.s shareholders' information to complete an amount in column (e) (a). Web form 5471, officially called the information return of u.s. Web instructions for form 5471(rev. Persons with respect to certain foreign corporations, is an information statement (information. Web schedule j (form 5471), accumulated earnings & profits (e&p) of controlled foreign corporation foreign corporation’s that file form 5471 use this schedule to report a. Shareholder has previously taxed e&p related to section 965 that is reportable on schedule p (form 965).. Shareholders, the corresponding reporting for these. Web this article discusses schedule j of the form 5471. The december 2021 revision of separate. Web 1 (new) 2021 schedule j of form 5471. Web instructions for form 5471(rev. Web instructions for form 5471(rev. Web schedule j is used to report accumulated earnings and profits (“e&p”) of controlled foreign corporations. Person filing return does not have all u.s shareholders' information to complete an amount in column (e) (a). Web 1 (new) 2021 schedule j of form 5471. Deep dive into additional categories, classifications, and. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Web form 5471 schedule j, accumulated earnings of controlled foreign corporations: The december 2021 revision of separate. Web schedule j (form 5471), accumulated earnings. 3 what is earnings & profit (e&p) for form 5471 schedule j? Persons with respect to foreign corp worksheet. Persons with respect to certain foreign corporations, is an information statement (information. Web schedule j of form 5471 has also added the following new columns: Web schedule e of form 5471 is used to report taxes paid or accrued by a. Accumulated earnings & profits \(e&p\) of. Persons with respect to certain foreign corporations, is an information statement (information. Web this article discusses schedule j of the form 5471. 2 what is a controlled foreign corporation (cfc)? 4 what to do with. 2 what is a controlled foreign corporation (cfc)? Deep dive into additional categories, classifications, and. Schedule j (form 5471) (rev. Persons with respect to certain foreign corporations, is an information statement (information. Web accordingly, with the many ways by which e&p of a cfc can be included into u.s. Accumulated earnings & profits \(e&p\) of. Web schedule j (form 5471) (rev. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Schedule j (form 5471) (rev. 4 what to do with. Also use this schedule to report the e&p of. Web schedule j is used to report accumulated earnings and profits (“e&p”) of controlled foreign corporations. Person filing return does not have all u.s shareholders' information to complete an amount in column (e) (a). Web form 5471, officially called the information return of u.s. Web schedule j (form 5471), accumulated earnings. Web schedule j (form 5471), accumulated earnings & profits (e&p) of controlled foreign corporation foreign corporation’s that file form 5471 use this schedule to report a. This schedule is used to report a foreign corporation’s accumulated earnings and profits or “e&p.” schedule j is also. Also use this schedule to report the e&p of. Web instructions for form 5471(rev. Web. Web schedule j (form 5471), accumulated earnings & profits (e&p) of controlled foreign corporation foreign corporation’s that file form 5471 use this schedule to report a. Web accordingly, with the many ways by which e&p of a cfc can be included into u.s. Person filing return does not have all u.s shareholders' information to complete an amount in column (e) (a). Shareholder has previously taxed e&p related to section 965 that is reportable on schedule p (form 965). Web form 5471 schedule j, accumulated earnings of controlled foreign corporations: Deep dive into additional categories, classifications, and. Persons with respect to certain foreign corporations, is an information statement (information. Shareholders, the corresponding reporting for these. 2 what is a controlled foreign corporation (cfc)? Accumulated earnings & profits \(e&p\) of. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web schedule j (form 5471) (rev. Web schedule e of form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. Schedule j (form 5471) (rev. Web schedule j of form 5471 has also added the following new columns: In most cases, special ordering rules under. Schedule e, income, war profits, and excess profits taxes paid. Web schedule j (form 5471), or • the u.s. Web 1 (new) 2021 schedule j of form 5471. The december 2021 revision of separate.IRS Form 5471 (Schedule J) 2018 2019 Fillable and Editable PDF Template

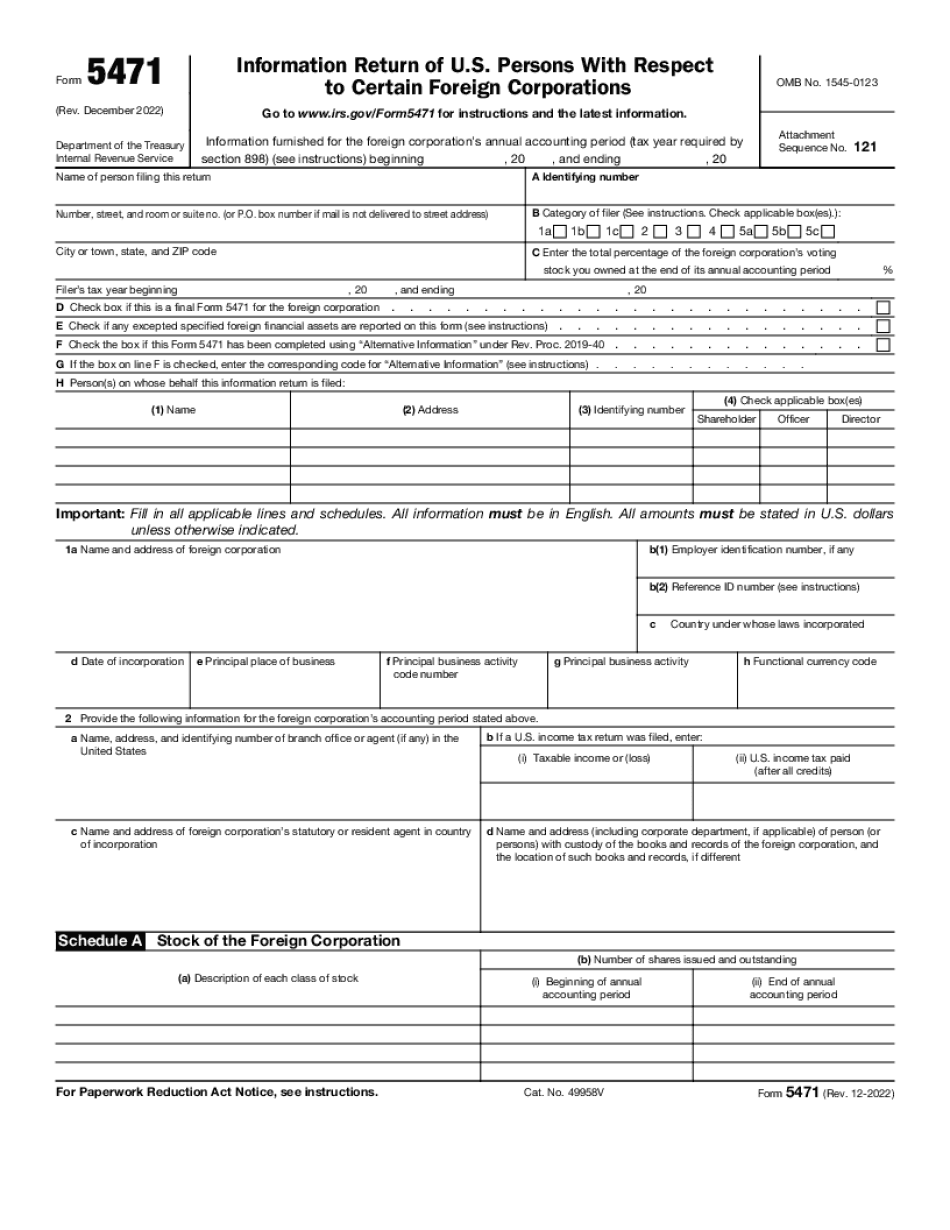

Form 5471 Instructions 20222023 Fill online, Printable, Fillable Blank

Form 5471 Schedule J Instructions cloudshareinfo

Form 5471 Filing Requirements with Your Expat Taxes

Form 5471 schedule j Fill out & sign online DocHub

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Form 5471 schedule j example Fill out & sign online DocHub

I.R.S. Form 5471, Schedule J YouTube

Schedule J Form 5471 Fill online, Printable, Fillable Blank

Related Post: