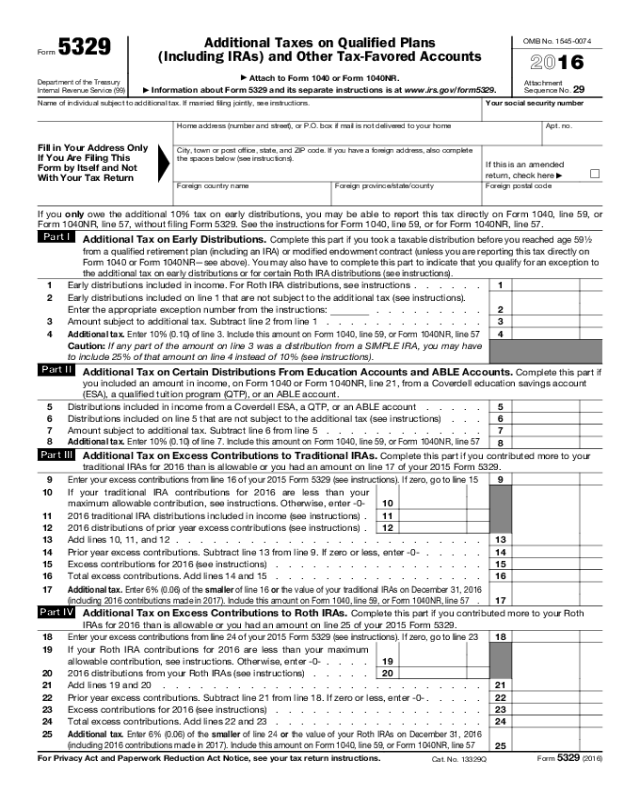

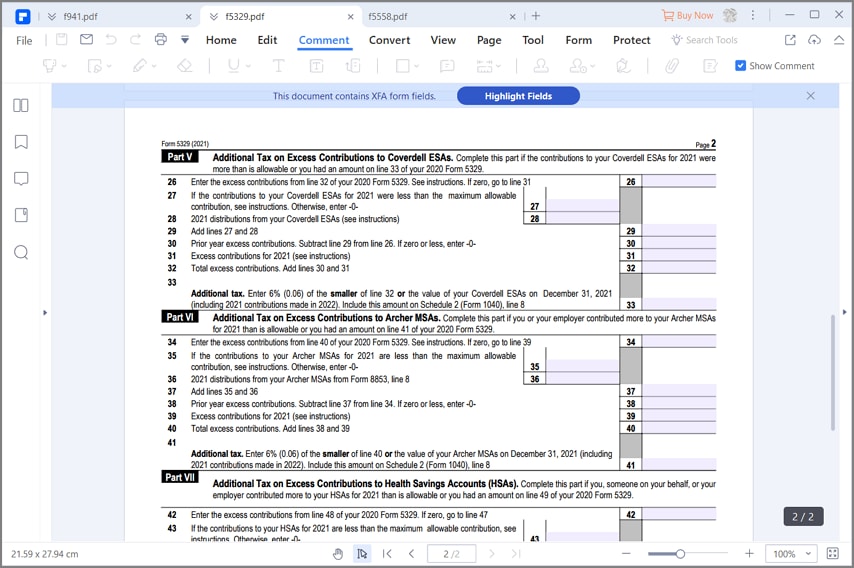

Form 5329 Line 48

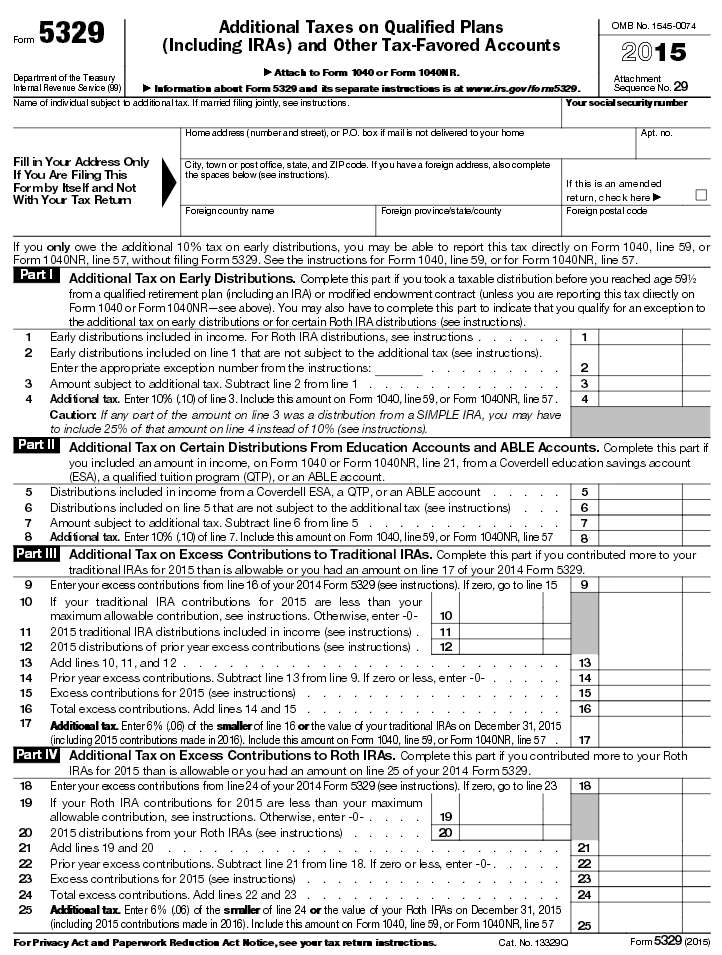

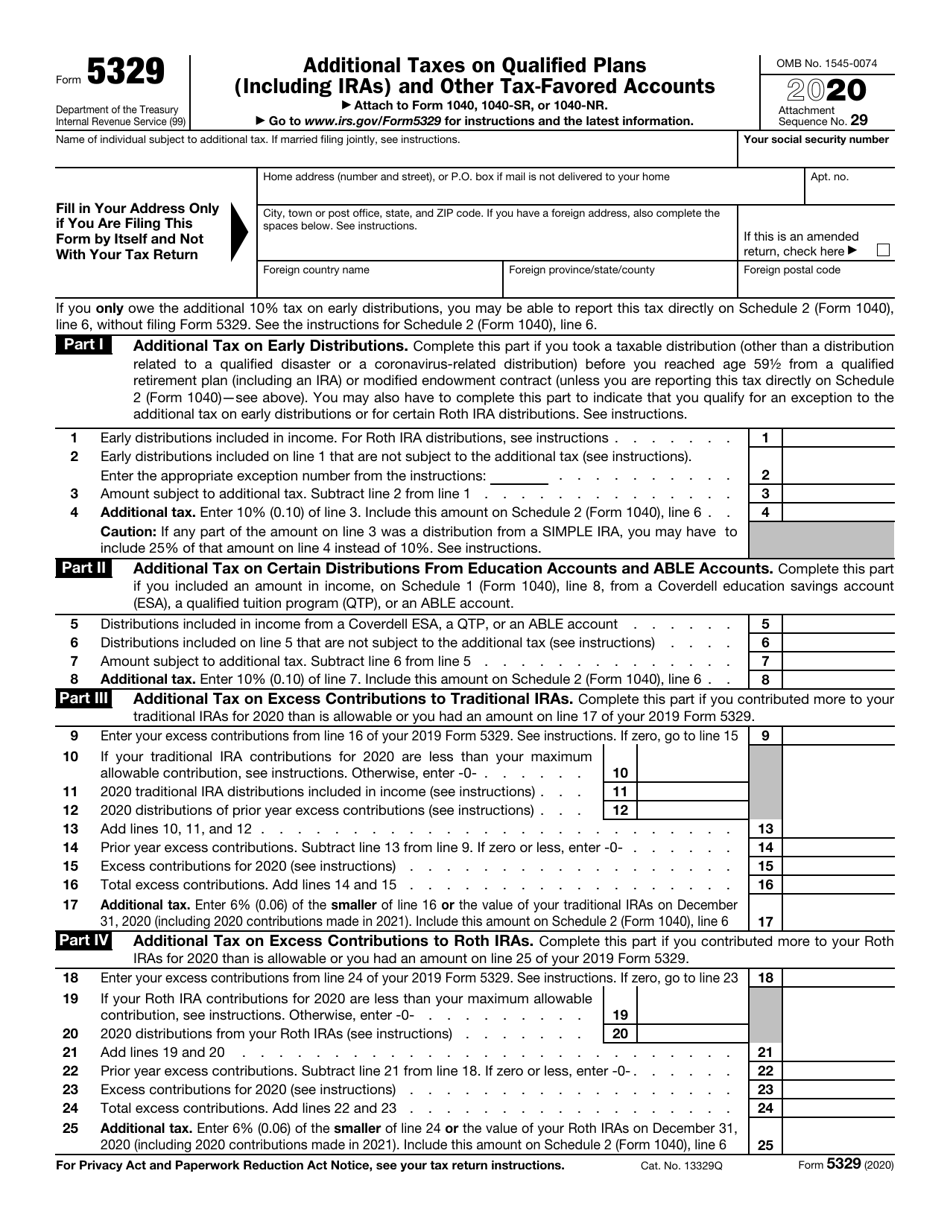

Form 5329 Line 48 - Web if you carried over an excess to the current tax year, then this amount appears on line 48 of the 5329. If zero, go to line 47. Web enter the amount from line 48 of your 2013 form 5329 only if the amount on line 49 of your 2013 form 5329 is more than zero. Go to screen 41.1, retirement plan taxes (5329).; Web iii and iv of the form 8329 used as a transmitting document. Below, you'll find answers to. Web on form 5329, under line 1, the distributions not subject to additional tax smart worksheet, column b for simple distributions, line a is grayed out. Additional taxes on qualified plans (including (irs) form is 2 pages long and contains: Scroll down to the excess contributions to. Shouldn't it be shown as an excess employer contribution withdrawn instead? Web iii and iv of the form 8329 used as a transmitting document. 43 if the contributions to your hsas for 2021 are less than the maximum. Web on form 5329, under line 1, the distributions not subject to additional tax smart worksheet, column b for simple distributions, line a is grayed out. February 2020) department of the treasury internal. Web turbotax, shows line 48 of my 2020 form 5329 as a deduction. Line 43 if contributions to your hsas for 2022 (line. Web learn & support. Hosting for lacerte & proseries. Below, you'll find answers to. Web the form 5329: If zero, go to line 47. Below, you'll find answers to. Web turbotax, shows line 48 of my 2020 form 5329 as a deduction. Hosting for lacerte & proseries. If you don't have a 5329, take this as evidence that you. Web enter the excess contributions from line 48 of your 2021 form 5329. If zero, go to line 47. If zero, go to line 47. 43 if the contributions to your hsas for 2021 are less than the maximum. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Shouldn't it be shown as an excess employer contribution withdrawn instead? Web turbotax, shows line 48 of my 2020 form 5329 as a deduction. Scroll down to the excess contributions to. 43 if the contributions to. Web learn & support. Go to screen 41.1, retirement plan taxes (5329).; Hosting for lacerte & proseries. Value of health savings account on 12/31/22 (force) hsa contributions less than maximum allowable contribution (force). If zero, go to line 47. Complete, edit or print tax forms instantly. Ad pdffiller.com has been visited by 1m+ users in the past month Web enter the excess contributions from line 48 of your 2021 form 5329. Web the form 5329: Web turbotax, shows line 48 of my 2020 form 5329 as a deduction. Common questions about form 5329 retirement plan taxes in proconnect. If you don’t have to file a 2022 income tax return, complete. Complete, edit or print tax forms instantly. February 2020) department of the treasury internal revenue service (99) additional taxes on qualified plans (including iras) and other. Web enter the amount from line 48 of your 2021 form 5329. Complete the remainder of this form 8329, making certain that all mortgage credit certificate amounts reported in all. If contributions to your hsas for 2014 (line. Web iii and iv of the form 8329 used as a transmitting document. Web if you carried over an excess to the current tax year, then this amount appears on line 48 of the. If you don't have a 5329, take this as evidence that you. Ad pdffiller.com has been visited by 1m+ users in the past month If zero, go to line 47. Value of health savings account on 12/31/22 (force) hsa contributions less than maximum allowable contribution (force). If contributions to your hsas for 2014 (line. Web enter the amount from line 48 of your 2013 form 5329 only if the amount on line 49 of your 2013 form 5329 is more than zero. Web iii and iv of the form 8329 used as a transmitting document. Web turbotax, shows line 48 of my 2020 form 5329 as a deduction. If zero, go to line 47. 43 if the contributions to your hsas for 2022 are less than the maximum. Web enter the excess contributions from line 48 of your 2021 form 5329. February 2020) department of the treasury internal revenue service (99) additional taxes on qualified plans (including iras) and other. Web learn & support. 43 if the contributions to your hsas for 2021 are less than the maximum. Additional taxes on qualified plans (including (irs) form is 2 pages long and contains: Web how do i enter excess contributions on form 5329, line 15? Value of health savings account on 12/31/22 (force) hsa contributions less than maximum allowable contribution (force). Get ready for tax season deadlines by completing any required tax forms today. Web enter the excess contributions from line 48 of your 2020 form 5329. Common questions about form 5329 retirement plan taxes in proconnect. If contributions to your hsas for 2014 (line. Hosting for lacerte & proseries. Web the form 5329: Scroll down to the excess contributions to. Web enter the amount from line 48 of your 2021 form 5329 only if the amount on line 49 of your 2021 form 5329 is more than zero.Fill Form 5329 Additional Taxes on Qualified Plans

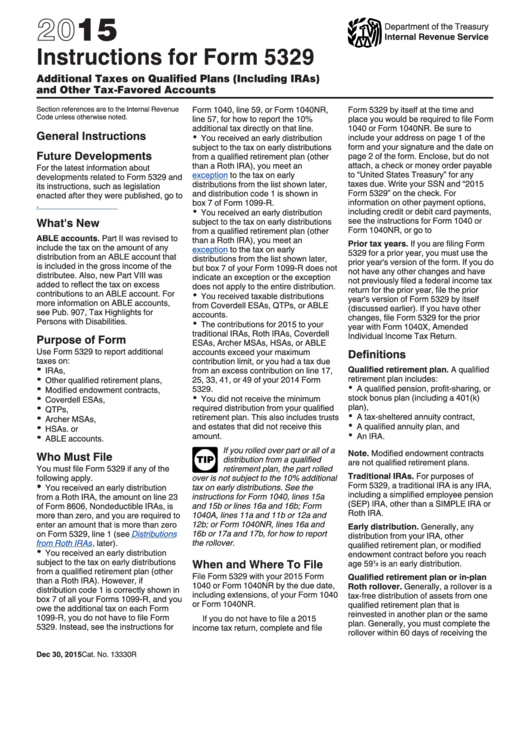

Form 5329 Instructions & Exception Information for IRS Form 5329

Form 5329 Fillable Printable Forms Free Online

Instructions for How to Fill in IRS Form 5329

IRS Form 5329 Explained How to Navigate Retirement Account Penalty

How to Fill in IRS Form 5329

Instructions For Form 5329 (2015) printable pdf download

Form 5329 Is Used for Which of the Following Purposes

IRS Form 5329 Download Fillable PDF or Fill Online Additional Taxes on

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Related Post: