Form 505 Maryland Instructions

Form 505 Maryland Instructions - Return taxpayer who moved into or out of. If you lived in maryland only part of the year, you must file form 502. If you are filing form 515, use the form 505nr instructions appearing in. Place form pv with attached check/money order on top of form 505. You can download or print. Direct deposit of refund (see instruction 22.) verify that all account information is. Easily sign the maryland 505nr with your finger. Your signature date preparer’s ptin (required by law) signature of preparer other than taxpayer spouse’s signature date address and. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Web if you are filing form 505, use the form 505nr instructions appearing on page 2 of this form. If you are filing form 515, use the form 505nr instructions appearing in. For returns filed without payments, mail your completed return to: Your signature date preparer’s ptin (required by law) signature of preparer other than taxpayer spouse’s signature date address and. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version. Section on page 3 of form 505 and its instruction 23 were expanded for taxpayers to authorize the state of maryland to disclose to their. Web open the form 505 maryland and follow the instructions. If you are filing form 515, use the form 505nr instructions appearing in. Your signature date preparer’s ptin (required by law) signature of preparer other. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. Easily sign the maryland 505nr with your finger. Section on page 3 of form 505 and its instruction 23 were expanded for taxpayers to authorize the state of maryland to disclose to their. Web if you work in maryland but reside. Starting january 2023, in cooperation with the. Web 2022 individual income tax instruction booklets. Web maryland tax, you must also file form 505. Web option 1 (include all) go to the maryland > composite worksheet. Web open the form 505 maryland and follow the instructions. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. Web if you are filing form 505, use the form 505nr instructions appearing on page 2 of this form. Web make checks payable to comptroller of maryland. Maryland nonresident income tax calculation. Web maryland 2021 form 505 nonresident income tax return. Do not attach form pv or check/ money order to form 505. Payment voucher with instructions and worksheet for individuals sending check or money order for. Web 2022 individual income tax instruction booklets. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022.. You can download or print. Place form pv with attached check/money order on top of form 505. Web open the form 505 maryland and follow the instructions. Web option 1 (include all) go to the maryland > composite worksheet. Starting january 2023, in cooperation with the. Web personal tax payment voucher for form 502/505, estimated tax and extensions. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. If you are filing form 505, use the form 505nr. • direct deposit of refund. Do not attach form pv or check/ money order to form 505. Starting january 2023, in cooperation with the. Do not attach form pv or check/ money order to form 505. • direct deposit of refund. If you are filing form 515, use the form 505nr instructions appearing in. Web maryland tax, you must also file form 505. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Place form ind pv with attached check/money order. Return taxpayer who moved into or out of. Web make checks payable to comptroller of maryland. Do not attach form ind pv or check/money. Attach to your tax return. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Do not attach form ind pv or check/money order to form 505. You can download or print. Web personal tax payment voucher for form 502/505, estimated tax and extensions. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. If you are a nonresident, you must file form 505 and form 505nr. If you are filing form 515, use the form 505nr instructions appearing in. For returns filed without payments, mail your completed return to: Web income tax payment voucher for use with forms 502 or 505. Web 2022 individual income tax instruction booklets. Web open the form 505 maryland and follow the instructions. Place form ind pv with attached check/money order. Web we last updated the nonresident income tax computation in january 2023, so this is the latest version of form 505nr, fully updated for tax year 2022. Web option 1 (include all) go to the maryland > composite worksheet. Web checks payable to comptroller of maryland. Web if you are filing form 505, use the form 505nr instructions appearing on page two of this form. Section on page 3 of form 505 and its instruction 23 were expanded for taxpayers to authorize the state of maryland to disclose to their. Maryland nonresident income tax calculation. Web if you are filing form 505, use the form 505nr instructions appearing on page 2 of this form.If you are a nonresident, you must file Form 505 and Form 505NR.

Fill Free fillable Form 505 2019 NONRESIDENT TAX RETURN

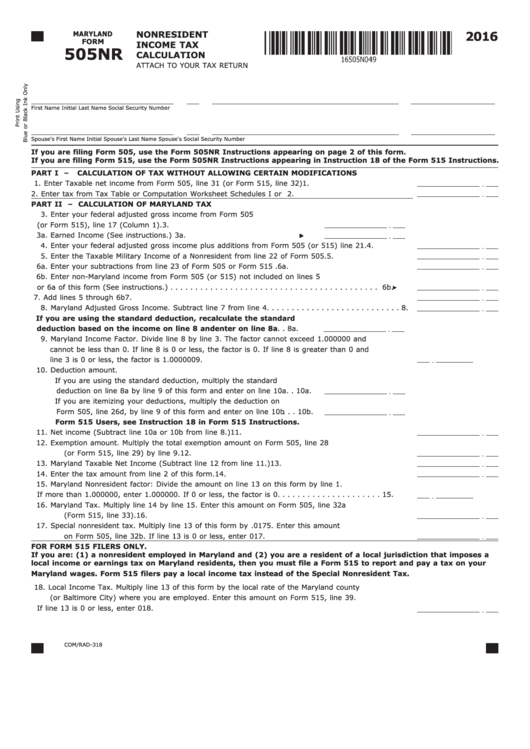

Fillable Nonresident Tax Calculation Maryland Form 505nr

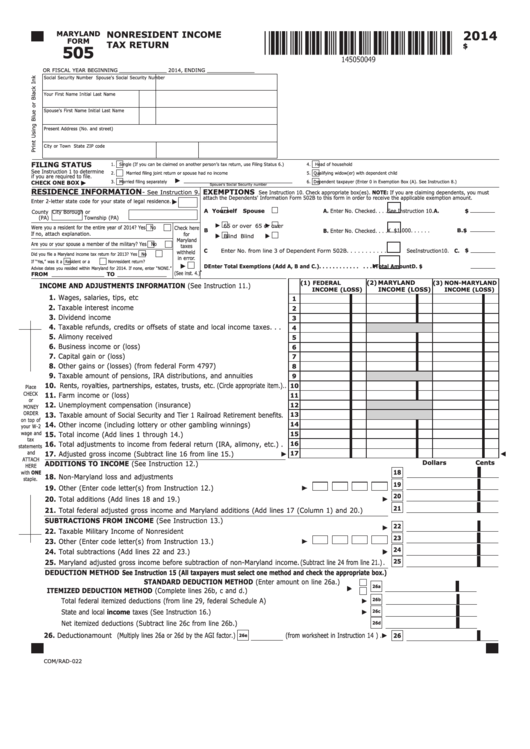

Fillable Maryland Form 505 Nonresident Tax Return 2014

2021 Form MD Comptroller 505X Fill Online, Printable, Fillable, Blank

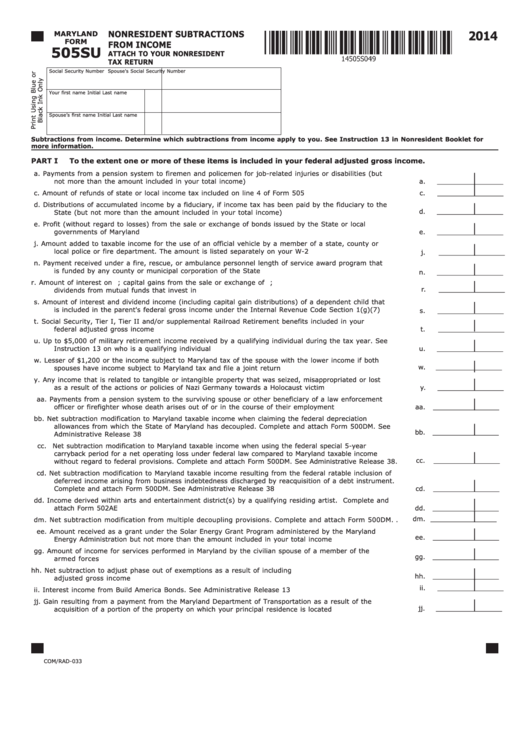

Fillable Maryland Form 505su Nonresident Subtractions From

Free Fillable Maryland Tax Forms Printable Forms Free Online

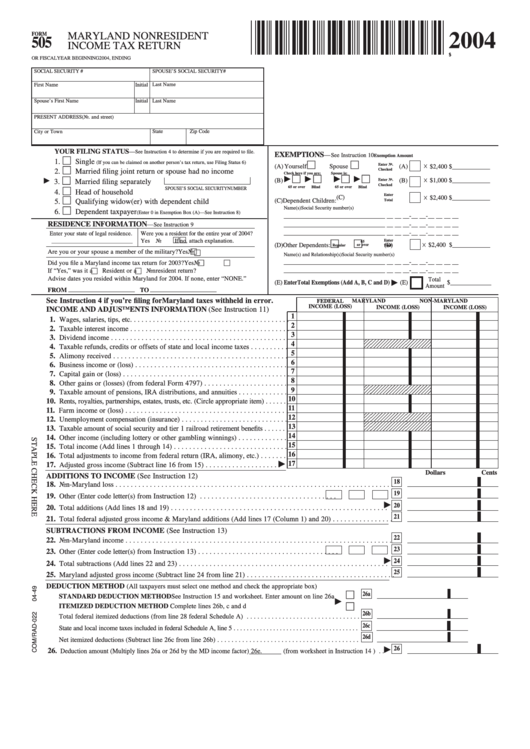

Fillable Form 505 Maryland Nonresident Tax Return 2004

Maryland Form 505 ≡ Fill Out Printable PDF Forms Online

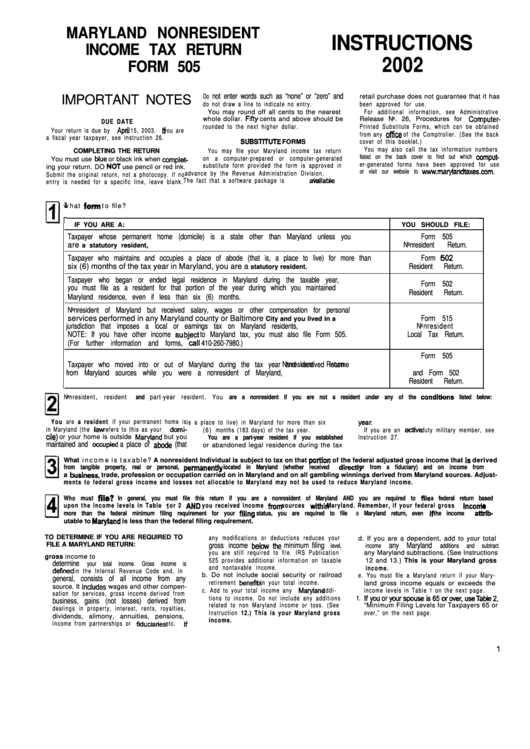

Instructions For Maryland Nonresident Tax Return Form 505 2002

Related Post: