Form 502 Ptet

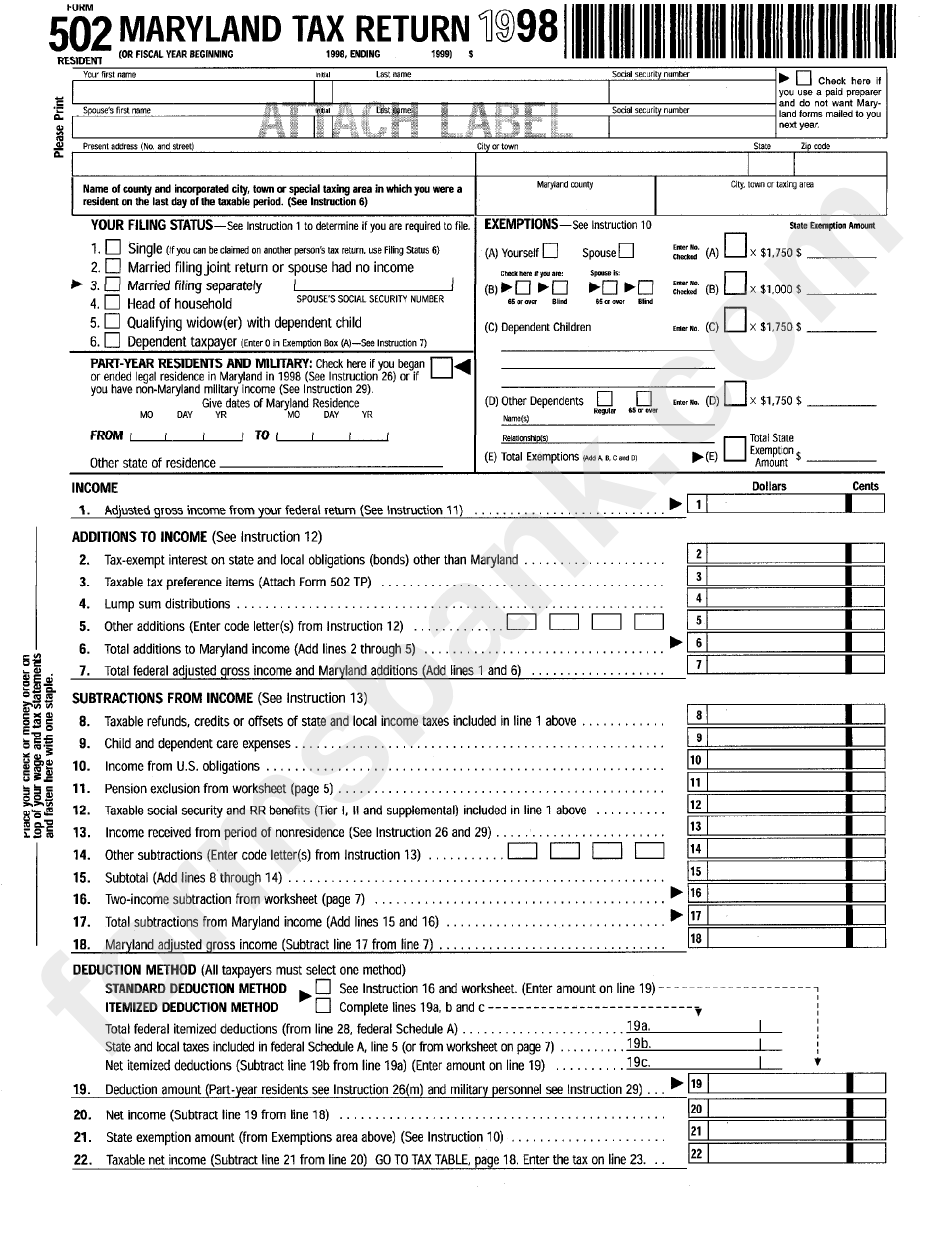

Form 502 Ptet - Fill out the school tax ceiling certificate for homeowner age 65 or older,. Web s corporations, partnerships, and limited liability companies. Web the virginia form 502ptet is a new form for the 2022 tax year. Web instead, the electing pte may file form 502ptet to request a refund of any ptet estimated tax payments it made. Find forms for your industry in minutes. January 3, 2023 there was no mechanism for such pte to file the ptet return by the applicable extended due date, taxpayers also may file an offer. Total withholding at end of year. How to make the election? Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss (negative number), section 2. Although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss (negative number), section 2. Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: If an electing pte has ineligible owners subject to withholding, the pte must file form. The form 502 should (1). Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Although the instructions for virginia form 502 ptet section 1 line 1 indicate that you may enter a loss (negative number), section 2. Web virginia department of taxation. Web ptet returns (“form 502ptet”). To initiate a lawsuit, a petition must be filed with the court. Web late payment penalty on tax due (will apply if there is a balance due on line 4 and form 502 is being filed more than 6 months after the original due date). For calendar year filers, that means april 15. Web form 502ptet and instructions. Web s. Web virginia department of taxation. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Part i withholding agent information. Web the virginia form 502ptet is a new form for the 2022 tax year. Total withholding at end of year. Web instead, the electing pte may file form 502ptet to request a refund of any ptet estimated tax payments it made. 1, 2021, but before jan. For calendar year filers, that means april 15. Web virginia department of taxation. Web the virginia form 502ptet is a new form for the 2022 tax year. 1, 2022 (2021 tax year), will not be issued by the department until well after. Part i withholding agent information. The form 502 should (1). (1) the name of the plaintiff; Web late payment penalty on tax due (will apply if there is a balance due on line 4 and form 502 is being filed more than 6 months after. Web form 502ptet and instructions. Part i withholding agent information. For calendar year filers, that means april 15. For taxable years beginning on and after january 1, 2021, but before. Web election procedures for tax years beginning on or after jan. 1, 2022 (2021 tax year), will not be issued by the department until well after. To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Web s corporations, partnerships, and limited liability companies. Streamlined document workflows for any industry. Web form 502ptet and instructions. Find forms for your industry in minutes. Web late payment penalty on tax due (will apply if there is a balance due on line 4 and form 502 is being filed more than 6 months after the original due date). Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax. Find forms for your industry in minutes. Fill out the school tax ceiling certificate for homeowner age 65 or older,. Web s corporations, partnerships, and limited liability companies. Web election procedures for tax years beginning on or after jan. Web virginia department of taxation. Web election procedures for tax years beginning on or after jan. If an electing pte has ineligible owners subject to withholding, the pte must file form 502 and form 502ptet. The form 502 should (1). How to make the election? 1, 2022 (2021 tax year), will not be issued by the department until well after. Web late payment penalty on tax due (will apply if there is a balance due on line 4 and form 502 is being filed more than 6 months after the original due date). Web form 502ptet and instructions. For calendar year filers, that means april 15. Web during the 2022 session, the virginia general assembly enacted house bill 1121 (2022 acts of assembly, chapter 690) and senate bill 692 (2022 acts of assembly, chapter. Web virginia department of taxation. To initiate a lawsuit, a petition must be filed with the court. (1) during tax year 2022, filing form 502v and submitting a. Web the virginia form 502ptet is a new form for the 2022 tax year. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. January 3, 2023 there was no mechanism for such pte to file the ptet return by the applicable extended due date, taxpayers also may file an offer. Web instead, the electing pte may file form 502ptet to request a refund of any ptet estimated tax payments it made. Part i withholding agent information. To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. 1, 2021, but before jan. Web s corporations, partnerships, and limited liability companies.Fillable Form 502 Maryland Tax Return 1998 printable pdf download

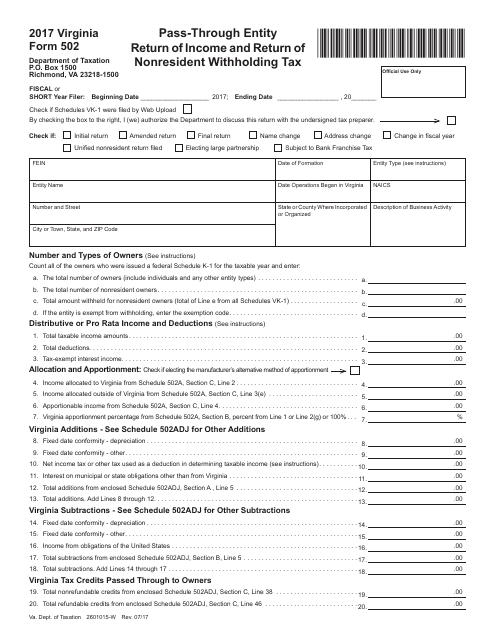

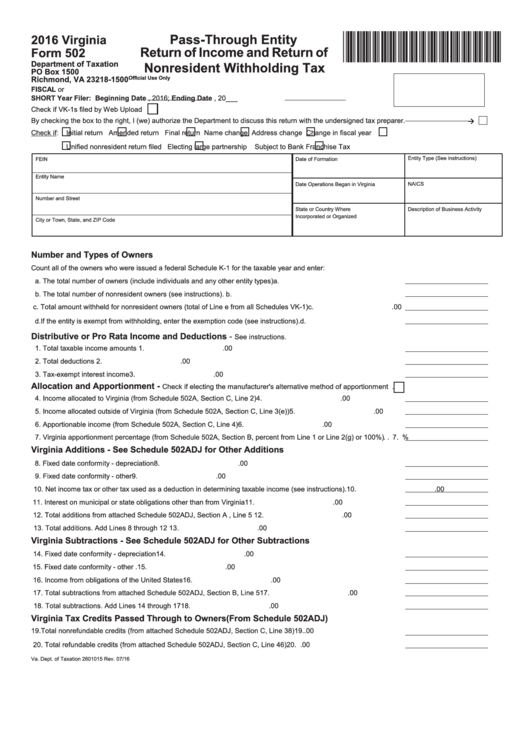

Form 502 Download Fillable PDF or Fill Online PassThrough Entity

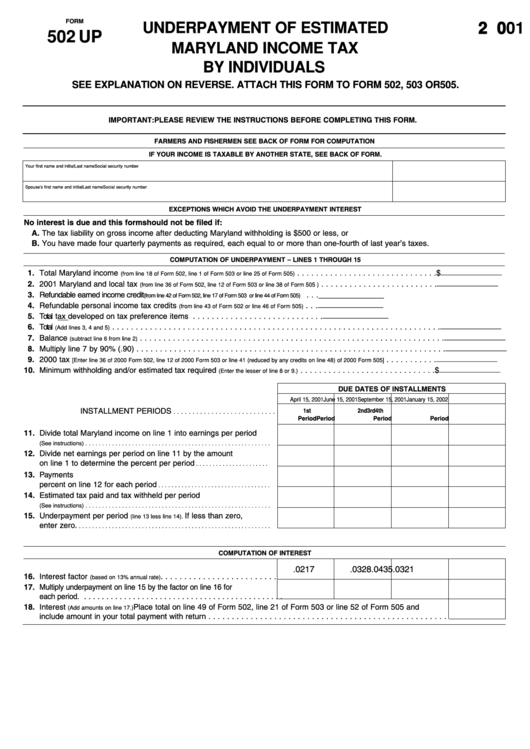

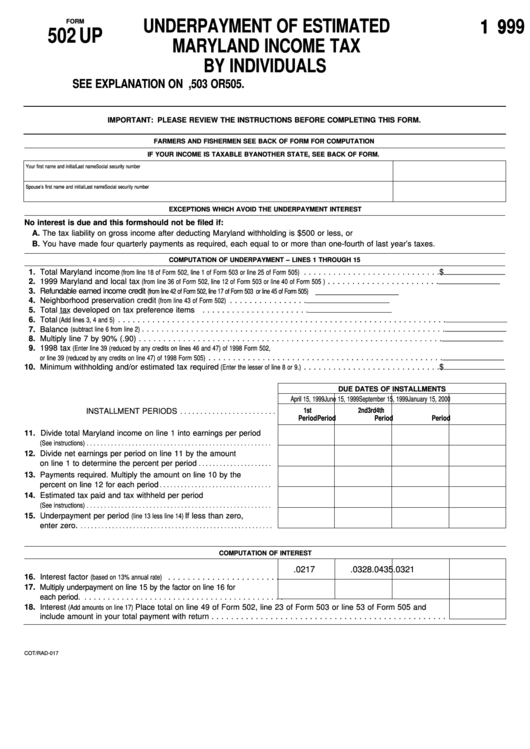

Form 502 Up Underpayment Of Estimated Maryland Tax By

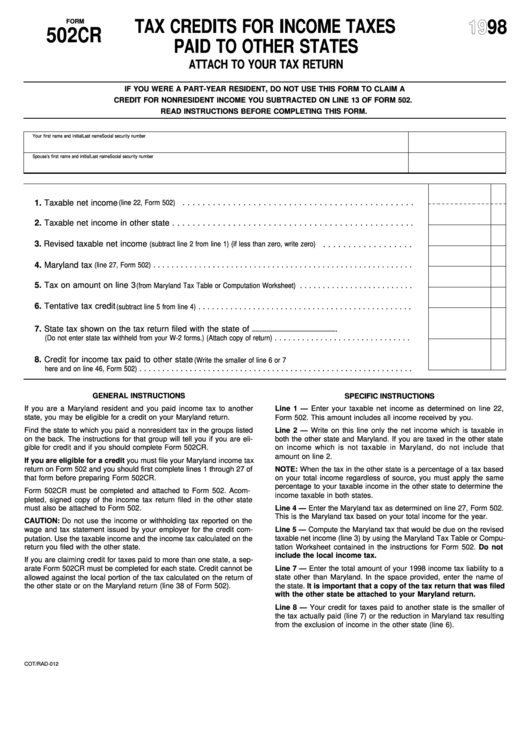

Fillable Form 502 Cr Tax Credits For Taxes Paid To Other

Form 502 Up Underpayment Of Estimated Maryland Tax By

B0e 502 a front rev 10 8 07 orange 2007 form Fill out & sign online

Fillable Virginia Form 502 PassThrough Entity Return Of And

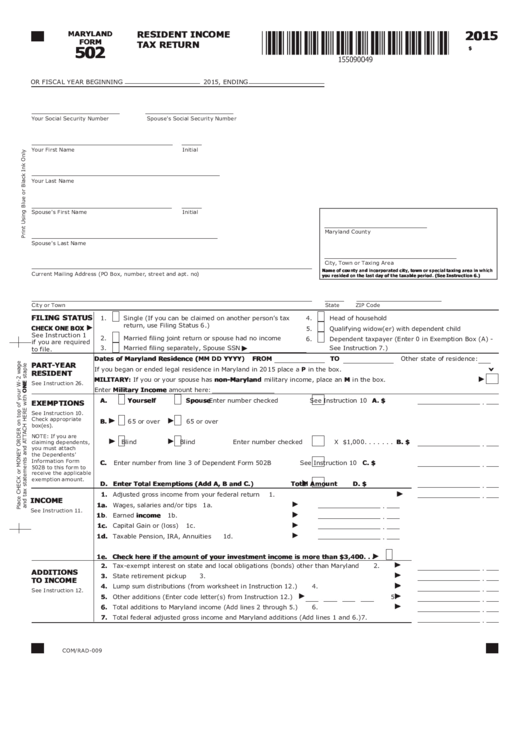

Fillable Maryland Form 502 Resident Tax Return 2015

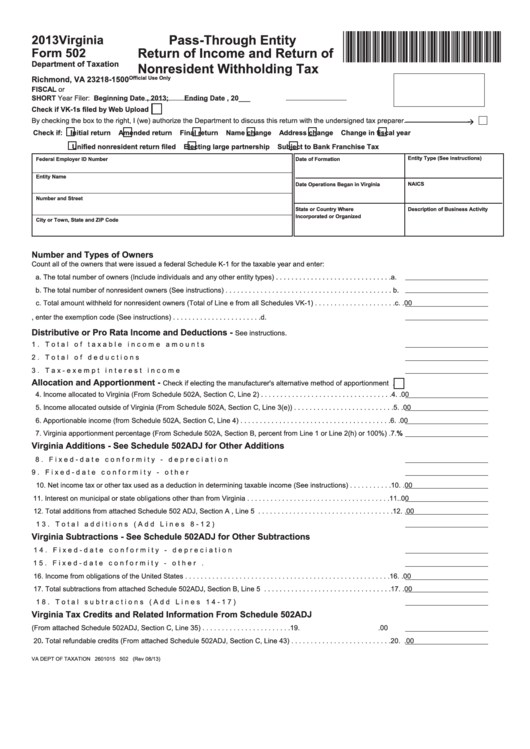

Fillable Form 502 PassThrough Entity Return Of And Return Of

Md 502 Form Fill Out and Sign Printable PDF Template signNow

Related Post: