Form 502 Maryland Instructions

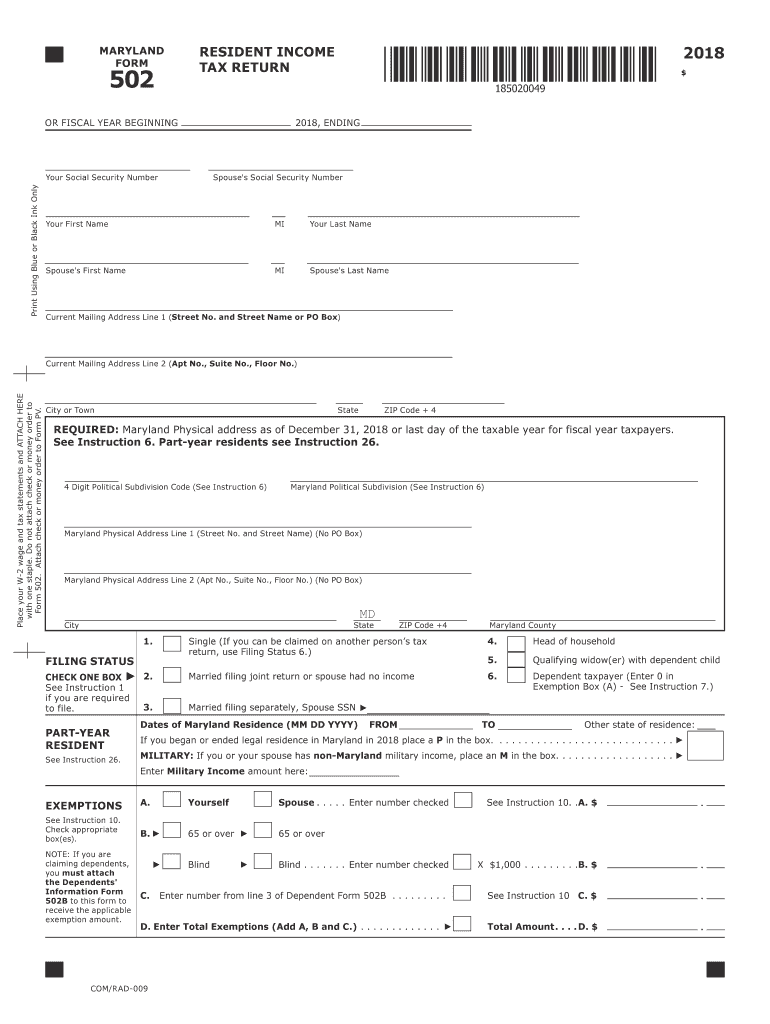

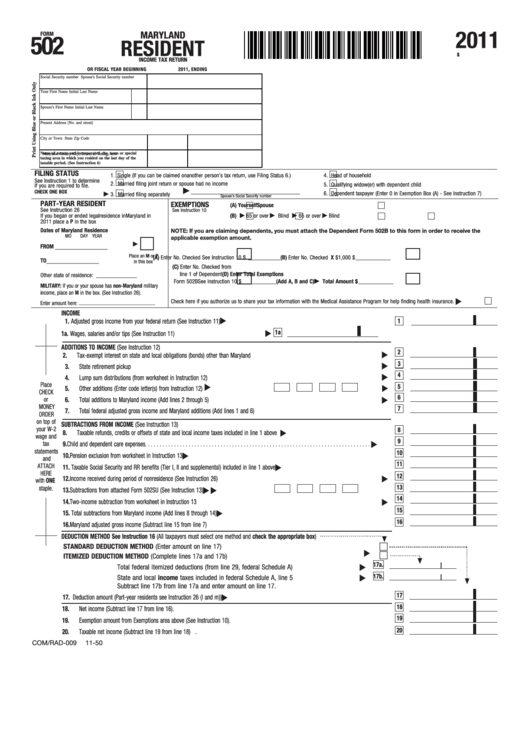

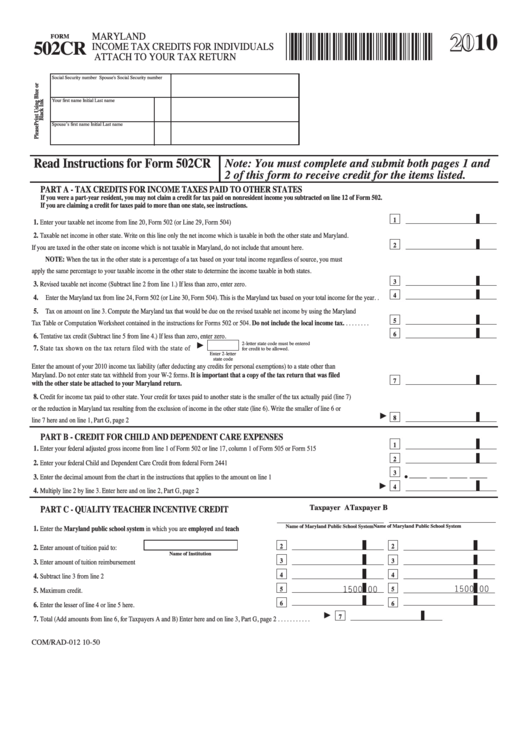

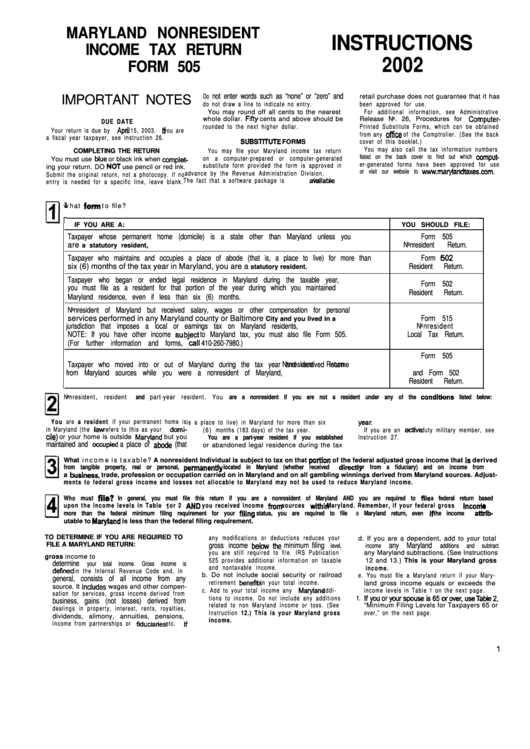

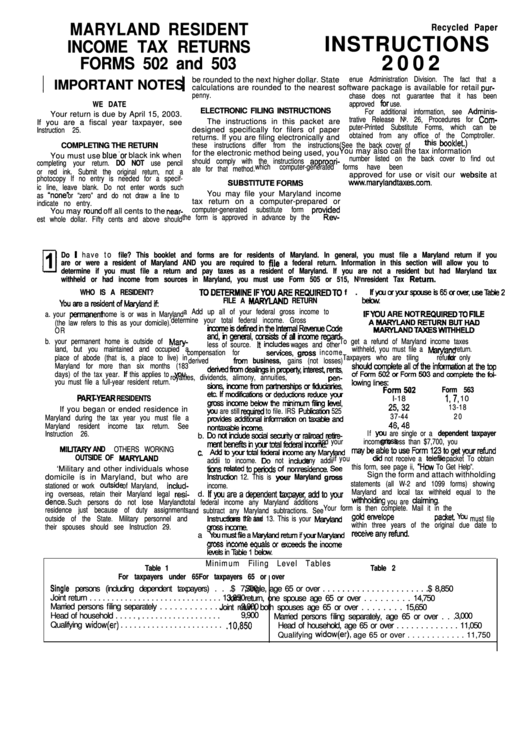

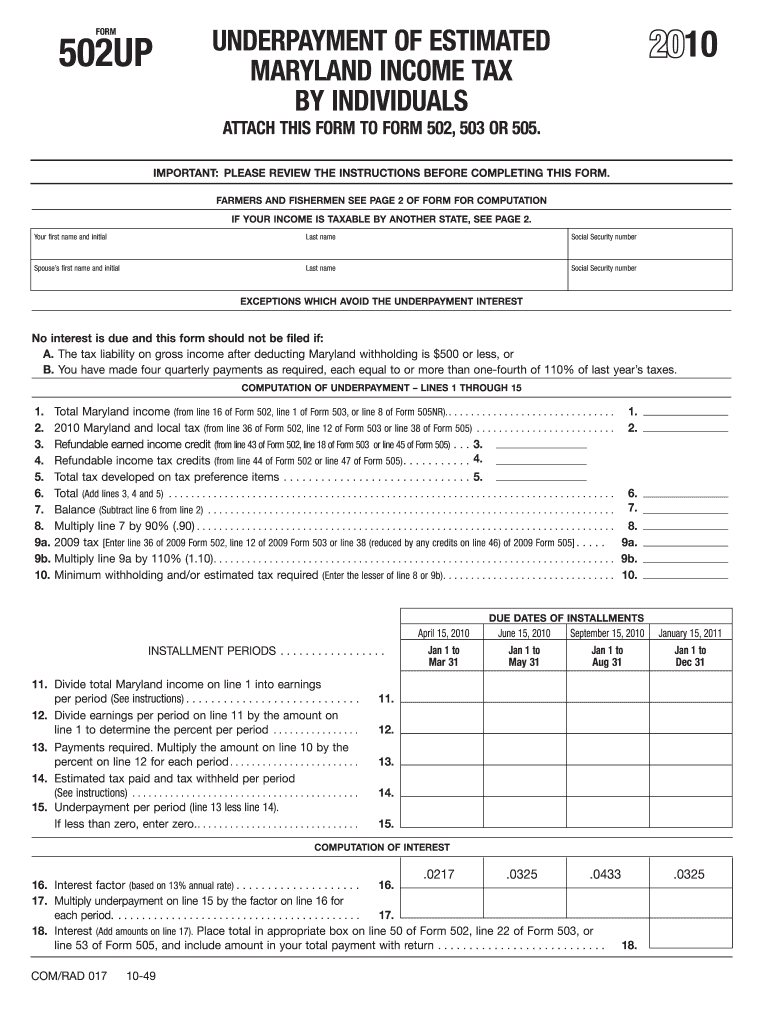

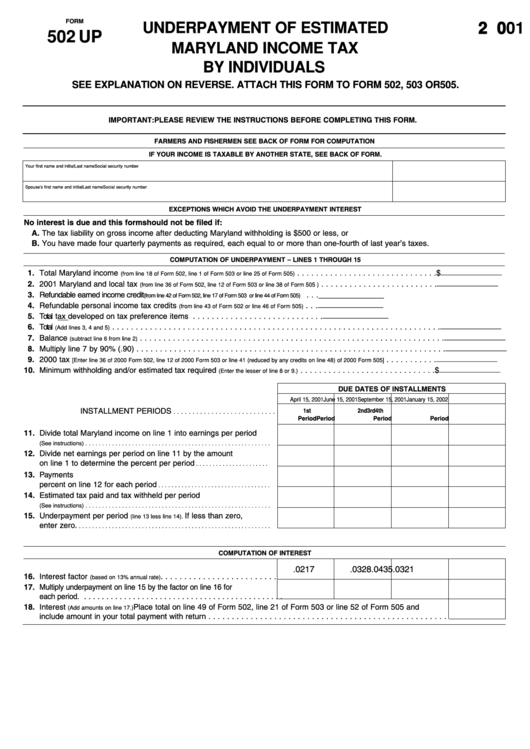

Form 502 Maryland Instructions - Attach this form to form 502, 505 or 515. If you began or ended legal residence in maryland in 2022 place a p in the box. Ad download, fax, print or fill online form 502 & more, subscribe now 502cr maryland personal income tax credits for individuals and instructions. Underpayment of estimated income tax by individuals. The new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. 502 maryland resident income tax return. Web if you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and instructions. It appears you don't have a pdf plugin for this browser. If you underpaid or failed to pay your estimated income taxes for the previous tax year, you must file form 502up to calculate. Maryland state and local tax forms and instructions. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Maryland state and local nonresident tax forms and instructions for filing nonresident personal state and local. Download or email form 502 & more. Web 2022 individual income tax instruction booklets. Web the tax forms ready for use as of today (april 15) are: Review administrative release 42 for additional. 22 29.special instructions for military taxpayers. If you are a nonresident, you must file form 505 and form 505nr. Web if you wish to calculate your maryland 502 (resident) return on paper before using this application, click here for forms and instructions. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. You must use form 502 if your federal adjusted gross income is $100,000. If you are a nonresident, you must file form 505 and form 505nr. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Web decide whether you will use form 502 (long form) or form 503 (short form). 22 29.special instructions for military taxpayers. Web if. 502cr maryland personal income tax credits for individuals and instructions. Maryland physical address of taxing area as of december 31, 2020 or last day of the taxable year for fiscal year taxpayers. Web the tax forms ready for use as of today (april 15) are: If you are a nonresident, you must file form 505 and form 505nr. Ad download,. The new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web if you wish to calculate your. The new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. 502cr maryland personal income tax credits for individuals and instructions. It appears you don't have a pdf plugin for this browser. Maryland physical address of taxing area as of december 31, 2020 or last day of. Web 2022 individual income tax instruction booklets. Web decide whether you will use form 502 (long form) or form 503 (short form). The new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. Web 2020 individual income tax instruction booklets. 22 29.special instructions for military taxpayers. Web the tax forms ready for use as of today (april 15) are: If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Underpayment of estimated income tax by individuals. 502 maryland resident income tax return. Complete, edit or print tax forms instantly. If you lived in maryland only part of the year, you must file form 502. 22 29.special instructions for military taxpayers. Web the tax forms ready for use as of today (april 15) are: Get form 502 maryland instructions. Complete, edit or print tax forms instantly. Get form 502 maryland instructions. If you underpaid or failed to pay your estimated income taxes for the previous tax year, you must file form 502up to calculate. It appears you don't have a pdf plugin for this browser. If you lived in maryland only part of the year, you must file form 502. Web determine the taxable amount of social security and/or railroad retirement benefits that were included in your federal adjusted gross income on line 1 of maryland form 502. Web 2020 individual income tax instruction booklets. Attach this form to form 502, 505 or 515. Maryland state and local nonresident tax forms and instructions for filing nonresident personal state and local. If you began or ended legal residence in maryland in 2022 place a p in the box. Maryland physical address of taxing area as of december 31, 2020 or last day of the taxable year for fiscal year taxpayers. Open form follow the instructions. Web decide whether you will use form 502 (long form) or form 503 (short form). Web 2022 individual income tax instruction booklets. Easily sign the form with your finger. Maryland state and local tax forms and instructions. 22 29.special instructions for military taxpayers. Do not attach form pv or check/money order to form 502. You must use form 502 if your federal adjusted gross income is $100,000 or more. 502 maryland resident income tax return. Place form pv with attached check/money order on top of form 502 and mail to:Md 502 instructions 2018 Fill out & sign online DocHub

Fillable Maryland Form 502 Printable Forms Free Online

Fillable Form 502cr Maryland Tax Credits For Individuals

Maryland Form 502 Instructions 2019

2019 Maryland Form 502 Instructions designshavelife

Maryland Form 502 Instructions ESmart Tax Fill Out and Sign Printable

Instructions For Maryland Resident Tax Returns Forms 502 And 503

MD 502UP 20202021 Fill out Tax Template Online US Legal Forms

2010 Form MD 502UP Fill Online, Printable, Fillable, Blank pdfFiller

Form 502 Up Underpayment Of Estimated Maryland Tax By

Related Post: