Form 4972 Tax Form

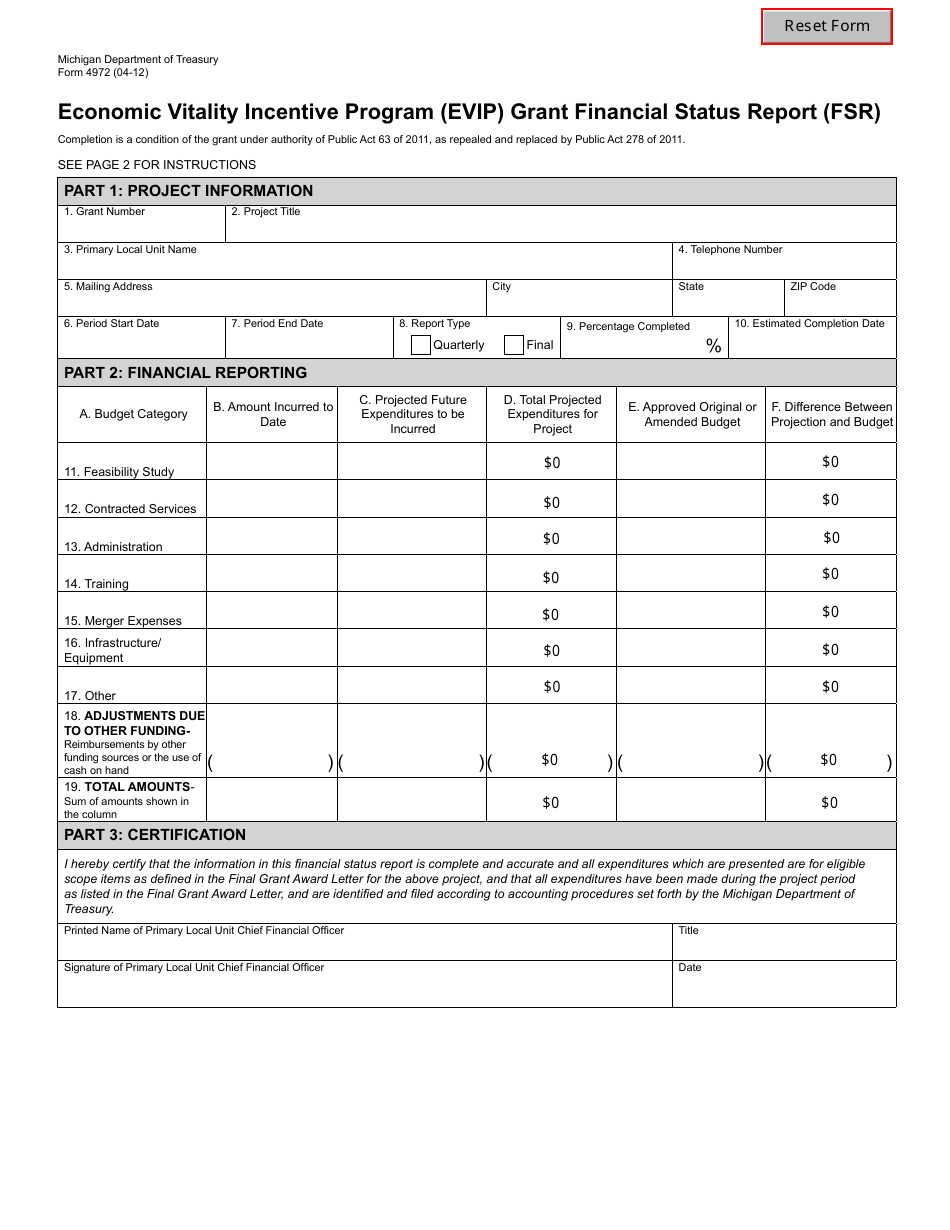

Form 4972 Tax Form - The following choices are available. Web what is irs form 4972. You can download or print current. Complete, edit or print tax forms instantly. Download or email irs 4972 & more fillable forms, register and subscribe now! Please use the link below. Complete, edit or print tax forms instantly. To claim these benefits, you must file irs. Tax form 4972 is used for reducing taxes. Web 1 best answer. To claim these benefits, you must file irs. Web 1 best answer. How to fill out tax form 4972. Download or email irs 4972 & more fillable forms, register and subscribe now! Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. If your answers are accurate,. Download or email irs 4972 & more fillable forms, register and subscribe now! The file is in adobe. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. How to fill out tax form 4972. Tax form 4972 is used for reducing taxes. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Use this form to figure the. It appears you don't have a pdf plugin for this browser. Please use the link below. How to fill out tax form 4972. Ad access irs tax forms. Download or email irs 4972 & more fillable forms, register and subscribe now! The following choices are available. It appears you don't have a pdf plugin for this browser. If your answers are accurate,. To claim these benefits, you must file irs. Web 1 best answer. The following choices are available. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. It appears you don't have a pdf plugin for this browser. The following choices are available. (from qualified plans of participants born before january 2, 1936). Complete, edit or print tax forms instantly. Use this form to figure the. Ad access irs tax forms. To claim these benefits, you must file irs. Download or email irs 4972 & more fillable forms, register and subscribe now! Download or email irs 4972 & more fillable forms, register and subscribe now! Web 1 best answer. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. To claim these benefits, you must file irs. Complete, edit or print tax forms instantly. Web amount to complete form 4972. Please use the link below. If your answers are accurate,. The following choices are available. The file is in adobe. Download or email irs 4972 & more fillable forms, register and subscribe now! It allows beneficiaries to receive their entire benefit in. Download or email irs 4972 & more fillable forms, register and subscribe now! Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. It allows beneficiaries to receive their entire benefit in. This publication discusses the tax treatment of distributions you receive from pension and. Ad access irs. It appears you don't have a pdf plugin for this browser. The file is in adobe. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. Tax form 4972 is used for reducing taxes. Ad access irs tax forms. Web what is irs form 4972. Web what is irs form 4972 used for? About publication 575, pension and annuity income. Complete, edit or print tax forms instantly. The following choices are available. How to fill out tax form 4972. It allows beneficiaries to receive their entire benefit in. Download or email irs 4972 & more fillable forms, register and subscribe now! Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. (from qualified plans of participants born before january 2, 1936). Download or email irs 4972 & more fillable forms, register and subscribe now! Web 1 best answer. Ad access irs tax forms. This publication discusses the tax treatment of distributions you receive from pension and. Complete, edit or print tax forms instantly.Form 4972 Download Fillable PDF or Fill Online Economic Vitality

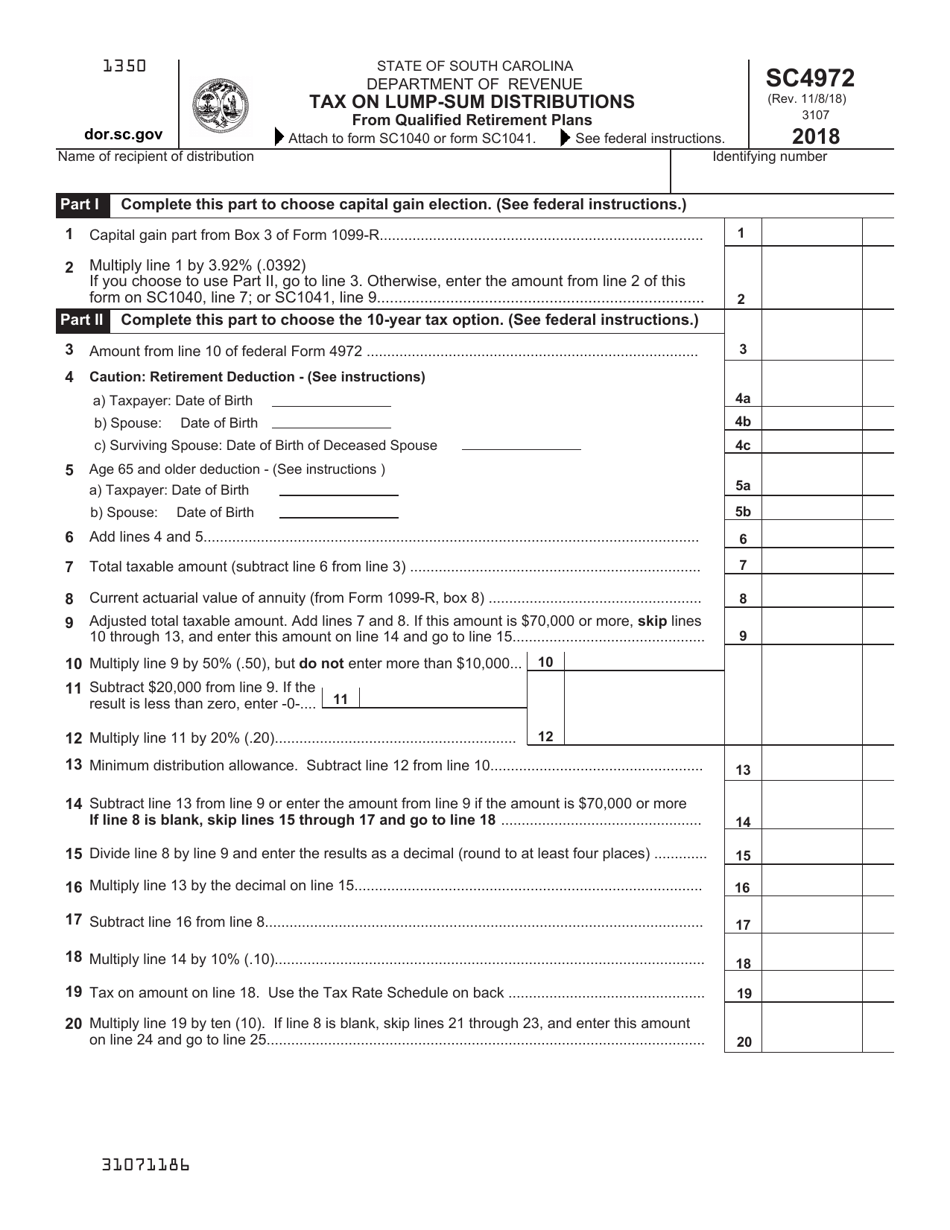

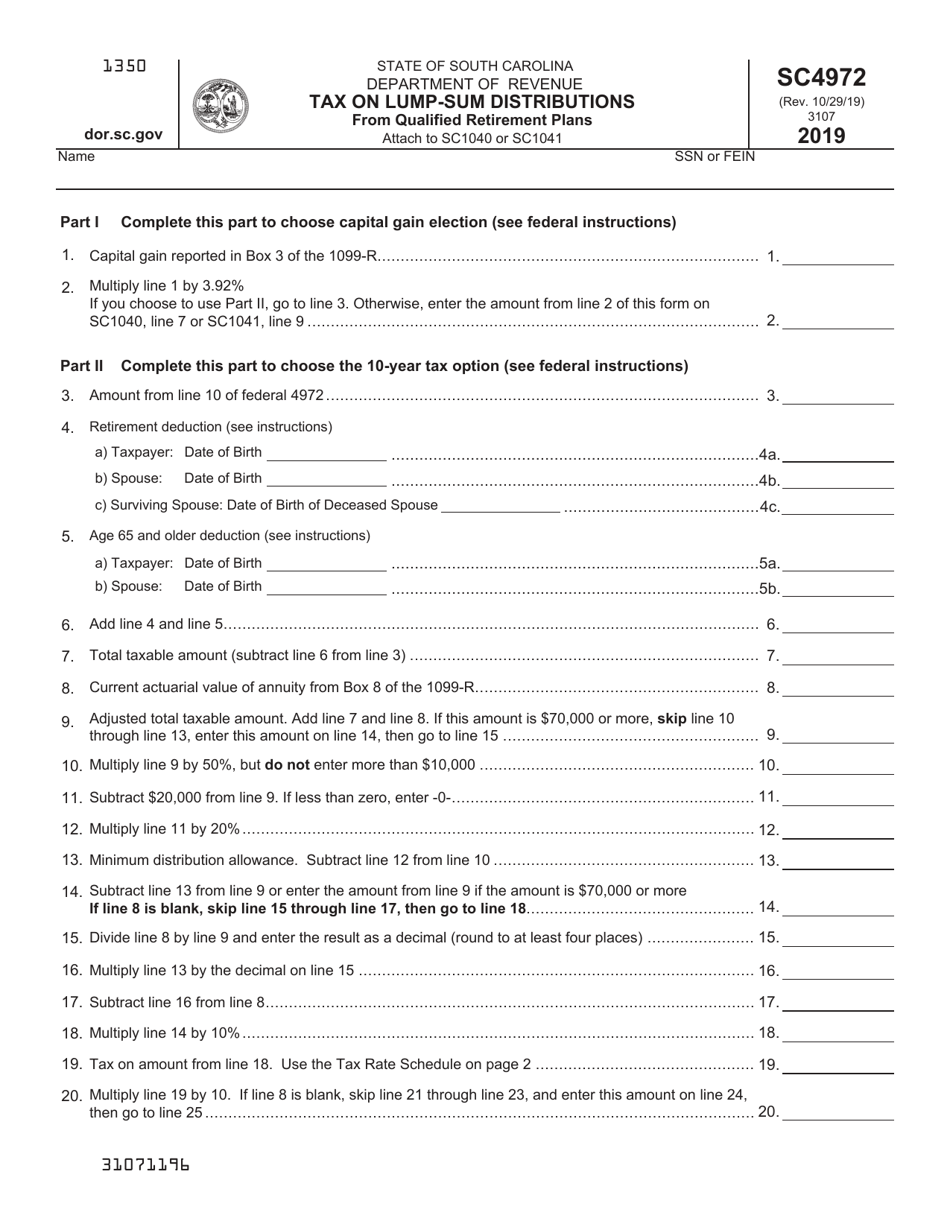

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

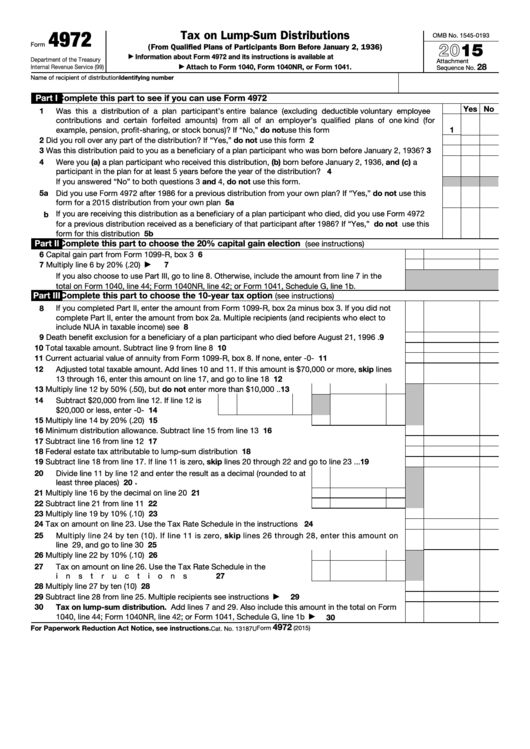

Fillable Form 4972 Tax On LumpSum Distributions 2015 printable pdf

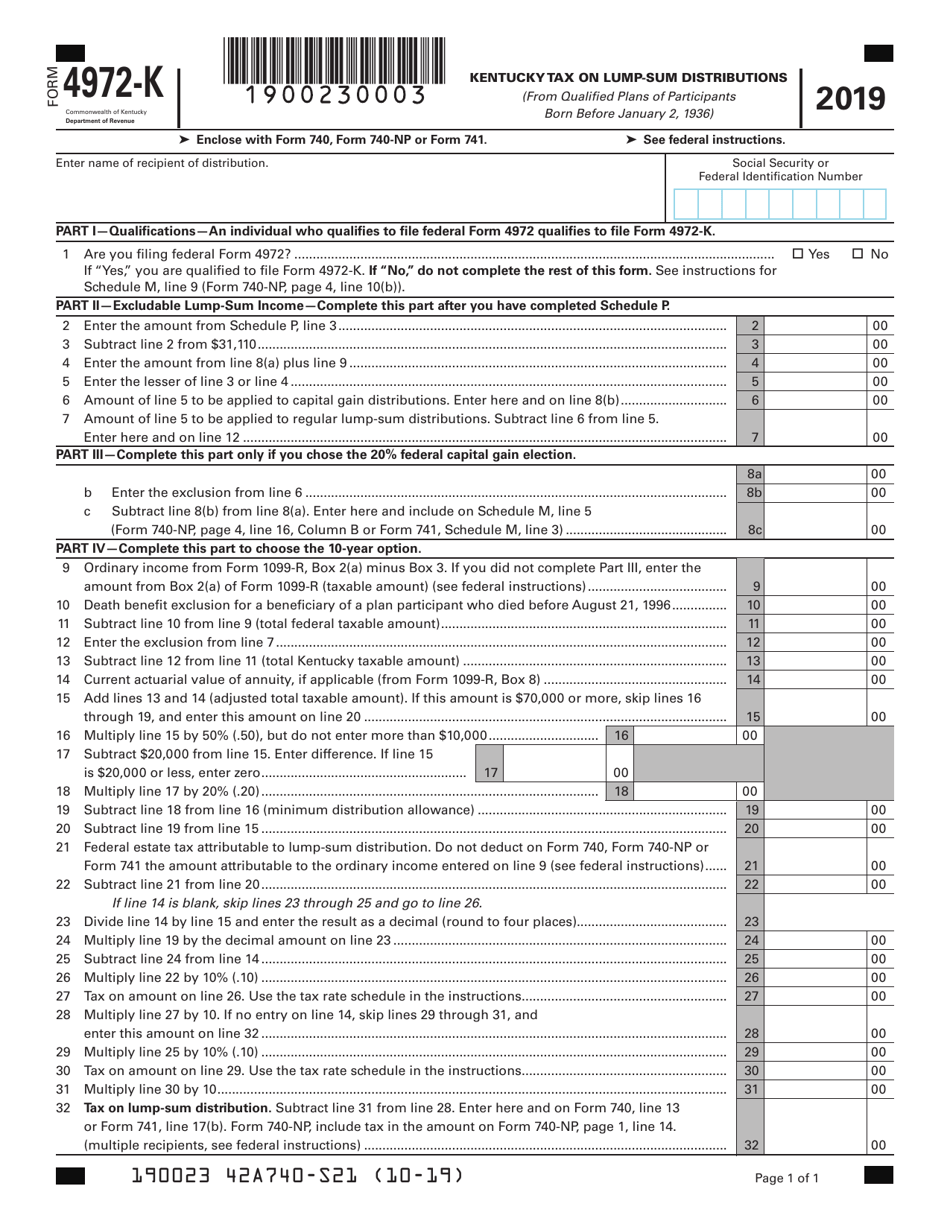

4972K Kentucky Tax on Lump Sum Distribution Form 42A740S21

Form 4972K Download Fillable PDF or Fill Online Kentucky Tax on Lump

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

Fill Form 4972 Tax on LumpSum Distributions

Publication 575 Pension and Annuity Taxation of Nonperiodic

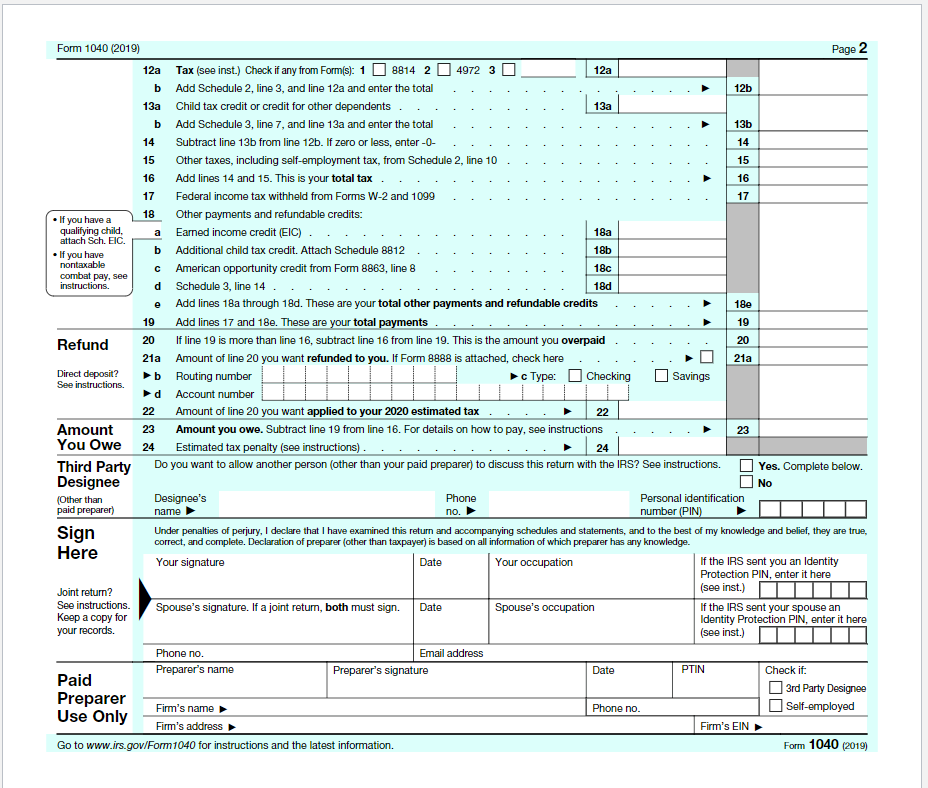

PLEASE USE THIS INFORMATION TO FILL OUT 1) Indivi...

2019 IRS Form 4972 Fill Out Digital PDF Sample

Related Post: