Form 4835 Vs Schedule E

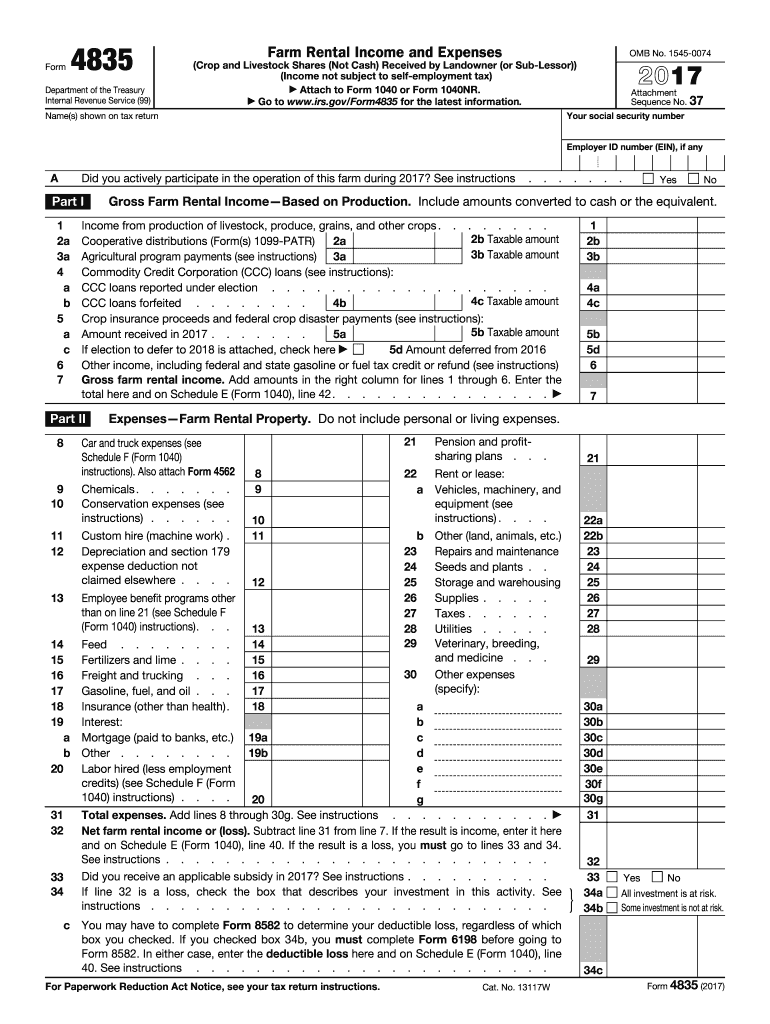

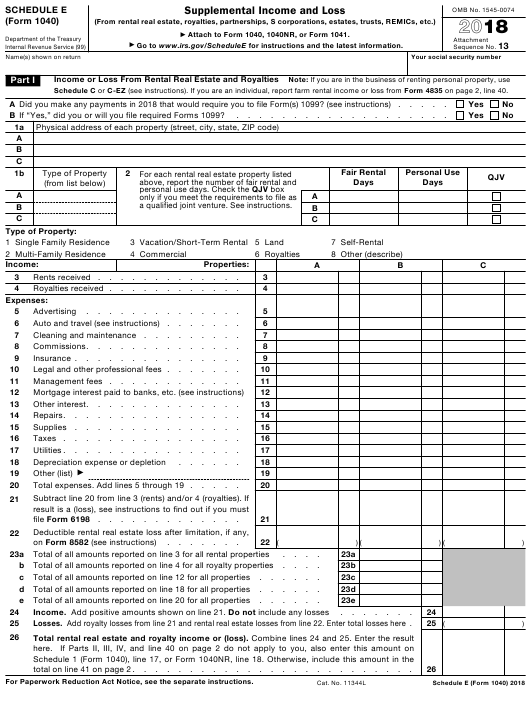

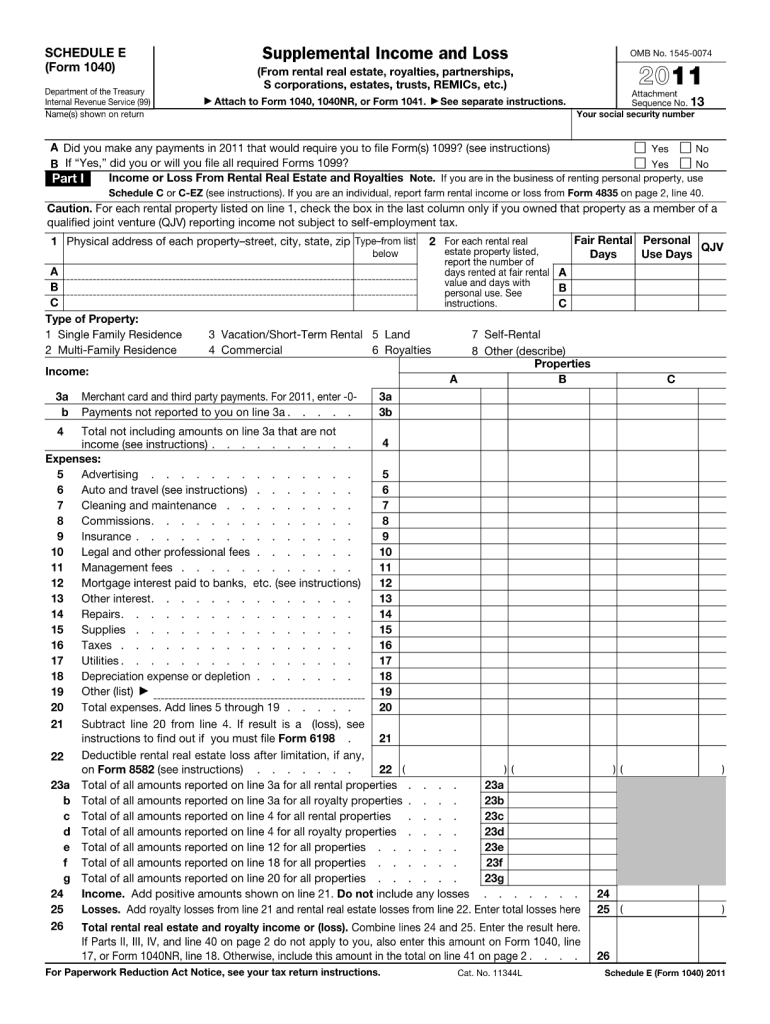

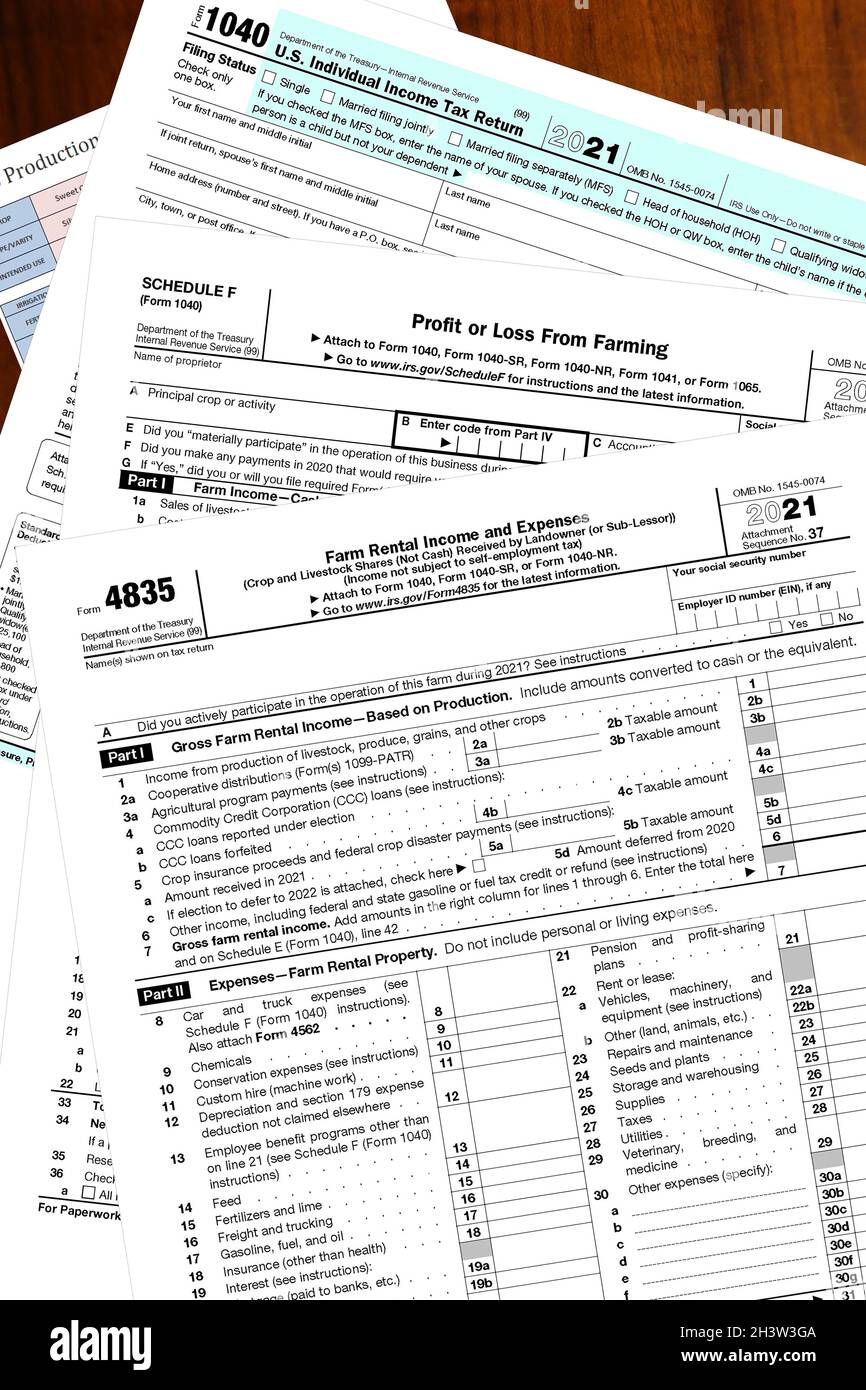

Form 4835 Vs Schedule E - If you checked box 34b, you must complete form 6198 before going to form 8582. Information about form 4835, farm rental income and expenses, including recent updates, related forms and. If you checked box 34b, you must complete form 6198 before going to form 8582. It depends on whether you receive cash payments or a share of the production as rent. Much interest you are allowed to deduct on form 4835. Ad access irs tax forms. In either case, enter the deductible loss here and on schedule e (form 1040),. Web report as income on schedule e (form 1040), part i; A partnership or s corporation with rental income and. Ad signnow.com has been visited by 100k+ users in the past month Web report as income on schedule e (form 1040), part i; • estate or trust with rental income and expenses from. Complete, edit or print tax forms instantly. A partnership or s corporation with rental income and. Ad access irs tax forms. Web schedule e and form 1040. Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Use screen 4835 on the. If you checked box 34b, you must complete form 6198 before going to form 8582. Complete, edit or print tax forms instantly. Web download or print the 2022 federal form 4835 (farm rental income and expenses) for free from the federal internal revenue service. A partnership or s corporation with rental income and. Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. In either. 2022 instructions for schedule f (2022) profit or loss from farming. Much interest you are allowed to deduct on form 4835. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Much interest you are allowed to deduct on form 4835. 2022 instructions for schedule f (2022) profit or loss from farming. Schedule e, if you are receiving fixed cash. Complete, edit or print tax forms instantly. Web download or print the 2022 federal form 4835 (farm rental income and expenses) for free from the federal internal revenue service. • estate or trust with rental income and expenses from. A partnership or s corporation with rental income and. Web download or print the 2022 federal form 4835 (farm rental income and expenses) for free from the federal internal revenue service. Much interest you are allowed to deduct on form 4835. Much interest you are allowed to deduct on form 4835. What is irs form 4835? In either case, enter the deductible loss here and on schedule e (form 1040),. Web report as income on schedule e (form 1040), part i; Web supplemental income and loss. If you checked box 34b, you must complete form 6198 before going to form 8582. • estate or trust with rental income and expenses from. It depends on whether you receive cash payments or a share of the production as rent. Ad signnow.com has been visited by 100k+ users in the past month Web schedule f (form 1040) to report farm income and expenses; Web download or print the 2022 federal form 4835 (farm rental income and expenses) for free from the federal internal revenue. What is irs form 4835? Web schedule e and form 1040. Ad access irs tax forms. Web download or print the 2022 federal form 4835 (farm rental income and expenses) for free from the federal internal revenue service. If you checked box 34b, you must complete form 6198 before going to form 8582. Web report as income on schedule e (form 1040), part i; Much interest you are allowed to deduct on form 4835. Ad access irs tax forms. Web download or print the 2022 federal form 4835 (farm rental income and expenses) for free from the federal internal revenue service. Ultimately, reporting your net farm rental income is essentially the same as. Web report as income on schedule e (form 1040), part i; Web schedule f (form 1040) to report farm income and expenses; Web form 4835 is available in an individual return for taxpayers who need to report farm rental income based on crops or livestock produced by a tenant. Ad access irs tax forms. Much interest you are allowed to deduct on form 4835. If you checked box 34b, you must complete form 6198 before going to form 8582. Schedule e, if you are receiving fixed cash. What is irs form 4835? Information about form 4835, farm rental income and expenses, including recent updates, related forms and. If you checked box 34b, you must complete form 6198 before going to form 8582. Complete, edit or print tax forms instantly. Web supplemental income and loss. Web page last reviewed or updated: Web report as income on schedule e (form 1040), part i; In either case, enter the deductible loss here and on schedule e (form 1040),. Use screen 4835 on the. A partnership or s corporation with rental income and. Web download or print the 2022 federal form 4835 (farm rental income and expenses) for free from the federal internal revenue service. 2022 instructions for schedule f (2022) profit or loss from farming. Much interest you are allowed to deduct on form 4835.2010 schedule e form Fill out & sign online DocHub

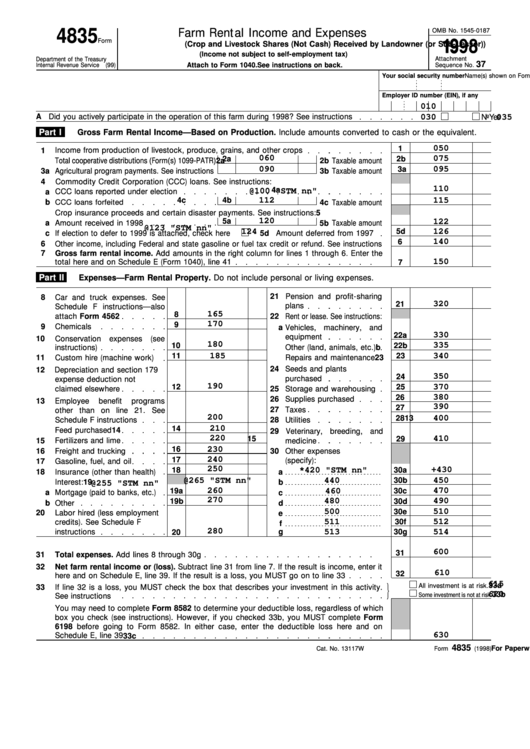

Form 4835 Farm Rental and Expenses (2015) Free Download

Form 4835 Fill Out and Sign Printable PDF Template signNow

Tax Form 1040 Rental And Royalty Schedule E 1040 Form Printable

Form 4835Farm Rental and Expenses

Form 4835 Farm Rental and Expenses (2015) Free Download

IRS Form 4835 2018 Fill Out, Sign Online and Download Fillable PDF

2011 Form IRS 1040 Schedule E Fill Online, Printable, Fillable, Blank

Form 4835 High Resolution Stock Photography and Images Alamy

Fillable Form 4835 Farm Rental And Expenses 1998 printable

Related Post: