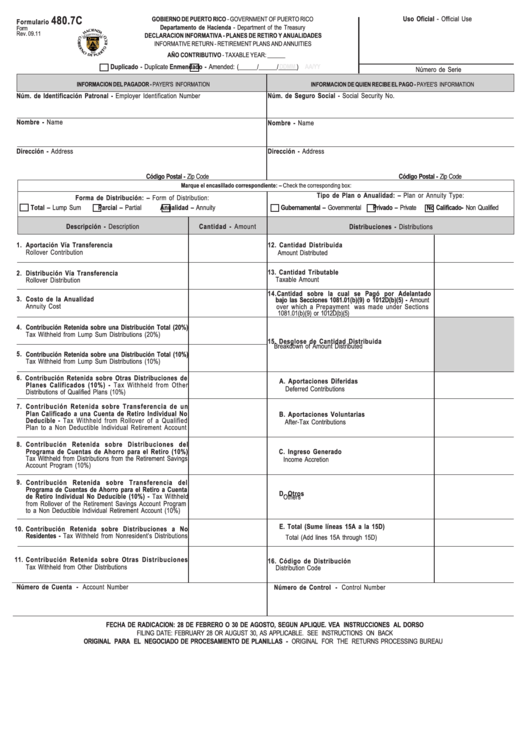

Form 480.6 C

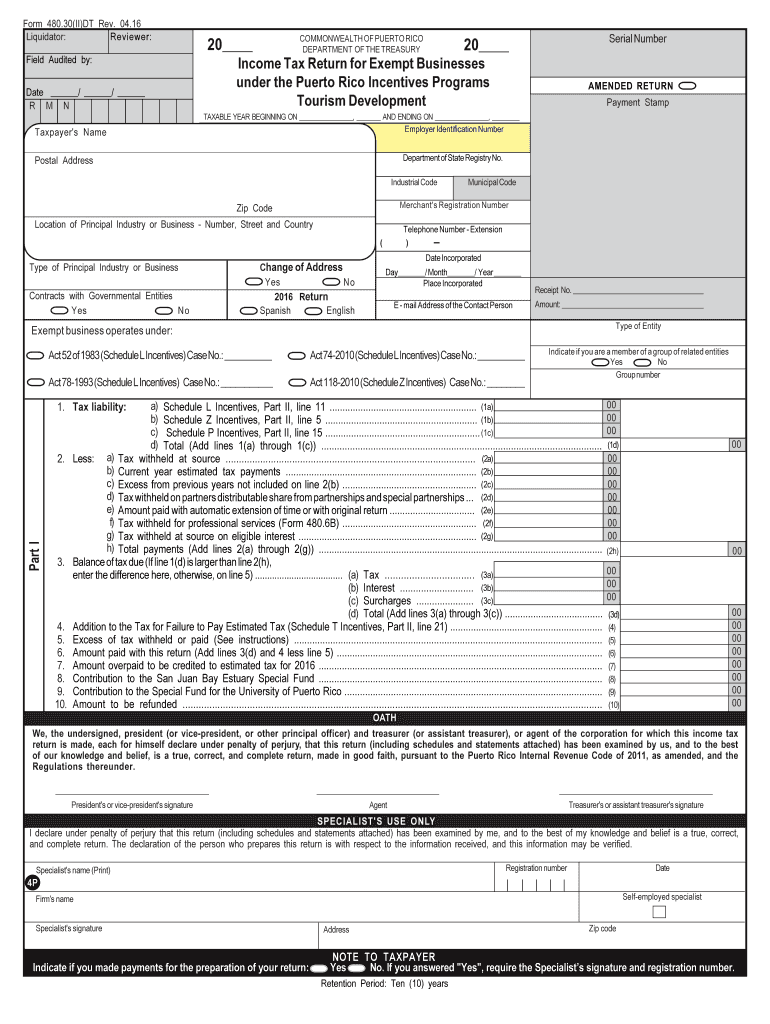

Form 480.6 C - To see as many meteors as possible, wait 30 to 45 minutes after you. El formulario 480.6 ec solo se puede radicar por medios electrónicos a través de uno de los programas certificados por el departamento (“programas. Upon the hearing, if it appears after consideration of all objections. Since this was for services you performed you should enter the income as self employment using schedule c. You will include the income, if. Web an individual who is not a bona fide resident of puerto rico for the tax year generally files tax returns with both puerto rico and the united states. Web on november 12, 2020, the puerto rico treasury department (“treasury”) issued internal revenue informative bulletin no. The irs has also put a plan in motion to digitize. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. The irs is currently working on building its own free tax filing program. You will include the income, if. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. El formulario 480.6 ec solo se puede radicar por medios electrónicos a través de uno de los programas certificados por el departamento (“programas. Unless the governing documents require greater coverage amounts, the association shall maintain crime insurance, employee dishonesty coverage,. Web the capital gain is sourced to puerto rico but also taxable in the us although a foreign tax credit will be allowed for the tax paid or accrued. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Web we would like to show you a description here but the. Upon the hearing, if it appears after consideration of all objections. Since this was for services you performed you should enter the income as self employment using schedule c. You will include the income, if. Web we would like to show you a description here but the site won’t allow us. The forms (480.6a, 480.6b, 480.6d, & 480.7f) must be. The irs has also put a plan in motion to digitize. Web an individual who is not a bona fide resident of puerto rico for the tax year generally files tax returns with both puerto rico and the united states. Unless the governing documents require greater coverage amounts, the association shall maintain crime insurance, employee dishonesty coverage, fidelity bond coverage,.. To see as many meteors as possible, wait 30 to 45 minutes after you. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Web how to file form 480.60 ec? Web we would like to show you a description here but the site won’t allow us. Web as established by the puerto rico internal revenue code. The irs is currently working on building its own free tax filing program. License plates are issued for a period of one year. To see as many meteors as possible, wait 30 to 45 minutes after you. The irs has also put a plan in motion to digitize. Web 2 days agometeor showers are usually best viewed when the sky. Web tax gap $688 billion. To see as many meteors as possible, wait 30 to 45 minutes after you. Web 2 days agometeor showers are usually best viewed when the sky is darkest, after midnight but before sunrise. Upon the hearing, if it appears after consideration of all objections. Addition or elimination of certain areas. Upon the hearing, if it appears after consideration of all objections. You will include the income, if. El formulario 480.6 ec solo se puede radicar por medios electrónicos a través de uno de los programas certificados por el departamento (“programas. Web an attachment in an email or through the mail as a hard copy, as an instant download. This form. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Web tax gap $688 billion. Since this was for services you performed you should enter the income as self employment using schedule c. You will include the income, if. Web we would like to show you a description here but the site won’t allow us. Addition or elimination of certain areas. El formulario 480.6 ec solo se puede radicar por medios electrónicos a través de uno de los programas certificados por el departamento (“programas. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Since this was for services you performed you should enter the income. Web an attachment in an email or through the mail as a hard copy, as an instant download. You will include the income, if. Addition or elimination of certain areas. The irs has also put a plan in motion to digitize. License plates are issued for a period of one year. Web tax gap $688 billion. Web the capital gain is sourced to puerto rico but also taxable in the us although a foreign tax credit will be allowed for the tax paid or accrued. It covers investment income that has been subject to puerto rico source withholding. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. This form is for information only. Since this was for services you performed you should enter the income as self employment using schedule c. The preparation of form 480.6a will be required when the payment. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. The forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Web an individual who is not a bona fide resident of puerto rico for the tax year generally files tax returns with both puerto rico and the united states. Web we would like to show you a description here but the site won’t allow us. It covers investment income that has been subject to puerto rico source withholding. Upon the hearing, if it appears after consideration of all objections. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. The irs is currently working on building its own free tax filing program.Form 480 6c Instructions Fill Out and Sign Printable PDF Template

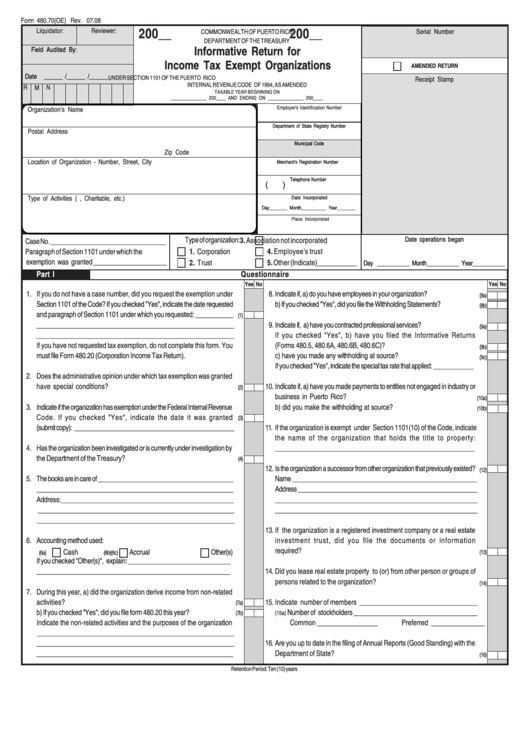

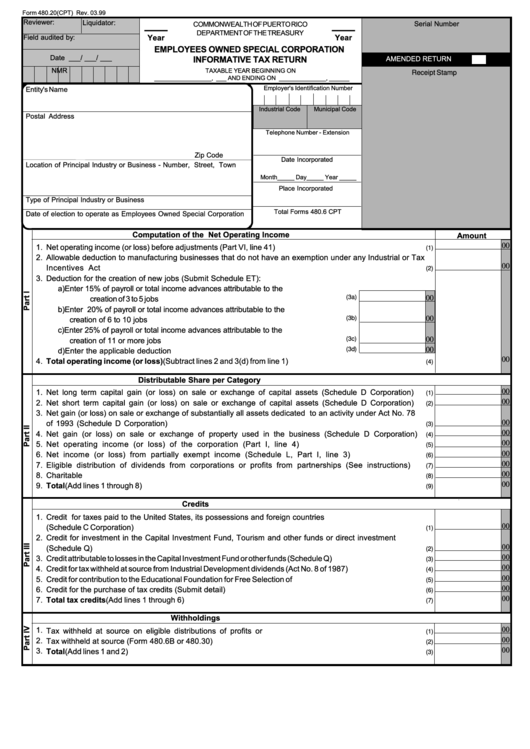

Form 480.70(Oe) Informative Return For Tax Exempt

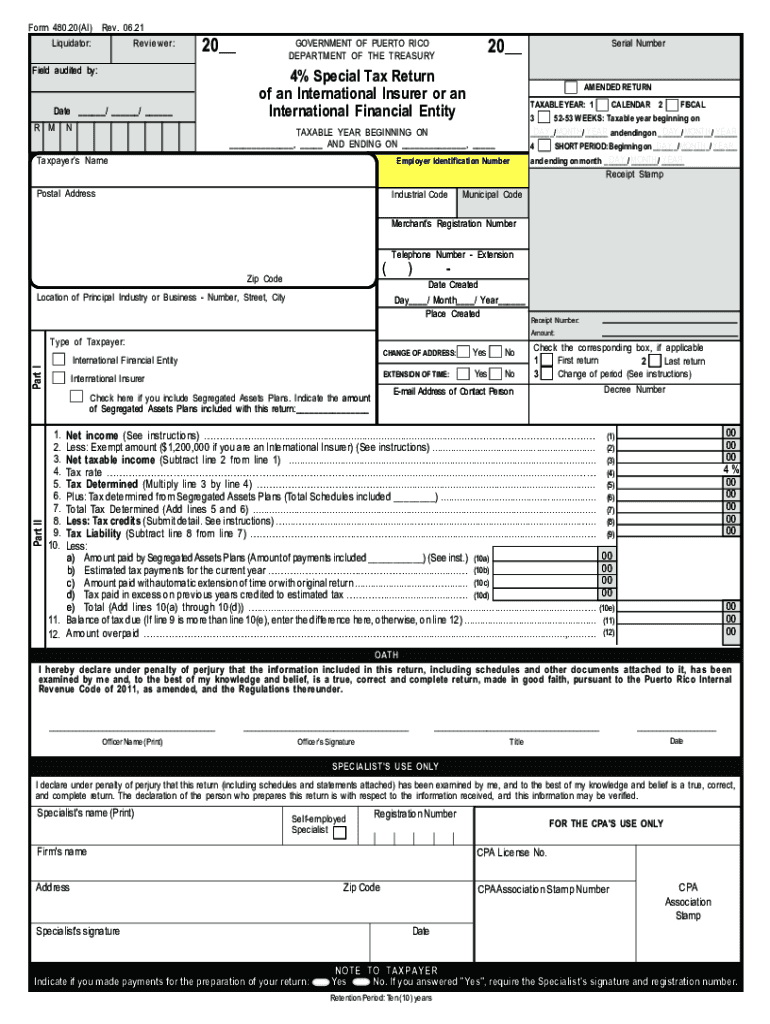

Pr 480 Insurer Entity Form Fill Out and Sign Printable PDF Template

20192023 PR Form 480.20(U) Fill Online, Printable, Fillable, Blank

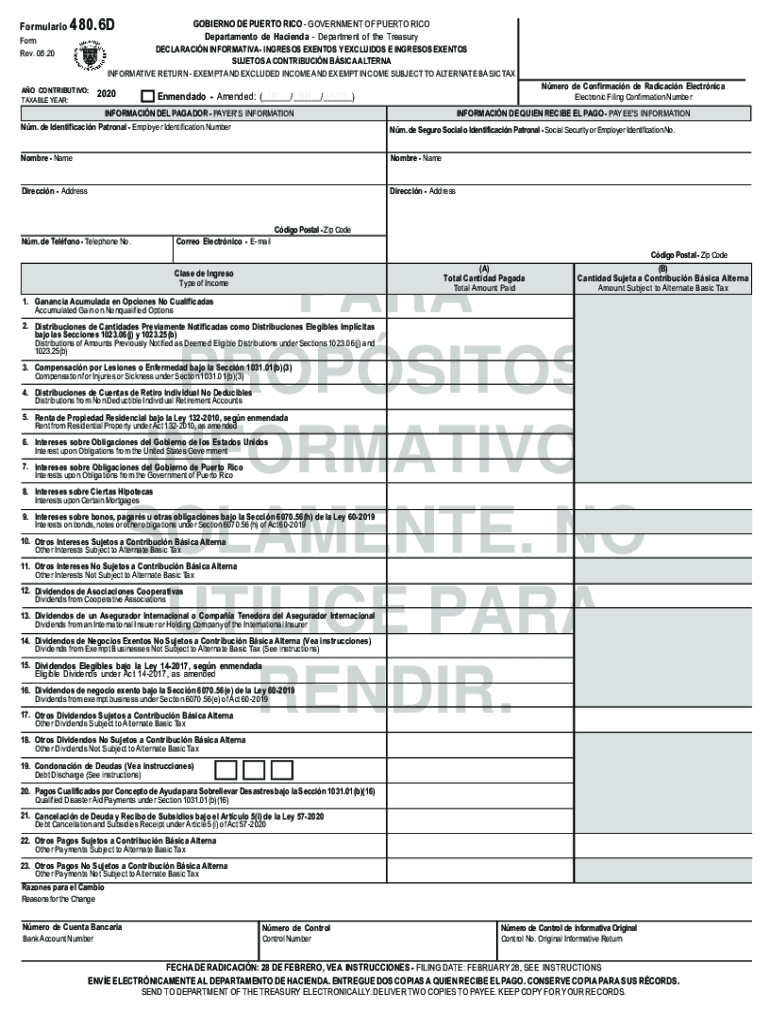

Form 480 6d puerto rico Fill out & sign online DocHub

Form 480.7c Informative Return Retirement Plans And Annuities

480 7a 2018 Fill Online, Printable, Fillable, Blank pdfFiller

480.6A 2019 Public Documents 1099 Pro Wiki

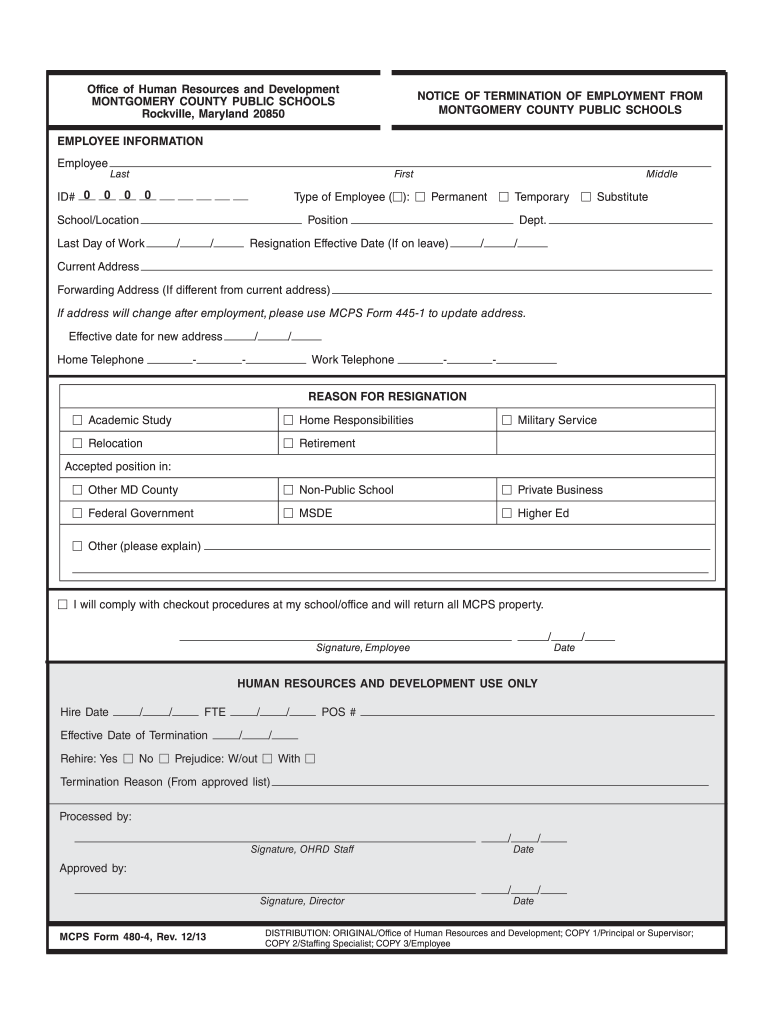

MCPS Form 480 4 Notice of Termination of Employment from

Form 480.20(Cpt) Employees Owned Special Corporation Informative Tax

Related Post: