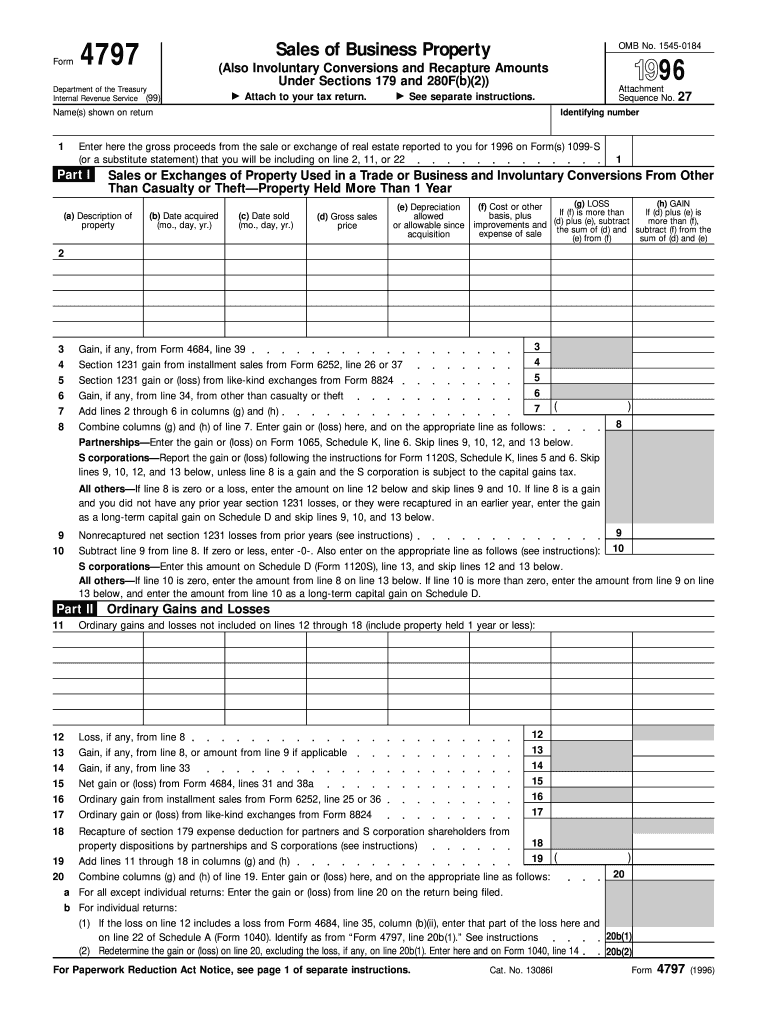

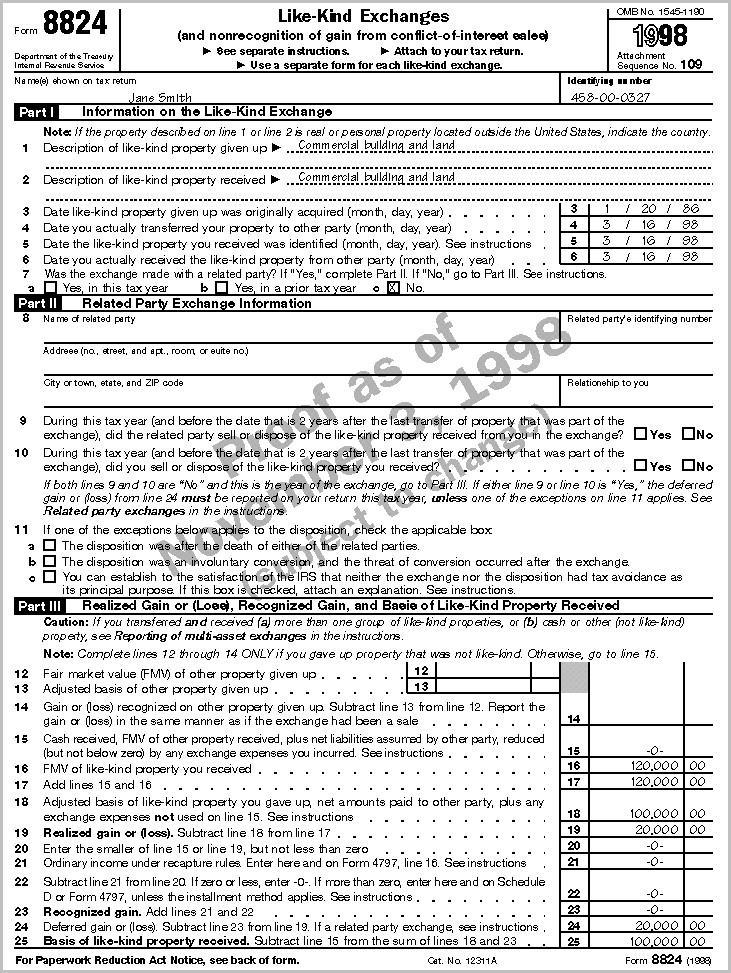

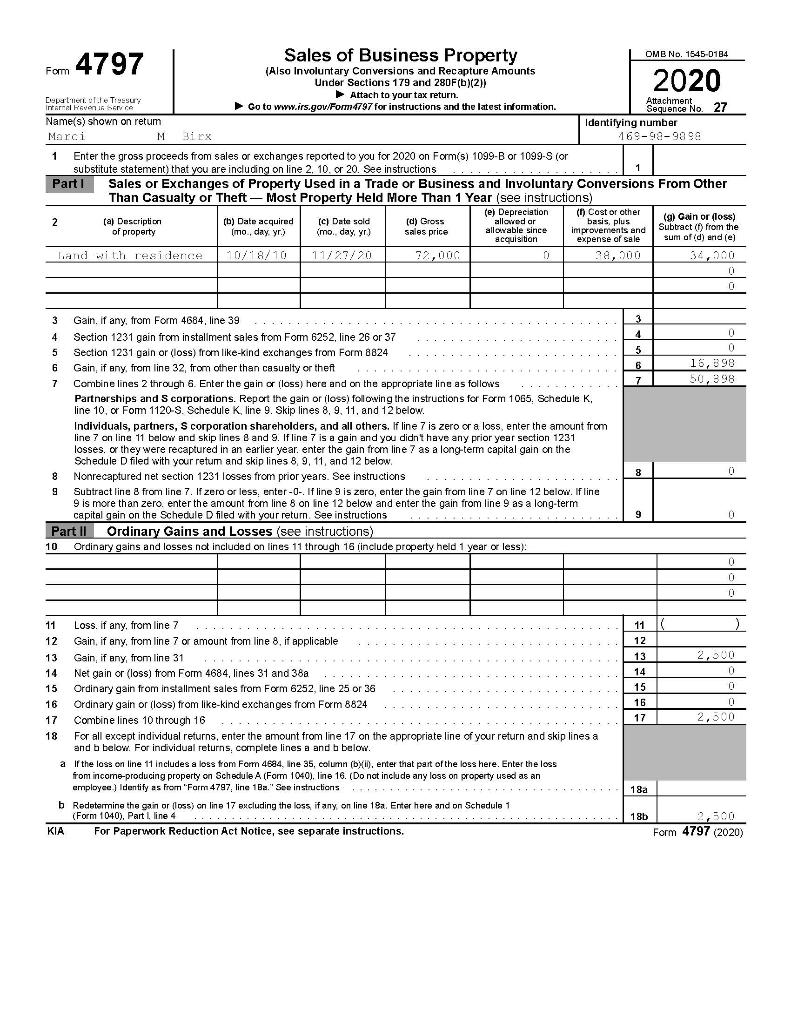

Form 4797 Part 1

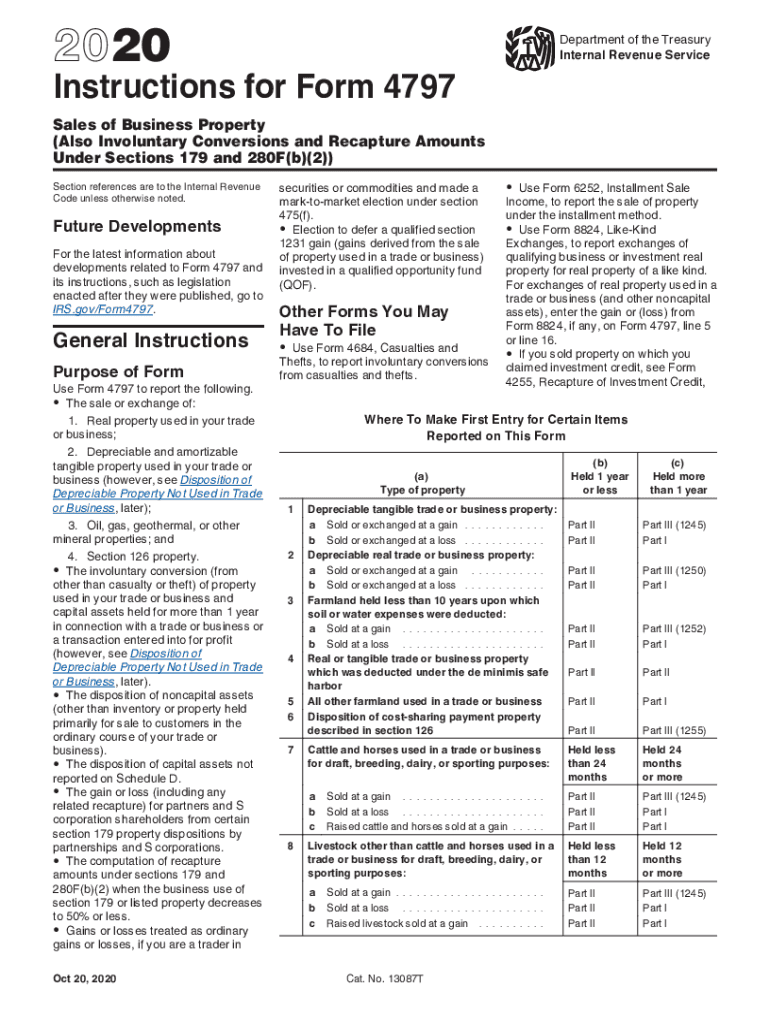

Form 4797 Part 1 - (also involuntary conversions and recapture amounts. •the sale or exchange of: Web as outlined above, the irs requires business owners to use form 4797 to report the disposition of capital assets not reported on schedule d. (ii), enter that part of. Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Ad signnow.com has been visited by 100k+ users in the past month Or form 8824, parts i and ii. Web form 4797, sales of business property is used to report the following transactions: Enter the name and identifying. (ii), enter that part of. Hello, i followed turbotax instructions to record the sale of a rental property under rental and royal properties section. Get ready for tax season deadlines by completing any required tax forms today. Real property used in your trade or business; Web reporting transactions on form 4797. Or form 8824, parts i and ii. (also involuntary conversions and recapture amounts. Depreciable and amortizable tangible property used in your. Web use form 4797 to report the following. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Property used in a trade or business. Form 4797 input for sales of business property. Real property used in your trade or business; Web form 4797, sales of business property is used to report the following. Web reporting transactions on form 4797. Solved•by intuit•15•updated 1 year ago. In 2019 turbotax, for a form 1065. Hello, i followed turbotax instructions to record the sale of a rental property under rental and royal properties section. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts. Property used in a trade or business. Web what is form 4797? In 2019 turbotax, for a form 1065. Depreciable and amortizable tangible property used in your. Enter the name and identifying. Enter the name and identifying. Hello, i followed turbotax instructions to record the sale of a rental property under rental and royal properties section. Web complete form 4797, line 19, columns (a), (b), and (c); Depreciable and amortizable tangible property used in your. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions. Complete, edit or print tax forms instantly. Web i have a k1 with required entries for form 4797 part ii line 10 and form 6251 line 17. Or form 8824, parts i and ii. Web as outlined above, the irs requires business owners to use form 4797 to report the disposition of capital assets not reported on schedule d. Sales. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Department of the treasury internal revenue service. Form 4797 input for sales of business property. Solved•by intuit•15•updated 1 year ago. In 2019 turbotax, for a form 1065. Enter the name and identifying. Property used in a trade or business. Department of the treasury internal revenue service. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. First of all, you can get this form from the department of treasury or you. Solved•by intuit•15•updated 1 year ago. Enter the amount in ordinary gain (loss) to. Department of the treasury internal revenue service. Web what is form 4797? Form 4797 input for sales of business property. Form 4797 input for sales of business property. Depreciable and amortizable tangible property used in your. Web complete form 4797, line 19, columns (a), (b), and (c); (ii), enter that part of. Web reporting transactions on form 4797. Web i have a k1 with required entries for form 4797 part ii line 10 and form 6251 line 17. Web use form 4797 to report the following. Solved•by intuit•15•updated 1 year ago. Real property used in your trade or business; Enter the amount in ordinary gain (loss) to. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of. Report the amount from line 1 above on form 4797, line 20;. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts. Ad signnow.com has been visited by 100k+ users in the past month Enter the name and identifying. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Or property was sold at a loss. Form 6252, lines 1 through 4; Report sales/exchanges of property held > 1 year when depreciation was not allowed/allowable. Department of the treasury internal revenue service.Form 4797 Fill Out and Sign Printable PDF Template signNow

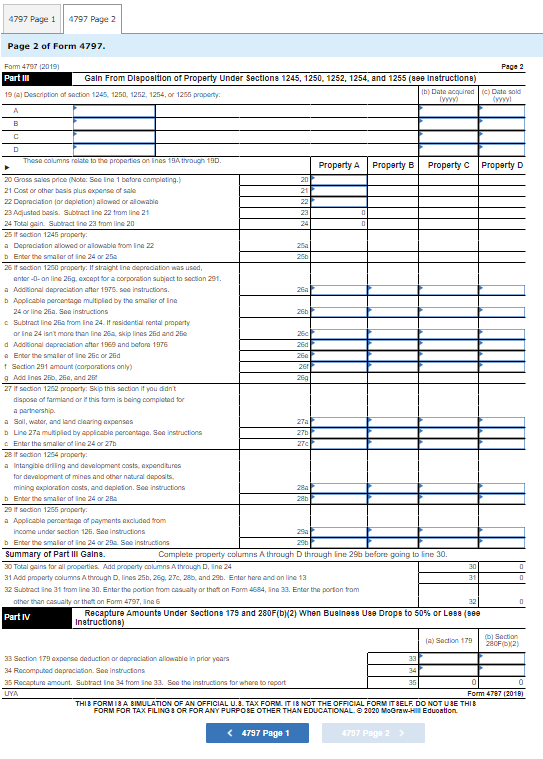

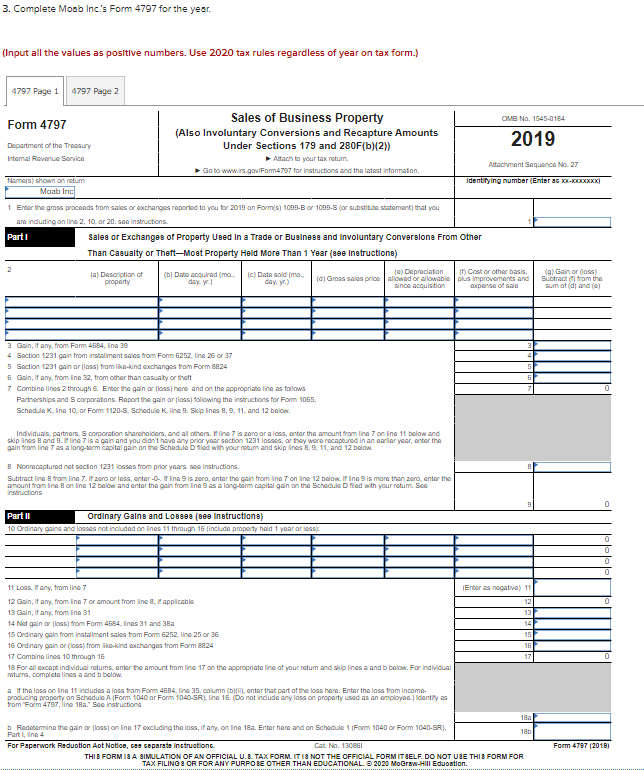

Complete Moab Inc S Form 4797 For The Year Aulaiestpdm Blog

Publication 544, Sales and Other Dispositions of Assets; Chapter 4

3. Complete Moab Inc.'s Form 4797 for the year.

Irs 1040 Form 4797 Form Resume Examples

Line 7 of Form 4797 is 50,898At what rate(s) is

Irs form 4797 instructions 2018 Fill out & sign online DocHub

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

A Not So Unusual Disposition Reported on IRS Form 4797 Center for

Form 4797 Sales of Business Property and Involuntary Conversions

Related Post:

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://image.slidesharecdn.com/1273290/95/form-4797sales-of-business-property-2-728.jpg?cb=1239371111)