Form 4797 Instruction

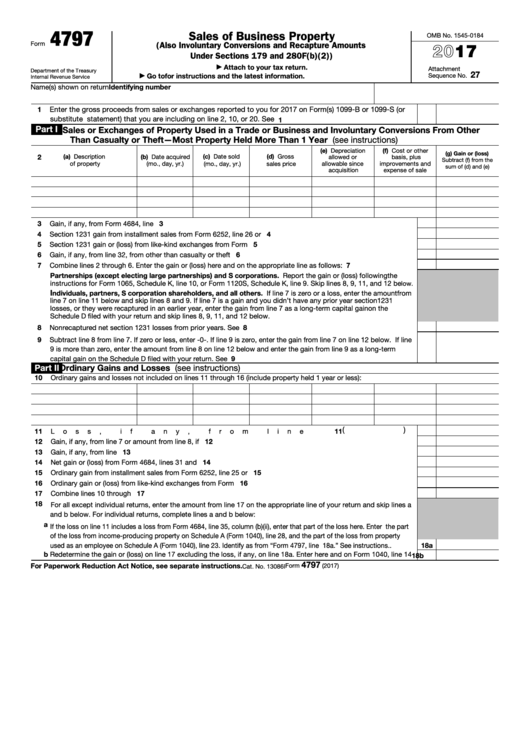

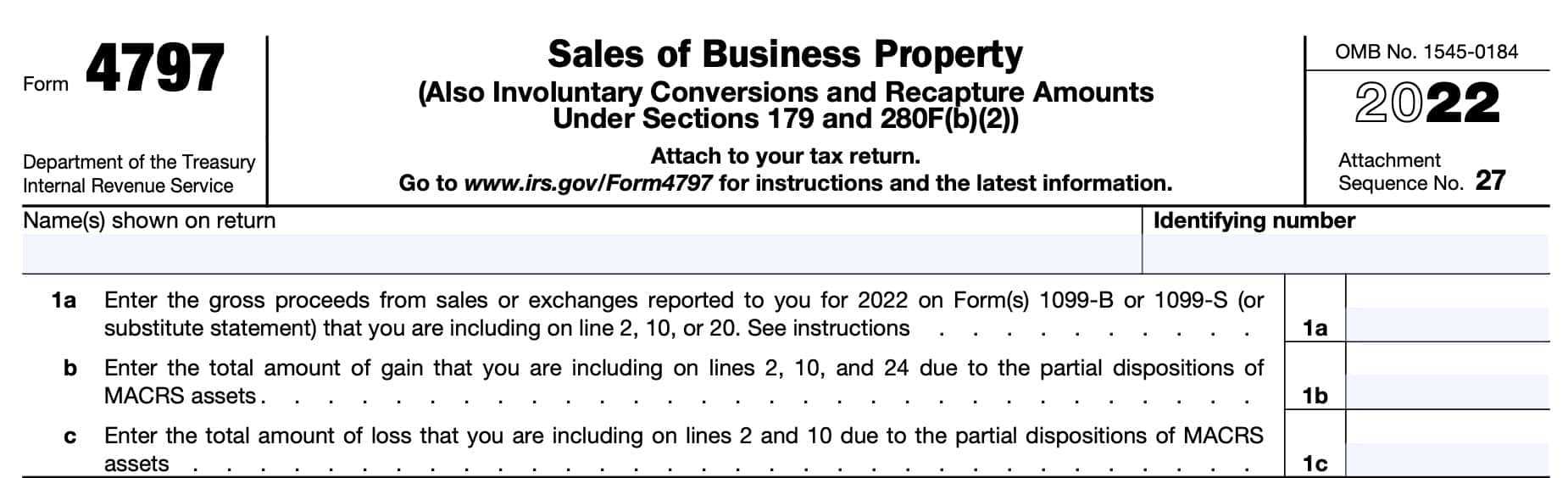

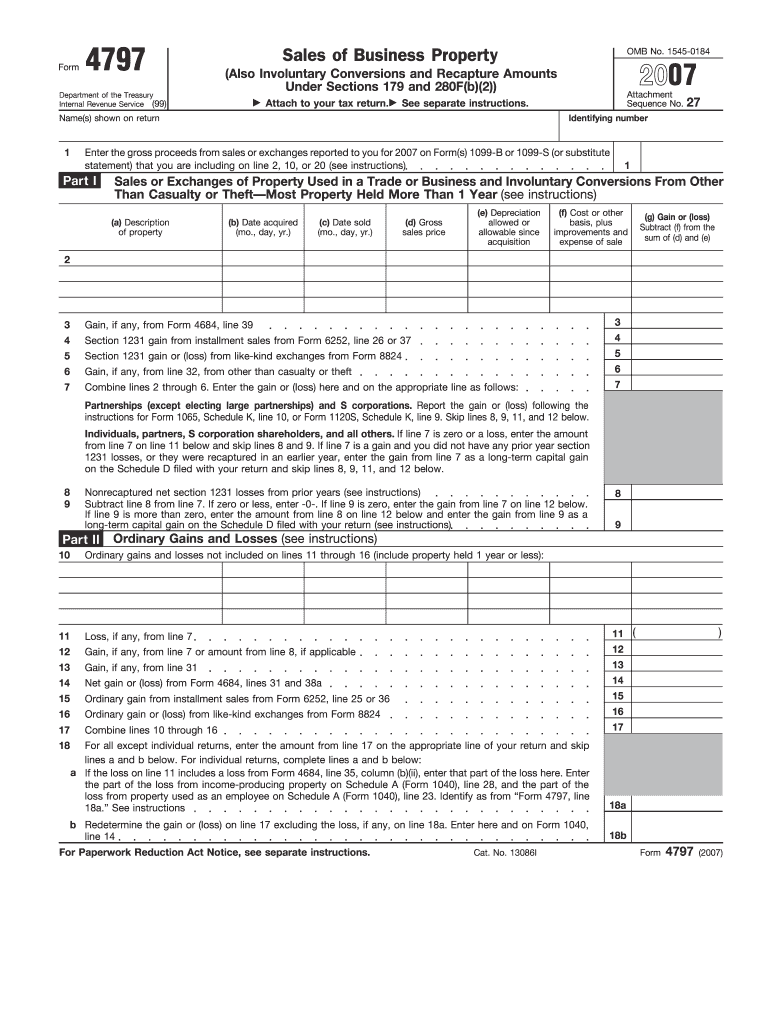

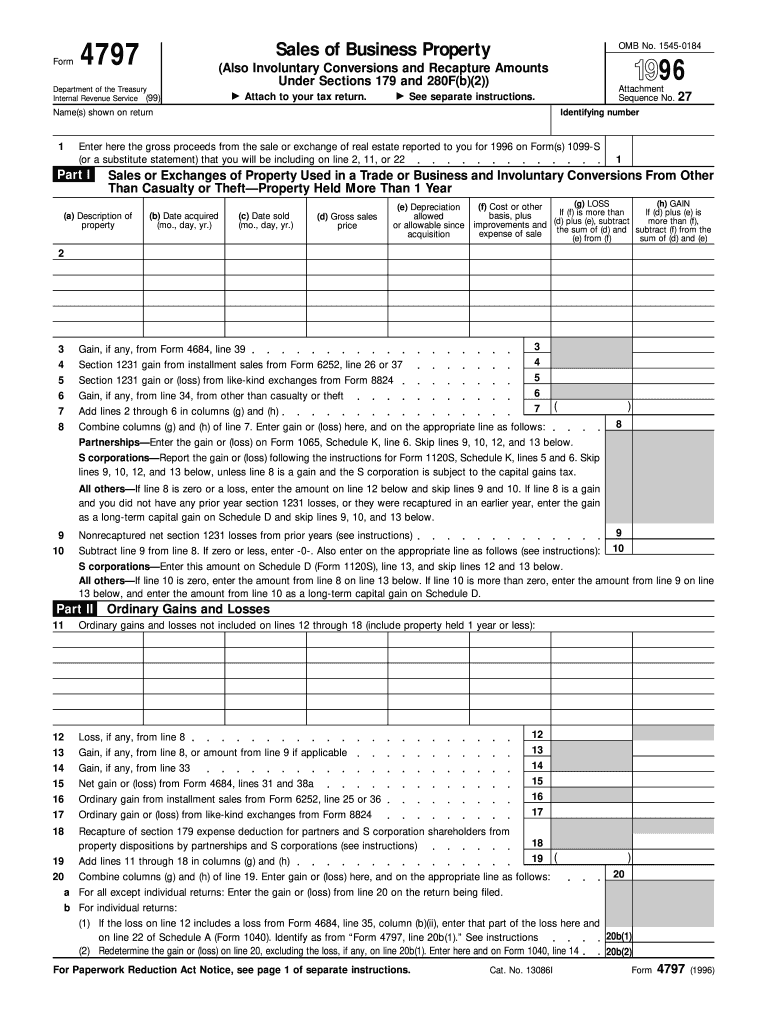

Form 4797 Instruction - Web form 4797 department of the treasury. Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. Open form follow the instructions. The sale or exchange of property. Web form 4797, sales of business property, page 1, is used to report: Enter here and on form 1040, line 14. Property used in your trade or business; Real property used in your trade or business; Web what is form 4797? Easily sign the form with your finger. Web form 4797, sales of business property, page 1, is used to report: The sale or exchange of: Enter here and on form 1040, line 14. The involuntary conversion of property and. Other forms you may have to file. Complete and file form 4797: Easily sign the form with your finger. The involuntary conversion of property and. Enter the name and identifying. Web form 8949 is needed and when it isn't. The sale or exchange of: Web instructions for form 4797. The involuntary conversion of property and. Open form follow the instructions. Gains and losses on the sale of depreciable assets held. Web we last updated the sales of business property in december 2022, so this is the latest version of form 4797, fully updated for tax year 2022. The sale or exchange of: Easily sign the form with your finger. The sale or exchange of property. Complete, edit or print tax forms instantly. You can download or print. Gains and losses on the sale of depreciable assets held. Real property used in your trade or business; The sale or exchange of: Property used in your trade or business; Web enter the amount in ordinary gain (loss) to be reported on 4797, line 10, or in passive ordinary gain (loss) to be reported on 4797, line 10. Other forms you may have to file. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Gains and losses on the sale of depreciable assets held. Real property used in your trade or business; Property used in your trade or business; Web form 8949 is needed and when it isn't. The sale or exchange of: Web what is form 4797? Open form follow the instructions. Enter the name and identifying. Web form 4797 department of the treasury. Real property used in your trade or business; Easily sign the form with your finger. First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. The involuntary conversion of property and. Gains and losses on the sale of nondepreciable assets. Web if you disposed of both depreciable property and other property (for example, a building and land) in the same transaction and realized a gain, you must allocate the amount realized. Ad download or email irs 4797 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Use form 4797 to report: Complete and file. Sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) department of the treasury. Sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) department of the treasury. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Enter here and on form 1040, line 14. Complete and file form 4797: Other forms you may have to file. Web form 8949 is needed and when it isn't. Use form 4797 to report the following. The sale or exchange of: Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. Gains and losses on the sale of depreciable assets held. Ad download or email irs 4797 & more fillable forms, register and subscribe now! Property used in your trade or business; The involuntary conversion of property and. The sale or exchange of: Real property used in your trade or business; Web enter the amount in ordinary gain (loss) to be reported on 4797, line 10, or in passive ordinary gain (loss) to be reported on 4797, line 10. Real property used in your trade or business; Web according to the irs, you should use your 4797 form to report all of the following: Web if you disposed of both depreciable property and other property (for example, a building and land) in the same transaction and realized a gain, you must allocate the amount realized.IRS Form 4797 Guide for How to Fill in IRS Form 4797

IRS Form 4797 Instructions Sales of Business Property

IRS 4797 2019 Fill and Sign Printable Template Online US Legal Forms

Instructions for Form 4797 Internal Revenue Service Fill Out and Sign

Form 4797 Fill Out and Sign Printable PDF Template signNow

2011 Form IRS Instruction 4797 Fill Online, Printable, Fillable, Blank

IRS Form 4797 Instructions Sales of Business Property

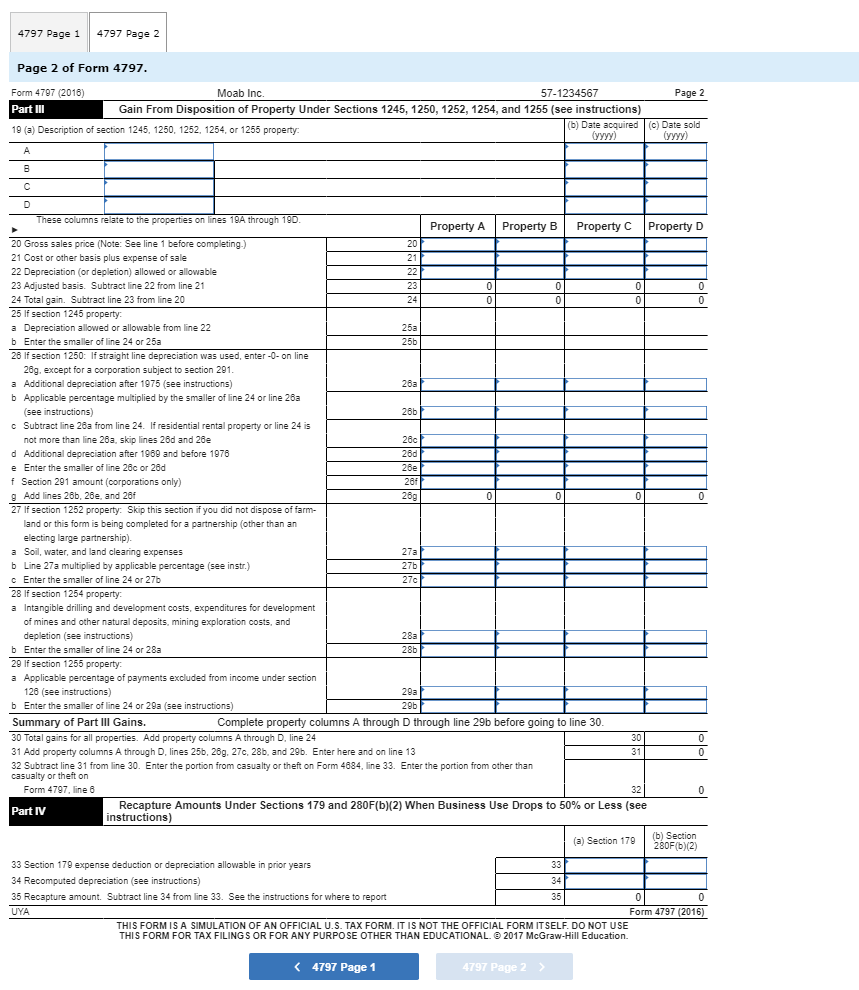

Complete Moab Inc S Form 4797 For The Year Aulaiestpdm Blog

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Fillable Form 4797 Sales Of Business Property 2016 printable pdf

Related Post:

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://www.formsbirds.com/formimg/more-tax-forms/8161/form-4797-sales-of-business-property-2014-l2.png)