Form 4684 Instructions

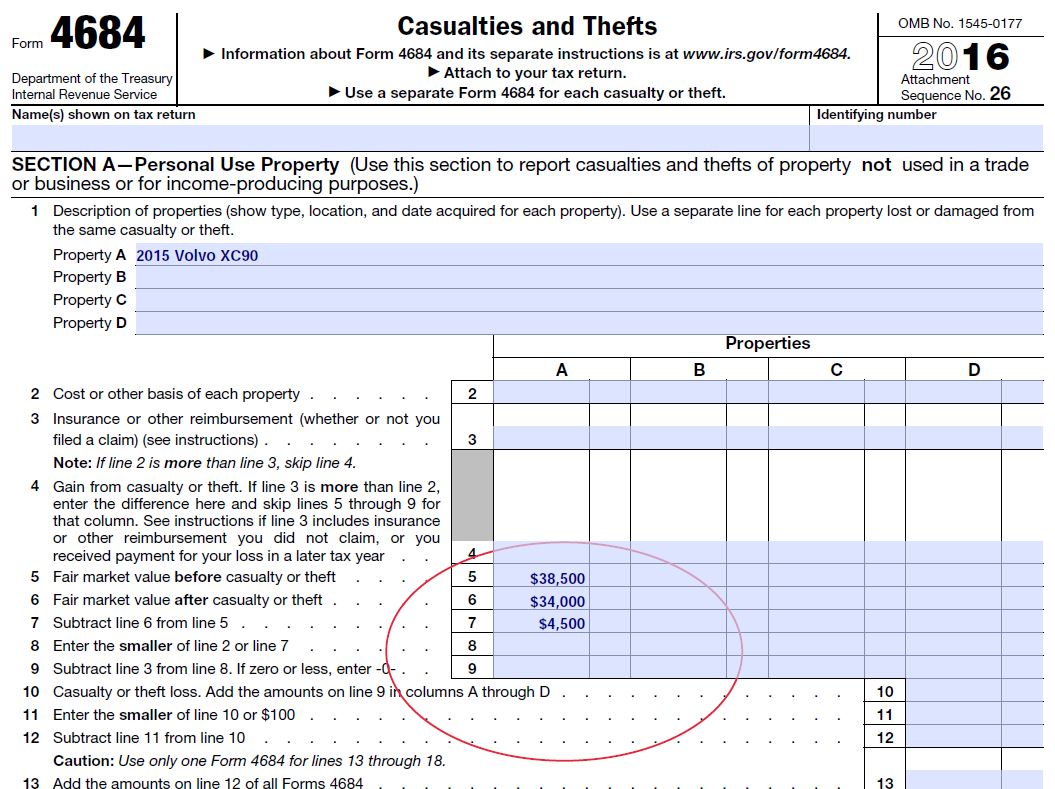

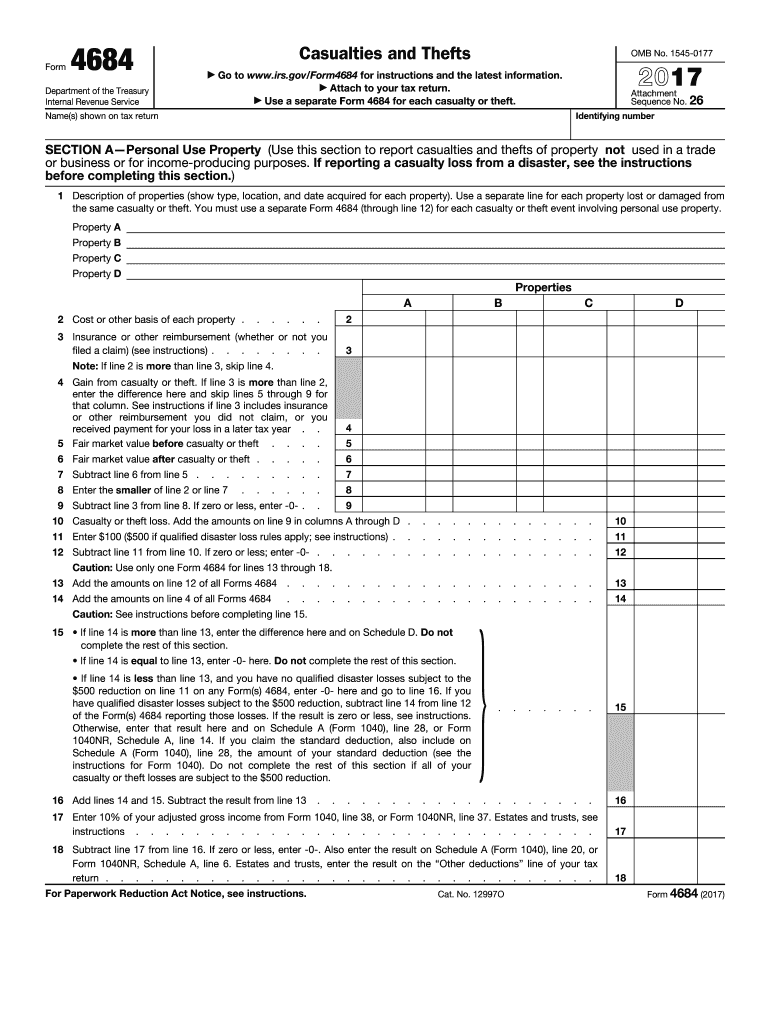

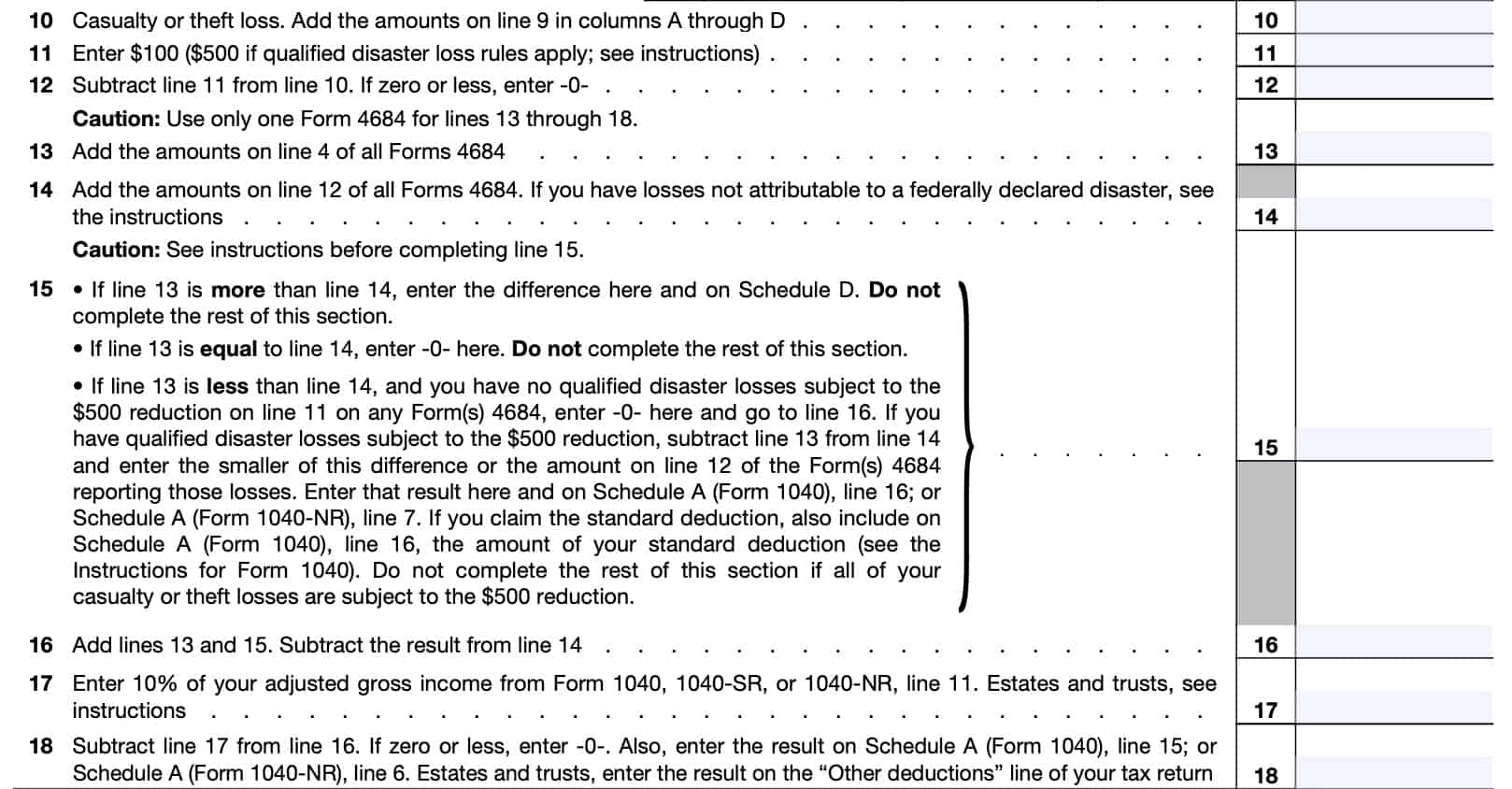

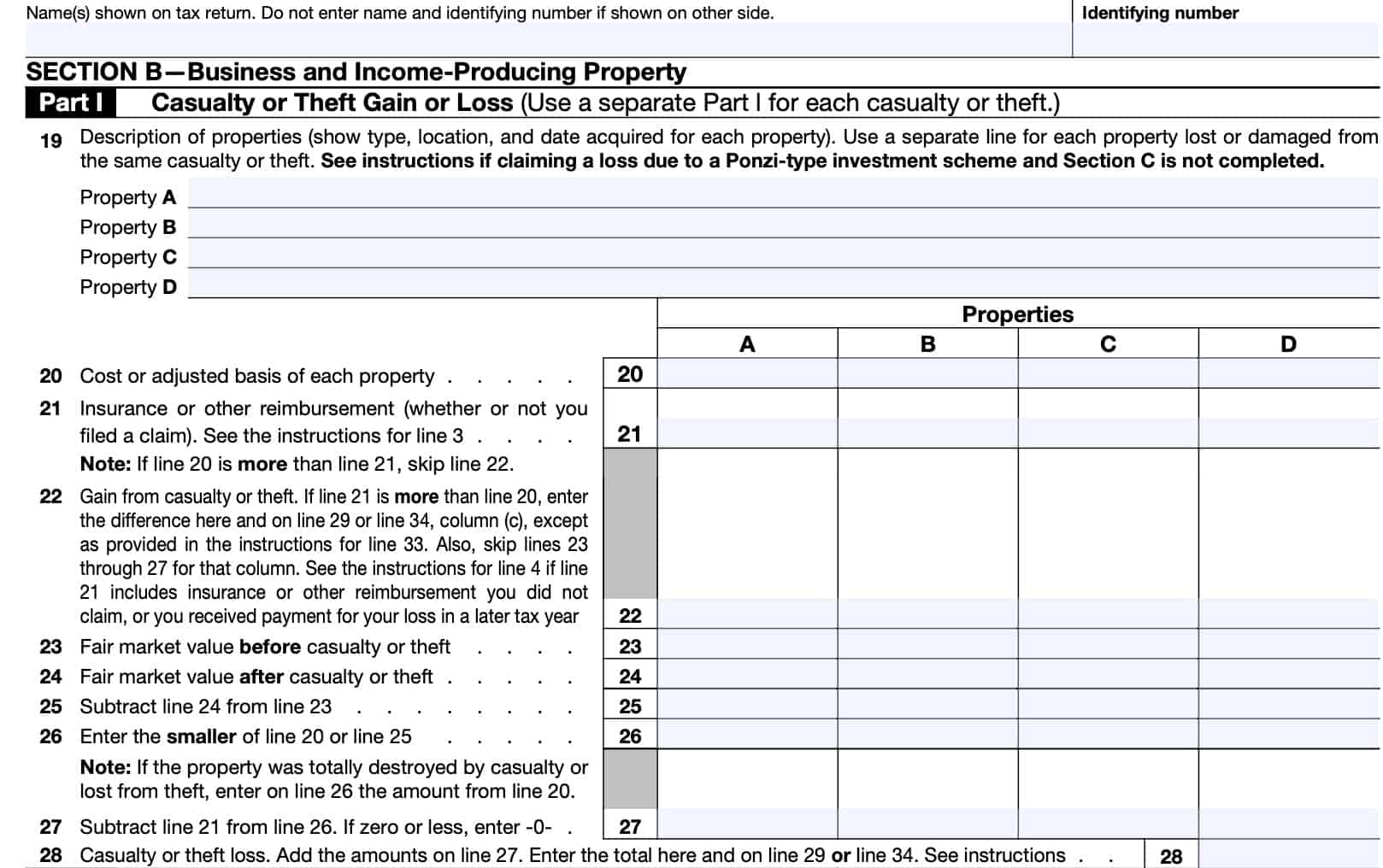

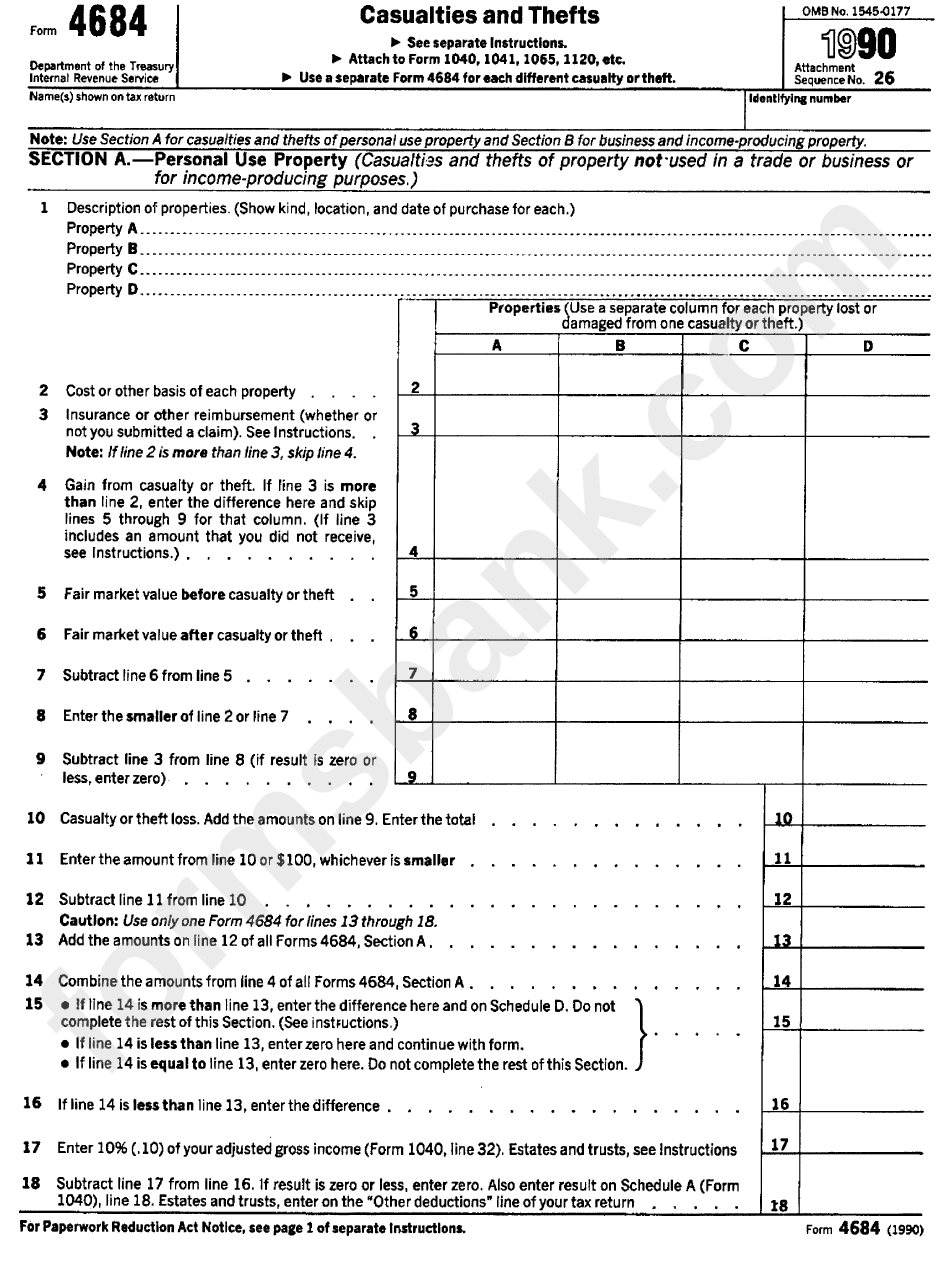

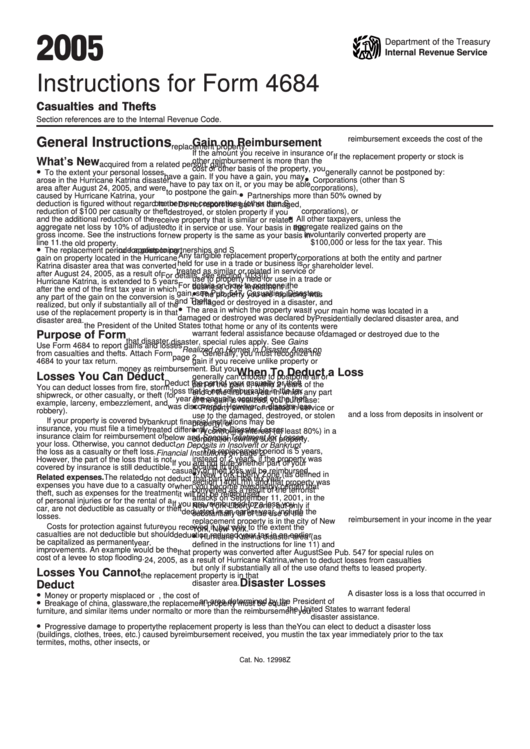

Form 4684 Instructions - Attach form 4684 to your income tax return. Web a casualty loss is claimed on form 4684, casualties and thefts, and is reported on schedule a as an itemized deduction. Web page last reviewed or updated: Web this article will show you how to generate form 4684, casualties and thefts, and how to report a casualty or theft. Web claiming the deduction requires you to complete irs form 4684. Tax relief for homeowners with corrosive drywall: Complete, edit or print tax forms instantly. Web if you choose to file the loss on the previous tax return, you would need to file an amended return. Try it for free now! Web for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4684. Department of the treasury internal revenue service. Purpose of form use form 4684 to report. Department of the treasury internal revenue service. Car, boat, and other accidents;. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Web how do you enter a casualty or theft for form 4684 in an individual return in proconnect? Look at irs publication 551, basis of assets, to help you figure the adjusted basis in your property. Go to www.irs.gov/form4684 for instructions and the latest information. Web entering a casualty or theft for form 4684. Purpose of form use form 4684. Department of the treasury internal revenue service. Web use a separate form 4684 for each casualty or theft. Tax relief for homeowners with corrosive drywall: Purpose of form use form 4684 to report gains and losses from casualties and thefts. To enter a casualty or theft on screen 22,. Web if you choose to file the loss on the previous tax return, you would need to file an amended return. See the form 8997 instructions for more information. Web entering a casualty or theft for form 4684. How to calculate your deduction amount. Web page last reviewed or updated: Web how do you enter a casualty or theft for form 4684 in an individual return in proconnect? Tax relief for homeowners with corrosive drywall: Go to www.irs.gov/form4684 for instructions and the latest information. Ad complete irs tax forms online or print government tax documents. Web need to attach form 8997 annually until you dispose of the qof investment. A casualty occurs when your property is damaged as a result of a disaster such as a storm,. Web entering a casualty or theft for form 4684. You can enter losses in two different areas, depending on whether the loss. Web page last reviewed or updated: See the form 8997 instructions for more information. A casualty occurs when your property is damaged as a result of a disaster such as a storm,. For more information on reporting a gain from the reimbursement of a casualty or. However, if the casualty loss is not the result of a federally declared disaster, you must be itemize. Web if you choose to file the loss on the. You can enter losses in two different areas, depending on whether the loss. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions. Web a casualty loss is claimed on form 4684, casualties and thefts, and is reported on schedule a as an itemized deduction. Web a casualty loss is claimed as an itemized deduction on. Department of the treasury internal revenue service. Web for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4684. Car, boat, and other accidents;. Upload, modify or create forms. Attach form 4684 to your income tax return. Web for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4684. This article will assist you with entering a casualty or theft for form 4684 in proseries. Web how do you enter a casualty or theft for form 4684 in an individual return in proconnect? Department. Go to www.irs.gov/form4684 for instructions and the latest information. Attach form 4684 to your income tax return. Try it for free now! Car, boat, and other accidents;. For more information on reporting a gain from the reimbursement of a casualty or. Web entering a casualty or theft for form 4684. However, if the casualty loss is not the result of a federally declared disaster, you must be itemize. Purpose of form use form 4684 to report gains and losses from casualties and thefts. Web this article will show you how to generate form 4684, casualties and thefts, and how to report a casualty or theft. Web this publication explains the tax treatment of casualties, thefts, and losses on deposits. See the form 8997 instructions for more information. Web how do you enter a casualty or theft for form 4684 in an individual return in proconnect? See the form 8997 instructions for more information. You can enter losses in two different areas, depending on whether the loss. A casualty occurs when your property is damaged as a result of a disaster such as a storm,. Web use the instructions on form 4684 to report gains and losses from casualties and thefts. The taxpayer must report the. Ad complete irs tax forms online or print government tax documents. Web calculate and report your losses on form 4684, casualties and thefts. You may be able to deduct part or all of each loss caused by theft, vandalism, fire, storm, or similar causes;Diminished Value and Taxes, IRS form 4684 Diminished Value of

Instructions For Form 4684 Casualties And Thefts 2005 printable pdf

4684 Form Fill Out and Sign Printable PDF Template signNow

Instructions For Form 4684 Casualties And Thefts 2016 printable pdf

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

Form 4684 Casualties And Thefts 1990 printable pdf download

Instructions For Form 4684 Casualties And Thefts 2005 printable pdf

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

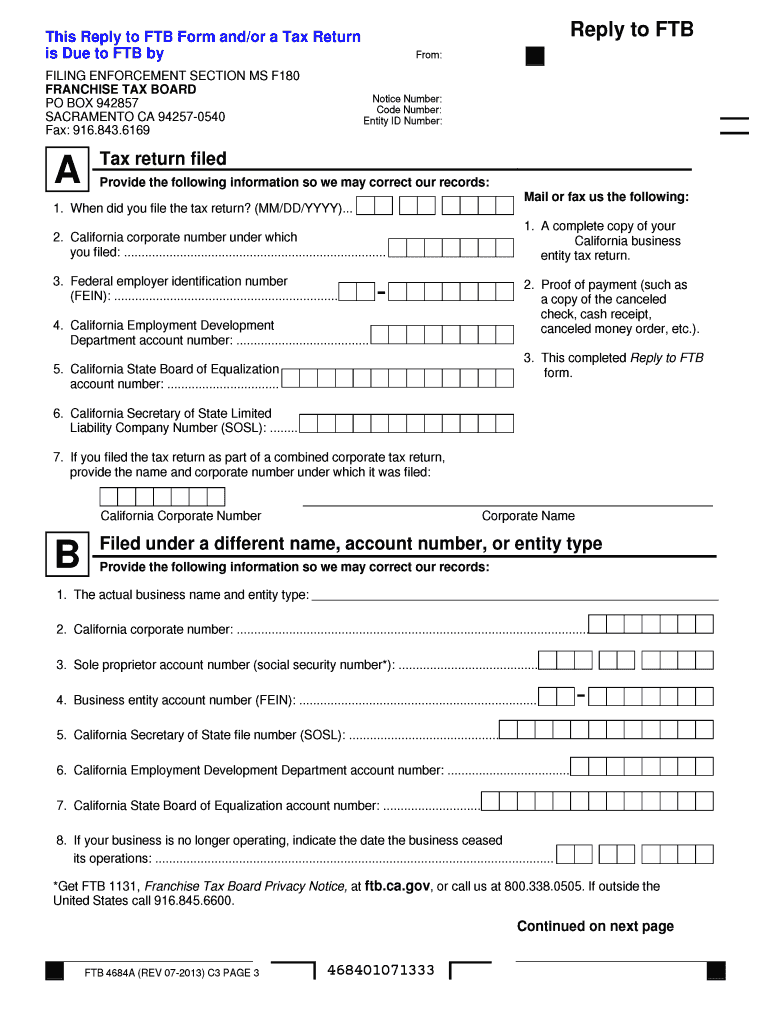

ca form 4684a Fill out & sign online DocHub

Related Post: