Form 4506-B

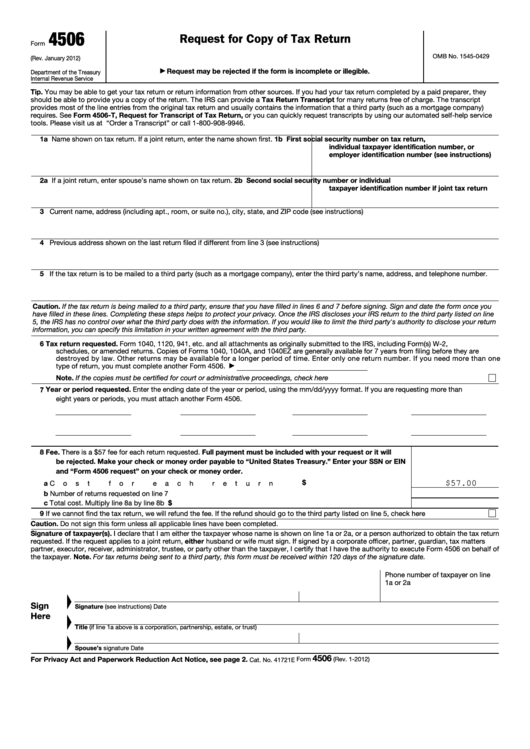

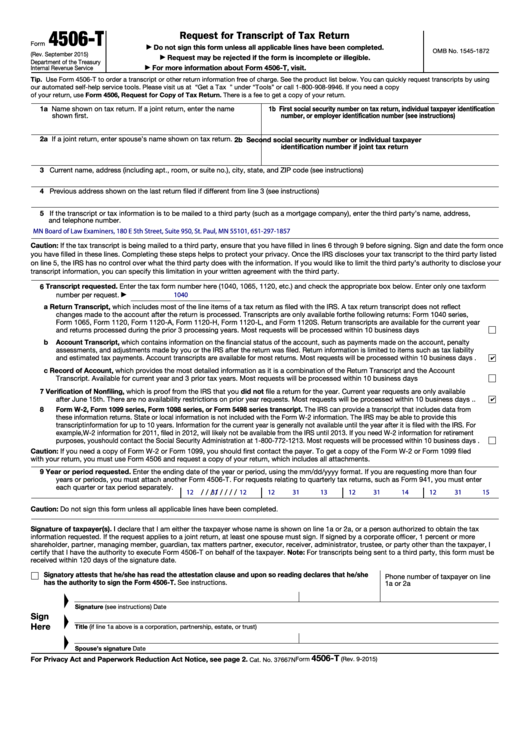

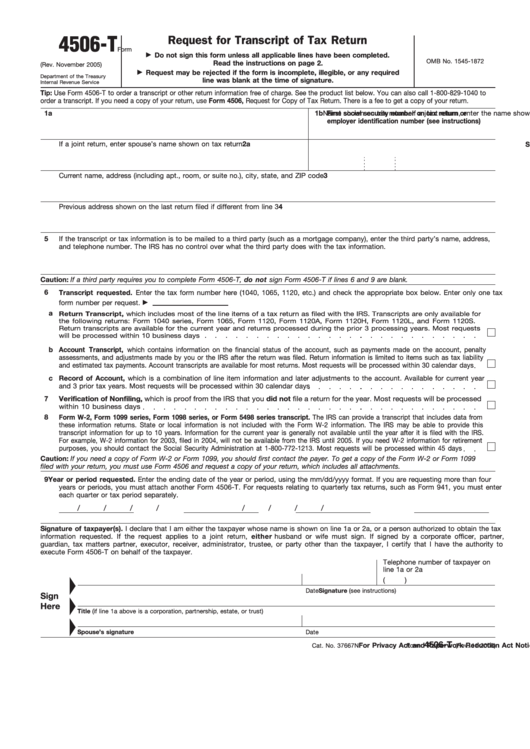

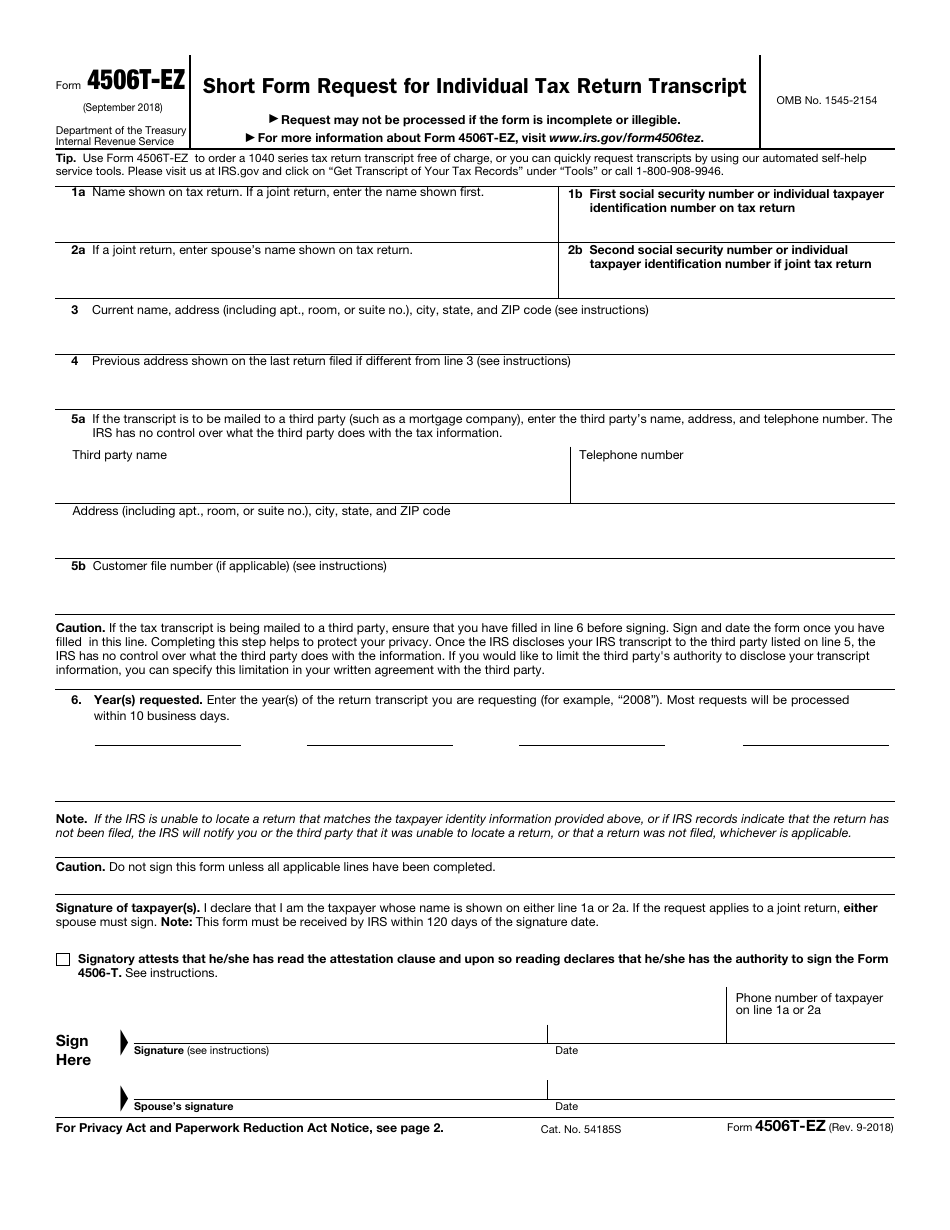

Form 4506-B - You can also designate (on line 5) a third party to receive the tax return. Web irs revising form 1024; Form 4506 is useful if you need a copy of your tax return from more than three years ago. Editable form 4506 t simple. Web page last reviewed or updated: The irs has reminded eligible educators that they will be able to deduct out of pocket classroom. Ad fillable irs form 4506 t. The purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated. Ives request for transcript of tax return. Enter the end date of the tax. Ad fillable irs form 4506 t. Information about form 4506, request for copy of tax return, including recent updates, related forms and. Web page last reviewed or updated: Internal revenue code section 6104 states that if an organization described in section 501(c) or (d) is exempt. How long will it take? Editable form 4506 t simple. Internal revenue code section 6104 states that if an organization described in section 501 (c) or (d) is exempt. Enter the end date of the tax. Internal revenue code section 6104 states that if an organization described in section 501(c) or (d) is exempt. How long will it take? Determination letters issued 2014 or later are available on tax exempt organization. Web form 4506, request for copy of tax return, takes longer and costs $50 per return. How long will it take? The irs has reminded eligible educators that they will be able to deduct out of pocket classroom. A copy of an exempt organization’s exemption application or letter. How long will it take? Enter the end date of the tax. Internal revenue code section 6104 states that if an organization described in section 501(c) or (d) is exempt. A copy of an exempt organization’s exemption application or letter. Web form 4506, request for copy of tax return, takes longer and costs $50 per return. Enter the end date of the tax. Ives request for transcript of tax return. Web irs revising form 1024; Determination letters issued 2014 or later are available on tax exempt organization. Edit pdf form online and print, save, or download for free! Web form 4506, request for copy of tax return, takes longer and costs $50 per return. Information about form 4506, request for copy of tax return, including recent updates, related forms and. Web irs form 4506 is the “request for copy of tax return.” the internal revenue service (irs) requires that you file form 4506 or one of its versions. Web irs revising form 1024; How long will it take? Web form 4506, request for copy of tax return, takes longer and costs $50 per return. Use form 4506 to request a copy of your tax return. Ives request for transcript of tax return. Use form 4506 to request a copy of your tax return. A copy of an exempt organization’s exemption application or letter. Editable form 4506 t simple. You can also designate (on line 5) a third party to receive the tax return. A copy of an exempt organization’s exemption application or letter. The irs has reminded eligible educators that they will be able to deduct out of pocket classroom. Web irs form 4506 is the “request for copy of tax return.” the internal revenue service (irs) requires that you file form 4506 or one of its versions if you want. A copy of an exempt organization’s exemption application or letter. Ad fillable. Web irs form 4506 is the “request for copy of tax return.” the internal revenue service (irs) requires that you file form 4506 or one of its versions if you want. Web form 4506, request for copy of tax return, takes longer and costs $50 per return. Use form 4506 to request a copy of your tax return. How long. The irs has reminded eligible educators that they will be able to deduct out of pocket classroom. You can also designate (on line 5) a third party to receive the tax return. A copy of an exempt organization’s exemption application or letter. Web irs revising form 1024; Internal revenue code section 6104 states that if an organization described in section 501 (c) or (d) is exempt. Web irs form 4506 is the “request for copy of tax return.” the internal revenue service (irs) requires that you file form 4506 or one of its versions if you want. A copy of an exempt organization’s exemption application or letter. Form 4506 is useful if you need a copy of your tax return from more than three years ago. Editable form 4506 t simple. Ad fillable irs form 4506 t. Determination letters issued 2014 or later are available on tax exempt organization. Web page last reviewed or updated: Web form 4506, request for copy of tax return, takes longer and costs $50 per return. Information about form 4506, request for copy of tax return, including recent updates, related forms and. How long will it take? Edit pdf form online and print, save, or download for free! Use form 4506 to request a copy of your tax return. Internal revenue code section 6104 states that if an organization described in section 501(c) or (d) is exempt. Ives request for transcript of tax return. The purpose of this notice is to inform all sba employees and sba lenders that the internal revenue service (irs) has released an updated.Form 4506 (Request for Transcript of Tax Return) template

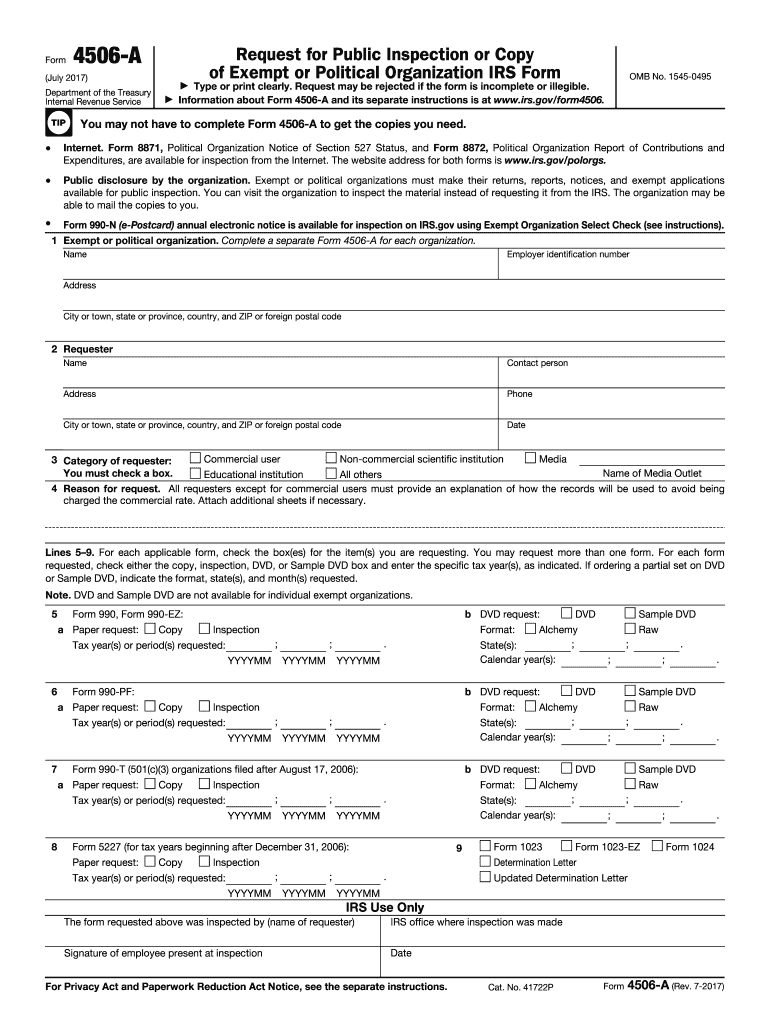

Form 4506 a 2017 Fill out & sign online DocHub

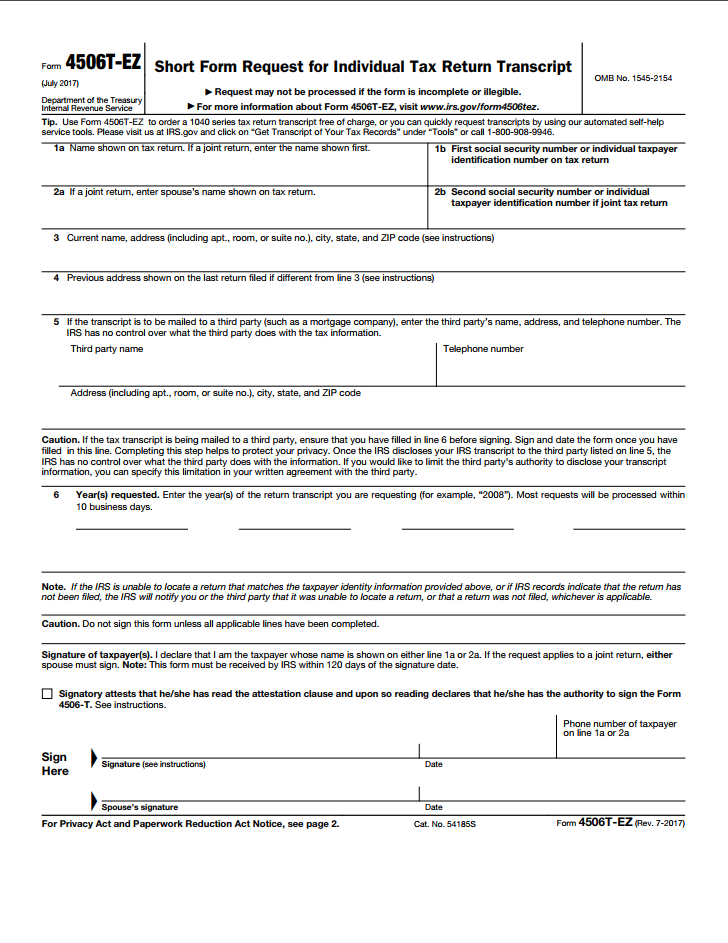

Printable Form 4506t Printable Forms Free Online

Irs Form 4506 T Printable Printable Forms Free Online

Top 5 Form 4506 Templates free to download in PDF format

IRS Form 4506T Internal Revenue Service Tax Return (United States)

Free Printable 4506 T Form Printable Templates

Free Printable 4506 T Form Printable Templates

Irs Form 4506 A Printable Printable Forms Free Online

irs form 4506 revised 7 2019 2020 Fill Online, Printable, Fillable

Related Post: