Form 3922 Lacerte

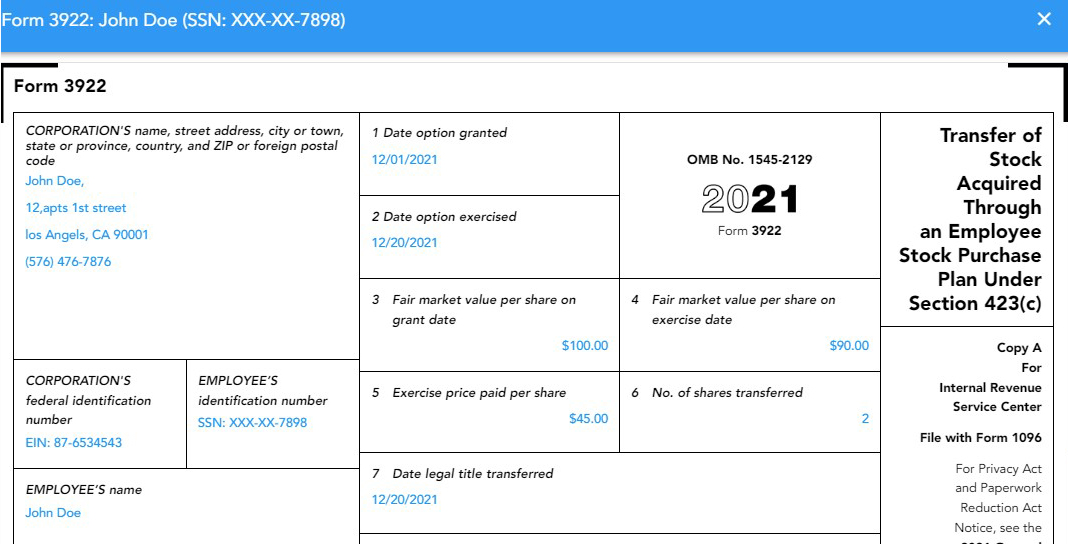

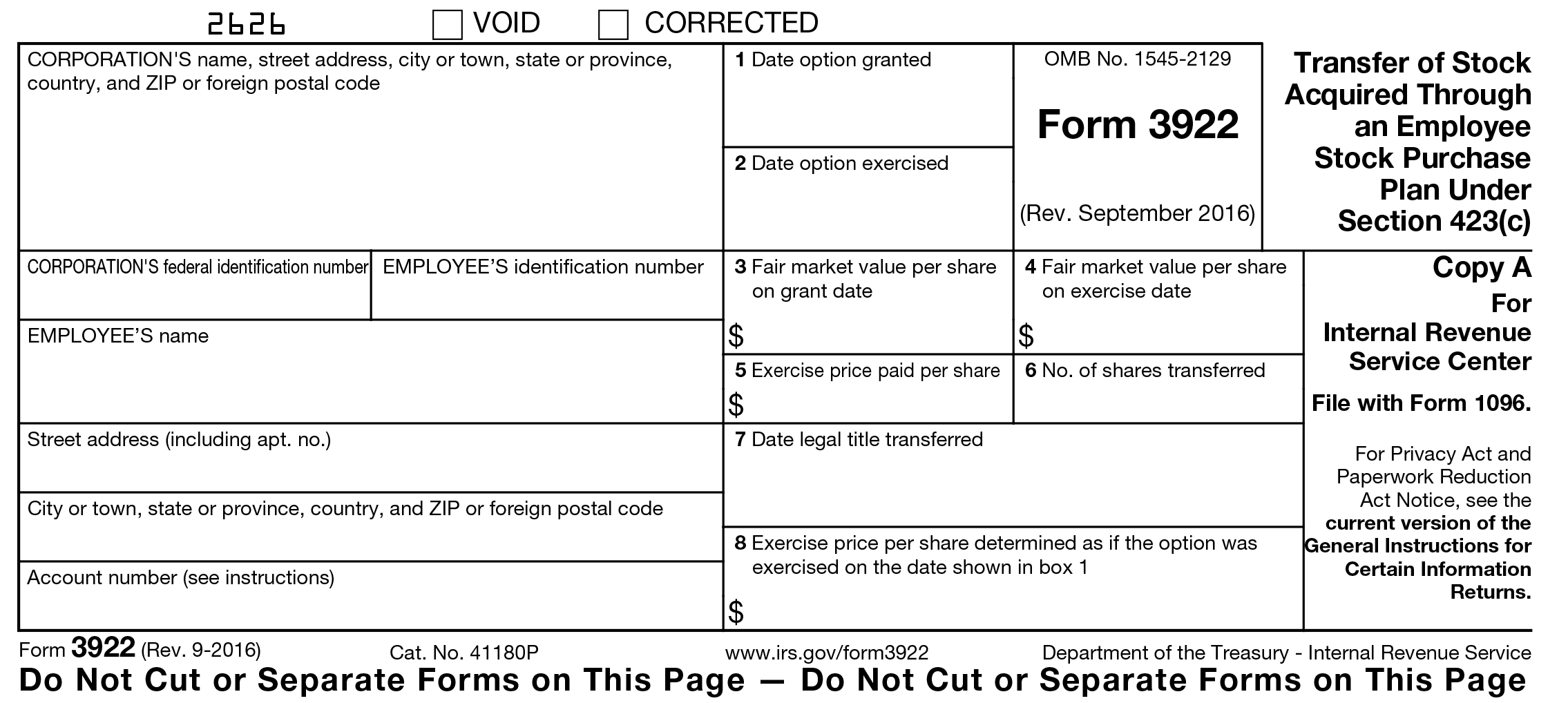

Form 3922 Lacerte - Solved•by turbotax•16130•updated march 13, 2023. Web electronic filing beginning 2024, you are required to file forms 3921 and 3922 electronically if you have 10 or more returns to file with the irs. How to fill out the form 3922 online: Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web form 3922 is issued for employee stock options you purchased but do not sell. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. You will need the information reported on form 3922 to determine stock basis. Save up to 48 minutes on complex returns & 28 minutes on simple ones, & get home earlier Ad save up to 48 minutes on complex returns with lacerte & add more value for your clients. Penalties for late filings $15 per form. This article will help you enter amounts. Where do i enter form 3922? However, you must recognize (report). Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), is a form a taxpayer receives if they have. Solved•by turbotax•16130•updated march 13, 2023. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Compare & find the best accounting software for your business. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. However, you must recognize (report). Web per. Get a free trial now! Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. How to fill out the form 3922 online: Web form 3922 is issued for employee stock options you purchased but do not sell. Since you have not sold the stock, the holding period requirements have not been determined. Web here is some information on how to utilize for 3922: Ad review the best accounting software for 2023. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web every corporation which in any calendar year transfers to any person a. Get a free trial now! Ad review the best accounting software for 2023. Penalties for late filings $15 per form. Your employer will send you form 3922,. This article will help you enter amounts. Your employer will send you form 3922,. All llcs in the state are required to pay this annual tax to stay compliant. Compare & find the best accounting software for your business. At this time, new york is the only state supported for tax year 2020, 2021, and. You will need the information reported on form 3922 to determine stock. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Solved•by turbotax•16130•updated march 13, 2023. Get a free trial now! Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c) by intuit • 434 • updated over 1 year ago electronic. At this time, new york is the only state supported for tax year 2020, 2021, and. You will need the information reported on form 3922 to determine stock basis. Web here is some. Where do i enter form 3922? Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. This article will help you enter amounts. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web form 3922 is an informational statement and would. How to fill out the form 3922 online: Penalties for late filings $15 per form. However, you must recognize (report). Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web here is some information on how to utilize for 3922: Ad review the best accounting software for 2023. At this time, new york is the only state supported for tax year 2020, 2021, and. Web electronic filing beginning 2024, you are required to file forms 3921 and 3922 electronically if you have 10 or more returns to file with the irs. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Since you have not sold the stock, the holding period requirements have not been determined. Can you store the information on form 3922 ( basis information) in lacerte? No income is recognized when you exercise an option under an employee stock purchase plan. Compare & find the best accounting software for your business. Web form 3922 is issued for employee stock options you purchased but do not sell. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c) by intuit • 434 • updated over 1 year ago electronic. All llcs in the state are required to pay this annual tax to stay compliant. Get a free trial now! Web here is some information on how to utilize for 3922: Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Solved•by turbotax•16130•updated march 13, 2023. Where do i enter form 3922? Your employer will send you form 3922,. Web per the form 3922 instructions for employee: Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. You will need the information reported on form 3922 to determine stock basis.Generating Form 3922 (Admin)

File IRS Form 3922 Online EFile Form 3922 for 2022

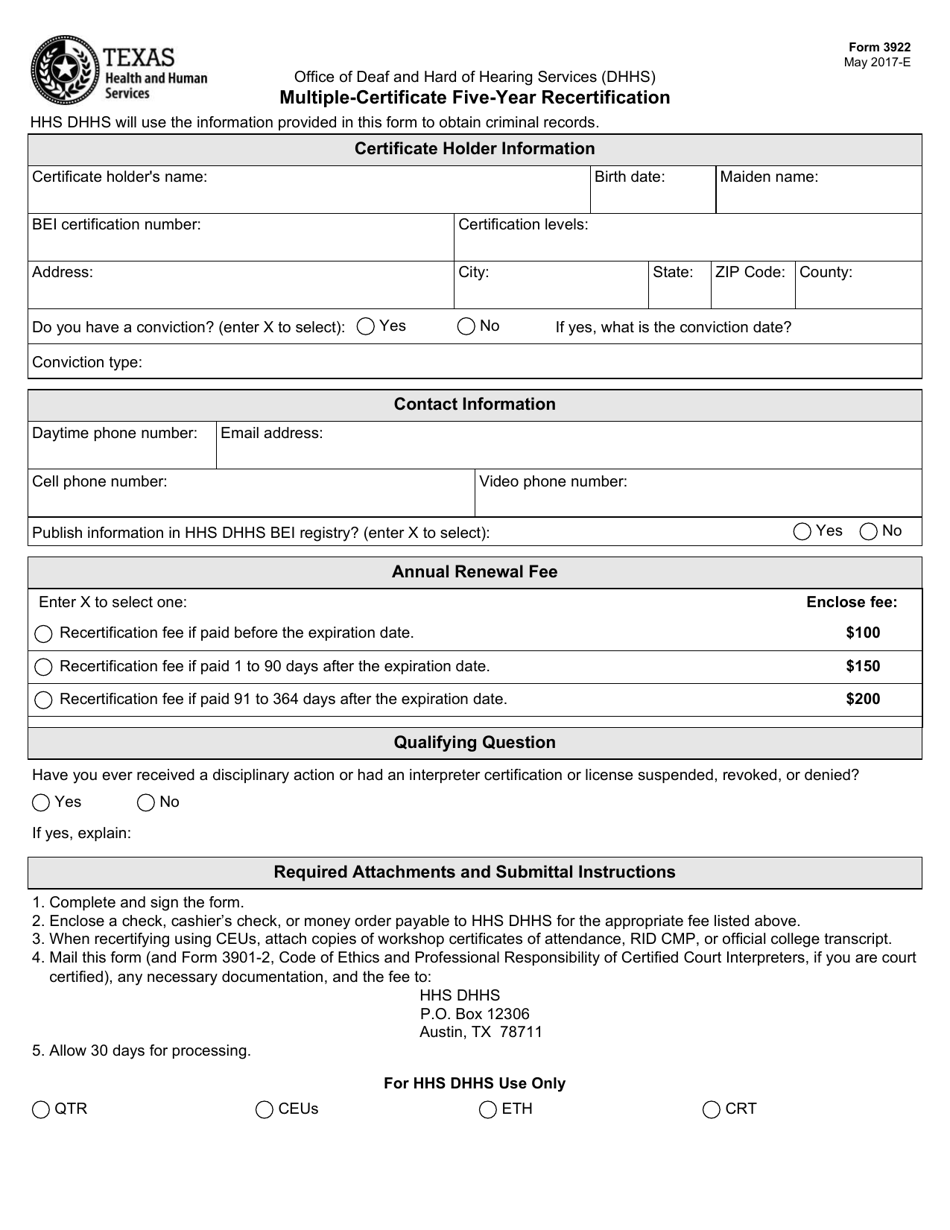

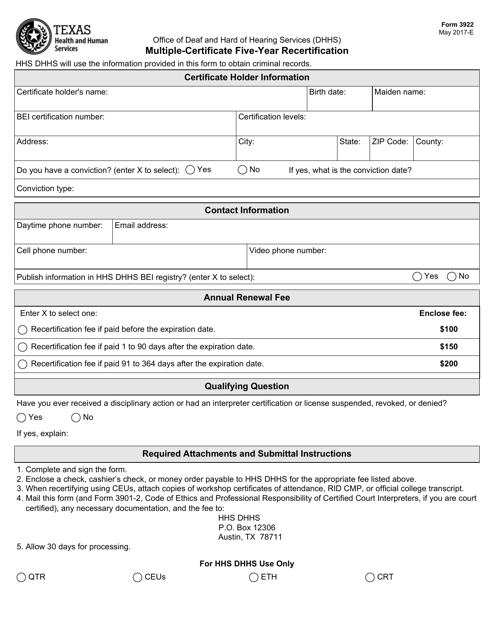

Form 3922 Fill Out, Sign Online and Download Fillable PDF, Texas

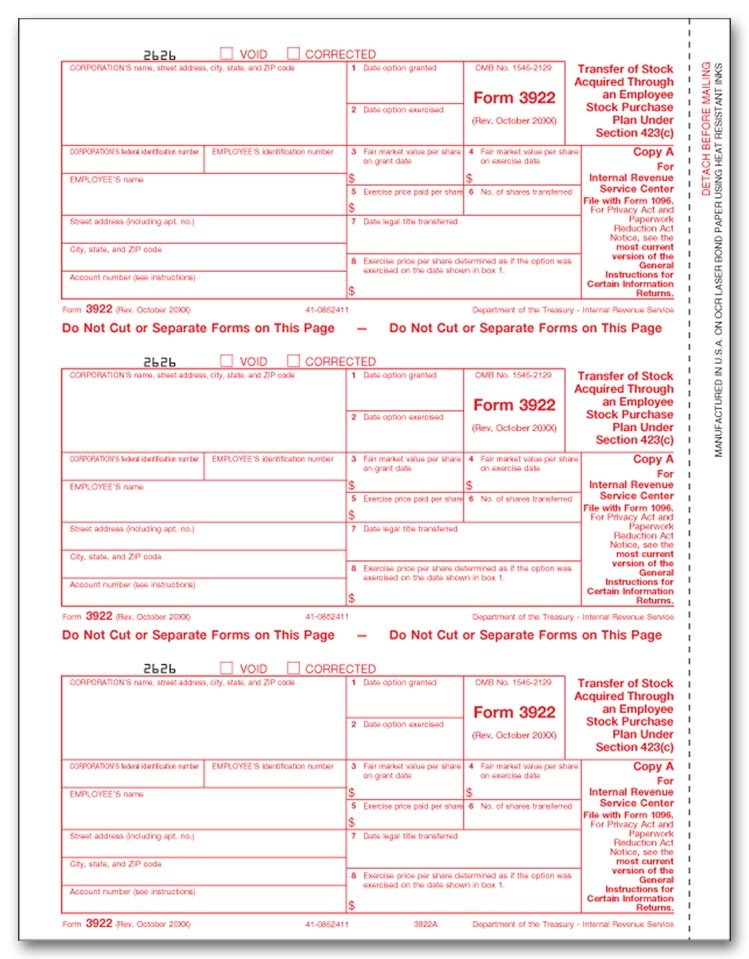

3922 Laser Tax Forms, Copy A

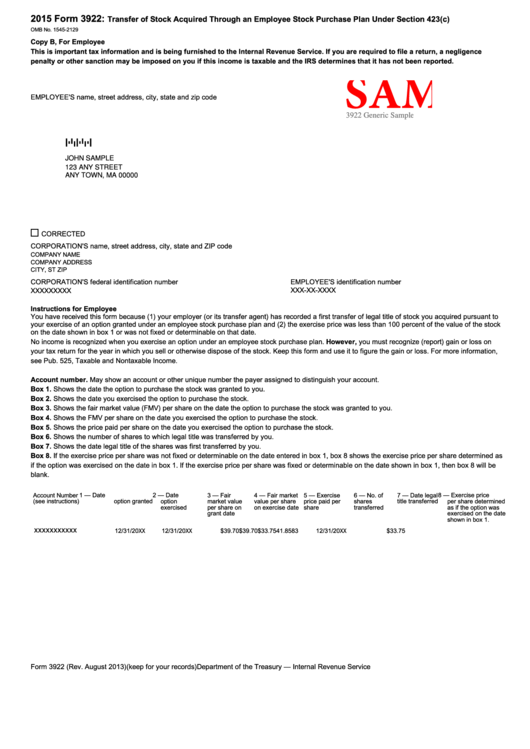

Form 3922 Sample Transfer Of Stock Acquired Through An Employee Stock

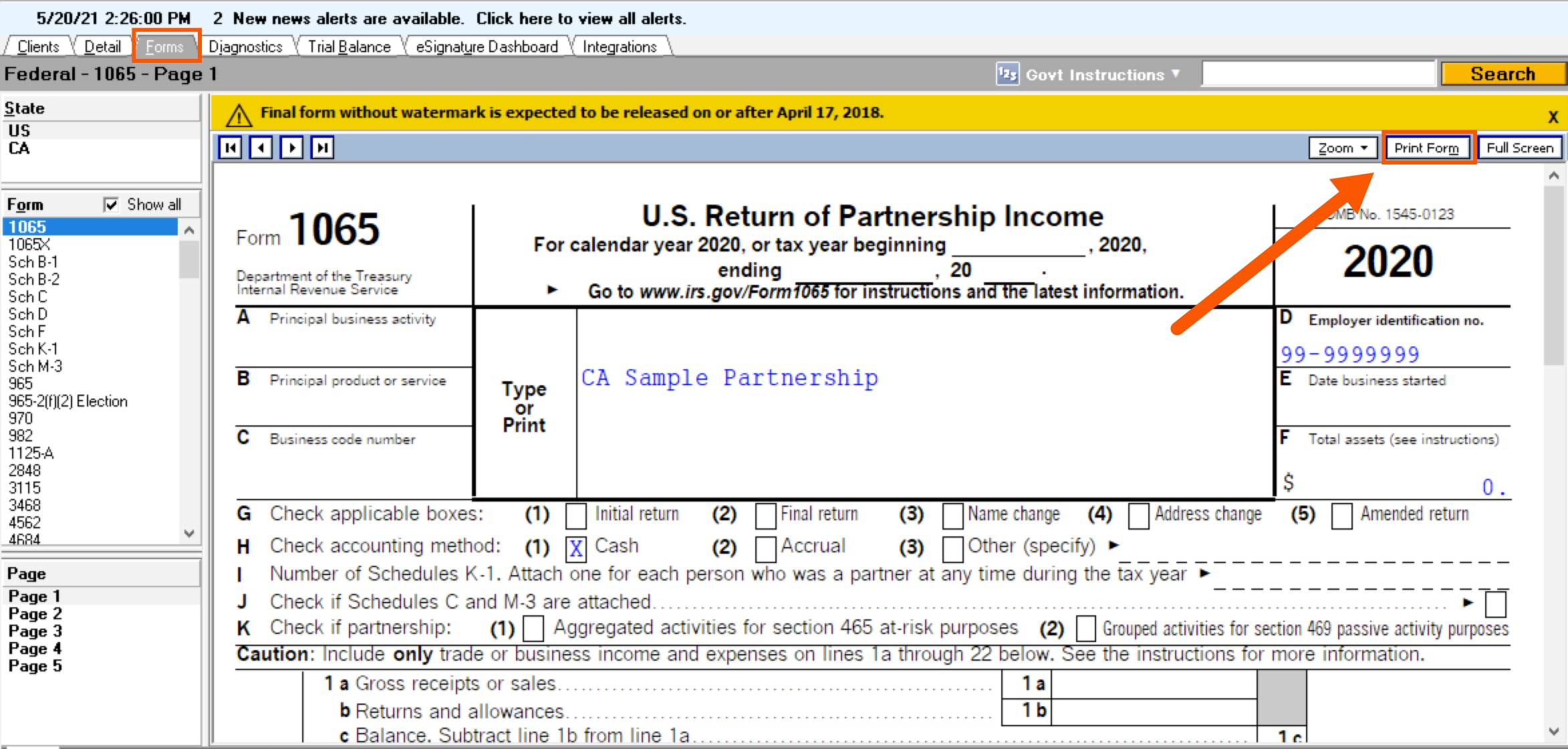

Removing the watermark from PDF printed forms

3922 2020 Public Documents 1099 Pro Wiki

Usps Questionnaire Fill Online, Printable, Fillable, Blank pdfFiller

Form 3922 Fill Out, Sign Online and Download Fillable PDF, Texas

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

Related Post: