Form 3893 Pte

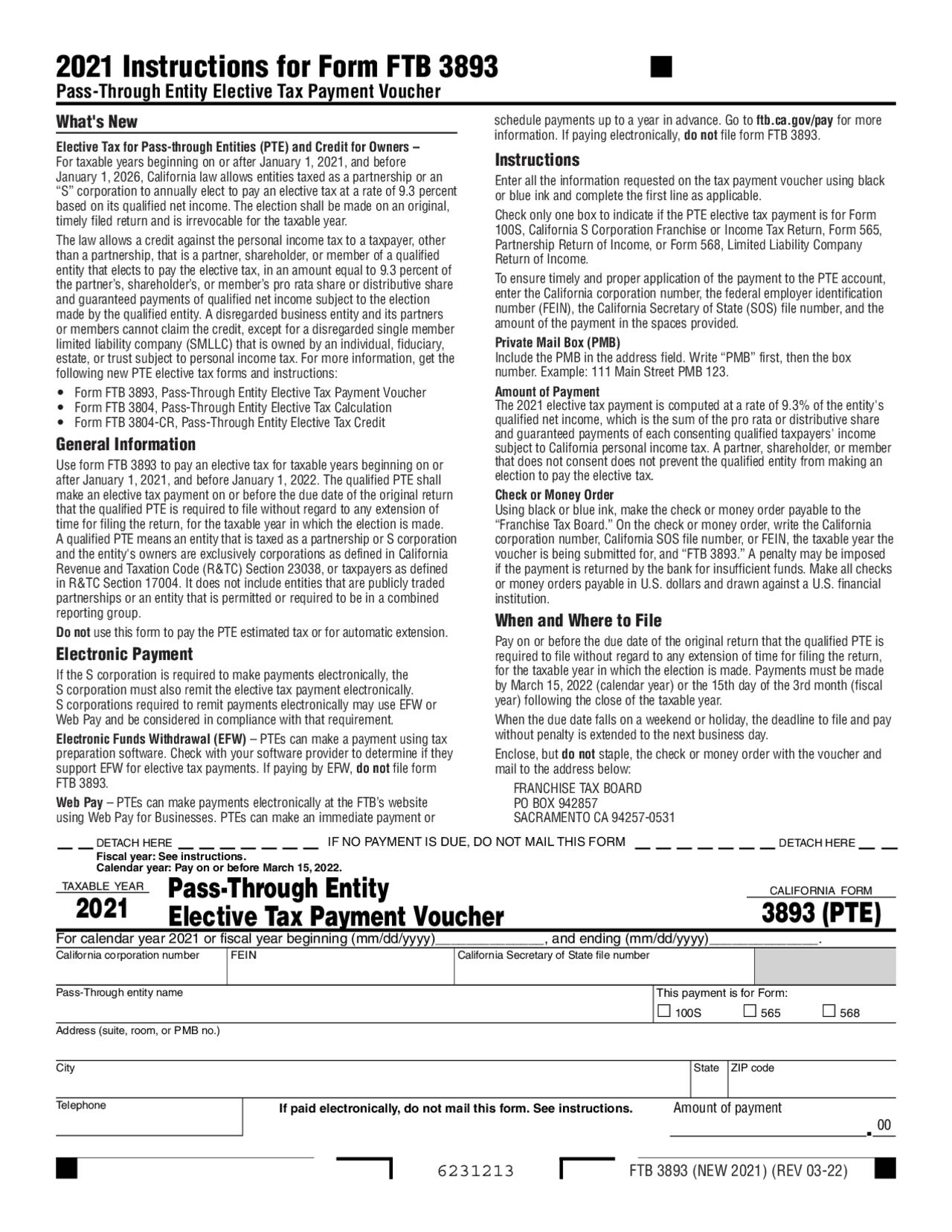

Form 3893 Pte - Web has ca form 3893 (pte) been added to the program? Web how to last modified: Has ca form 3893 (pte) been added to the program? Web this form must be attached to the partnership return for the tax year shown and must be filed by the due date of the return (including extensions). Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). If the partnership files form. “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Web the remainder of pte tax owed will be included in the total amount due (form 565, line 38; We developed the following tax forms for qualified entities to make the tax year 2022 pte elective tax payments and calculate the 2022 pte elective tax and for qualified taxpayers to claim the 2022 pte elective tax credit: Partnerships and s corporations may. Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. However, the instructions to for ftb 3893 indicate. Web go to california > ca26a. Web the remainder of pte tax owed will be included in the total amount due (form 565, line 38; Web the california franchise tax board dec. Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web california form 3893 (pte) for calendar year 2023 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. Web use form ftb 3893 to. Web this form must be attached to the partnership return for the tax year shown and must be filed by the due date of the return (including extensions). “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. The qualified pte shall make an elective tax payment. We developed the following. Partnerships and s corporations may. We developed the following tax forms for qualified entities to make the tax year 2022 pte elective tax payments and calculate the 2022 pte elective tax and for qualified taxpayers to claim the 2022 pte elective tax credit: Has ca form 3893 (pte) been added to the program? Web this form must be attached to. If the partnership files form. Web the california franchise tax board dec. Web the remainder of pte tax owed will be included in the total amount due (form 565, line 38; Web how to last modified: If an entity does not make that first. Web how to last modified: Partnerships and s corporations may. However, the instructions to for ftb 3893 indicate. The qualified pte shall make an elective tax payment. Voucher 3893 (pte) should be printed. “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. We developed the following tax forms for qualified entities to make the tax year 2022 pte. We developed the following tax forms for qualified entities to make the tax year 2022 pte elective tax payments and calculate the 2022 pte elective tax and for qualified taxpayers to claim the 2022 pte elective tax credit: Web has ca form 3893 (pte) been added to the program? Partnerships and s corporations may. Web how to last modified: Web. Voucher 3893 (pte) should be printed. Web the california franchise tax board dec. Web has ca form 3893 (pte) been added to the program? If an entity does not make that first. However, the instructions to for ftb 3893 indicate. Web california form 3893 (pte) for calendar year 2023 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web go to california > ca26a. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Voucher 3893 (pte) should be printed. The qualified pte shall make an. Voucher 3893 (pte) should be printed. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Web revised 2022, 2023 form 3893 instructions: If the partnership files form. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. We developed the following tax forms for qualified entities to make the tax year 2022 pte elective tax payments and calculate the 2022 pte elective tax and for qualified taxpayers to claim the 2022 pte elective tax credit: Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. However, the instructions to for ftb 3893 indicate. Web go to california > ca26a. The qualified pte shall make an elective tax payment. If the payment has yet to be made, line 35 should be zero, line 40 tax due should be 10k. Web procedure tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. If an entity does not make that first. Web this form must be attached to the partnership return for the tax year shown and must be filed by the due date of the return (including extensions). Web the california franchise tax board dec. Has ca form 3893 (pte) been added to the program? We anticipate the revised form 3893 will be available march 7, 2022. 11/05/2022 objectives prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet view. Web has ca form 3893 (pte) been added to the program?Ca Form 3893 Voucher VOUCHERSOF

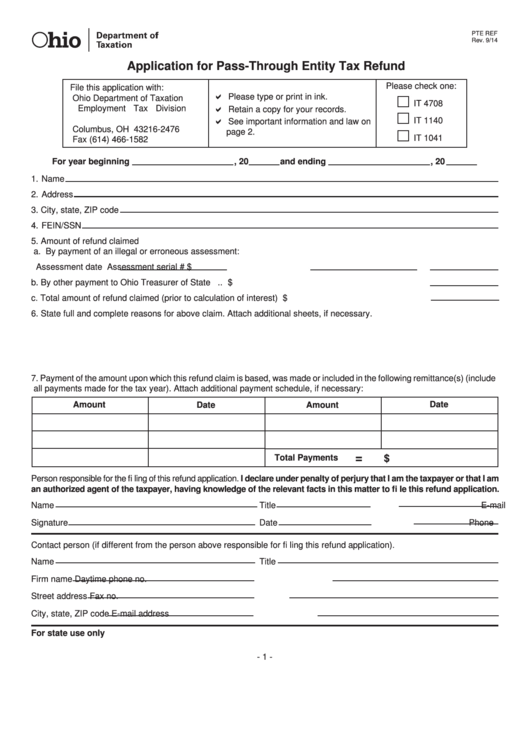

Fillable Form Pte Ref Application For PassThrough Entity Tax Refund

2023 Form 3893 Printable Forms Free Online

California Form 3893 Passthrough Entity Tax Problems Windes

2021 Instructions for Form 3893, PassThrough Entity Elective

2023 Form 3893 Printable Forms Free Online

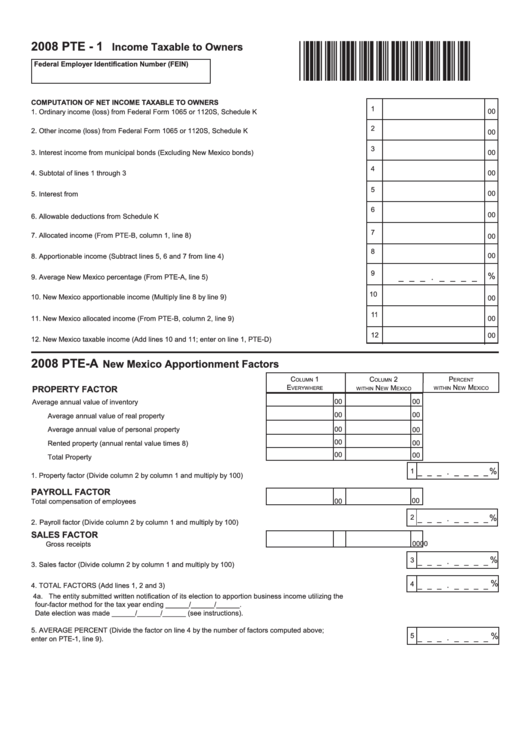

Form Pte1 Taxable To Owners 2008 printable pdf download

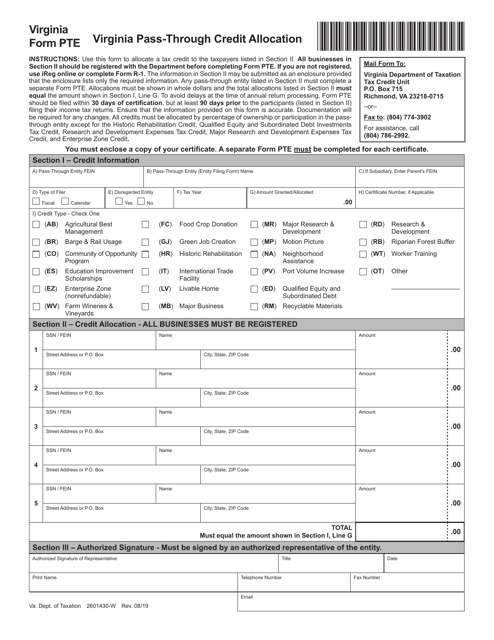

Form PTE Download Fillable PDF or Fill Online Virginia PassThrough

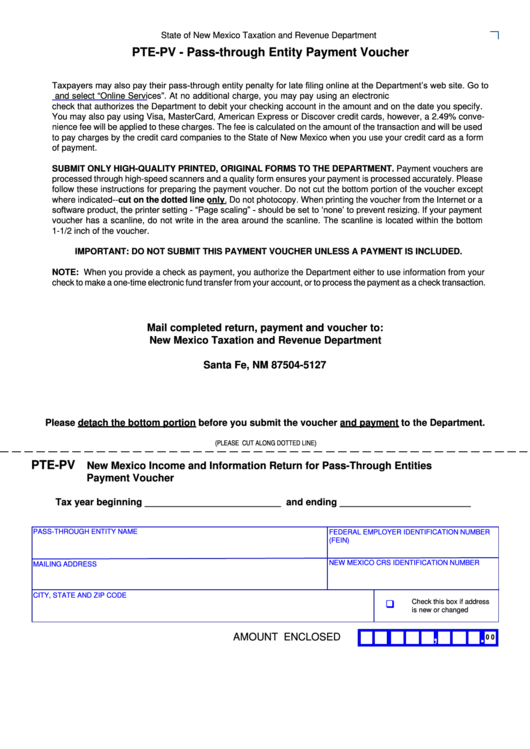

Form PtePv New Mexico And Information Return For PassThrough

Virginia fprm pte Fill out & sign online DocHub

Related Post: