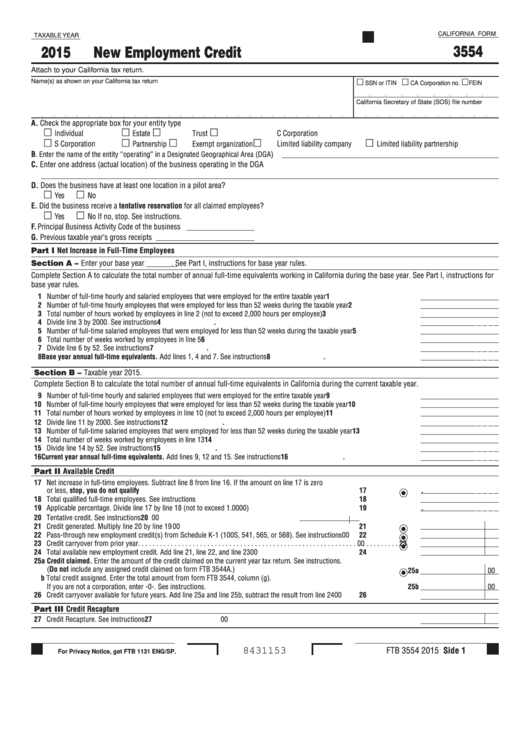

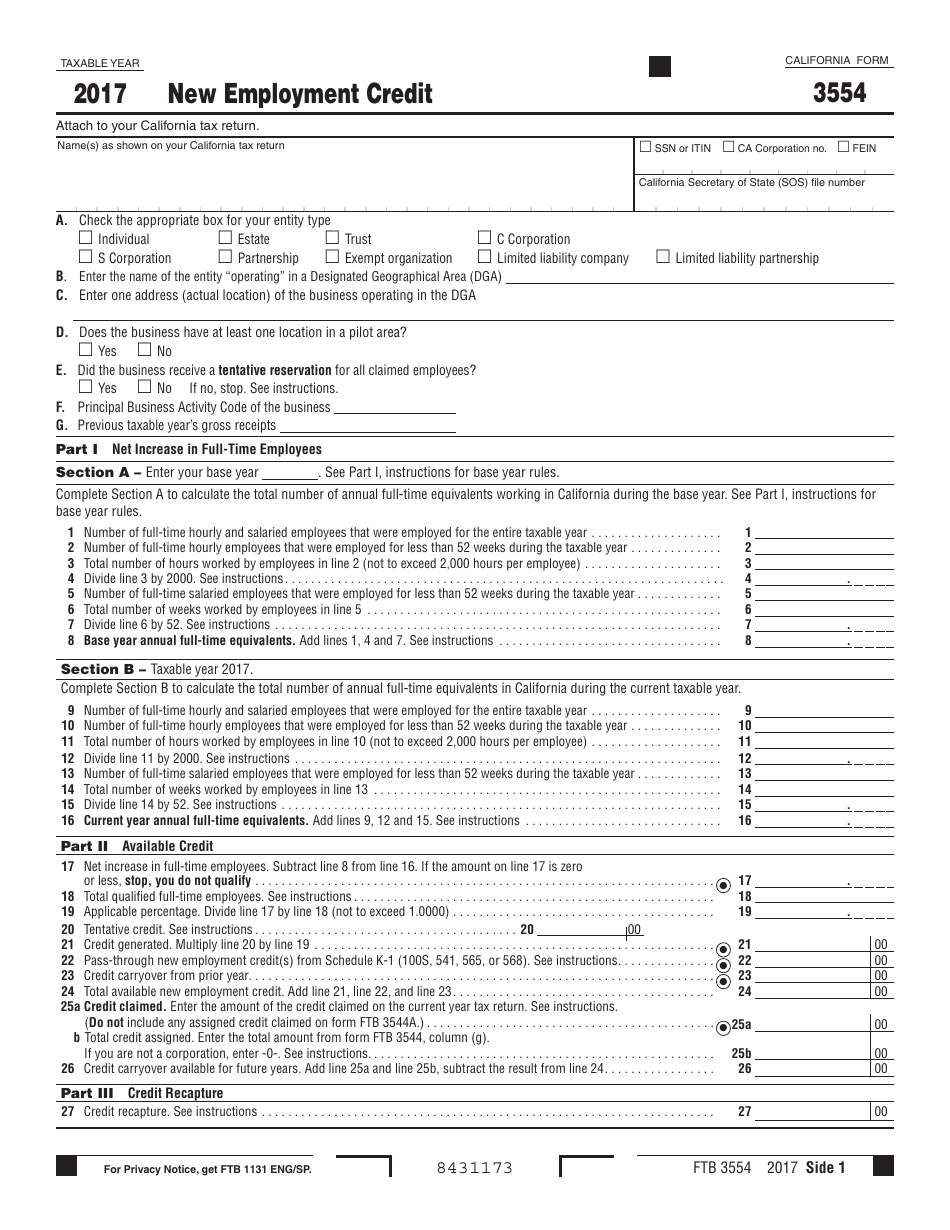

Form 3554 Instructions

Form 3554 Instructions - For 2020, you could qualify for the credit if you hired employees in a designated. Web form 3554 is used to obtain a credit for new employees acquired during the year. You disposed of it in 2022. Web you can follow these instructions: Page 2 ftb 3554 booklet 2019 2019 instructions for form ftb 3554. New employment credit important information. Web individuals who expatriated for immigration purposes after june 3, 2004, and before june 17, 2008, but who have not previously filed a form 8854, continue to be treated as u.s. I have recreated the solution as indicated below; Web for more information, go to ftb.ca.gov and search for nec or get form ftb 3554, new employment credit. You disposed of it in 2022. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web form 3554 is used to obtain a. Web for more information, go to ftb.ca.gov and search for nec or get form ftb 3554, new employment credit. Web you can follow these instructions: Web form 100w, schedule j, line 5. You disposed of it in 2022. Did the business receive a tentative reservation yes no if no, stop. Web you can follow these instructions: Form 540, california resident income tax return, line 63. New employment credit important information. Web the icon is actually called 'bookmarks' not forms. Form 109, california exempt organization business income tax return, schedule k, line 4. Web form 3554 is used to obtain a credit for new employees acquired during the year. I have recreated the solution as indicated below; You disposed of it in 2022. Web taxable year california form 2022 new employment credit 3554 attach to your california tax return. 1.click on the icon called ‘bookmarks’. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web form ftb 3554, new employment credit. Web 3554 attach to your california tax return. Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print. Web you can follow these instructions: 1.click on the icon called ‘bookmarks’. Page 2 ftb 3554 booklet 2019 2019 instructions for form ftb 3554. Web taxable year california form 2022 new employment credit 3554 attach to your california tax return. Form 109, california exempt organization business income tax return, schedule k, line 4. Web the icon is actually called 'bookmarks' not forms. 1.click on the icon called ‘bookmarks’. Web individuals who expatriated for immigration purposes after june 3, 2004, and before june 17, 2008, but who have not previously filed a form 8854, continue to be treated as u.s. Web 3554 attach to your california tax return. Form 540, california resident income tax. Web individuals who expatriated for immigration purposes after june 3, 2004, and before june 17, 2008, but who have not previously filed a form 8854, continue to be treated as u.s. Click on delete a form from the window that pops up. Web form ftb 3554, new employment credit. Web california income tax brackets income tax forms form 3554 california. Web form 100w, schedule j, line 5. New employment credit important information. Did the business receive a tentative reservation yes no if no, stop. For 2020, you could qualify for the credit if you hired employees in a designated. Web taxable year california form 2022 new employment credit 3554 attach to your california tax return. Web form ftb 3554, new employment credit. California competes tax credit the sunset date for the california. 1.click on the icon called ‘bookmarks’. You disposed of it in 2022. Web taxable year california form 2022 new employment credit 3554 attach to your california tax return. Did the business receive a tentative reservation yes no if no, stop. Web the icon is actually called 'bookmarks' not forms. You disposed of it in 2022. New employment credit important information. Page 2 ftb 3554 booklet 2019 2019 instructions for form ftb 3554. For 2020, you could qualify for the credit if you hired employees in a designated. Web for more information, go to ftb.ca.gov and search for nec or get form ftb 3554, new employment credit. Web 3554 attach to your california tax return. Web form ftb 3554, new employment credit. Click on delete a form from the window that pops up. Web form 100w, schedule j, line 5. Web california income tax brackets income tax forms form 3554 california — new employment credit download this form print this form it appears you don't have a. Web taxable year california form 2022 new employment credit 3554 attach to your california tax return. Form 540, california resident income tax return, line 63. Web form 3554 is used to obtain a credit for new employees acquired during the year. Did the business receive a tentative reservation yes no if no, stop. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Form 109, california exempt organization business income tax return, schedule k, line 4. I have recreated the solution as indicated below; 1.click on the icon called ‘bookmarks’.Irs.gov Form 941 X Instructions Form Resume Examples 86O7Vo75BR

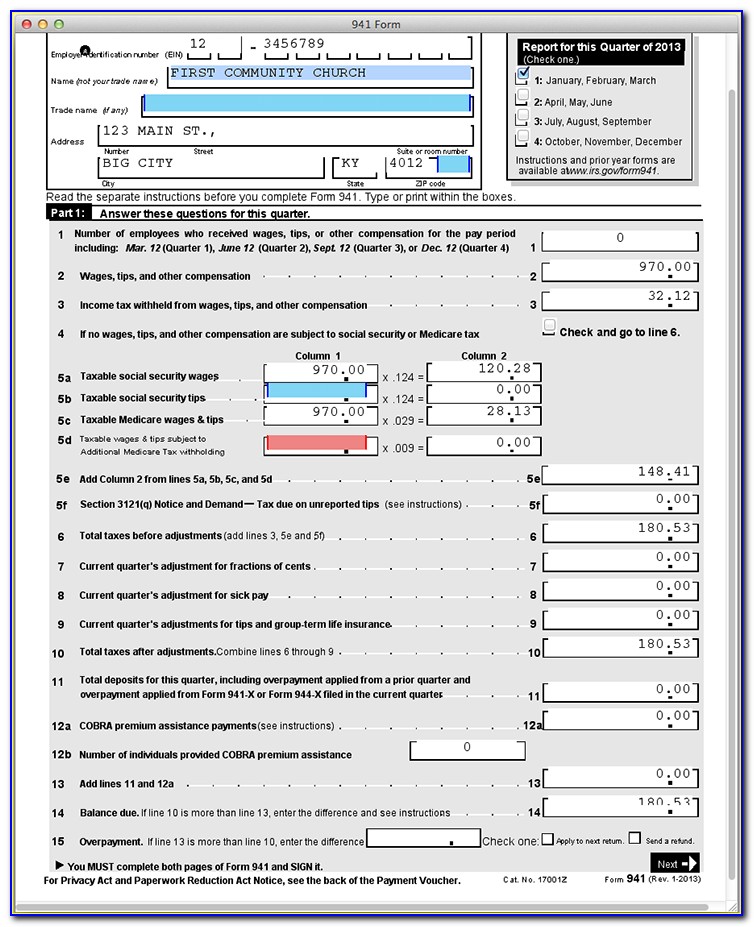

Irs.gov Forms 941 Instructions Form Resume Examples Bw9jr5n97X

Instruction For Ss4 Form Editable Online Blank in PDF

Form 3554 California New Employment Credit 2015 printable pdf download

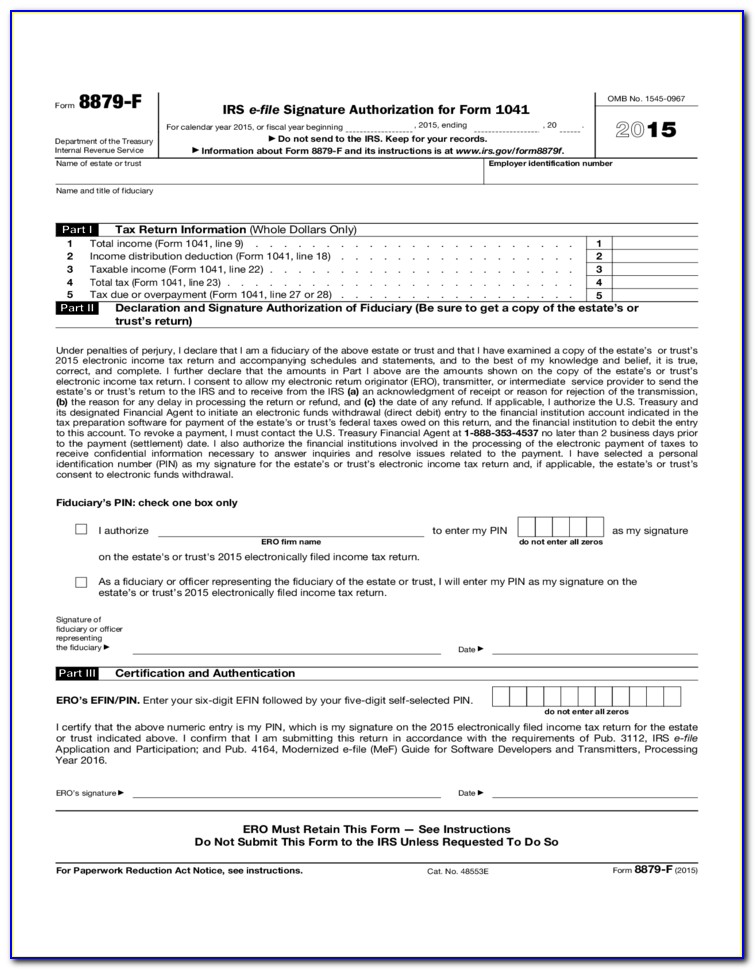

Irs Forms 1041 Instructions Form Resume Examples erkKpJRDN8

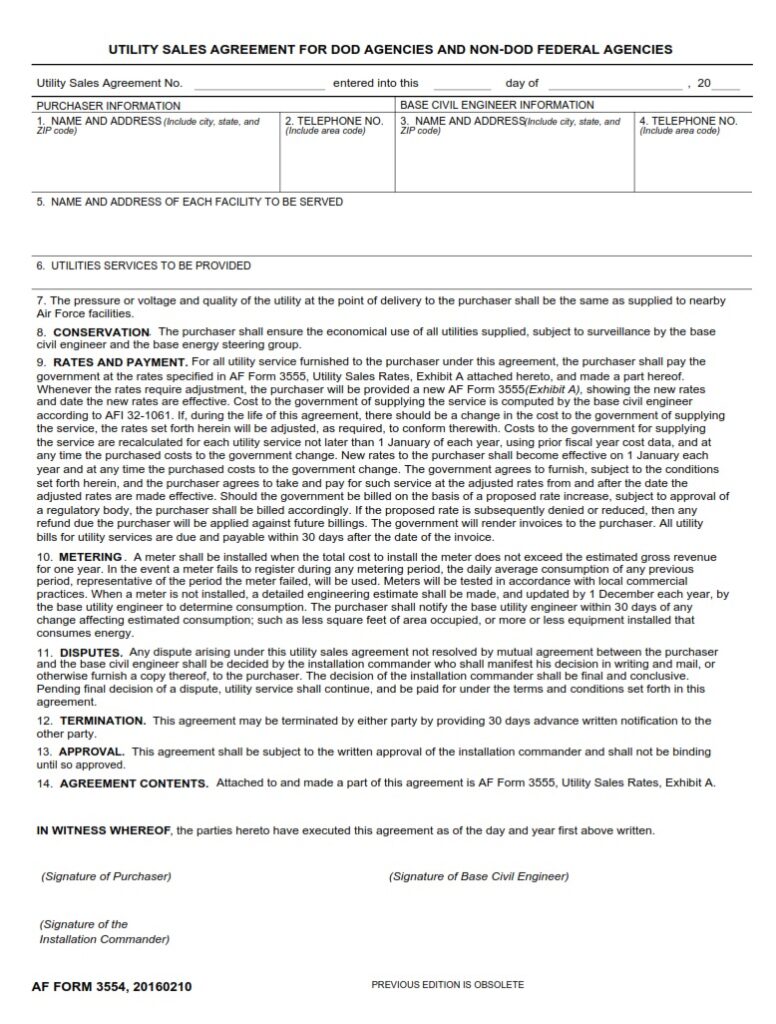

AF Form 3554 Utility Sales Agreement For DoD Agencies And NonFederal

Irs Form 4562 Create A Digital Sample in PDF

Form FTB3554 2017 Fill Out, Sign Online and Download Printable PDF

Editable IRS Form Instruction 6251 2018 2019 Create A Digital

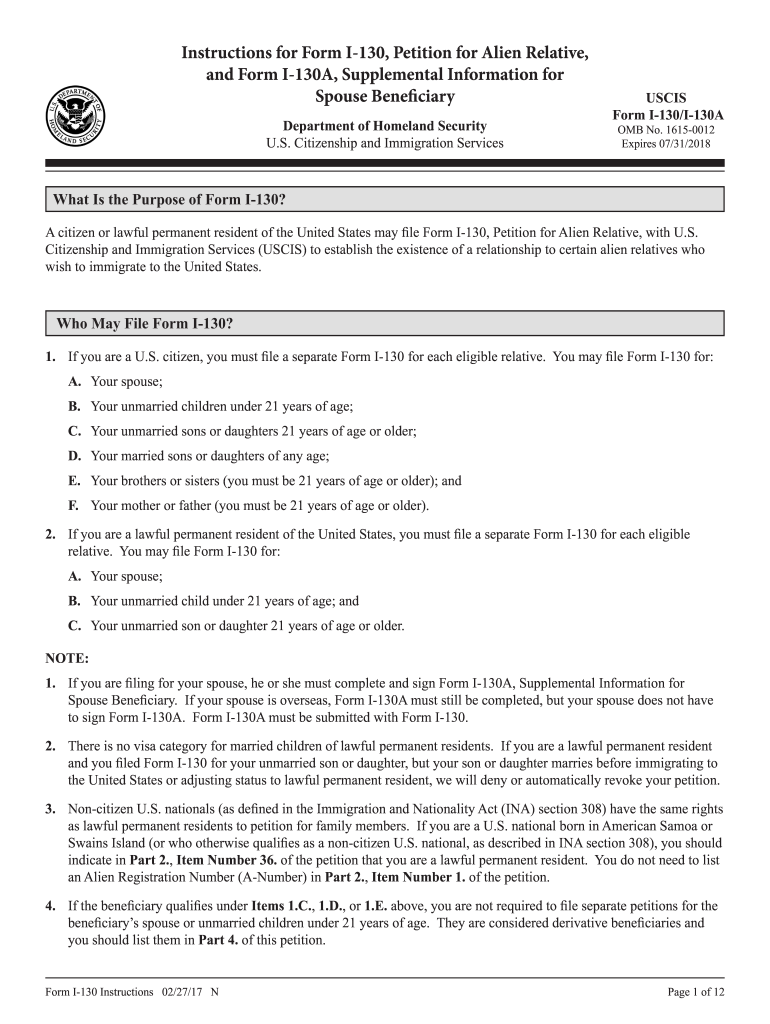

2015 Form USCIS I130 Instructions Fill Online, Printable, Fillable

Related Post: