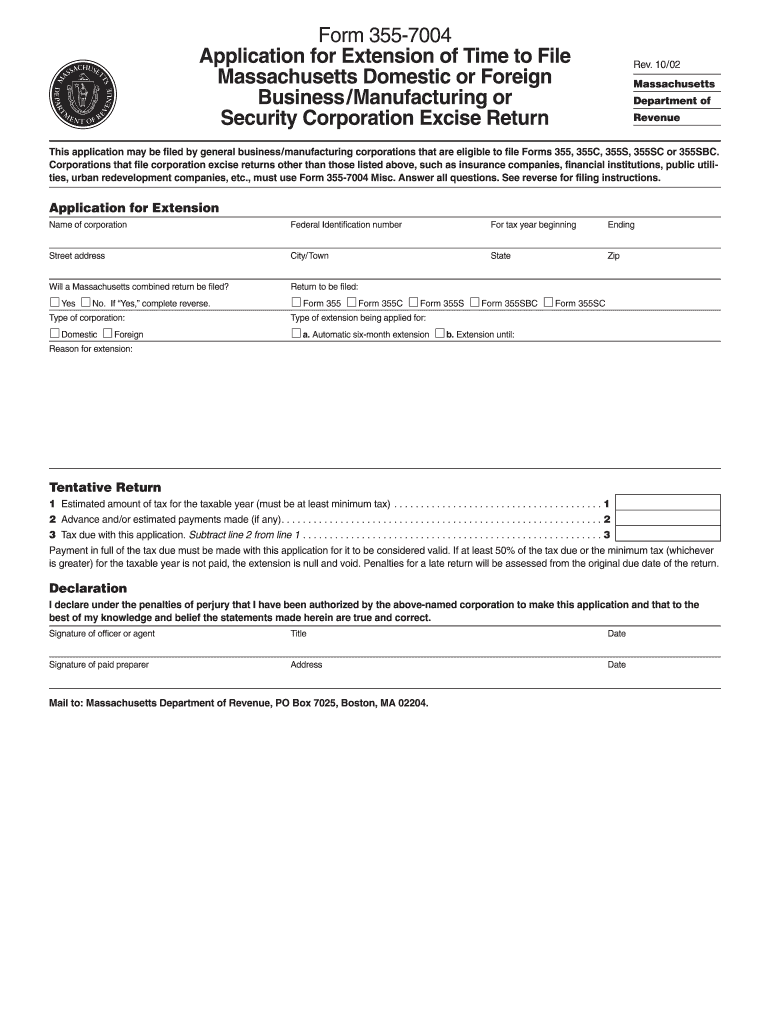

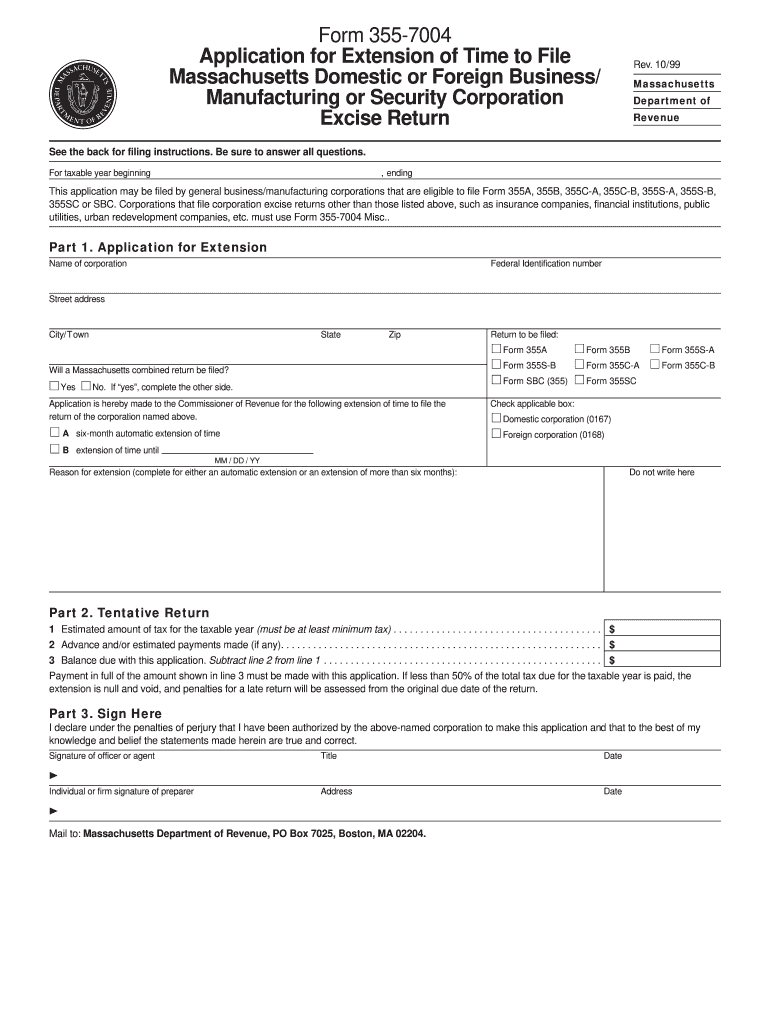

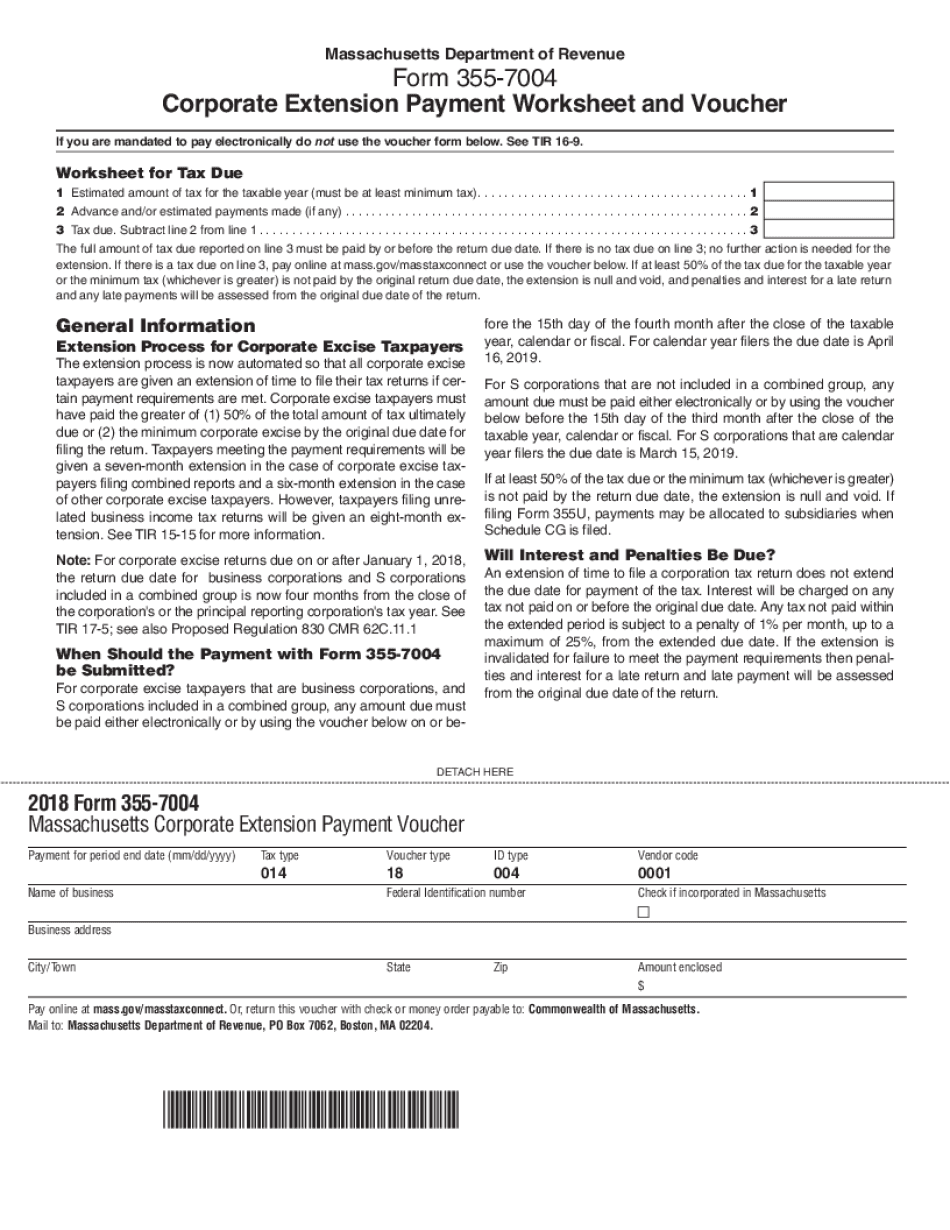

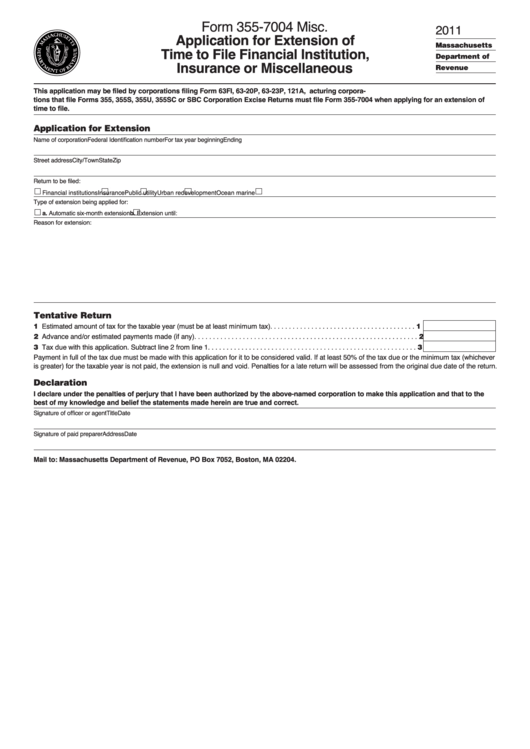

Form 355 7004

Form 355 7004 - Web what form does the state of massachusetts require to apply for an extension? This booklet also includes an application for. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. December 2018) department of the treasury internal revenue service. Use this worksheet to calculate the tax due that must be paid by or before the original due date of the return. Corporate extension payment worksheet and voucher. Find forms for your industry in minutes. When should this form be filed? Streamlined document workflows for any industry. Ad get ready for tax season deadlines by completing any required tax forms today. If you are mandated to pay electronically do. How do i pay my balance due to the state of massachusetts with my. If you are mandated to pay electronically do not use the. Complete, edit or print tax forms instantly. Web massachusetts department of revenue. The extension process is now automated so that all corporate excise taxpayers are given. Web form 7004 can be filed electronically for most returns. Web all corporations and financial institutions that reasonably estimate their excise to be in excess of $1,000 for the taxable year are required to make estimated. Corporate extension payment worksheet and voucher. Web extension process for. Ad get ready for tax season deadlines by completing any required tax forms today. Web a massachusetts tax extension will give you 6 extra months to file, moving the deadline to september 15 (for calendar year filers). How do i pay my balance due to the state of massachusetts with my. Web all corporations and financial institutions that reasonably estimate. Web file form 2210 unless one or more boxes in part ii below applies. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Period end date amount enclosed. Web what form does the state of massachusetts require to apply for an extension? Web many. Corporate extension payment worksheet and voucher. Web file form 2210 unless one or more boxes in part ii below applies. If you are mandated to pay electronically do not use the. The extension process is now automated so that all corporate excise taxpayers are given. To apply for a massachusetts business. Find forms for your industry in minutes. The extension process is now automated so that all corporate excise taxpayers are given. To apply for a massachusetts business. Applies, you must figure your penalty and file form 2210. Web massachusetts department of revenue. If you are mandated to pay electronically do not use the. Web all corporations and financial institutions that reasonably estimate their excise to be in excess of $1,000 for the taxable year are required to make estimated. When should this form be filed? Gross receipts or sales under $1,000,000; To apply for a massachusetts business. When should this form be filed? The extension process is now automated so that all corporate excise taxpayers are given. Find forms for your industry in minutes. The reason for delay must be stated on all requests for extension. Corporate extension payment worksheet and voucher. All other business/manufacturing corporations that file forms 355, 355s, 355u,. Web file form 2210 unless one or more boxes in part ii below applies. Corporate extension payment worksheet and voucher. To apply for a massachusetts business. December 2018) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. If you are mandated to pay electronically do not use the. Web extension process for financial institution, insurance or miscellaneous excise taxpayers. This form is for income earned in tax year 2022, with tax. Web form 7004 can be filed electronically for most returns. Streamlined document workflows for any industry. Ad get ready for tax season deadlines by completing any required tax forms today. Web extension process for financial institution, insurance or miscellaneous excise taxpayers. When should this form be filed? The extension process is now automated so that all corporate excise taxpayers are given. Period end date amount enclosed. Web many corporate filers qualify to file using form 355sbc. Complete, edit or print tax forms instantly. Web what form does the state of massachusetts require to apply for an extension? This booklet also includes an application for. Web massachusetts department of revenue. This form is for income earned in tax year 2022, with tax. Web file form 2210 unless one or more boxes in part ii below applies. Find forms for your industry in minutes. Corporate extension payment worksheet and voucher. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. December 2018) department of the treasury internal revenue service. Web form 7004 can be filed electronically for most returns. If you are mandated to pay electronically do. Web a massachusetts tax extension will give you 6 extra months to file, moving the deadline to september 15 (for calendar year filers).Irs Form 7004 amulette

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

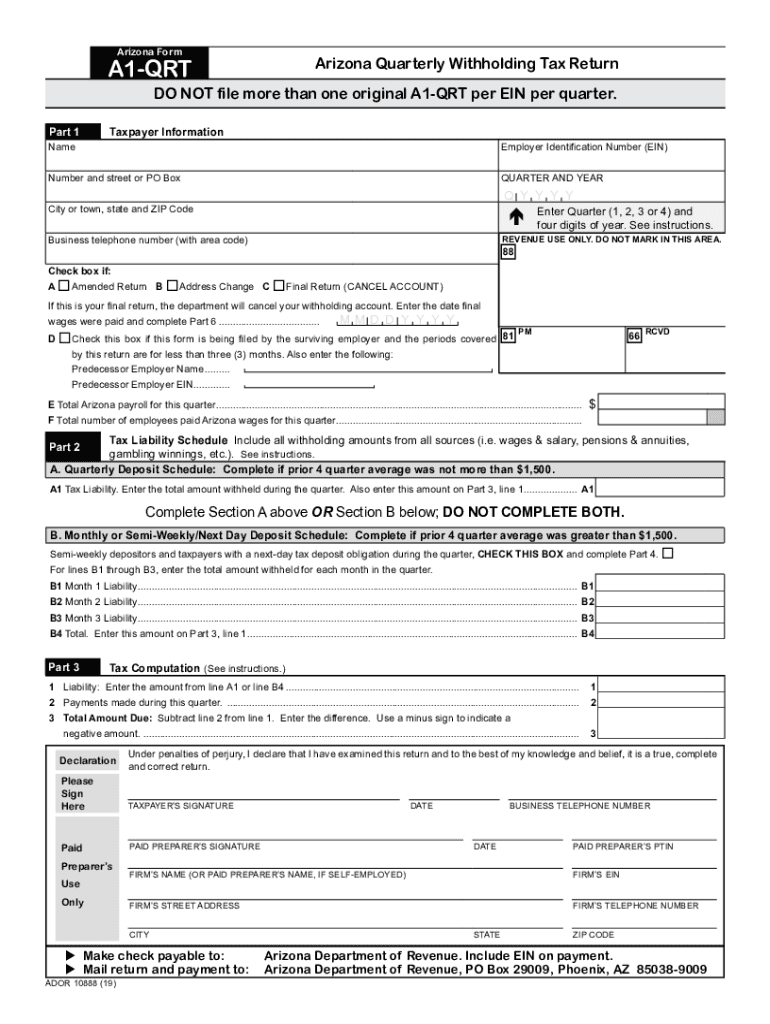

A1 qrt 2019 Fill out & sign online DocHub

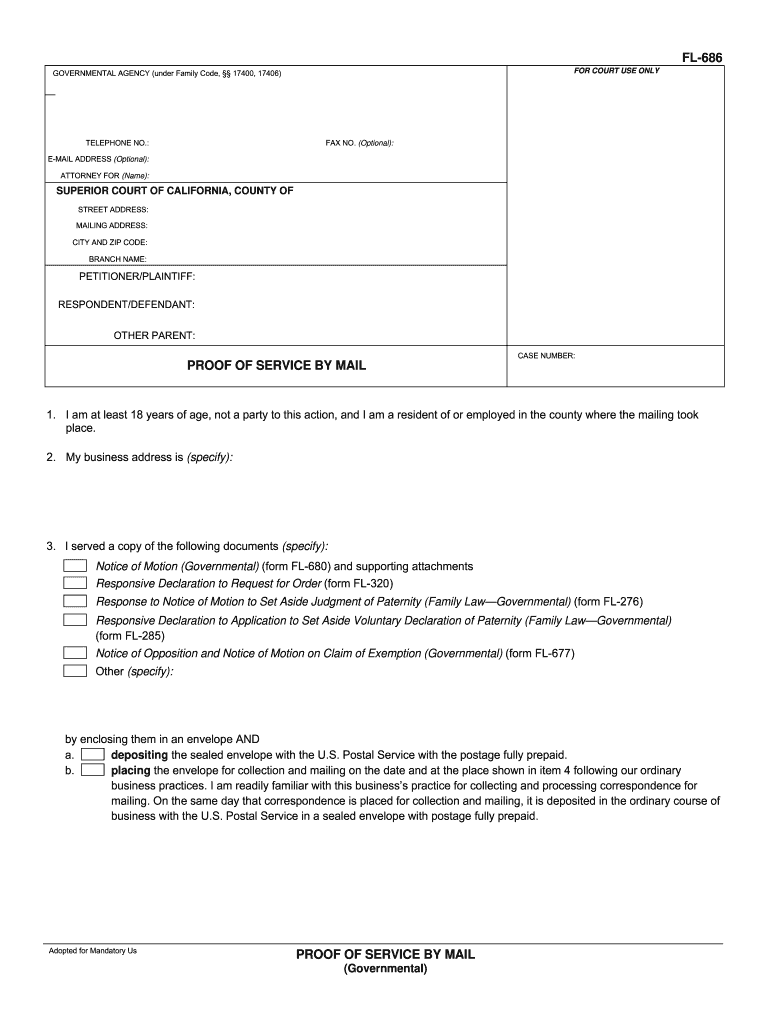

Fl 355 form proof of service by mail Fill out & sign online DocHub

Mass 355 7004 payment 2002 form Fill out & sign online DocHub

1999 Form MA 3557004 Fill Online, Printable, Fillable, Blank pdfFiller

Form 355 7004 Fill Out and Sign Printable PDF Template signNow

Florida Form F7004 Tentative Tax Return and

Form 3557004 Misc. Application For Extension Of Time To File

Related Post: