Form 3520 Part Iv Example

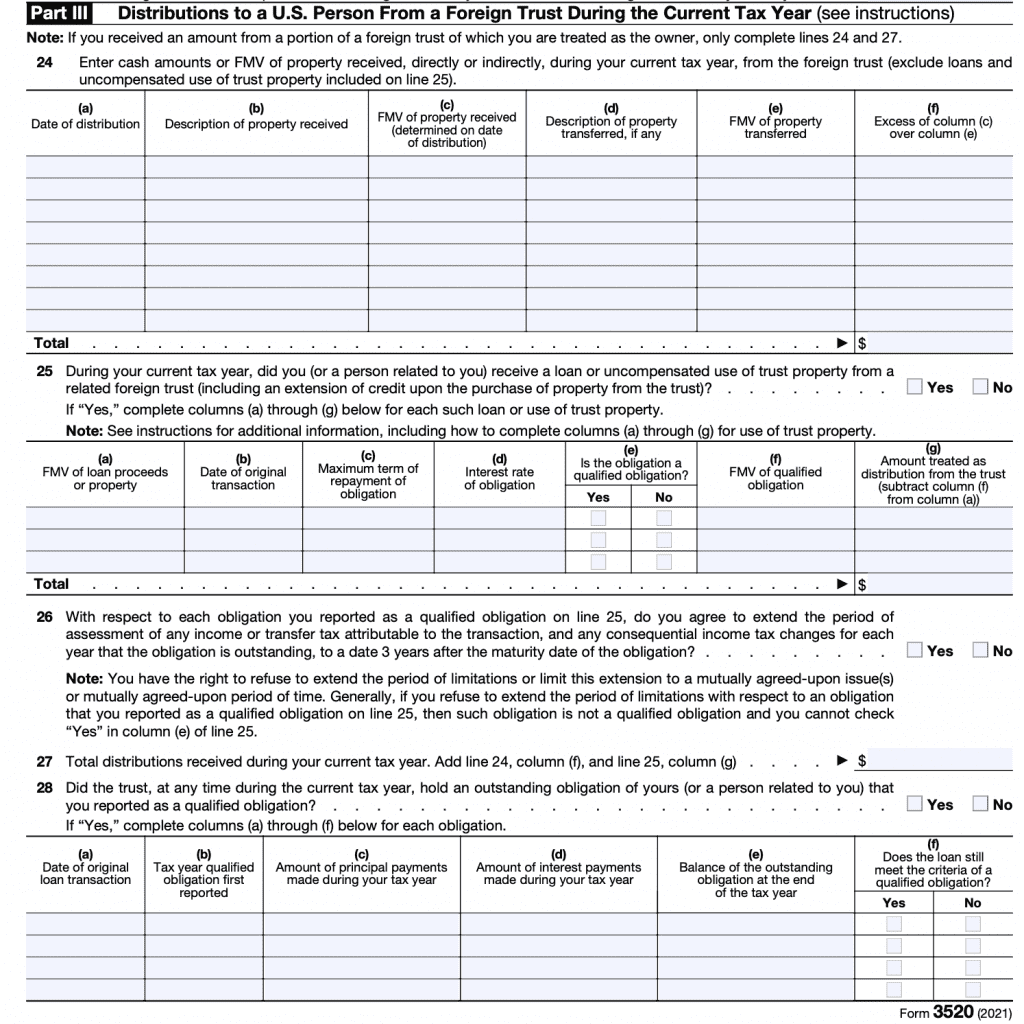

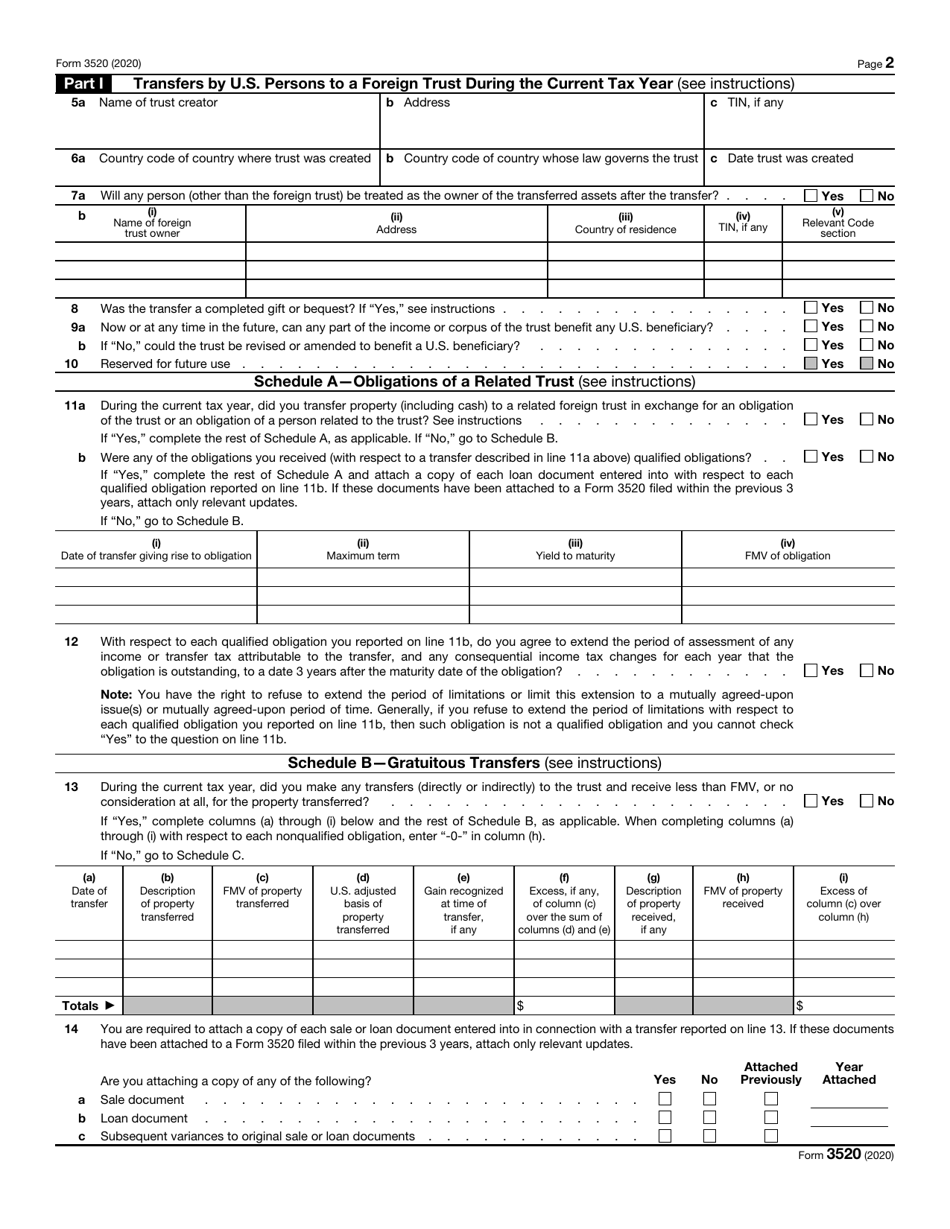

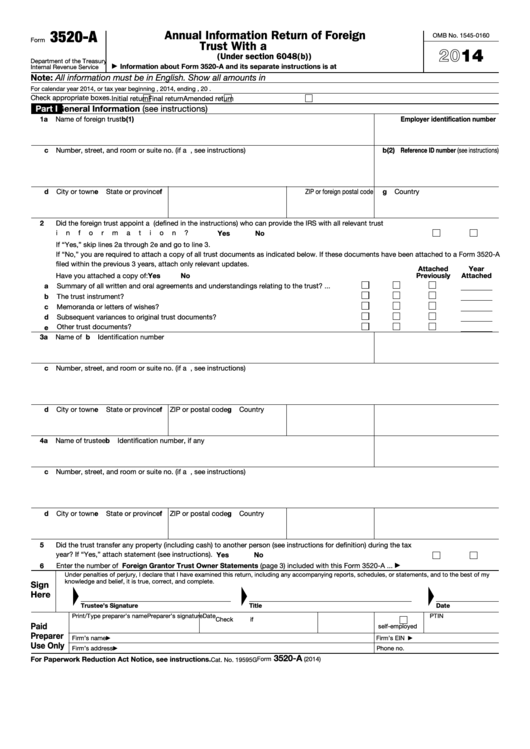

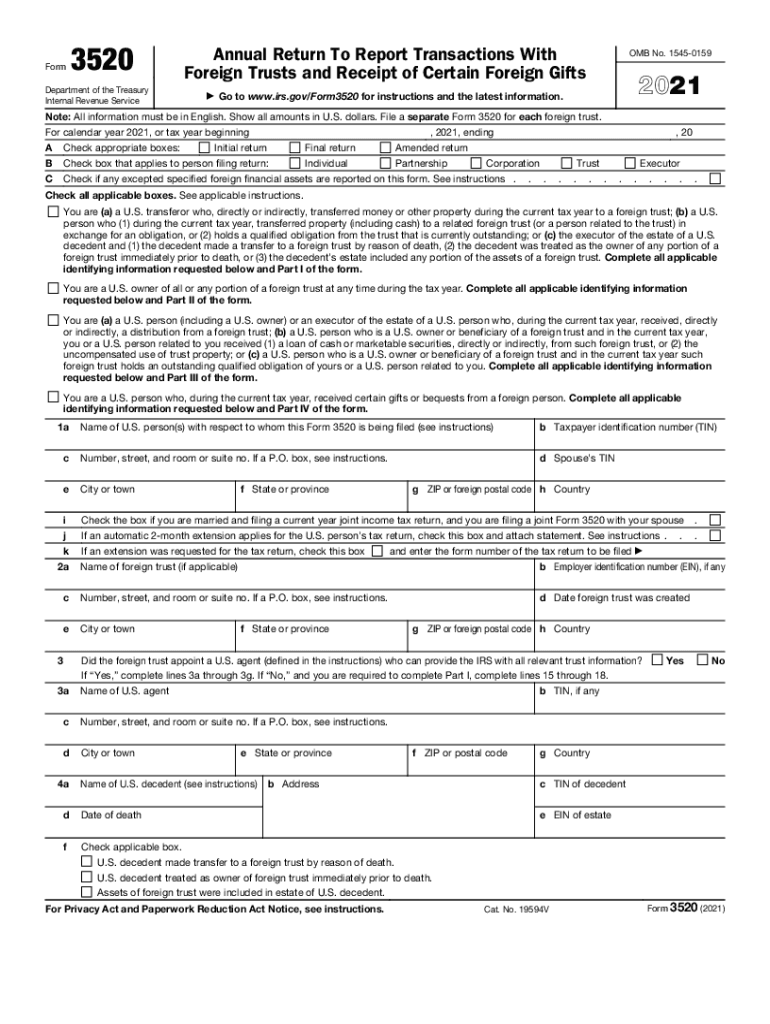

Form 3520 Part Iv Example - Web identifying information requested below and part iv of the form. Web complete the identifying information on page 1 of the form and part iv. When certain foreign trust, foreign gift, or foreign bequest transactions occur, the irs requires. What is a foreign trust. See the instructions for part iv. Ad signnow.com has been visited by 100k+ users in the past month Citizen and your foreign parents or relatives deposit more than. Complete, edit or print tax forms instantly. Web part iv is for the actual reporting of the gift (s). Web 1 gifts from foreign persons. Citizen and your foreign parents or relatives deposit more than. 3 the irs wants to track the money. Web requested below and part iii of the form. Web form 3520, part iv. Top 13mm (1⁄ 2 ), center sides. Web one example is form 3520, yet another of the “informational returns” required to be filed by us persons who are owners (grantors) of foreign trusts, transferred assets into a. Ad signnow.com has been visited by 100k+ users in the past month Not sure if you need. Because form 3520 deals with foreign trusts, it is. Reporting foreign trusts, inheritances,. Person who, during the current tax year, received certain gifts or bequests from a foreign person. What is a foreign trust. Web identifying information requested below and part iv of the form. The foreign gift portion of the form 3520 is limited to sections i and iv of the form. Web common examples of individuals with foreign gift reporting requirements: Web complete the identifying information on page 1 of the form and part iv. 3 the irs wants to track the money. 4 who reports gifts from foreign persons to the irs? Web requested below and part iii of the form. Ad signnow.com has been visited by 100k+ users in the past month Web the irs form 3520 reports (annually) information about us persons’ (a) ownership of foreign trusts, (b) contributions to foreign trusts, (c) distributions from foreign trusts and. Because form 3520 deals with foreign trusts, it is. 4 who reports gifts from foreign persons to the irs? Web 1 gifts from foreign persons. And see the instructions for part iv. And see the instructions for part iv. The foreign gift portion of the form 3520 is limited to sections i and iv of the form. Person who, during the current tax year, received certain gifts or bequests from a foreign person. Owner, including recent updates, related forms and instructions on how to file. Reporting foreign trusts, inheritances, and gifts for. When certain foreign trust, foreign gift, or foreign bequest transactions occur, the irs requires. Complete, edit or print tax forms instantly. Web 1 gifts from foreign persons. The foreign gift portion of the form 3520 is limited to sections i and iv of the form. Person who, during the current tax year, received certain gifts or bequests from a foreign. The foreign gift portion of the form 3520 is limited to sections i and iv of the form. Complete, edit or print tax forms instantly. Web requested below and part iii of the form. Reporting foreign trusts, inheritances, and gifts for americans abroad. What is a foreign trust. And see the instructions for part iv. The form provides information about the foreign trust, its u.s. Web receipt of foreign gifts or bequests reportable on part iv of form 3520. Ad signnow.com has been visited by 100k+ users in the past month Reporting foreign trusts, inheritances, and gifts for americans abroad. The form provides information about the foreign trust, its u.s. See the instructions for part iv. Web part iv is for the actual reporting of the gift (s). 2 irs reporting of gifts from foreign persons. Web complete the identifying information on page 1 of the form and part iv. Web identifying information requested below and part iv of the form. Complete, edit or print tax forms instantly. Web common examples of individuals with foreign gift reporting requirements: And see the instructions for part iv. Because form 3520 deals with foreign trusts, it is. Owner, including recent updates, related forms and instructions on how to file. I received foreign gifts from 4 people in excess of $5000, but only 3 lines are provided on this form and more space is needed. The form provides information about the foreign trust, its u.s. See the instructions for part iv. Person(s) with respect to whom this form 3520 is being filed. Person who, during the current tax year, received certain gifts or bequests from a foreign person. The foreign gift portion of the form 3520 is limited to sections i and iv of the form. You are a resident alien or a u.s. What is a foreign trust. Web receipt of foreign gifts or bequests reportable on part iv of form 3520. Web one example is form 3520, yet another of the “informational returns” required to be filed by us persons who are owners (grantors) of foreign trusts, transferred assets into a. Web requested below and part iii of the form. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Not sure if you need. 4 who reports gifts from foreign persons to the irs?IRS Form 3520Reporting Transactions With Foreign Trusts

IRS Form 3520Reporting Transactions With Foreign Trusts

IRS Form 3520 Download Fillable PDF or Fill Online Annual Return to

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Form 3520 Fill out & sign online DocHub

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Form 3520 Fill Out and Sign Printable PDF Template signNow

Form 3520 Blank Sample to Fill out Online in PDF

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

3.21.19 Foreign Trust System Internal Revenue Service

Related Post: