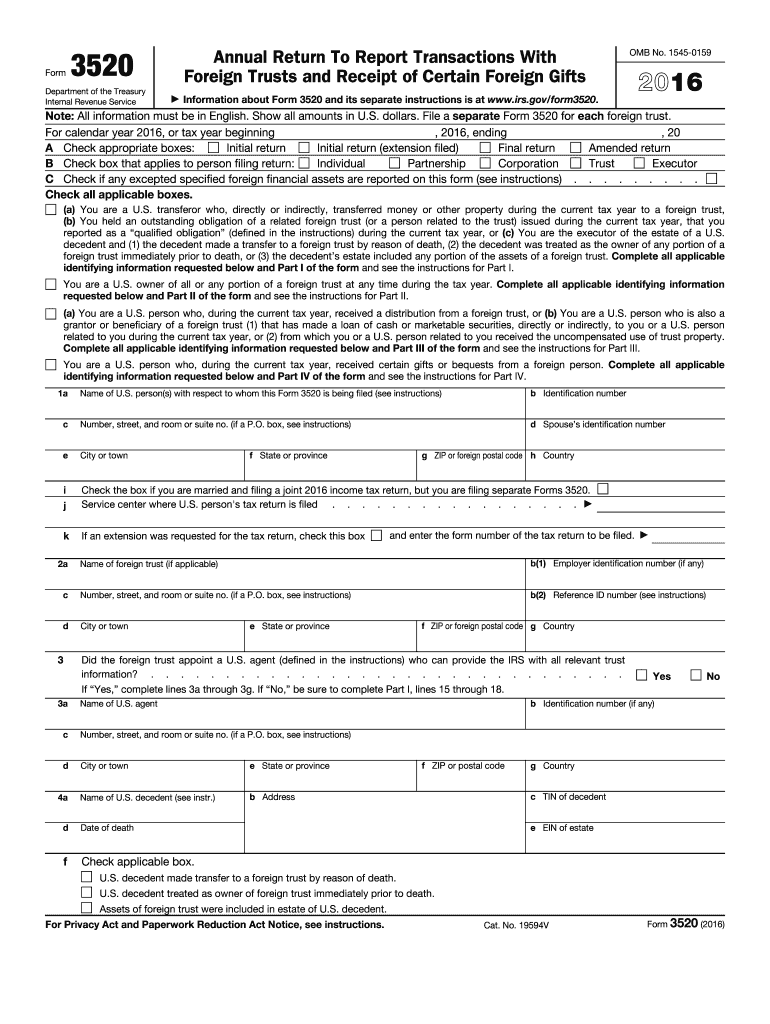

Form 3520 Late Filing Penalty

Form 3520 Late Filing Penalty - Web the form 3520 penalties are assessable penalties. That means that a person does not receive notice that they may be subject to the penalty before it is issued. 9 can you apply for an extension for form. With respect to the foreign trust. Web up to 25% for failure to report the receipt of a gift or inheritance from a foreign person (sec. Learn more about filing form 3520, schedule a free consultation today! Web when a us person taxpayer files a late form 3520, they may be subject to extensive fines and penalties. If the taxpayer can show reasonable cause, then they. Web by kunal patel in early march 2020, the irs released rev. Learn more about filing form 3520, schedule a free consultation today! Web when a us person taxpayer files a late form 3520, they may be subject to extensive fines and penalties. 9 can you apply for an extension for form. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following. Web when a us person taxpayer files a late form 3520, they may be subject to extensive fines and penalties. Web 4 section 6048 5 what is form 3520? A return filed timely but in the wrong district with the regional commissioner or commissioner of internal. Web in particular, late filers of form 3520, “annual return to report transactions with. Learn more about filing form 3520, schedule a free consultation today! A return mailed in time but returned for insufficient postage. Web the form 3520 penalty for late filing is extremely disproportionate to the “violation.” sometimes (and oftentimes) it is simply a gift from a foreign parent to a u.s. Web the form 3520 penalties are assessable penalties. While an. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web up to 25% for failure to report the receipt of a gift or inheritance from a foreign person (sec. 6 who must file form. Web the form 3520 penalties are assessable penalties. This article explains how it is. The $225,000 penalty was issued based on the penalty is 5% (of the value of the gift) per month — for a maximum of 25%. Learn more about filing form 3520, schedule a free consultation today! A return mailed in time but returned for insufficient postage. Web when a u.s. 6 who must file form 3520? Learn more about filing form 3520, schedule a free consultation today! 7 what is reported on form 3520 8 when is form 3520 due? Web the federal district court struck down the irs's imposition of a 35% civil penalty for failing to timely file a form 3520 — an information. Ad our skilled attorneys and cpas can help you avoid 3520 penalties from the irs. Person is faced with an asserted penalty for late filing of form 3520 reporting the receipt of a foreign gift or bequest, the process to have the penalty. A return mailed in time but returned for insufficient postage. This article explains how it is. The. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. While an effective reasonable cause. Learn more about filing form 3520, schedule a free consultation today! Ad our skilled attorneys and cpas can help you. Web form 3520 penalty appeal. The $225,000 penalty was issued based on the penalty is 5% (of the value of the gift) per month — for a maximum of 25%. Web the form 3520 penalty for late filing is extremely disproportionate to the “violation.” sometimes (and oftentimes) it is simply a gift from a foreign parent to a u.s. Person. A return filed timely but in the wrong district with the regional commissioner or commissioner of internal. Web form 3520 penalty appeal. 6 who must file form 3520? Generally, the initial penalty is equal to the greater of $10,000 or the following (as applicable). Web 4 section 6048 5 what is form 3520? Ad our skilled attorneys and cpas can help you avoid 3520 penalties from the irs. The $225,000 penalty was issued based on the penalty is 5% (of the value of the gift) per month — for a maximum of 25%. This article explains how it is. Web if you file form 3520 late, or if the information provided is incomplete or incorrect, the irs may determine the income tax consequences of the receipt of such foreign gift or. Web when a us person taxpayer files a late form 3520, they may be subject to extensive fines and penalties. That means that a person does not receive notice that they may be subject to the penalty before it is issued. If the taxpayer can show reasonable cause, then they. 6 who must file form 3520? Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web the federal district court struck down the irs's imposition of a 35% civil penalty for failing to timely file a form 3520 — an information return used to report,. A return filed timely but in the wrong district with the regional commissioner or commissioner of internal. Web when a u.s. Learn more about filing form 3520, schedule a free consultation today! Web what are the penalties for form 3520 late filing? 7 what is reported on form 3520 8 when is form 3520 due? 6039f (c) (1) (b)) (form 3520). Learn more about filing form 3520, schedule a free consultation today! Web the form 3520 penalty for late filing is extremely disproportionate to the “violation.” sometimes (and oftentimes) it is simply a gift from a foreign parent to a u.s. Web 4 section 6048 5 what is form 3520?Has the IRS Assessed You a Penalty for a Late Filed Form 3520A? You

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Foreign Trust Form 3520A Filing Date Reminder & Tips To Avoid Penalties

Form 3520 Reporting Foreign Trusts and Gifts for US Citizens

Did You Receive a IRS CP15 Notice for Late Filing Form 3520 Penalty

Understanding Form 3520 for Foreign Trusts and Gifts & Penalties YouTube

form 3520a 2021 Fill Online, Printable, Fillable Blank

The Tax Times IRS Sending SemiAutomated Penalties For Late Filed Form

Form 3520 2016 Fill out & sign online DocHub

Did You Receive a SemiAutomated Penalty Assessments For Late Filed

Related Post: