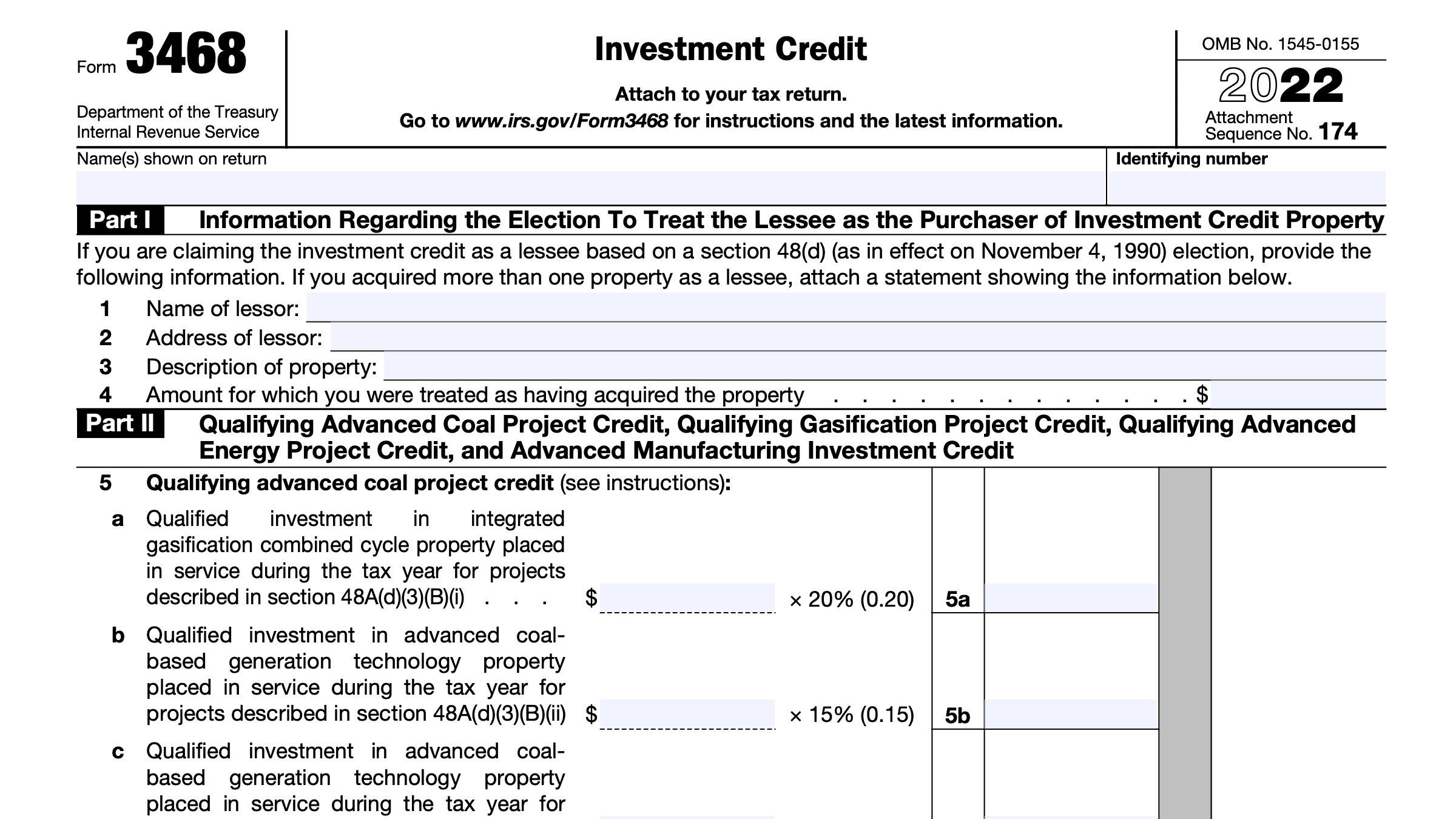

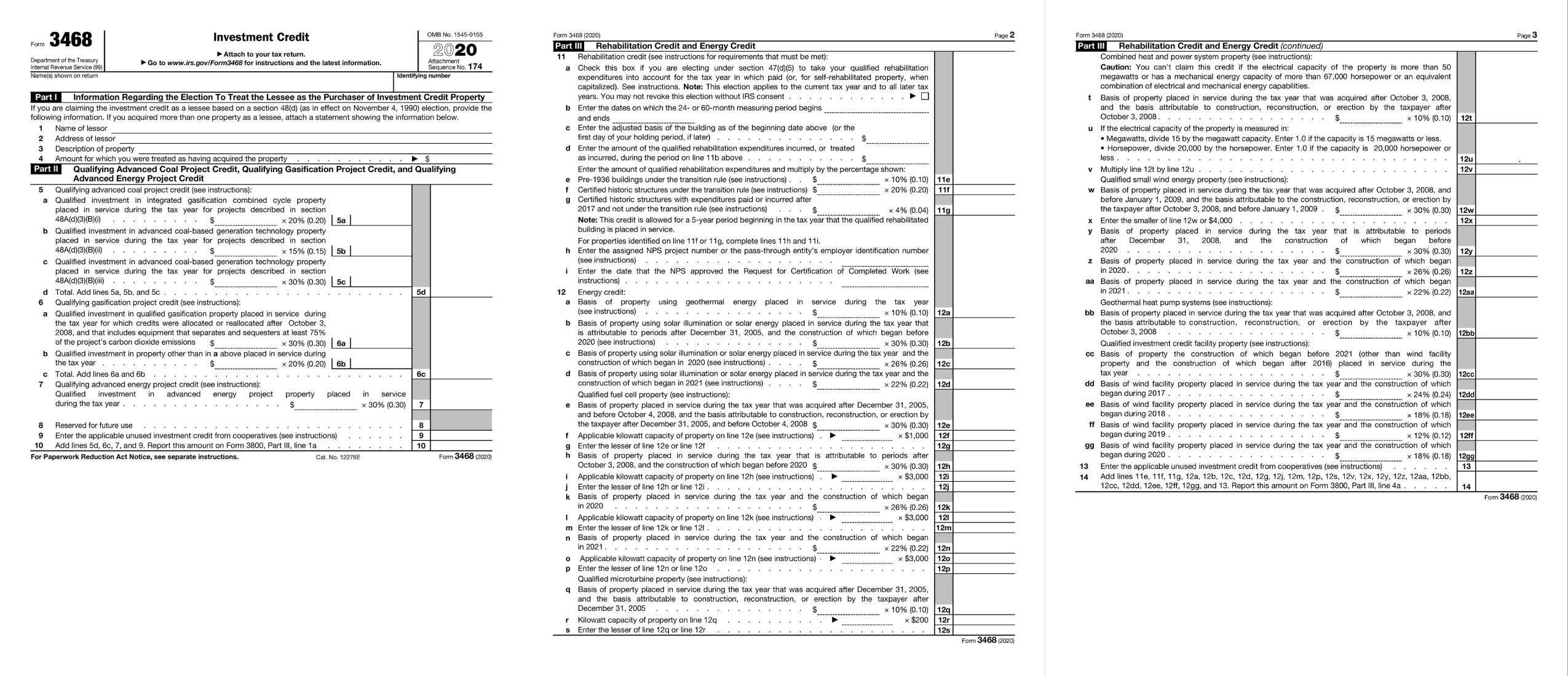

Form 3468 Irs

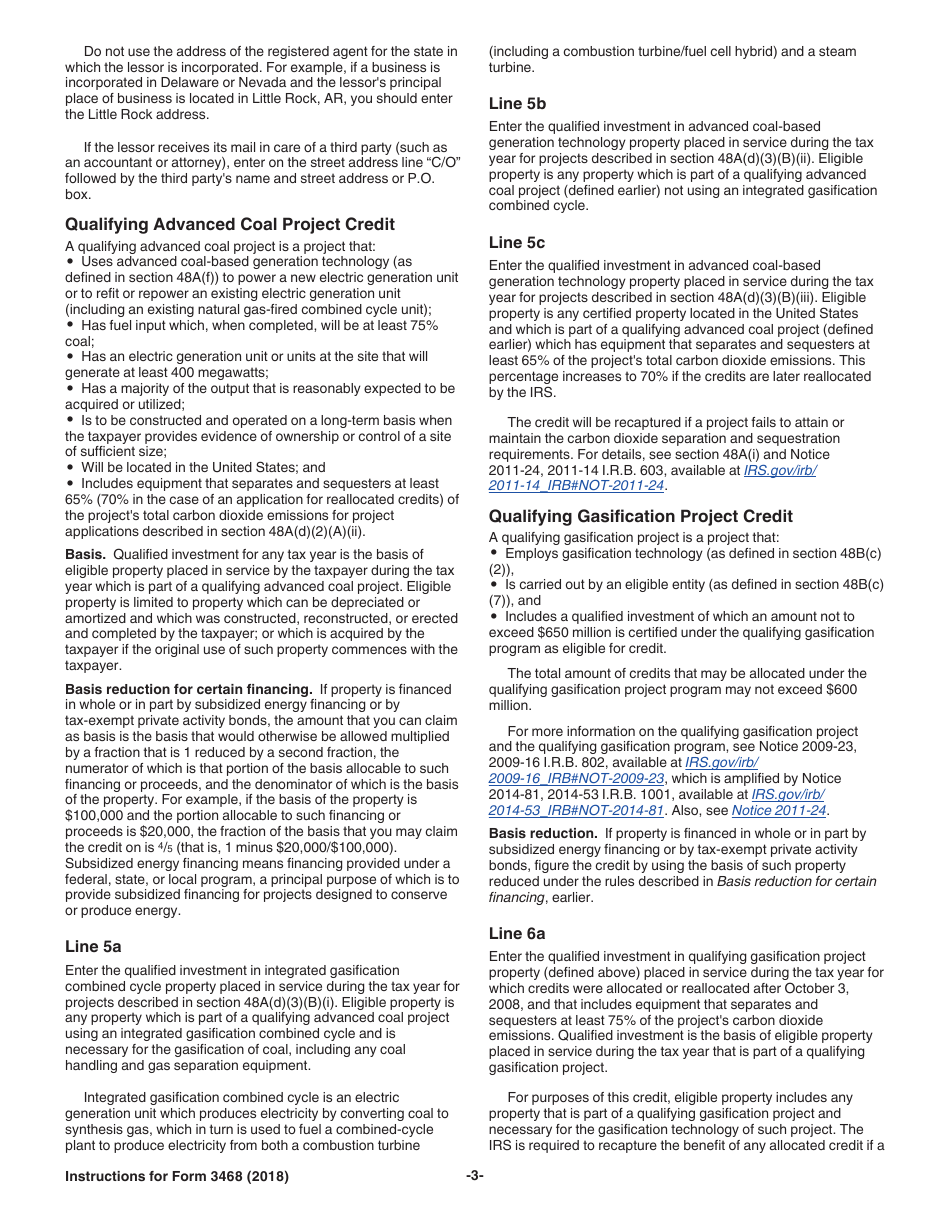

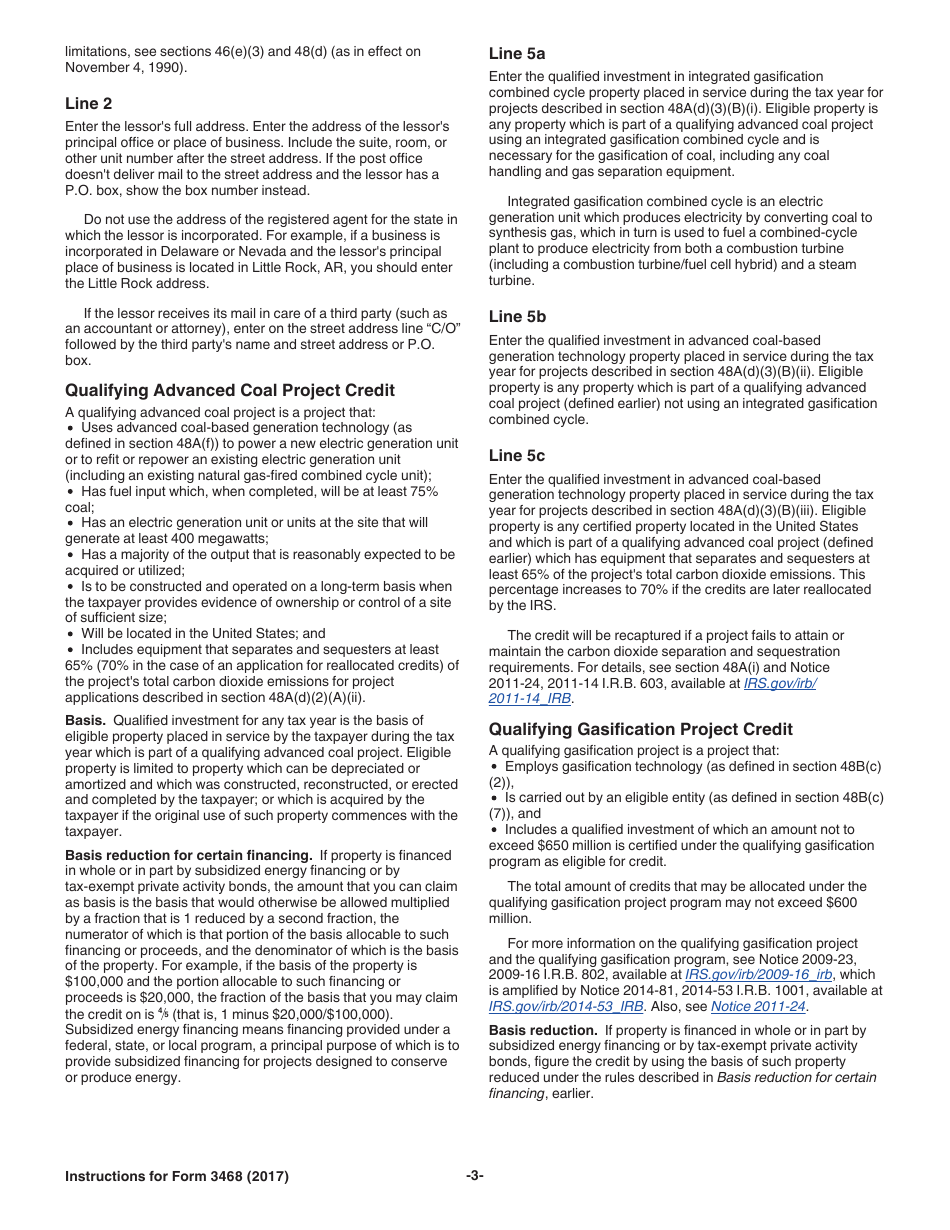

Form 3468 Irs - Web steps to claim the solar tax credit there are three major steps you'll need to take: Web purpose of form use form 3468 to claim the investment credit. Meaning of 3468 form as a finance term. Many credits make up the investment. Web form 3468 is used to compute the investment credit; Web the investment tax credit is part of the general business credit. Web what is the investment credit, form 3468? Generally, (a) an estate or trust whose. Web see supplemental instructions for form 3468, line 14 below and latest instructions for form 3800, part iii, posted at irs.gov/form3800. Web about form 3468, investment credit. Web form 3468 is used to compute the investment credit; Web 22% in 2023. Form 3468 is used to compute taxpayers' credit against their income tax for certain expenses incurred for their trades or. Web about form 3468, investment credit. Determine if your system qualifies for the itc. Determine if your system qualifies for the itc. Web purpose of form use form 3468 to claim the investment credit. Estimate how much you could potentially save in just a matter of minutes. Web about form 3468, investment credit. Web see supplemental instructions for form 3468, line 14 below and latest instructions for form 3800, part iii, posted at irs.gov/form3800. Web who must complete form 3468? Web the investment tax credit is part of the general business credit. Web what is the investment credit, form 3468? The investment credit is composed of various credits including the business energy credit. Determine if your system qualifies for the itc. Use this form to claim the investment credit. Web steps to claim the solar tax credit there are three major steps you'll need to take: Be sure you are still eligible to claim the credit by. Web 22% in 2023. Form 3468 is used to compute taxpayers' credit against their income tax for certain expenses incurred for their trades or. Web who must complete form 3468? Meaning of 3468 form as a finance term. Web form 3468 investment credit information can be entered in screen 20.2, other credits in the investment credit (3468) section. The investment credit is composed of various credits including the business energy credit. Web what is the investment credit, form 3468? Use this form to claim the investment credit. Web irs form 3468, investment credit, is the tax form that the internal revenue service uses to allow businesses to reduce corporate income taxes by. You can figure this credit on form 3468: The investment credit consists of the following credits: Web form 3468 is a federal corporate income tax form. Many credits make up the investment. You can figure this credit on form 3468: Web form 3468 investment credit information can be entered in screen 20.2, other credits in the investment credit (3468) section. Ultratax cs provides two options to enter form 3468 credit information: The credit automatically drops to 10% if your business doesn't start using the solar. Ultratax cs provides two options to enter form 3468 credit information: Web form 3468 investment credit information can be entered in screen 20.2, other credits in the investment credit (3468) section. Web what is the investment credit, form 3468? Be sure you are still eligible to claim the credit by. Beginning in tax year 2018, changes have been made to. The investment credit is composed of various credits including the business energy credit. Ad we help get taxpayers relief from owed irs back taxes. Web about form 3468, investment credit. Web who must complete form 3468? Fast, easy and secure application. • established new rules for certain filers to elect to treat credit amounts as deemed payments and rules. Web energy project will be posted at irs.gov/form3468 in the coming weeks. Form 3468 is used to compute taxpayers' credit against their income tax for certain expenses incurred for their trades or. Be sure you are still eligible to claim the credit. Estimate how much you could potentially save in just a matter of minutes. Web 22% in 2023. You can figure this credit on form 3468: Web irs form 3468, investment credit, is the tax form that the internal revenue service uses to allow businesses to reduce corporate income taxes by. Web steps to claim the solar tax credit there are three major steps you'll need to take: Department of the treasury internal revenue service. Taxpayers claim many of these credits using irs form. Web the investment tax credit is part of the general business credit. Web purpose of form use form 3468 to claim the investment credit. Web what is the investment credit, form 3468? Web form 3468 investment credit information can be entered in screen 20.2, other credits in the investment credit (3468) section. Enter the asset the credit will be taken on in screen asset in the appropriate activity. Fast, easy and secure application. Use this form to claim the investment credit. The investment credit consists of the following credits: • established new rules for certain filers to elect to treat credit amounts as deemed payments and rules. Web form 3468 is a federal corporate income tax form. Many credits make up the investment. The investment credit is composed of various credits including the business energy credit. The specific instructions section of the instructions for form 3468 state the following:Form 3468 Investment Credit (2015) Free Download

IRS Form 3468 Guide to Claiming the Investment Tax Credit

Instructions for Form 3468, Investment Credit

Instructions For Form 3468 2016 printable pdf download

Instructions For Form 3468 Department Of The Treasury printable pdf

Instructions For Form 3468 Investment Credit 1994 printable pdf

Federal Investment Tax Credit (ITC) Form 3468/3468i, Eligible

Download Instructions for IRS Form 3468 Investment Credit PDF, 2018

Download Instructions for IRS Form 3468 Investment Credit PDF, 2017

IRS Form 3468 2018 Fill Out, Sign Online and Download Fillable PDF

Related Post: