Form 2848 Instructions

Form 2848 Instructions - Web today, we're mostly going to be talking about form 2848, but let's take a moment to explain the difference between form 2848 and form 8821. Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; Web the irs calls form 2848 the power of attorney and declaration of representative form. Web if the internal revenue service (irs) decides to investigate your income tax return, you may need to use an irs power of attorney form to appoint a qualified. Web when do you need form 2848? Power of attorney and declaration of representative. Web use form 2848 to authorize an individual to represent you before the irs. The irs is also authorized to accept a power of attorney other than a form 2848, power of attorney, provided that it includes (1) the. Web irs power of attorney form 2848 | revised jan. Web use form 2848 to authorize an individual to represent you before the irs. Try it for free now! Web if the internal revenue service (irs) decides to investigate your income tax return, you may need to use an irs power of attorney form to appoint a qualified. Power of attorney and declaration of representative. January 2021) department of the treasury internal revenue service. See substitute form 2848, later, for information about using a. Web if the internal revenue service (irs) decides to investigate your income tax return, you may need to use an irs power of attorney form to appoint a qualified. Create a high quality document now! While you can authorize immediate family members to act on. Ad get ready for tax season deadlines by completing any required tax forms today. Therefore. Web use form 2848 to authorize an individual to represent you before the irs. January 2021) department of the treasury internal revenue service. Therefore form 56 or new form 2848 signed by estate executor or. The irs is also authorized to accept a power of attorney other than a form 2848, power of attorney, provided that it includes (1) the.. See substitute form 2848, later, for information about using a power of attorney other than a form. Web if the internal revenue service (irs) decides to investigate your income tax return, you may need to use an irs power of attorney form to appoint a qualified. Ad get ready for tax season deadlines by completing any required tax forms today.. Web use form 2848 to authorize an individual to represent you before the irs. See substitute form 2848, later, for information about using a power of attorney other than a form. Not just anyone can be granted power of attorney with the irs. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for. Upload, modify or create forms. Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 2848 to authorize an individual to represent you before the irs. Not just anyone can be granted power of attorney with the irs. Power of attorney and declaration of representative. Web today, we're mostly going to be talking about form 2848, but let's take a moment to explain the difference between form 2848 and form 8821. March 2012) department of the treasury internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. See substitute form 2848, later, for. Web instructions for form 2848 (mar. Get 15 form 2848 instructions on how to complete this important irs tax form correctly. Ad get ready for tax season deadlines by completing any required tax forms today. Web need to fill out form 2848 for power of attorney? The irs is also authorized to accept a power of attorney other than a. Web the irs calls form 2848 the power of attorney and declaration of representative form. Ad get ready for tax season deadlines by completing any required tax forms today. Create a high quality document now! While you can authorize immediate family members to act on. Irs power of attorney form 2848 is a document used when designating. Web use form 2848 to authorize an individual to represent you before the irs. Web use form 2848 to authorize an individual to represent you before the irs. Web if the internal revenue service (irs) decides to investigate your income tax return, you may need to use an irs power of attorney form to appoint a qualified. Form 2848 is. Not just anyone can be granted power of attorney with the irs. Form 2848 is used when the third. Try it for free now! March 2012) department of the treasury internal revenue service. Web when do you need form 2848? The irs is also authorized to accept a power of attorney other than a form 2848, power of attorney, provided that it includes (1) the. Create a high quality document now! Web use form 2848 to authorize an individual to represent you before the irs. Web the irs is proposing changes to the instructions of both the form 2848 and the 8821 to explain what it means to authenticate the taxpayer's identity, when an authorization form. Web the irs calls form 2848 the power of attorney and declaration of representative form. Web instructions for form 2848 (mar. Like many irs forms, the irs has provided detailed. Get 15 form 2848 instructions on how to complete this important irs tax form correctly. Web we provide detailed instructions and a sample of irs form 2848, which can serve as a helpful guide for those unfamiliar with the form's requirements. Web use form 2848 to authorize an individual to represent you before the irs. Web if the internal revenue service (irs) decides to investigate your income tax return, you may need to use an irs power of attorney form to appoint a qualified. Try it for free now! Upload, modify or create forms. See substitute form 2848, later, for information about using a power of attorney other than a form. Web today, we're mostly going to be talking about form 2848, but let's take a moment to explain the difference between form 2848 and form 8821.Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

[Form 2848 Instructions] How to Fill out Form 2848 EaseUS Article

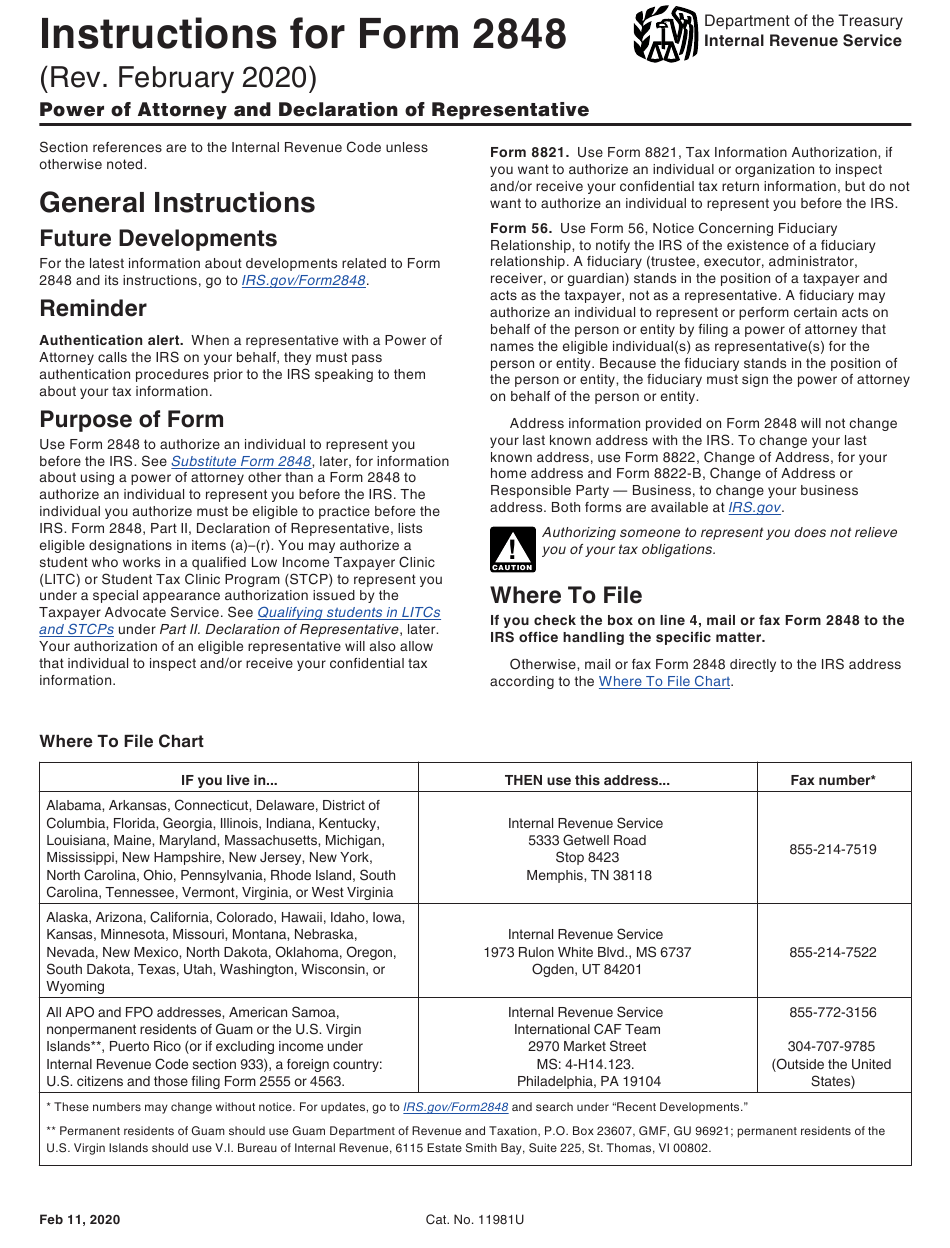

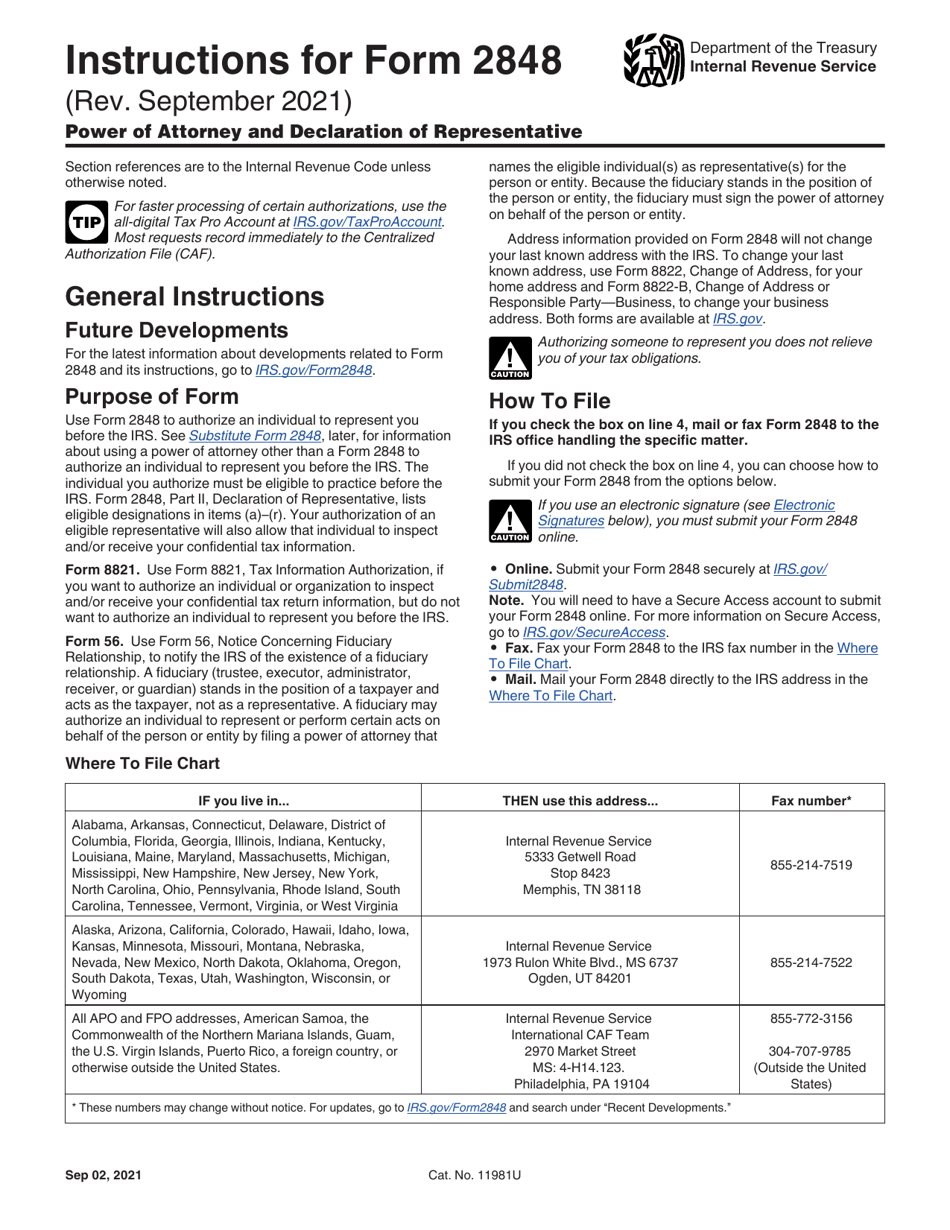

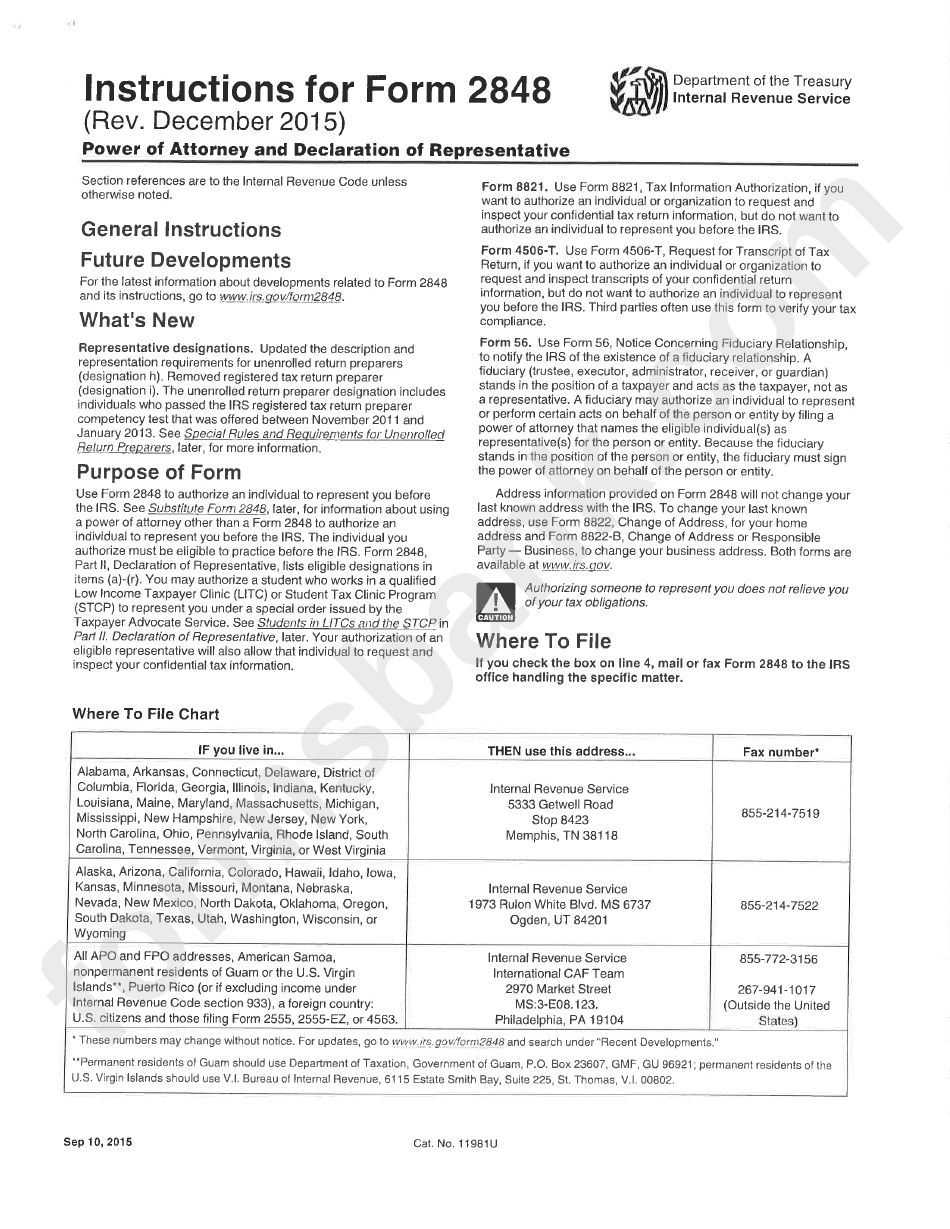

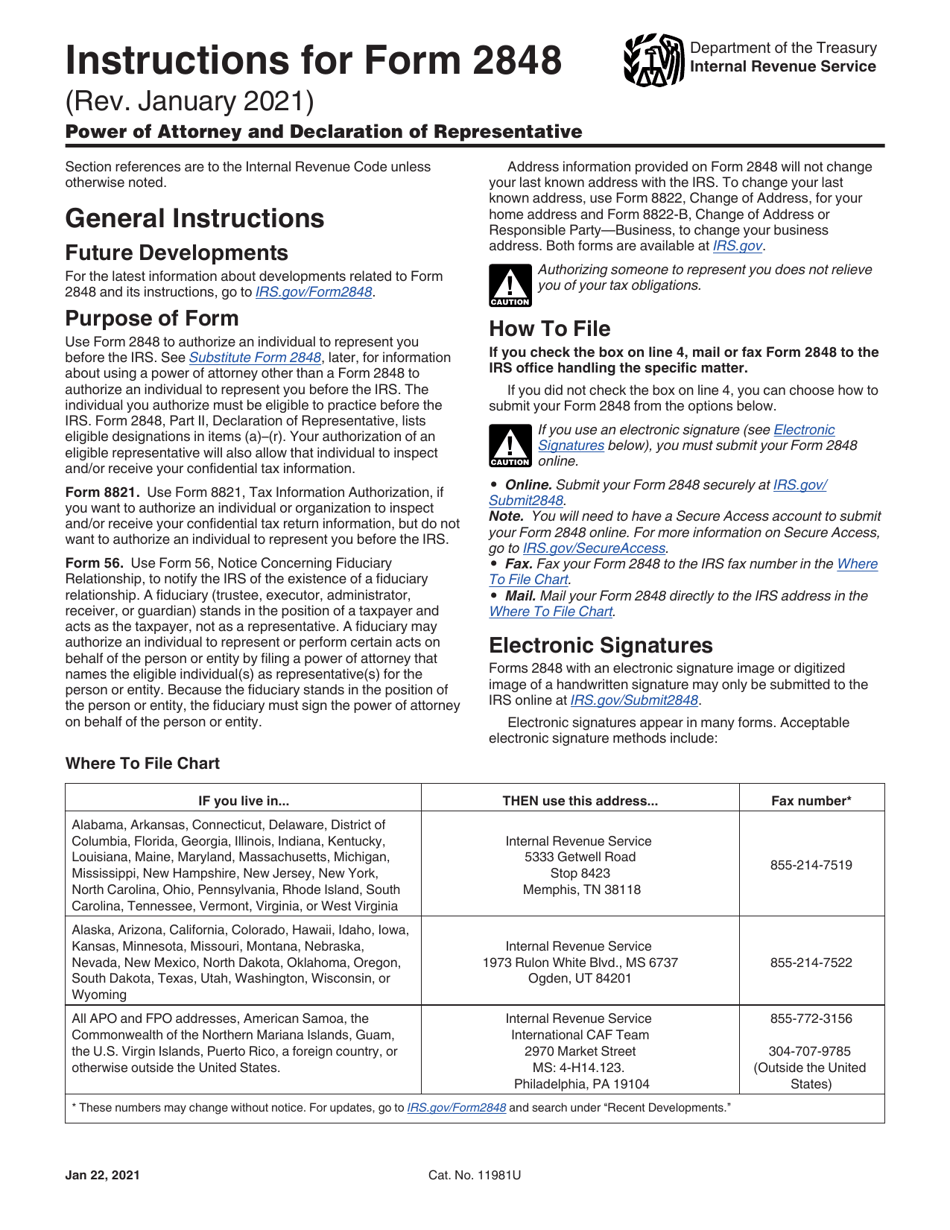

Download Instructions for IRS Form 2848 Power of Attorney and

Form 2848 Instructions for IRS Power of Attorney Community Tax

IRS Form 2848 Instructions

Form 2848 Instructions for IRS Power of Attorney Community Tax

Instructions For Form 2848 Power Of Attorney And Declaration Of

Download Instructions for IRS Form 2848 Power of Attorney and

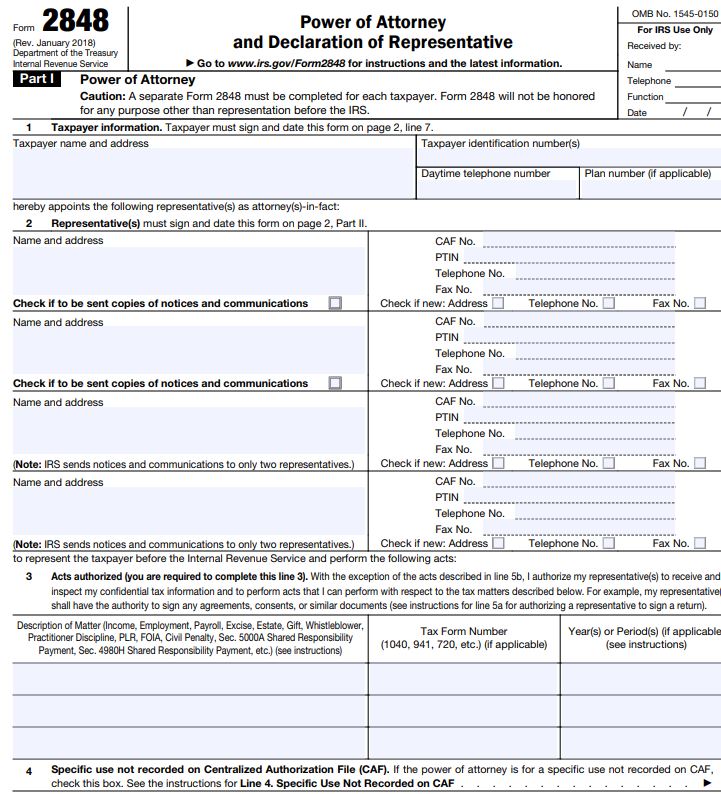

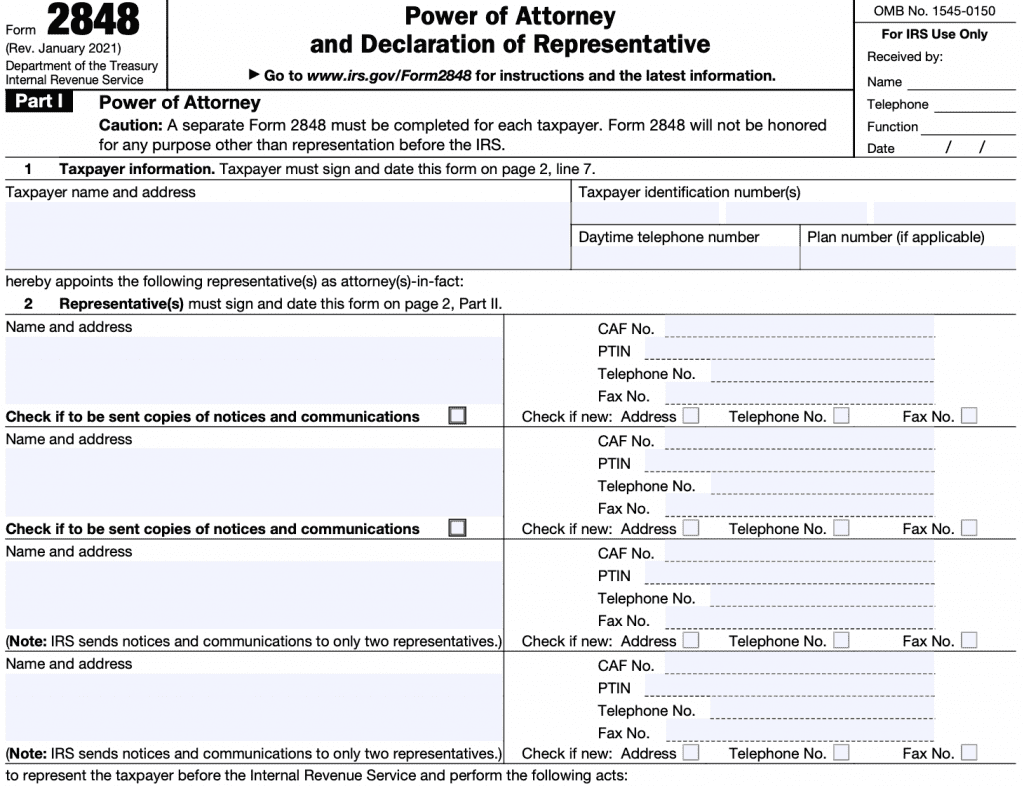

Form 2848 [PDF] Download Fillable IRS Power Of Attorney

Download Instructions For IRS Form 2848 Power Of Attorney Power Of

Related Post:

![[Form 2848 Instructions] How to Fill out Form 2848 EaseUS Article](https://i.pinimg.com/originals/5d/2e/e7/5d2ee7f7d89068e86f739e40ac8cd1e8.png)

![Form 2848 [PDF] Download Fillable IRS Power Of Attorney](https://www.pdffiller.com/preview/429/367/429367563/big.png)