Form 2441 Line 26

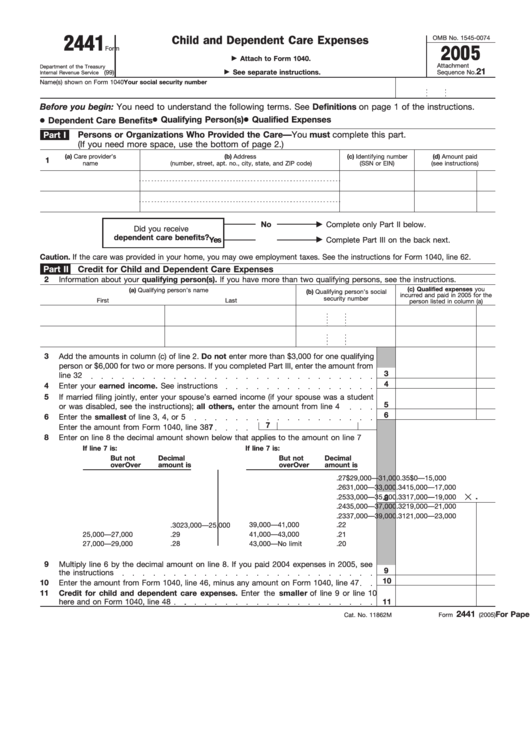

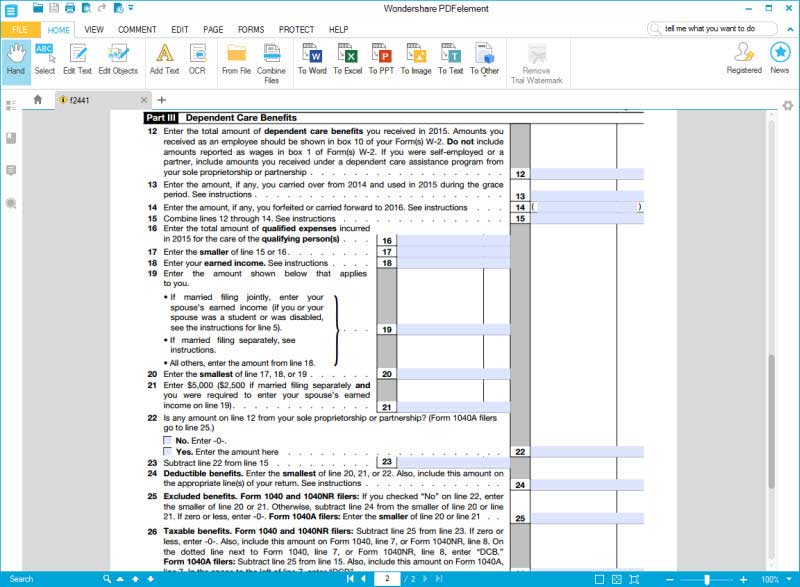

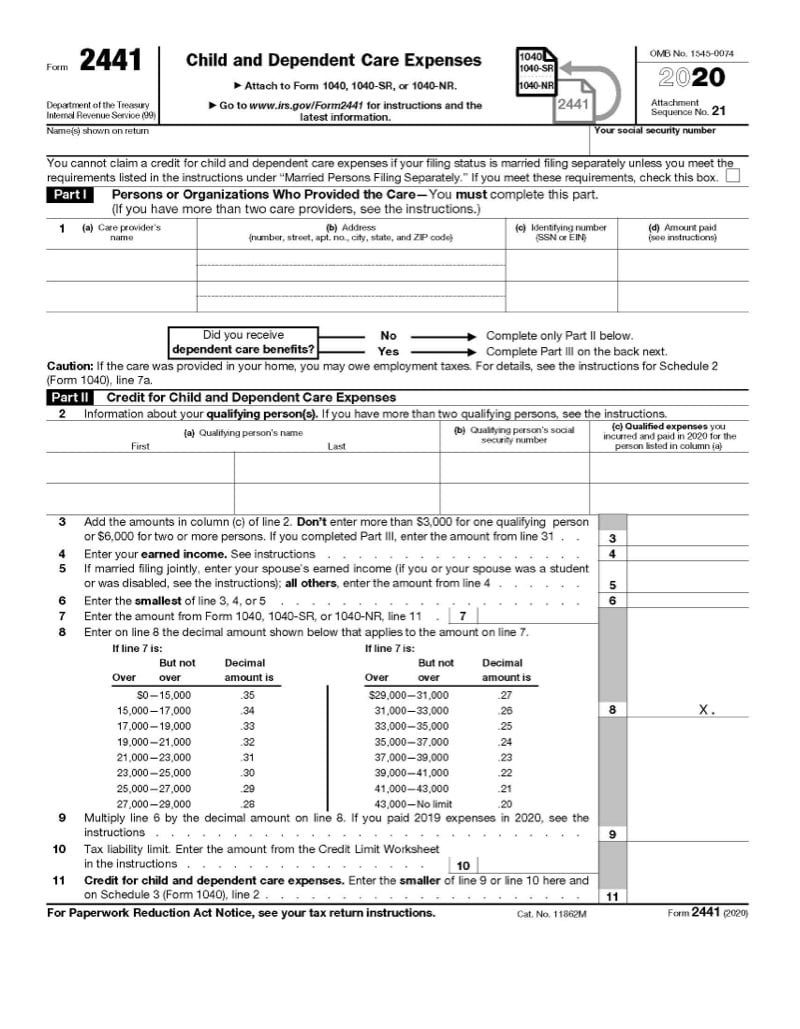

Form 2441 Line 26 - There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based. Subtract line 26 from line. If your filing status is married filing. Hiring someone to care for your loved one so you can continue working is a. March 26, 2023 at 9:00 am. You can download or print. If you received any dependent care benefits. Web form 2441(2006) before you begin: Ad get ready for tax season deadlines by completing any required tax forms today. Web december 22, 2021 · 5 minute read. Per irs publication 503 child and dependent care expenses, page 2: If line 26 is more than zero, you have taxable dependent care benefits. Web december 22, 2021 · 5 minute read. Web for a spouse who qualifies for the credit, but is a full time student or disabled, irs rules attribute a certain amount of earned income to the. Per irs publication 503 child and dependent care expenses, page 2: All about irs form 2441. There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based. See definitions on page 1 of the instructions. Web line 1e is calculated from form. Download or email irs 2441 & more fillable forms, register and subscribe now! Generally, married persons must file a joint return to claim the credit. Form 2441, child and dependent care expenses. All about irs form 2441. You can download or print. There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based. March 26, 2023 at 9:00 am. Irs form 2441 is used to report child and dependent care expenses on a federal income tax return. Web form 2441(2006) before you begin: Web. Web the taxable amount of benefits will show on form 2441, line 26 and will also show in the space to the left of line 7 of the 1040 with the initials dcb. Download or email irs 2441 & more fillable forms, register and subscribe now! Ad get ready for tax season deadlines by completing any required tax forms today.. Download or email irs 2441 & more fillable forms, register and subscribe now! Child and dependent care expenses. Web about the qualifying person on line 2. If you entered an amount on line 13, add it to the $5,000 or $2,500 amount you enter on line 21. Web 1c tip income not reported on line 1a; Publication 503 pdf ( html | ebook epub) recent developments. If line 26 is more than zero, you have taxable dependent care benefits. Web the taxable amount of benefits will show on form 2441, line 26 and will also show in the space to the left of line 7 of the 1040 with the initials dcb. Form 2441, child and. Web the taxable amount of benefits will show on form 2441, line 26 and will also show in the space to the left of line 7 of the 1040 with the initials dcb. Web it explains how to figure and claim the credit. There is a new line b that has a checkbox for you to indicate if you’re entering. Irs form 2441 is used to report child and dependent care expenses on a federal income tax return. Hiring someone to care for your loved one so you can continue working is a. March 26, 2023 at 9:00 am. There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250. Hiring someone to care for your loved one so you can continue working is a. Web for a spouse who qualifies for the credit, but is a full time student or disabled, irs rules attribute a certain amount of earned income to the spouse for purposes of the credit. Line 1f is calculated from form 8839, line 29, with an. Ad get ready for tax season deadlines by completing any required tax forms today. See the instructions for line 8 for the 2021 phaseout schedule. If you received any dependent care benefits. Web form 2441(2006) before you begin: All about irs form 2441. See definitions on page 1 of the instructions. Web we last updated the child and dependent care expenses in december 2022, so this is the latest version of form 2441, fully updated for tax year 2022. Web it explains how to figure and claim the credit. Adjustments will be based on your income, your spouse’s income (if. Subtract line 26 from line. You need to understand the following terms. Irs form 2441 is used to report child and dependent care expenses on a federal income tax return. Web december 22, 2021 · 5 minute read. If your filing status is married filing. Web instructions for line 13. March 26, 2023 at 9:00 am. Web for a spouse who qualifies for the credit, but is a full time student or disabled, irs rules attribute a certain amount of earned income to the spouse for purposes of the credit. There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based. Web line 1e is calculated from form 2441, line 26, with an “add” button for the form. Download or email irs 2441 & more fillable forms, register and subscribe now!Instructions for form 2441 for 2016 Fill out & sign online DocHub

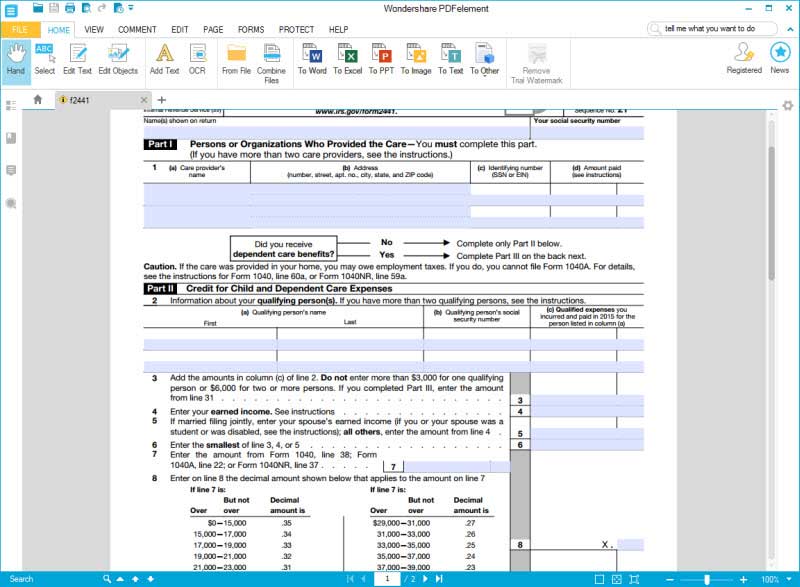

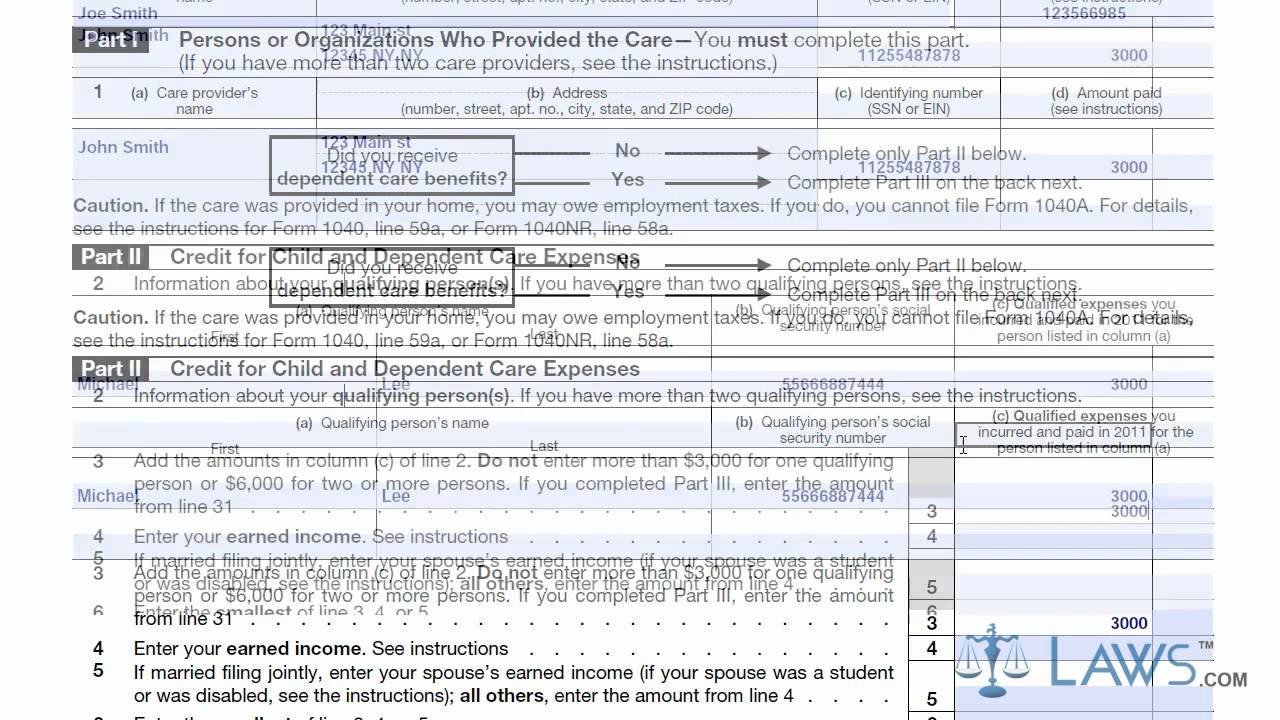

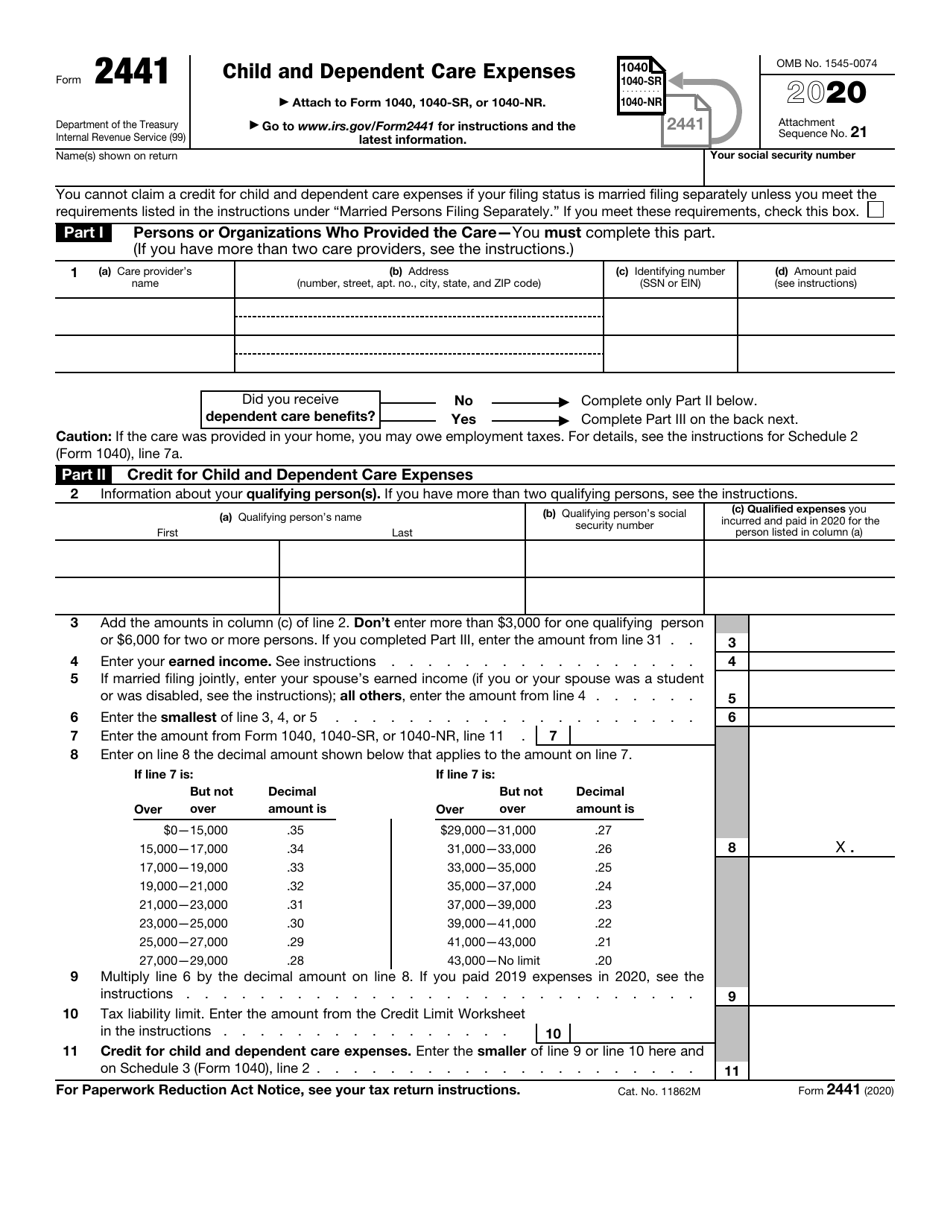

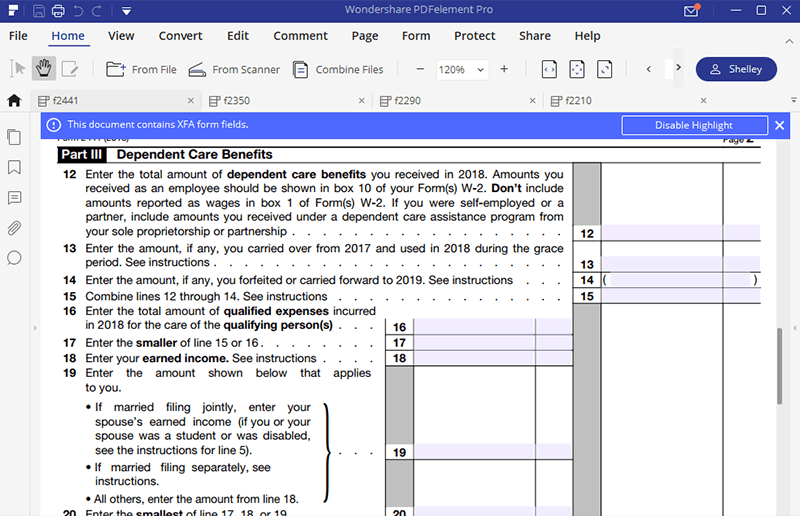

Instructions for How to Fill in IRS Form 2441

Irs form 2441 instructions Canadian Manuals Stepbystep Guidelines

Learn How to Fill the Form 2441 Dependent Care Expenses YouTube

IRS Form 2441 Download Fillable PDF or Fill Online Child and Dependent

Instructions for How to Fill in IRS Form 2441

Fillable Form 2441 Child And Dependent Care Expenses printable pdf

Instructions for How to Fill in IRS Form 2441

Reporting Child & Dependent Care Expenses IRS Form 2441

Irs Form 2441 Printable Printable Forms Free Online

Related Post:

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)