Form 2439 Irs

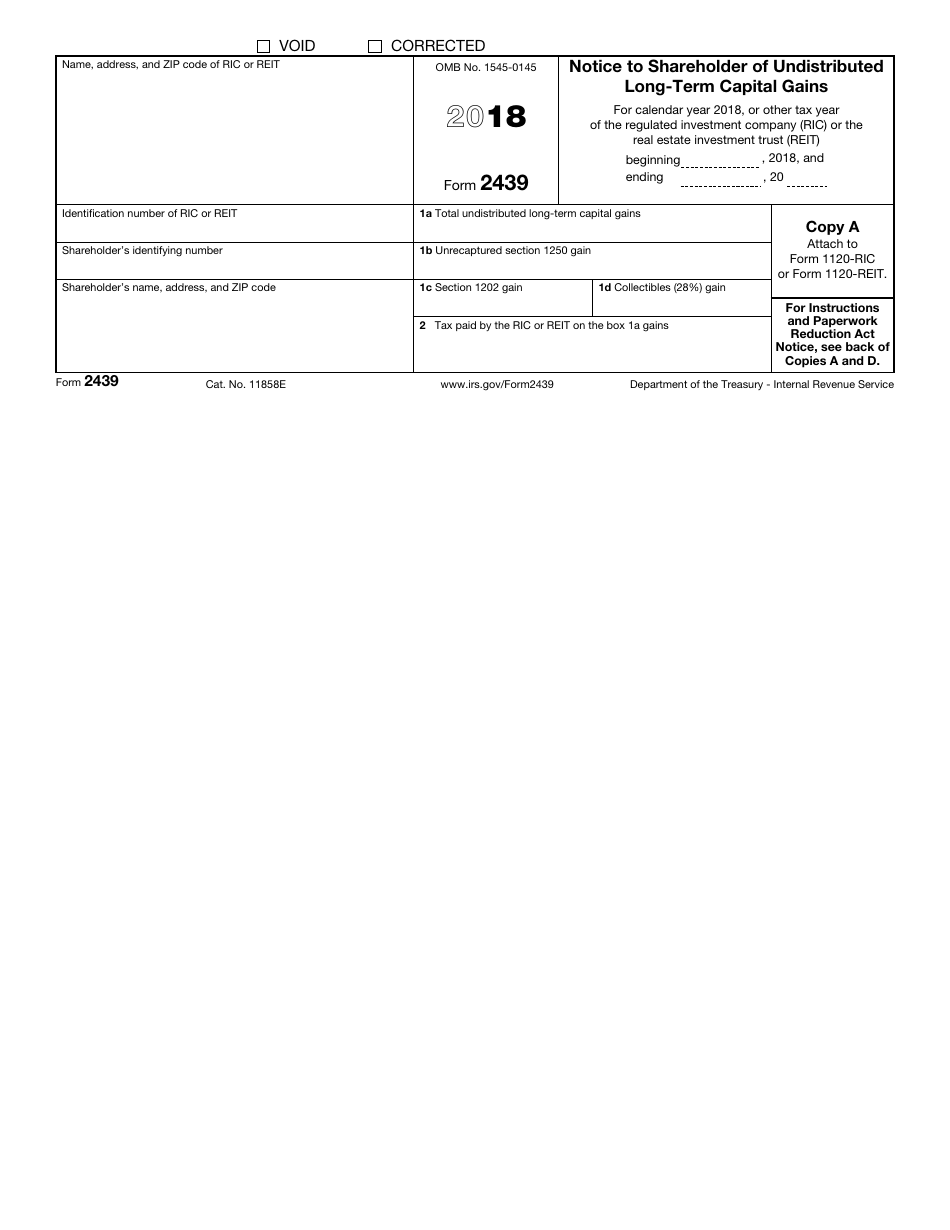

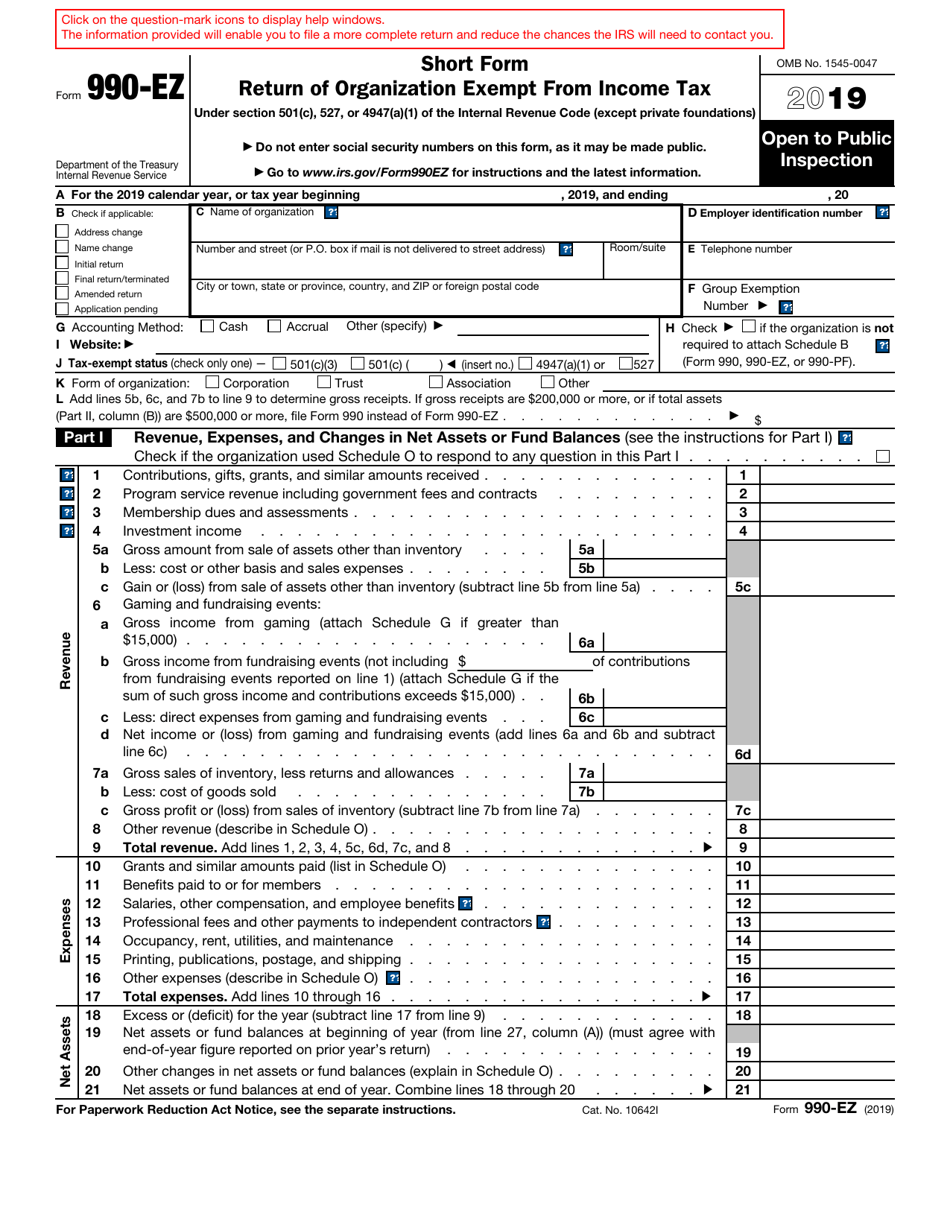

Form 2439 Irs - Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. Web form 2439 is a form used by the irs to request an extension of time to file a return. Web information about form 2438, undistributed capital gains tax return, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. Web access irs forms, instructions and publications in electronic and print media. Ad click here to check all the information you need for irs offices near you. Web (1) complete all three copies of form 2439 for each owner. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen. Web to enter form 2439 capital gains, complete the following: Your basis allocation is $158. Web access irs forms, instructions and publications in electronic and print media. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Form 2439 says you’ve received a capital gain allocation of $200, and the mutual fund. Web complete copies a, b, c, and d of form 2439 for each owner. Get information on tax collection, income tax forms, and tax assistance near you. Form 2439 is required by the u.s. Web access irs forms, instructions and publications in electronic and print media. Enter the ale member’s complete address (including. Web form 2439 is a tax form that reports the undistributed capital gains of a mutual fund or a real estate investment trust (reit) to its shareholders. Web cpas should read the detailed instructions in this announcement for changes in the following forms: Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. Web to enter form. Web form 2439 is a form used by the irs to request an extension of time to file a return. Web when this happens, the mutual fund company will send you a form 2439: The irs form 2439 is issued to a shareholder by either a reit or ric when the corporation has undistributed. Web information about form 2438, undistributed. Your basis allocation is $158. The above information will flow to: Get information on tax collection, income tax forms, and tax assistance near you. Web complete copies a, b, c, and d of form 2439 for each owner. The amounts entered in boxes 1b, 1c, and 1d and. Web cpas should read the detailed instructions in this announcement for changes in the following forms: Complete, edit or print tax forms instantly. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen. Form 2439 is required by the u.s. Web. Your basis allocation is $158. Web complete copies a, b, c, and d of form 2439 for each owner. Web to enter form 2439 capital gains, complete the following: The above information will flow to: Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. The above information will flow to: Enter the ale member’s complete address (including. Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. Web (1) complete all three copies of form 2439 for each owner. Web complete copies a, b, c, and d of form 2439 for each owner. Get information on tax collection, income tax forms, and tax assistance near you. Get ready for tax season deadlines by completing any required tax forms today. The amounts entered in boxes 1b, 1c, and 1d and. Web form 2439 is a form used by the irs to request an extension of time to file a return. Form 2439 says you’ve. Web complete copies a, b, c, and d of form 2439 for each owner. Get information on tax collection, income tax forms, and tax assistance near you. Get ready for tax season deadlines by completing any required tax forms today. Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. Form 2439. The irs form 2439 is issued to a shareholder by either a reit or ric when the corporation has undistributed. Get ready for tax season deadlines by completing any required tax forms today. Web to enter form 2439 capital gains, complete the following: Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. Web access irs forms, instructions and publications in electronic and print media. Get information on tax collection, income tax forms, and tax assistance near you. Your basis allocation is $158. Ad click here to check all the information you need for irs offices near you. If you received a form 2439 with a gain in box 1c, part or all of that gain (which is also included in box 1a) may be eligible for the section 1202 exclusion. Web cpas should read the detailed instructions in this announcement for changes in the following forms: Form 2439 is required by the u.s. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen. Enter the ale member’s complete address (including. Web (1) complete all three copies of form 2439 for each owner. Form 2439 says you’ve received a capital gain allocation of $200, and the mutual fund paid $42 of tax on this amount. Web form 2439 is a form used by the irs to request an extension of time to file a return. Web complete copies a, b, c, and d of form 2439 for each owner. Internal revenue service (irs) for use by rics, reits, etfs, and mutual funds. The above information will flow to: Web form 2439 is a tax form that reports the undistributed capital gains of a mutual fund or a real estate investment trust (reit) to its shareholders.Ssurvivor Form 2439 Statements

Ssurvivor Form 2439 Statements

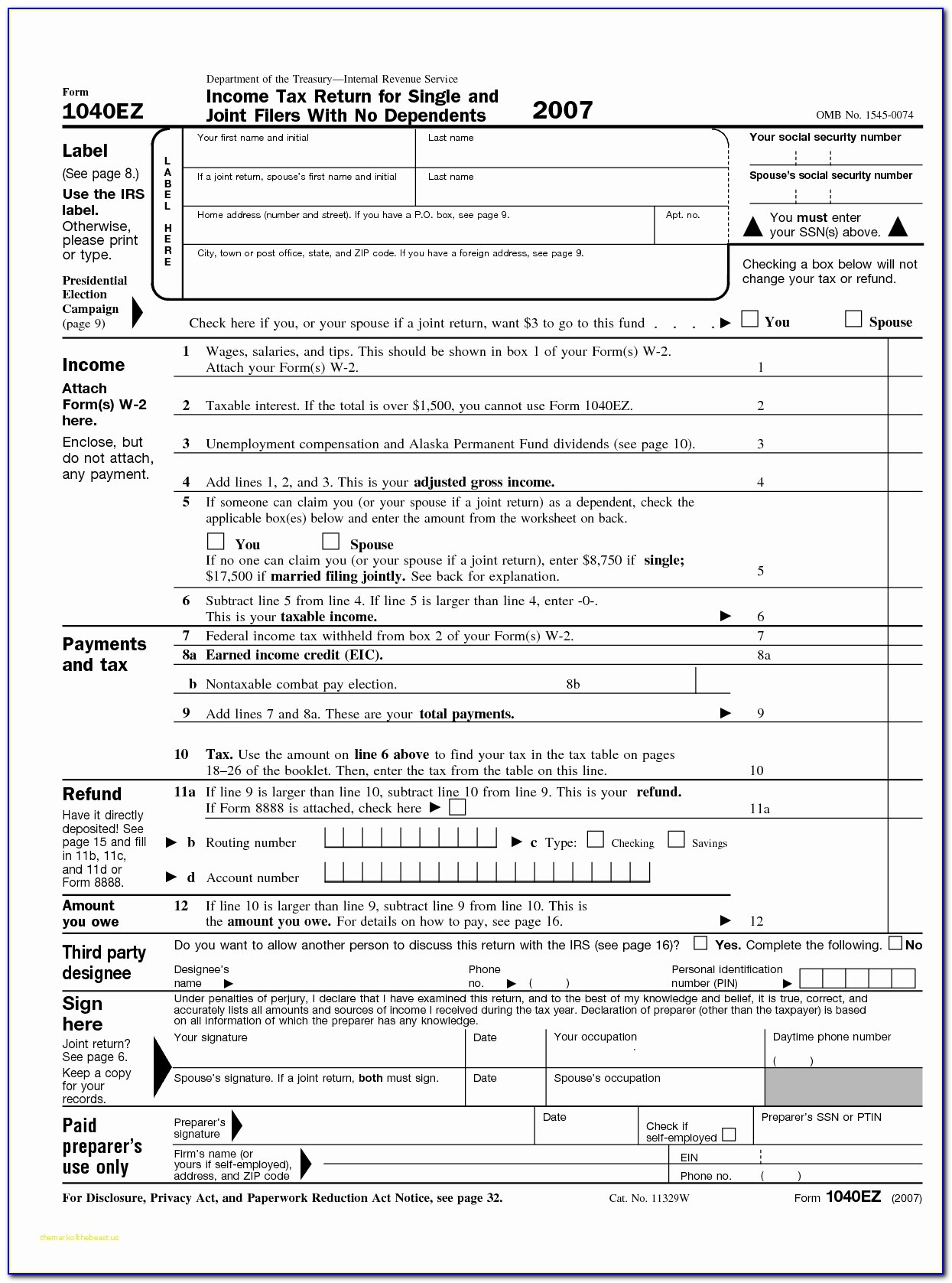

Irs W9 Form 2021 Printable Calendar Printable Free

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

IRS Form 2439 2018 Fill Out, Sign Online and Download Fillable PDF

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

Free Printable Irs Tax Forms Printable Form 2023

Irs Form W4V Printable where do i mail my w 4v form for social

Related Post: