Form 2350 Vs 4868

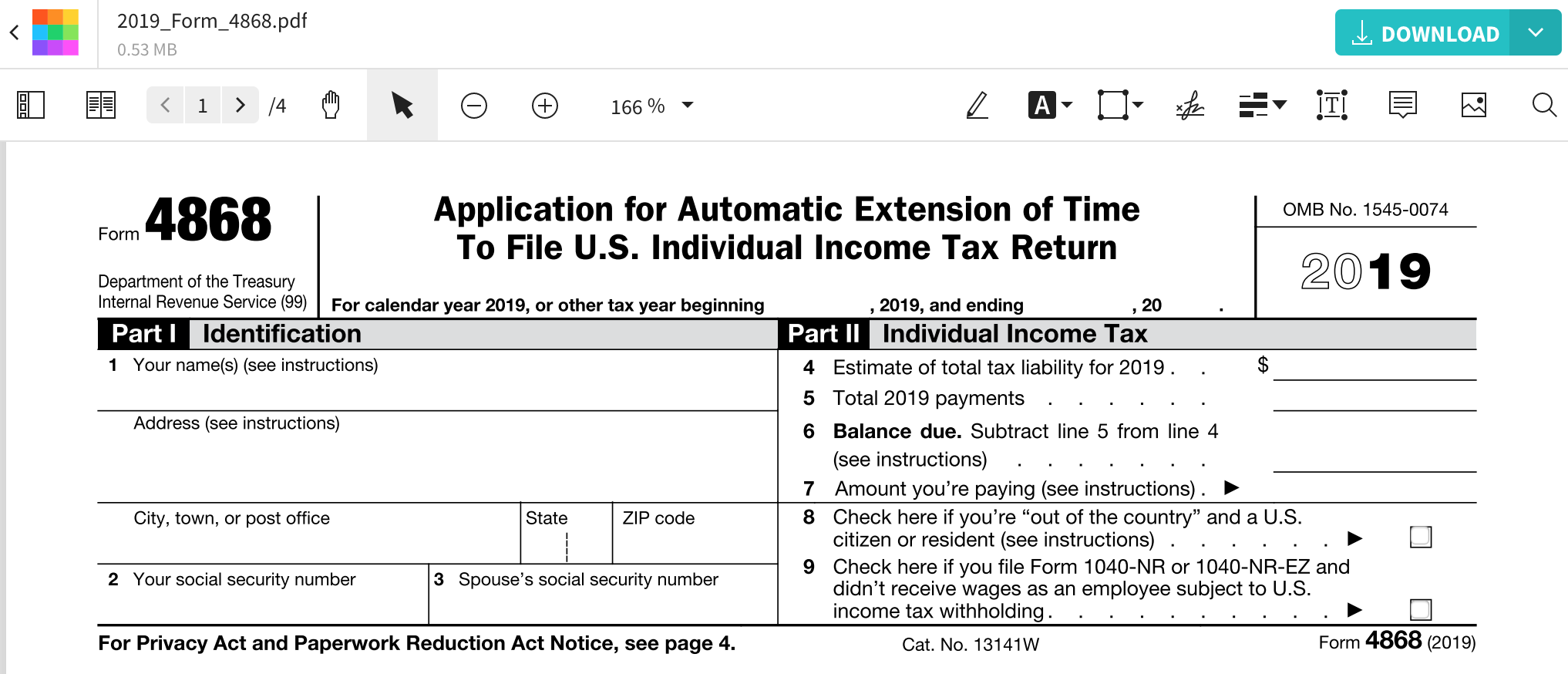

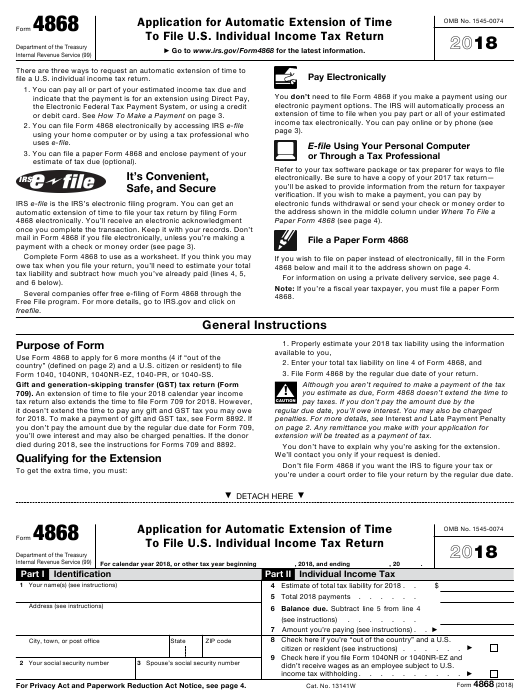

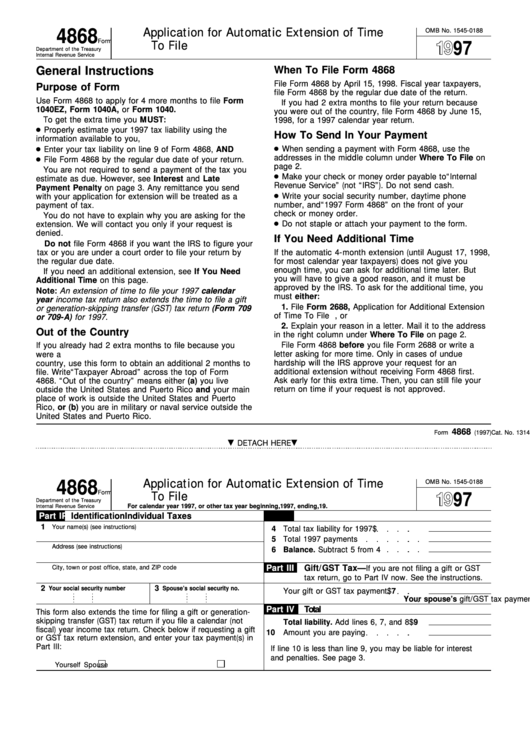

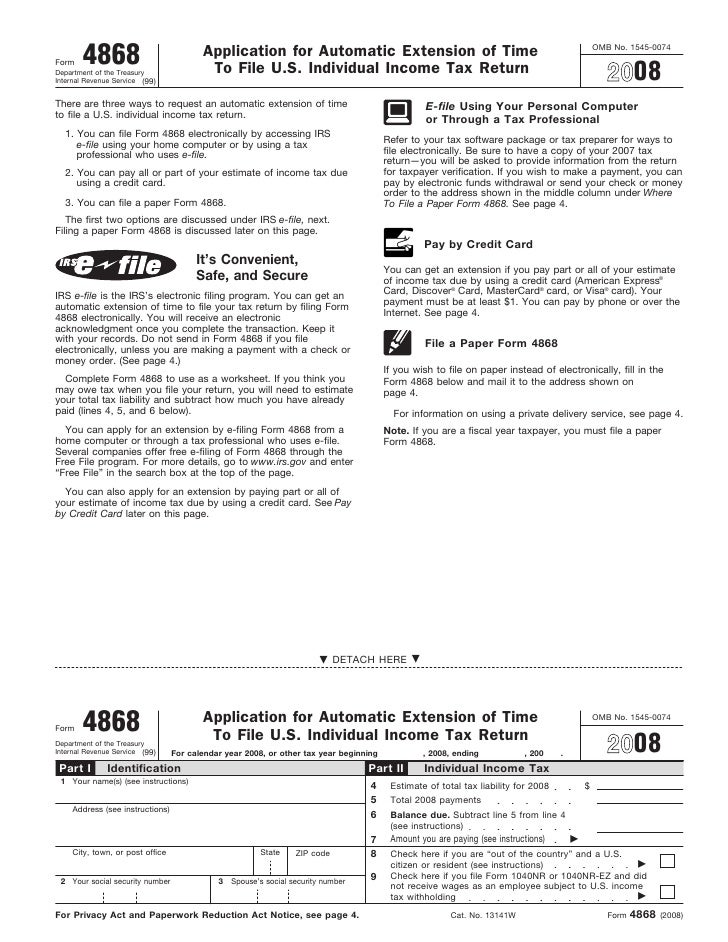

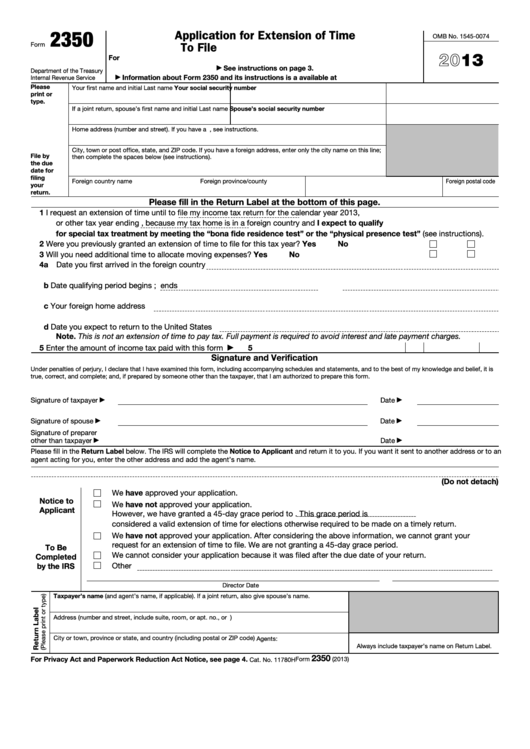

Form 2350 Vs 4868 - Web • tax form 2350 (application for automatic extension of time to file u. Web all other taxpayers should file form 4868, application for automatic extension of time to file u.s. Individual income tax return, to request an extension of time to file their. Enter your total tax liability on line 4 of form 4868, and 3. Web form 2350 is only to be used when you need additional time to file your return in order to qualify for the special tax treatment using the bona fide residence test or the. Form 4868 is used to apply for a standard extension to october 15. Web form 2350 and form 4868 are both used to request an income tax filing extension for us tax returns.americans who stay abroad may use form 2350 to request an income tax. Citizens and resident aliens abroad who expect to qualify for special. Income tax return, including recent. Although they sound similar, there are also some key differences. Form 2350, application for extension of time to file u.s. Enter your total tax liability on line 4 of form 4868, and 3. Web while the form 4868 and 7004 are relatively straightforward and simply involve an extension of time to file either a tax return or other form — the internal revenue service form. Form 2350, on the other. Although they sound similar, there are also some key differences. Ad access irs tax forms. Individual income tax return,” is a form that taxpayers can file with the irs if. However, there are several key distinctions between them. If you are unable to file the fbar by the deadline, you may request an extension until october 15, 2023 by. Web form 2350 is only to be used when you need additional time to file your return in order to qualify for the special tax treatment using the bona fide residence test or the. Individual income tax return, to request an extension of time to file their. If you are unable to file the fbar by the deadline, you may. Web • tax form 2350 (application for automatic extension of time to file u. Web while the form 4868 and 7004 are relatively straightforward and simply involve an extension of time to file either a tax return or other form — the internal revenue service form. Web all other taxpayers should file form 4868, application for automatic extension of time. Form 4868 and form 2350 are both irs forms used to request a filing extension. Web page last reviewed or updated: Web page last reviewed or updated: Individual income tax return,” is a form that taxpayers can file with the irs if. Pdf editor lets you to make changes to the form 4868 instructions fill online. Web page last reviewed or updated: Amount you are paying from form 4868, line 7. Although they sound similar, there are also some key differences. Ad access irs tax forms. File form 4868 by the regular due date of your return. However, there are several key distinctions between them. Amount you are paying from form 4868, line 7. Individual income tax return, to request an extension of time to file their. Web form 2350 and form 4868 are both used to request an income tax filing extension for us tax returns.americans who stay abroad may use form 2350 to request an. Form 2350, application for extension of time to file u.s. Web form 4868 is used for requesting for a normal extension until october 15. Web form 2350 and form 4868 are both used to request an income tax filing extension for us tax returns.americans who stay abroad may use form 2350 to request an income tax. Pdf editor lets you. Form 4868 is used to apply for a standard extension to october 15. Web page last reviewed or updated: Individual income tax return, to request an extension of time to file their. Web 2350 vs 4868 form: Web page last reviewed or updated: Web page last reviewed or updated: Web all other taxpayers should file form 4868, application for automatic extension of time to file u.s. Web while the form 4868 and 7004 are relatively straightforward and simply involve an extension of time to file either a tax return or other form — the internal revenue service form. Amount you are paying from. Web form 2350 is only to be used when you need additional time to file your return in order to qualify for the special tax treatment using the bona fide residence test or the. Web distribute the prepared document via electronic mail or fax, print it out or download on your gadget. Although they sound similar, there are also some key differences. Web form 4868 is used for requesting for a normal extension until october 15. Web • tax form 2350 (application for automatic extension of time to file u. File form 4868 by the regular due date of your return. Web form 2350 and form 4868 are both used to request an income tax filing extension for us tax returns.americans who stay abroad may use form 2350 to request an income tax. Web page last reviewed or updated: Income tax return, includes a table listing a number of circumstances which. Individual income tax return, to request an extension of time to file their. Citizens and resident aliens abroad who expect to qualify for special. Web form 4868, application for automatic extension of time to file u.s. Although you aren’t required to make a payment of. Income tax return, including recent. Web 2350 vs 4868 form: Individual income tax return,” is a form that taxpayers can file with the irs if. Form 2350, on the other hand, is intended to help new expatriates qualify for the foreign earned income. Amount you are paying from form 4868, line 7. Form 4868 is used to apply for a standard extension to october 15. Information about form 2350, application for extension of time to file u.s.Form 2350 vs. Form 4868 What Is the Difference?

Fillable Form 2350 Application For Extension Of Time To File U.s

23 [PDF] FORM 4868 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2

2023 Irs Form 4868 Printable Forms Free Online

Irs Form 4868 Fillable Printable Forms Free Online

Learn How to Fill the Form 4868 Application for Extension of Time To

Printable Irs Form 4868 Printable Forms Free Online

Form 4868Application for Automatic Extension of Time

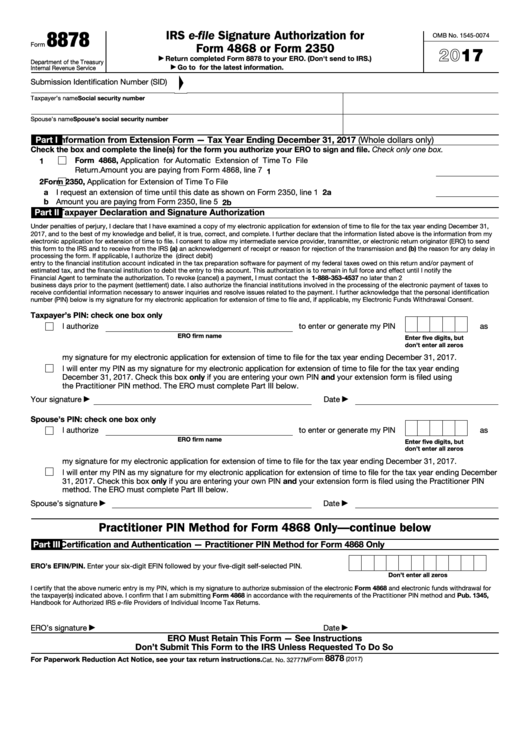

Fillable Form 8878 Irs EFile Signature Authorization For Form 4868

Form 8878 IRS efile Signature Authorization for Form 4868 or Form

Related Post:

![23 [PDF] FORM 4868 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2](https://data.formsbank.com/pdf_docs_html/230/2306/230647/page_1_thumb_big.png)