Form 2290 Suspended Vehicles

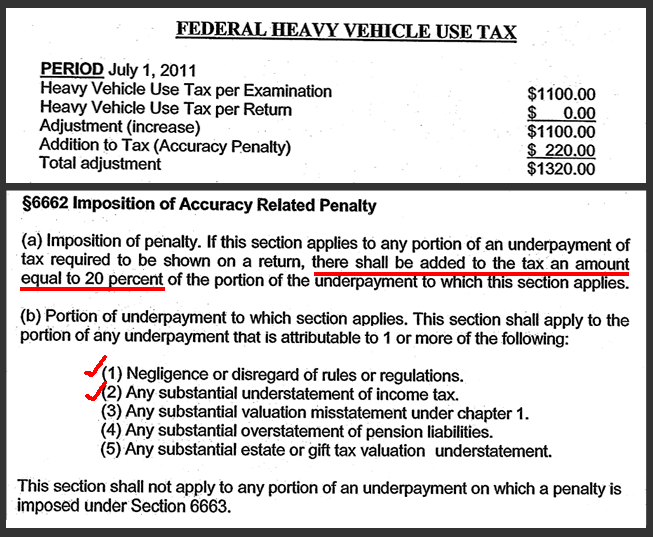

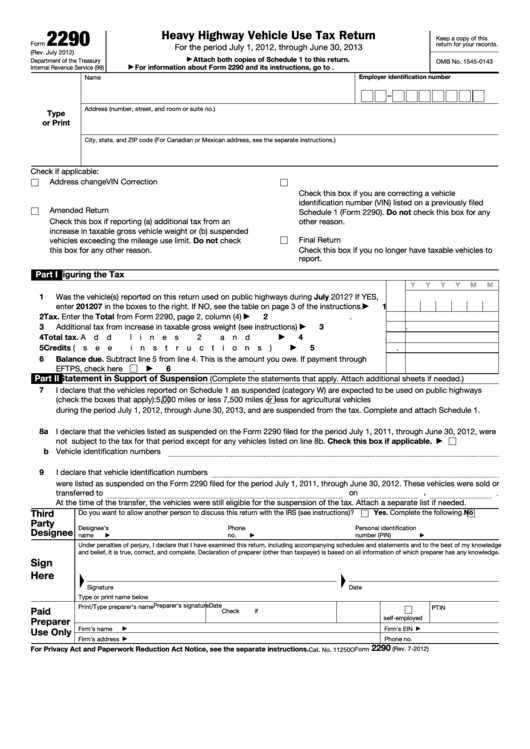

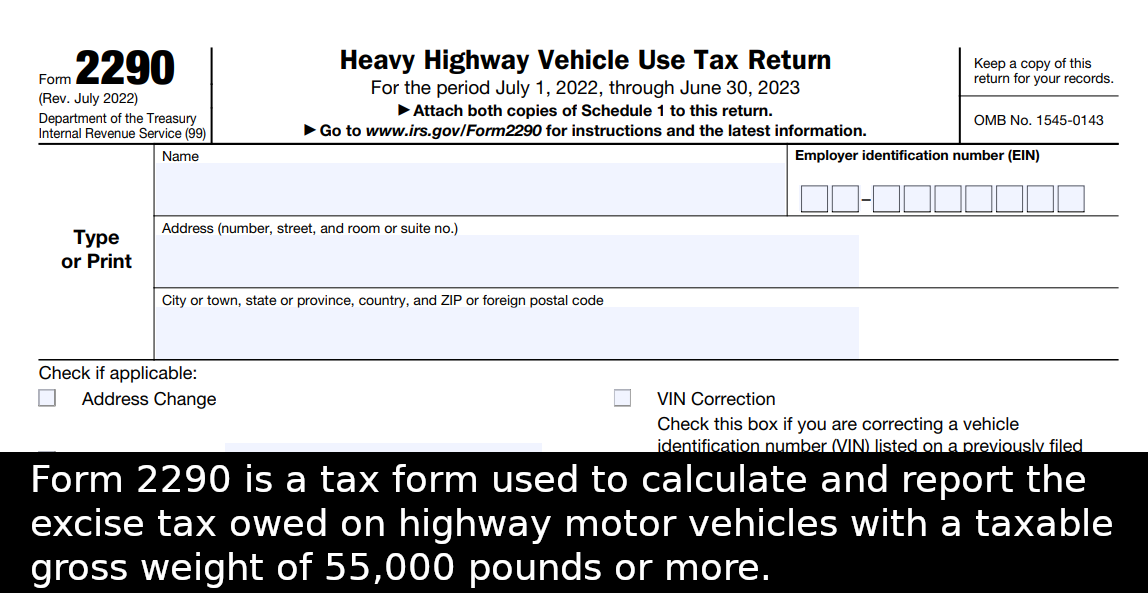

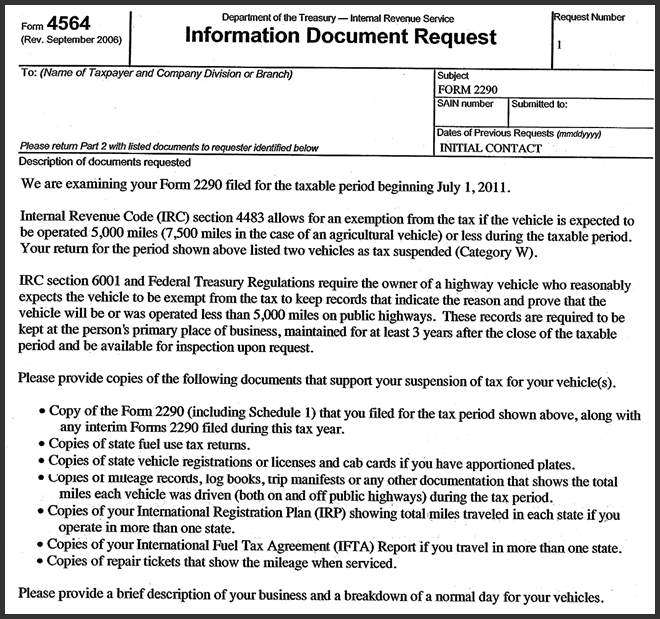

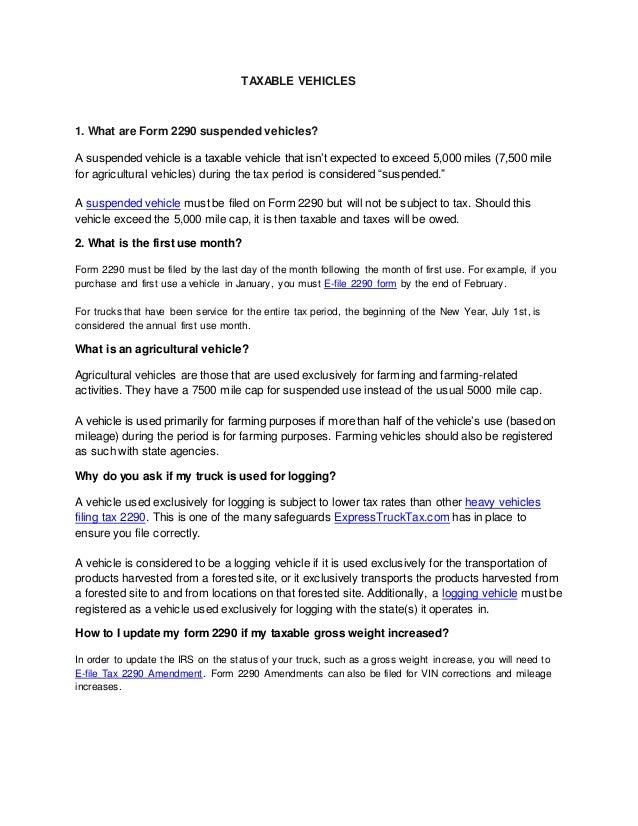

Form 2290 Suspended Vehicles - Web electronic filing is required for each return reporting and paying tax on 25 or more vehicles that you file during the tax period. The buyer must report it with the hvut form. Web when your heavy vehicle will be travelling within the mileage use limit of 5,000 miles (7,000 miles or less for agricultural vehicles) during the tax period, you can file the form 2290. Web reporting an irs 2290 for a suspended vehicle is simple by following just three steps as given. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Easy, fast, secure & free to try. Web truck owners should report their suspended vehicles in form 2290. Do your truck tax online & have it efiled to the irs! Web a heavy highway motor vehicle whose mileage limit is less than 5,000 miles in a tax period is considered a “suspended vehicle”. Ad online 2290 tax filing in minutes. File your 2290 tax online in minutes. Web when filing form 2290, a vehicle that weighs 55,000 pounds or more is considered suspended by the irs if it is driven less than 5,000 miles in a year, or less. Determine if your vehicle qualifies for suspension to qualify for suspension, your vehicle must not expect to travel more than 5,000. What is a 2290 suspended vehicle? A suspended vehicle is any taxable vehicle that is expected to be used 5,000 miles or less (7,500 mile for agricultural vehicles) during the tax period. Web a heavy highway motor vehicle whose mileage limit is less than 5,000 miles in a tax period is considered a “suspended vehicle”. Web heavy highway vehicle use. Web even if your truck is categorized to fall under the class of suspended vehicles you are still required to file form 2290. Web completed the suspension statement on another form 2290 if that vehicle later exceeded the mileage use limit during the period. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. A suspended vehicle is any taxable vehicle that is expected to be used 5,000 miles or less (7,500 mile for agricultural vehicles) during the tax period. Web the federal heavy vehicle. Get expert assistance with simple 2290 @ $6.95. Any vehicles that do go beyond. Easy, fast, secure & free to try. A suspended vehicle is any taxable vehicle that is expected to be used 5,000 miles or less (7,500 mile for agricultural vehicles) during the tax period. Ad get schedule 1 in minutes, your form 2290 is efiled directly to. Web if your suspended vehicle crosses the 5,000 miles limit during the tax year, you have to file a form 2290 amendment to report the exceeded mileage to the irs. Web reporting an irs 2290 for a suspended vehicle is simple by following just three steps as given. Web what is considered a suspended vehicle on form 2290? Generally the. Get expert assistance with simple 2290 @ $6.95. Easy, fast, secure & free to try. Web form 2290 is used to report vehicles with a taxable weight of 50,000 pounds or more. Truckers having an account with tax2efile login to the account,. This is the same form the irs requires to register the highway use tax. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. Web when filing form 2290, a vehicle that weighs 55,000 pounds or more is considered suspended by the irs if it is driven less than 5,000 miles in a year, or less. Web a heavy highway motor. This is the same form the irs requires to register the highway use tax. Web electronic filing is required for each return reporting and paying tax on 25 or more vehicles that you file during the tax period. Generally the 2290 taxes are reported from july. File your 2290 tax online in minutes. Web heavy highway vehicle use tax return. Web truck owners should report their suspended vehicles in form 2290. What is a 2290 suspended vehicle? Generally the 2290 taxes are reported from july. Get expert assistance with simple 2290 @ $6.95. Easy, fast, secure & free to try. The main reason for filing form 2290 is. Easy, fast, secure & free to try. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; File your truck tax & get schedule 1 in minutes. Web even if your truck is categorized to fall under the class of suspended vehicles you are still required to file form 2290. Web the federal heavy vehicle use tax form 2290 is reported on your heavy highway vehicles year on year to stay on road. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022 attach both copies of. A suspended vehicle is any taxable vehicle that is expected to be used 5,000 miles or less (7,500 mile for agricultural vehicles) during the tax period. Ad online 2290 tax filing in minutes. File your 2290 tax online in minutes. What is a 2290 suspended vehicle? Generally the 2290 taxes are reported from july. Web reporting an irs 2290 for a suspended vehicle is simple by following just three steps as given. This is the same form the irs requires to register the highway use tax. Web when filing form 2290, a vehicle that weighs 55,000 pounds or more is considered suspended by the irs if it is driven less than 5,000 miles in a year, or less. This will be any vehicle that does not travel more than 5000, in a given tax period. See suspended vehicles exceeding the mileage. Web when your heavy vehicle will be travelling within the mileage use limit of 5,000 miles (7,000 miles or less for agricultural vehicles) during the tax period, you can file the form 2290. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Get expert assistance with simple 2290 @ $6.95.IRS Notice Decoder Form 2290 Proof for Suspended Vehicles

Free Printable Form 2290 Printable Templates

Form 2290 Heavy Vehicle Use Tax

Heavy Vehicle Used Tax Form 2290 on Suspended Vehicles

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

IRS Form 2290 Suspended Vehicles Medium

Free Printable Form 2290 Printable Templates

IRS Notice Decoder Form 2290 Proof for Suspended Vehicles

Reporting Suspended Vehicles On Form 2290

IRS Form 2290 taxable vehicles

Related Post: