Form 2241 Instructions

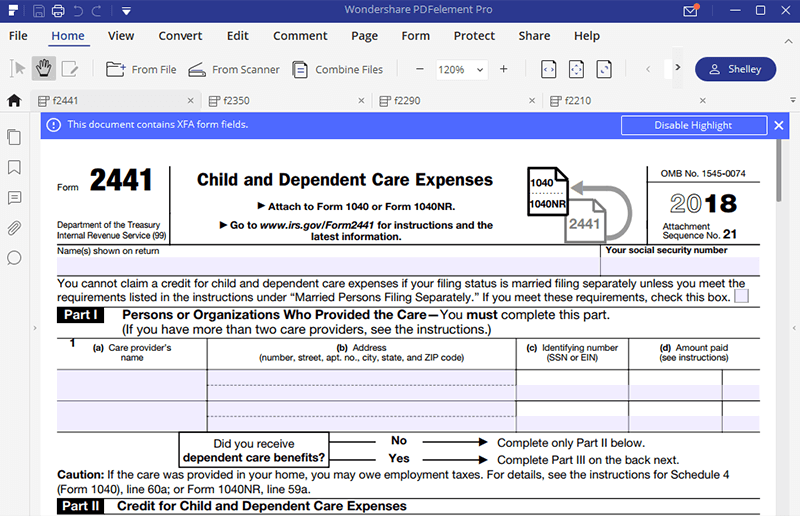

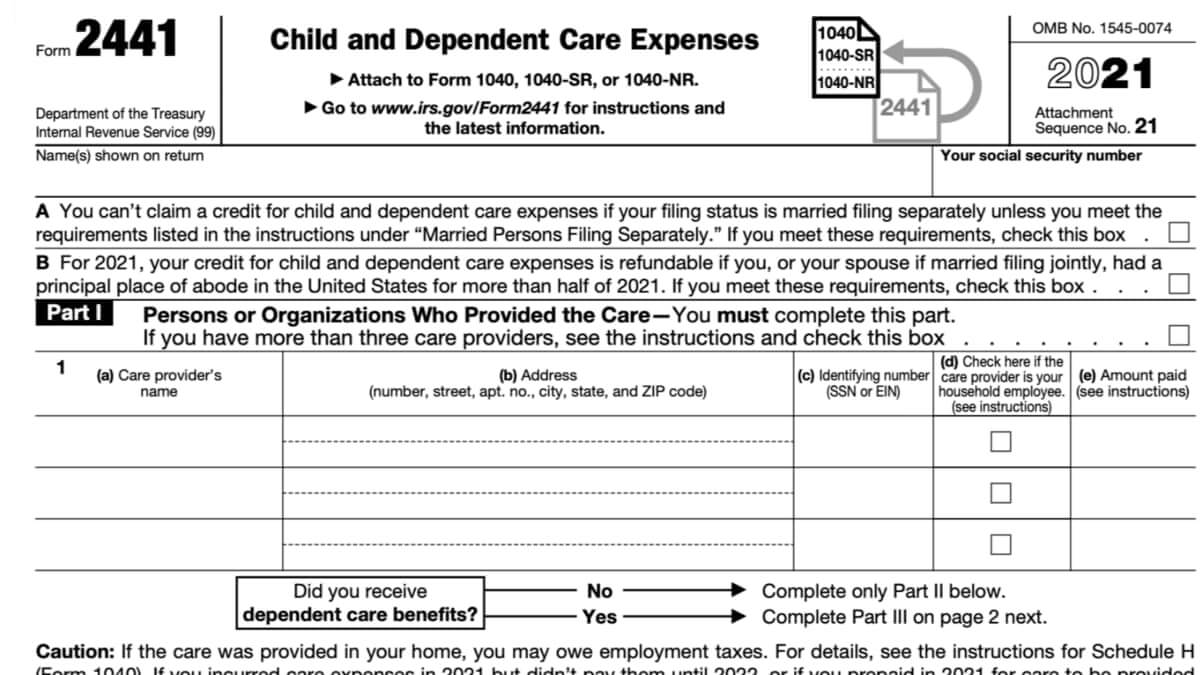

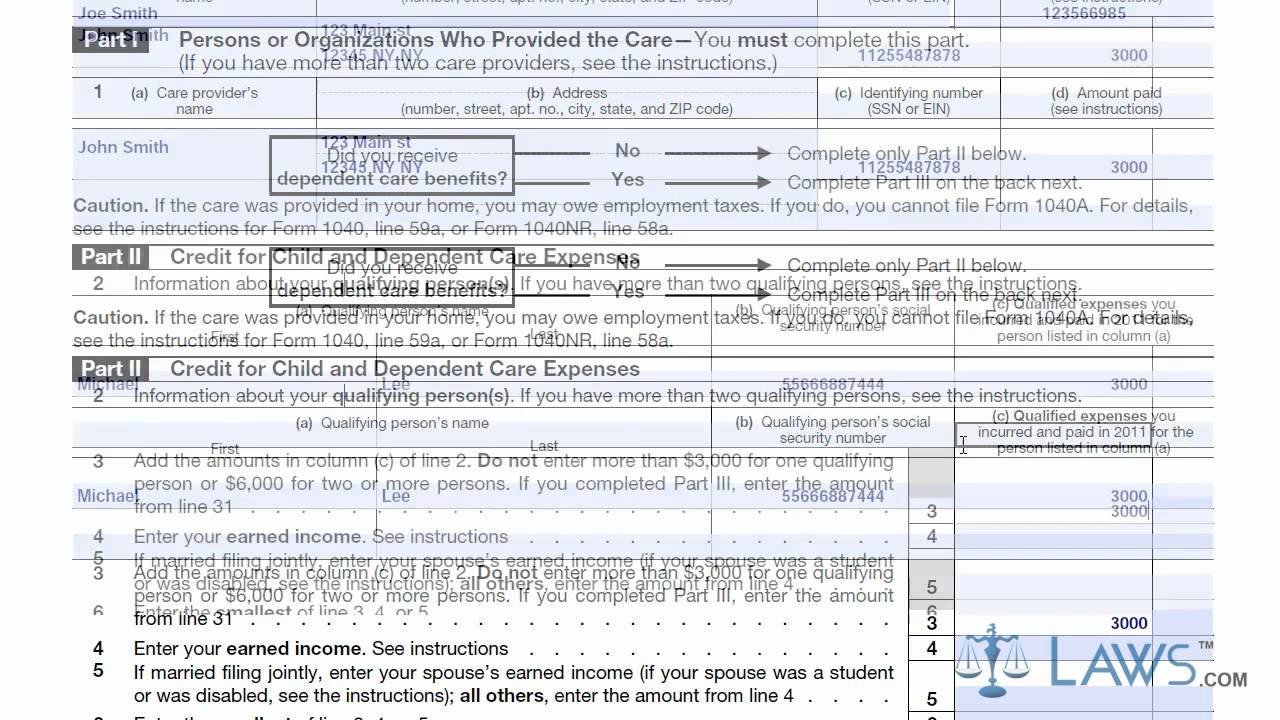

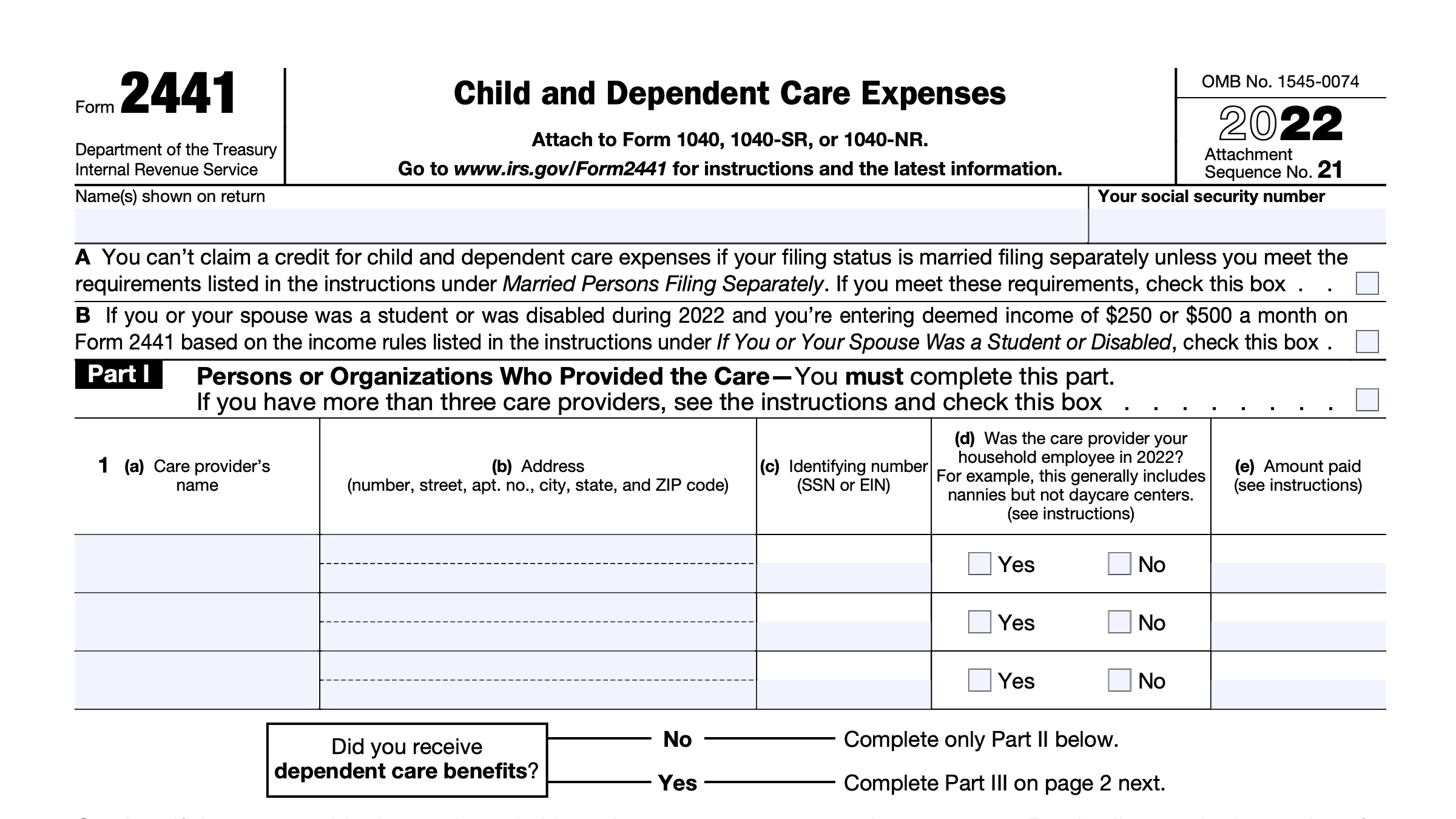

Form 2241 Instructions - Ad forms, deductions, tax filing and more. For additional information about the credit, see pub. When personnel is exposed to ionizing radiation by accident, we need to report it using dd form 1141. Ask a tax professional anything right now. Publication 503 child and dependent care expenses. The following articles are the top questions referring to child and dependent care qualified expenses (2441):. Web the taxact program will apply the information to form 2441, and report it on line 13a of form 1040 for you. Persons or organizations who provided the care. Do not file form 8941. Web form 2441 instructions. Questions answered every 9 seconds. The following articles are the top questions referring to child and dependent care qualified expenses (2441):. Changes to the credit for child and dependent care expenses for 2021. Web page last reviewed or updated: Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. When personnel is exposed to ionizing radiation by accident, we need to report it using dd form 1141. **these changes are for tax year 2021 only. Get ready for tax season deadlines by completing any required tax forms today. Child and dependent care expenses. December 22, 2021 · 5 minute read. Web form 202441 child and dependent care expenses 22. If you paid 2021 expenses in 2022, see the instructions for line 9b and complete worksheet a at the end of these instructions. Web irs instructions for form 2441. Get ready for tax season deadlines by completing any required tax forms today. Publication 503 child and dependent care expenses. Web the taxact program will apply the information to form 2441, and report it on line 13a of form 1040 for you. Web see form 2441, line 8, for the 2022 phaseout schedule. Questions answered every 9 seconds. To claim the child and dependent care tax credit, taxpayers must file their form 1040 federal income tax return using the form. Changes to the credit for child and dependent care expenses for 2021. Web solved•by intuit•7•updated december 20, 2022. Access irs forms, instructions and publications in electronic and print media. Web form 202441 child and dependent care expenses 22. Get ready for tax season deadlines by completing any required tax forms today. Do not file form 8941. Persons or organizations who provided the care. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Child and dependent care expenses. For the latest information about developments related to form 2441 and its instructions, such. The following articles are the top questions referring to child and dependent care qualified expenses (2441):. Web february 27, 2021 by john. To claim the child and dependent care tax credit, taxpayers must file their form 1040 federal income tax return using the form 2441. Publication 503 child and dependent care expenses. Web irs instructions for form 2441. Changes to the credit for child and dependent care expenses for 2021. Web see form 2441, line 8, for the 2022 phaseout schedule. Web irs form 2441 instructions. Web february 27, 2021 by john. Department of the treasury internal revenue service. Do not file form 8941. Web to claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal income tax. Persons or organizations who provided the care. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to. Web february 27, 2021 by john. Web to claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal income tax. Child and dependent care expenses. Complete, edit or print tax forms instantly. The form must be typed or neatly. Publication 503 child and dependent care expenses. To claim the child and dependent care tax credit, taxpayers must file their form 1040 federal income tax return using the form 2441. Questions answered every 9 seconds. For 2021, the american rescue plan act of 2021 (the arp) increases the amount of the. Web the taxact program will apply the information to form 2441, and report it on line 13a of form 1040 for you. December 22, 2021 · 5 minute read. Child and dependent care expenses. The following articles are the top questions referring to child and dependent care qualified expenses (2441):. Web solved•by intuit•7•updated december 20, 2022. For additional information about the credit, see pub. The form must be typed or neatly. Changes to the credit for child and dependent care expenses for 2021. Web form 2441 instructions. Web page last reviewed or updated: Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. **these changes are for tax year 2021 only. Web see form 2441, line 8, for the 2022 phaseout schedule. Child and dependent care expenses.Learn How to Fill the Form 2441 Dependent Care Expenses YouTube

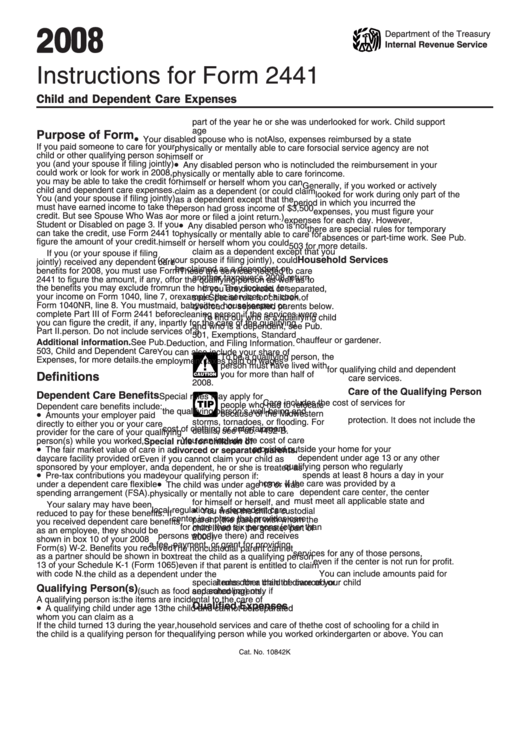

Instructions For Form 2441 Child And Dependent Care Expenses 2008

Instructions pour remplir le formulaire IRS 2441

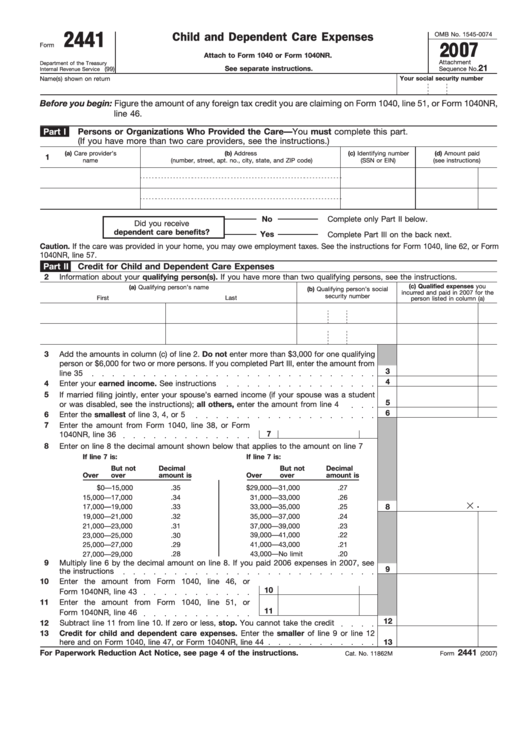

Fillable Form 2441 Child And Dependent Care Expenses printable pdf

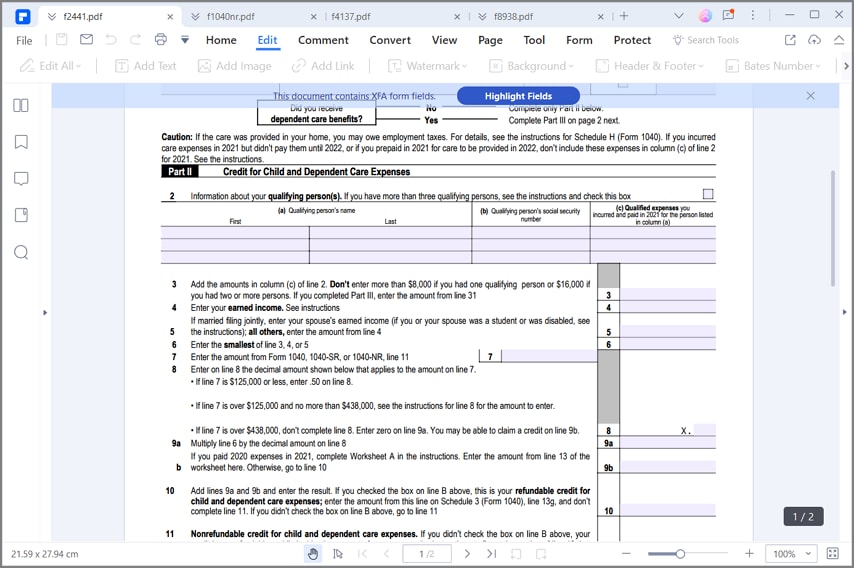

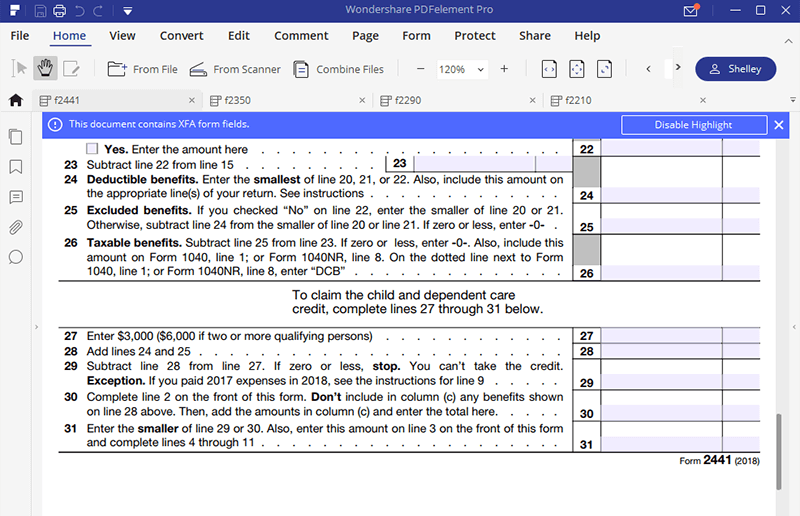

Instructions for How to Fill in IRS Form 2441

IRS Form 2441 Instructions Child and Dependent Care Expenses

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out (2023)

2022 Form IRS Instruction 2441Fill Online, Printable, Fillable, Blank

Ssurvivor Form 2441 Instructions 2016

2441 Form 2022 2023

Related Post:

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)